401(k) accounts are workplace retirement savings plans that employees can contribute to with pre-tax dollars, sometimes receiving matching contributions from employers.

Those who contribute to workplace 401(k)s must know the rules for 401(k) required minimum distributions, or RMDs, since RMD rules mandate that accountholders begin withdrawing money at age 73 (previously age 72) or face substantial IRS penalties.

This guide will explain why RMDs exist, what the RMD rules are for 401(k) plans, what exceptions exist, how RMDs can be avoided, and how RMDs affect you if you inherit a 401(k).

Why required minimum distributions exist

The government provides a tax break for retirement savings by allowing workers to contribute to a 401(k) with pre-tax funds and enjoy tax-free growth on investments within a 401(k).

Uncle Sam wants to collect its piece of the money eventually, though, so RMD rules exist to make sure those who have invested in a 401(k) begin taking the money out during retirement.

RMDs ensure workers take out a set minimum amount of money each year based on their life expectancy. Withdrawals that follow RMD rules are taxed as ordinary income.

By requiring 401(k) accountholders to take RMDs, the government also makes it impossible for wealthier retirees to just leave their 401(k) funds to grow tax-free indefinitely before passing the account assets on to heirs.

RMD rules for 401(k) plans

RMD rules require that workers begin taking RMDs by April 1 of the year after the accountholder turn 73. The Secure Act 2.0, which passed in December 2022, increased the age from 72 to 73.

RMDs must be taken not just from 401(k) plans but from other retirement plans, including different types of IRAs. These include SEP and Simple IRAs, as well as from 403(b)s, 457(b)s, profit-sharing plans, and other defined contribution plans. The amount of your RMD is based on your account balance and life expectancy.

The IRS provides worksheets and tables to calculate RMDs. If you do not take your RMD, you'll face a 25% penalty on whatever amount you fail to withdraw. If you act quickly to correct this mistake, the penalty may be reduced to 10%. (For 2022 and previous tax years, the penalty was 50%, but the Secure Act 2.0 decreased the fine.)

So if you were supposed to take a $5,000 RMD in 2022 (for taxes that were due in April 2023) and you don't remove any money from your 401(k), you would have owed $2,500. But in 2023, your penalty would drop to $1,250 (for taxes that are due in April 2024).

Exceptions to RMDs

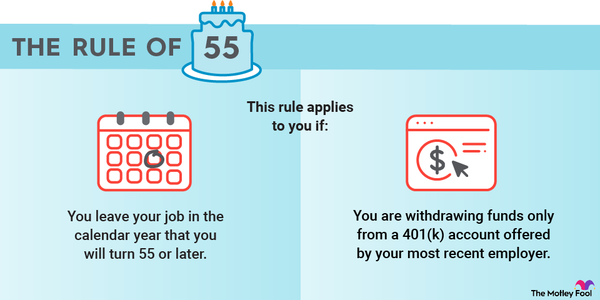

Although there's generally no flexibility when it comes to 401(k) RMDs, there is one exception. If you're still working for the company sponsoring your plan by the time you turn 73 (previously 2022) and you don't own 5% or more of that company, you may be able to avoid RMDs for as long as you remain employed -- although not all plans allow this.

Once you leave that company, however, you'll need to start taking withdrawals. Also keep in mind that this exception applies to 401(k)s only. If you have an IRA in addition to your 401(k), you'll need to take your RMDs regardless of whether you're still working at the time.

How to avoid RMDs

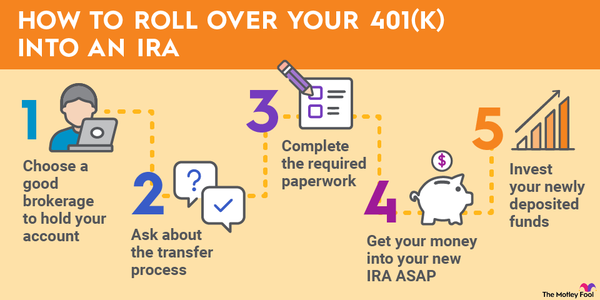

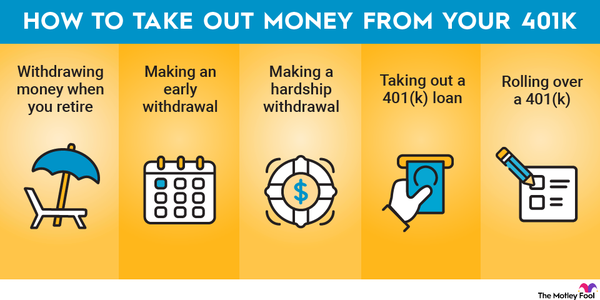

The best way to avoid RMDs (and the taxes they trigger) is to switch your traditional 401(k) to a Roth IRA.

Roth IRAs are funded with after-tax dollars so there's no immediate tax savings when you contribute. Your money, however, gets to grow tax-free, and withdrawals in retirement aren't taxed at all.

Furthermore, Roth IRAs don't impose RMDs, which means you can leave your money in your plan indefinitely and let it grow. Note that Roth 401(k)s, despite the fact they are also funded with after-tax money weren't exempt from RMDs in 2023 and previous tax years. However, beginning in 2024, workplace accounts with a Roth designation will no longer have RMDs.

Moving money from a traditional 401(k) to a Roth account is a taxable event and can delay eligibility for penalty-free withdrawals, so be sure you know the rules before you do a rollover.

Related Retirement Topics

RMDs for inherited accounts

If you inherit a 401(k) from someone else, you are also required to take RMDs. However, the rules for when and how you must take them out differ depending on whether you're the spouse of the deceased or a non-spouse beneficiary, among other factors.

- If you inherit a 401(k) from a spouse, you'll have a choice of rolling the money over to your own 401(k) or IRA and taking RMDs as if the account had been your own all along or transferring assets into an inherited IRA and taking distributions based on your life expectancy using the IRS Single Life Expectancy table.

- If you inherit from a non-spouse who died after Jan. 1, 2020, you'll generally need to roll the money into an inherited IRA and withdraw all assets within 10 years. However, different rules apply for "designated beneficiaries," including disabled individuals.

If you have a 401(k), be sure to read up on the rules of required minimum distributions so you're not caught off-guard down the line. The last thing you want is to forgo some of your hard-earned savings because you failed to take your RMDs in time.