A work 401(k) is a nice perk to help you increase your retirement savings. If you're also trying to save outside of your employer-sponsored retirement plan, however, you might run into some problems.

The good news is that you can contribute to an IRA even if you also contribute to a 401(k) at work. There are certain limitations you should consider, though.

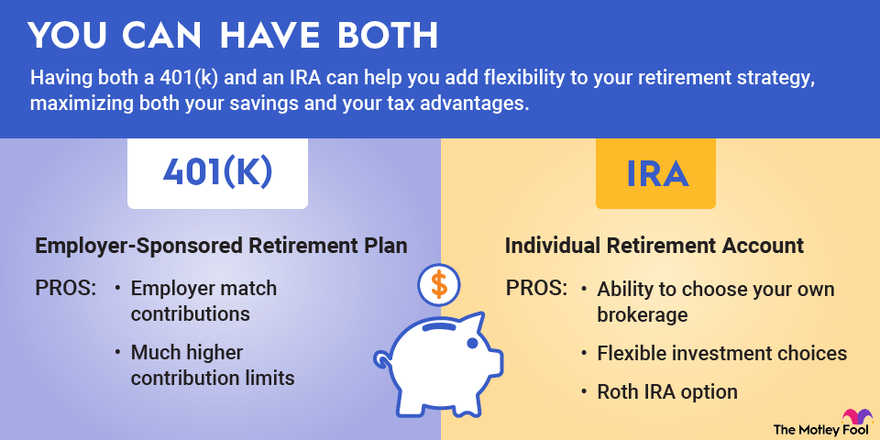

While a 401(k) and an IRA will both help you save for your retirement, there are a few important differences. A 401(k) is established by an employer; an IRA is established by an individual. A 401(k) may have a company match contribution, and a 401(k) may have more limited investment options than an IRA.

Check your eligibility

Check your eligibility

If you have a 401(k) or similar retirement plan at work, your eligibility to contribute to an IRA and take a tax deduction depends on your income and which type of IRA you'd like to contribute to -- traditional or Roth IRA.

With a traditional IRA, there are specific income limitations for people who are eligible to participate in an employer's retirement plan.

For 2024, the income limits are:

| Tax Filing Status | AGI Limit for Full Traditional IRA Contribution Deduction | Phaseout for Traditional IRA Contribution Deduction |

|---|---|---|

| Single or head of household | $77,000 | $87,000 |

| Married, filing jointly | $123,000 | $143,000 |

| Married, filing separately | $0 | $10,000 |

For 2023, the income limits were:

| Tax Filing Status | AGI Limit for Full Traditional IRA Contribution Deduction | Phaseout for Traditional IRA Contribution Deduction |

|---|---|---|

| Single or head of household | $73,000 | $83,000 |

| Married, filing jointly | $116,000 | $136,000 |

| Married, filing separately | $0 | $10,000 |

Here's what this means. If you participate in an employer's retirement plan, such as a 401(k), and your adjusted gross income (AGI) is equal to or less than the number in the first column for your tax filing status, you are able to make and deduct a traditional IRA contribution up to the maximum of $7,000, or $8,000 if you're 50 or older, in 2024. These limits were $6,500, or $7,500 if you're 50 or older, in 2023. If your AGI is between the numbers in both columns, you are eligible to deduct a partial traditional IRA contribution. Finally, if your AGI is as much as or more than the phaseout limit in the last column, you are ineligible for the traditional IRA deduction.

Keep in mind these are the limits to take a traditional IRA deduction. If your income is above the limit, you can still make nondeductible contributions to a traditional IRA. That's useful if you also don't qualify to contribute to a Roth IRA and you can execute the backdoor Roth IRA strategy.

Contributing to a Roth IRA

Contributing to a Roth IRA

Unlike with a traditional IRA, Roth IRA contributions are not limited solely because you can participate in your employer's retirement plan. Instead, there is an income limit for Roth IRA contributions that applies to all savers.

For 2024, the income limits for contributing to a Roth IRA are:

| Filing Status | Full Contribution AGI Limit | Phaseout Limit |

|---|---|---|

| Single or head of household | $146,000 | $161,000 |

| Married, filing jointly | $230,000 | $240,000 |

| Married, filing separately | $0 | $10,000 |

For 2023, the income limits for contributing to a Roth IRA were:

| Filing Status | Full Contribution AGI Limit | Phaseout Limit |

|---|---|---|

| Single or head of household | $138,000 | $153,000 |

| Married, filing jointly | $218,000 | $228,000 |

| Married, filing separately | $0 | $10,000 |

Other than the limits for married taxpayers filing separately, the Roth IRA income limits are significantly more generous than the deductible traditional IRA limits for employer-sponsored retirement plan participants.

It's also important to point out that these are the income limits to contribute directly to a Roth IRA. There is no income limit to convert a traditional IRA to a Roth IRA.

Roth IRA contributions are never tax-deductible. You're able to withdraw contributions tax- and penalty-free at any time. Earnings can be withdrawn tax-free after age 59 1/2. That makes a Roth IRA more flexible than a traditional IRA. You'll pay tax on all withdrawals from a traditional IRA, and early withdrawals carry a 10% penalty.

The decision between a Roth IRA and a traditional IRA often comes down to whether you want to pay taxes on those funds now (Roth) or later (traditional). If you expect your taxes to be higher in retirement, use a Roth.

For higher-income earners who don't qualify for a traditional IRA deduction, a Roth IRA is a no-brainer. Roth IRAs also have no required minimum distribution and no maximum contribution age, so if you're saving later in life, a Roth makes a lot of sense.

Why you should contribute to an IRA in addition to a 401(k)

Why you should contribute to an IRA in addition to a 401(k)

There are several key differences between IRAs and employer-sponsored retirement plans such as 401(k)s that can make it worthwhile to contribute to both.

For one thing, IRAs are much more flexible when it comes to your investment choices. With a 401(k), you are allowed to choose from a basket of investment funds. On the other hand, with an IRA, you can invest in virtually any stocks, bonds, or funds you want.

In addition, a Roth IRA can help you diversify your tax advantages and can also provide several other benefits your 401(k) doesn't. This can give you much more control over your taxable income in retirement.

The bottom line is that IRAs can add flexibility to your retirement strategy, so it can certainly be a good idea to use one to supplement your employer-sponsored retirement plan.