Switching jobs pulls your mind in several directions at once, and it's easy for your old 401(k) to get lost in the shuffle. But you can't afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can't afford to leave any old retirement accounts behind. If you've lost track of your old 401(k), take these steps to find it and put that money to good use.

1. Contact your former employer

1. Contact your former employer

Contacting your former employer is the fastest way to find your old 401(k). The company's HR department should have records of your retirement account and can advise you on how to access it or roll it over if that's what you decide to do. More on that below.

2. Look for contact information

2. Look for contact information.

If you don't know how to contact your former employer -- perhaps the company no longer exists or it was acquired or merged with another company -- see if you have any old 401(k) statements. These should have contact information to help put you in touch with the plan administrator.

If you don't have an old 401(k) statement handy or yours doesn't tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account's tax return, known as Form 5500. That will most likely have contact information for your 401(k)'s plan administrator.

3. Search for unclaimed retirement benefits

3. Search for unclaimed retirement benefits.

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It's a free service, and it only requires your Social Security number.

What to do with your old 401(k)

What to do with your old 401(k)

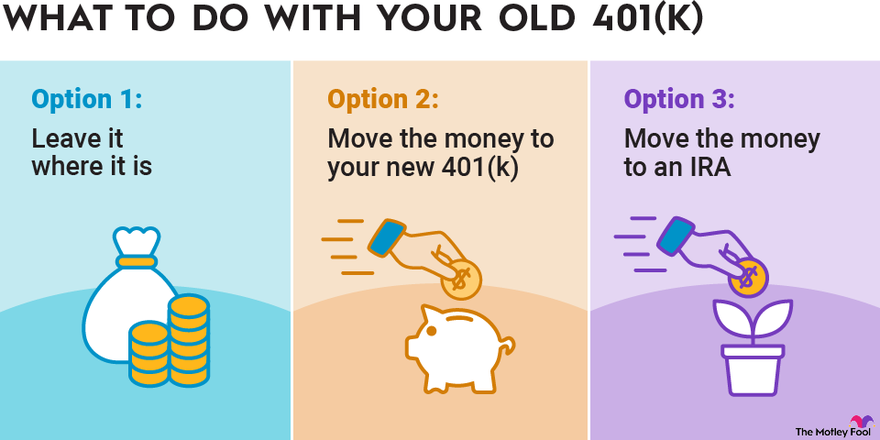

Once you've found your old 401(k), you have to decide what to do with it. There are three options:

Option 1: Leave it where it is

Option 1: Leave it where it is

You don't have to move the money out of your old 401(k) if you don't want to. You won't ever lose the funds -- provided you don't lose track of your old account again. But this option is usually the least desirable.

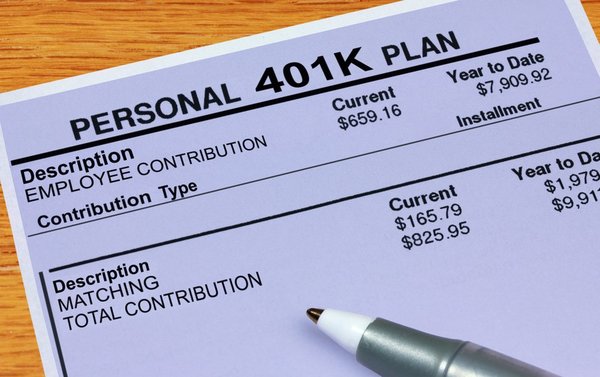

For one, it's more difficult to manage your retirement savings when they're spread out over many accounts. You also get stuck paying whatever your old 401(k)'s fees were, and these can be higher than what you'd pay if you moved your money to an individual retirement account, for example.

But if you like your plan's investment options and the fees aren't too high, you could consider leaving your old 401(k) funds where they are. Just make careful note of how to access them again so you don't forget.

Option 2: Move the money to your new 401(k)

Option 2: Move the money to your new 401(k).

If you have a new job with a new 401(k), your current employer may permit you to roll over your old 401(k) funds into your new account. However, not all plans allow this, so check with your company's HR department or plan administrator to see if it's an option for you.

If it is and you decide it's your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don't handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401(k), make sure you like your investment options and are comfortable with the fees your new 401(k) charges. Many employers don't allow you to transfer money out of your 401(k) if you're a current employee, so once you transfer your old 401(k) funds to your new account, they could be stuck there, at least until you leave your current job.

Option 3: Move the money to an IRA

Option 3: Move the money to an IRA

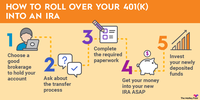

If you're not able to transfer the funds to your current 401(k) or you don't want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401(k), and you still have the choice between a direct or indirect rollover.

You'll need to set up a new IRA with any broker if you don't already have one. Make sure you choose an IRA that's taxed the same way as your old 401(k) funds. Most 401(k)s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401(k), you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401(k) doesn't mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they'll be most useful to you. Think the decision through carefully, then follow the steps above.