It's imperative that you're financially prepared for retirement. Living on Social Security alone is difficult, so you'll want an additional source of income. For most people, that extra money must come from retirement savings.

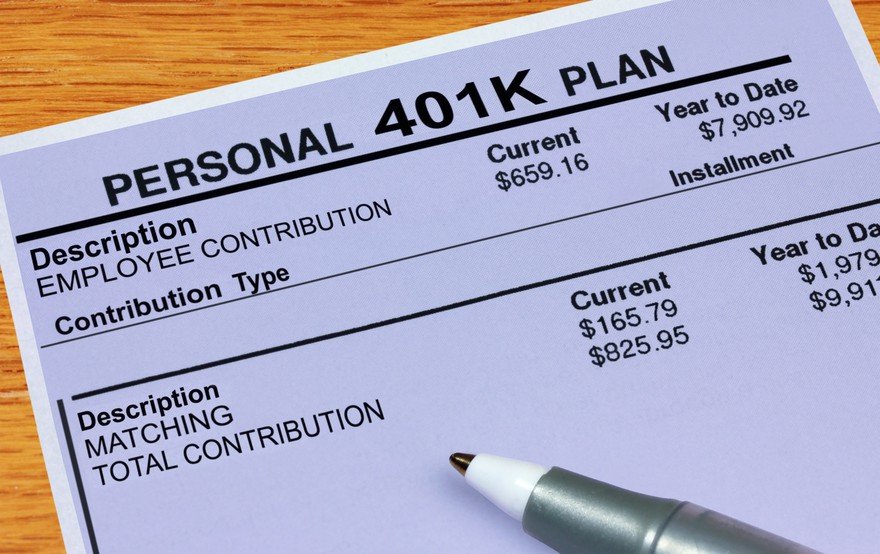

A 401(k) is a popular retirement investment account used by millions of U.S. workers, in large part because this account offers generous tax advantages. Because it's administered by employers, it's convenient to invest in.

If you have access to a workplace 401(k), saving in it early and aggressively could provide a path to a secure retirement. But how have Americans done with investing in their 401(k) accounts? Check out the average 401(k) balance by age and income level to see where you stack up when it comes to your retirement savings.

The average 401(k) balance by age

Each year, Vanguard collects data from approximately 5 million retirement accounts. Based on its analysis in 2023, the average 401(k) balance was $112,572 in 2022, down about 20% from 2021. The drop was largely due to declines in the stock and bond markets through the end of 2022. However, averages varied substantially by age. The table below shows the average and median balances for individuals in different age groups.

| Age | Average 401(k) Balance | Median 401(k) Balance |

|---|---|---|

| Younger than 25 | $5,236 | $1,948 |

| 26 to 34 | $30,017 | $11,037 |

| 35 to 44 | $76,354 | $28,318 |

| 45 to 54 | $142,069 | $48,301 |

| 55 to 64 | $207,874 | $71,168 |

| 65 and older | $232,710 | $70,620 |

Average 401(k) balances at 30

Many financial experts recommend that your savings at age 30 equal at least one year of your salary. The Bureau of Labor Statistics (BLS) reports the average salary for full-time workers ages 25 to 34 was $56,160 in the fourth quarter of 2023. That means many 30-year-olds in the U.S. have an average balance that falls short of the recommended amount.

Average 401(k) balances at 40

You should aim to have at least three times your annual salary saved for retirement by age 40. Workers ages 35 to 44 have an average salary of $67,756, according to the BLS. A worker earning the average salary would want to have just over $200,000 saved. Again the average and median 401(k) balances fall short.

Average 401(k) balances at 50

By the time you hit 50, you should have six times your salary invested for your later years. The BLS reports the average salary for workers ages 45 to 54 is $66,300. This would mean a typical worker should have savings of nearly $400,000.

Average 401(k) balances at 60

Finally, by age 60, you should have eight times your final salary, and, by age 67 (full retirement age for many in the U.S.), you should have 10 times your final salary. By this point, workers are getting very close to retirement and should ideally have a substantial nest egg.

How much could your 401(k) grow?

The earlier you start investing in your 401(k), the easier it is to build a hefty balance thanks to compound earnings.

When you invest money, your investments earn money for you. This can be reinvested so you then have a larger pool of assets earning returns. Your money can grow exponentially. That's why Albert Einstein was famously quoted as describing compound interest as the "eighth wonder of the world."

The chart below shows how much $1,000 invested in your 401(k) could turn into by age 67, depending on when you make your $1,000 investment and assuming an 8% average annual rate of return.

| Age When You Invest Your $1,000 | Value of $1,000 Investment at Age 67 |

|---|---|

| 20 | $37,232 |

| 30 | $17,245 |

| 40 | $7,988 |

| 50 | $3,700 |

| 60 | $1,713 |

While it may be a challenge to save when you're young, it pays to do so.

The average 401(k) balance by income level

Not surprisingly, income impacts the amount workers invest in their 401(k). The table below shows the average account balance based on income level.

| Income Range | Average 401(k) Balance | Median 401(k) Balance |

|---|---|---|

| Below $15,000 | $20,765 | $4,033 |

| $15,000 to $29,999 | $13,871 | $4,568 |

| $30,000 to $49,999 | $28,672 | $11,556 |

| $50,000 to $74,999 | $66,918 | $31,064 |

| $75,000 to $99,999 | $113,617 | $58,665 |

| $100,000 to $149,999 | $186,066 | $104,155 |

| $150,000 and up | $340,245 | $201,301 |

Higher earners need more money saved for retirement because, in most cases, they are used to a higher standard of living. They will need their retirement investment accounts to produce sufficient funds to maintain their lifestyle after their paychecks stop.

Many workers contribute a set percentage of income to their 401(k), such as 10%. With this percentage-based approach, higher earners inevitably invest more for retirement each year than their lower-earning counterparts.

Average 401(k) balances by gender

Gender can also impact 401(k) balances. In particular, men have much higher average balances than their female peers.

This is explained by many factors, including the gender wage gap (men tend to earn more than women) and the fact that women may have fewer years on the job because they are more likely to take time off due to caregiving responsibilities.

The table below shows the average and median 401(k) balances by gender.

| Gender | Average 401(k) Balance | Median 401(k) Balance |

|---|---|---|

| Male | $136,977 | $34,961 |

| Female | $95,570 | $24,714 |

Unfortunately, women often face an uphill battle in investing enough for a secure future -- especially since they tend to live longer than men and need larger balances as a result.

Average 401(k) balance at retirement

Many U.S. workers retire by the time they reach 65. Vanguard's data shows the average 401(k) balance for workers 65 and older to be $232,710, while the median balance is $70,620.

For retirees following the 4% rule, the average balance would produce just $9,300 in annual retirement income, while the median would provide only around $2,800. Even when combined with Social Security, this may not be sufficient to provide a comfortable income in retirement.

Aim to invest as much as possible in your 401(k) and other retirement accounts

A 401(k) can be a convenient and simple way to save for retirement, although you have other options, including traditional IRAs and Roth IRAs.

You should be investing in these retirement plans throughout your career with the goal of amassing a nest egg large enough to meet your needs. If you aren't hitting your investment targets, consider carefully reviewing your budget to find more opportunities to save. As you earn salary increases, you may also want to save those raises in your 401(k) rather than spending the extra income since this can make it easier to hit your savings targets.

By automating contributions to a 401(k) and aiming to save 15% or more of your income for retirement throughout your career, you could end up with a 401(k) balance well above the average or median for workers in the U.S. Hopefully, you'll have a more secure retirement for doing so.