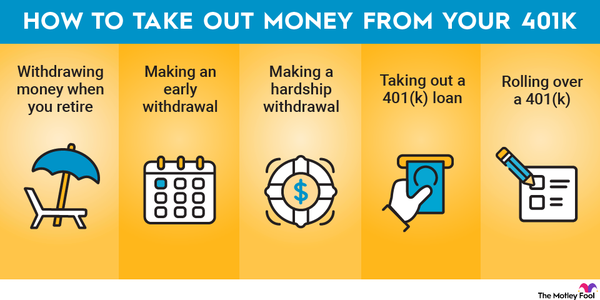

For many Americans, the balance of their 401(k) account is one of the biggest financial assets they own -- but the money in these accounts isn't always available since there are restrictions on when it can be accessed.

401(k) plans are meant to help you save for retirement, so if you take 401(k) withdrawals before age 59 1/2, you'll generally owe a 10% early withdrawal penalty on top of ordinary income taxes.

However, there are limited exceptions. For instance, if you incur unreimbursed medical expenses that exceed 10% of your adjusted gross income, you can withdraw money from a 401(k) penalty-free to pay them. Similarly, you can take a penalty-free distribution if you're a military reservist called to active duty.

Because the exceptions are narrow, most people must leave their money invested until age 59 1/2 to avoid incurring substantial taxes. However, there is one big exception that could apply if you're an older American who needs earlier access to your 401(k) funds. It's called the "rule of 55," and here's how it could work for you.

What is the rule of 55?

What is the rule of 55?

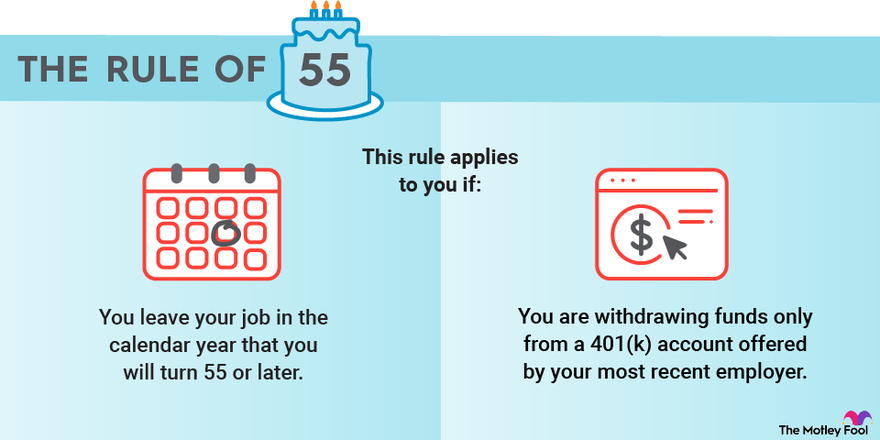

The rule of 55 is an IRS regulation that allows certain older Americans to withdraw money from their 401(k)s without incurring the customary 10% penalty for early withdrawals made before age 59 1/2. The rule of 55 applies to you if:

- You leave your job in the calendar year that you will turn 55 or later (or the year you will turn 50 if you are a public safety worker such as a police officer or an air traffic controller). You can leave for any reason, including because you were fired, you were laid off, or you quit.

- You are withdrawing funds only from a 401(k) account offered by your most recent employer. You cannot withdraw money penalty-free from accounts with other past employers, nor can you make penalty-free withdrawals from an IRA, even if you rolled over your 401(k) into one upon leaving your most recent job.

One common misconception is that you can leave your job before the calendar year you turn 55 and the rule will still apply to you. This is not the case. If you are turning 55 in 2024 and leave your job on Dec. 31, 2023, you'd still owe an early withdrawal penalty on 401(k) distributions.

How to make the best use of the rule of 55

How to make the best use of the rule of 55

The restrictions of the rule of 55 make it vital to use smart retirement planning techniques. First and foremost, you need to time your early retirement so you don't leave your job before the year in which you'll turn 55.

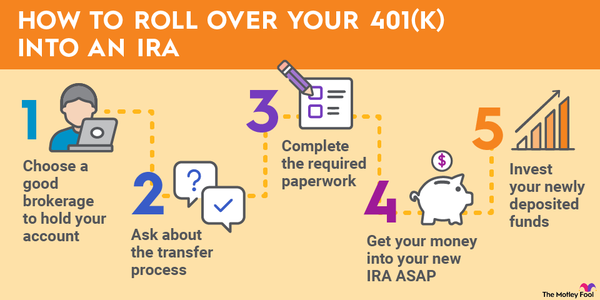

Second, if you want to maximize the amount of money you can withdraw without penalties, you should take advantage of rollover options to move as much money as you can into your current employer's 401(k) before leaving your job. For example:

- Many companies allow you to roll over 401(k)s from previous employers into your new employer's account.

- Many also enable you to move money from an IRA into your workplace 401(k) if the money got into the IRA when you rolled over a former workplace 401(k).

Any money in your current employer's 401(k) account when you leave your job will qualify for the rule of 55, so using rollovers to put as much money into that account as possible provides you with the most flexibility. If you don't roll the money from old 401(k)s or rollover IRAs into your current 401(k) before leaving, you won't have the option to withdraw without penalty until age 59 1/2.

Finally, remember not to roll over your eligible 401(k) account into an IRA after quitting at age 55 or older. Doing so will cause you to lose the exemption and subject you to penalties for withdrawals until you hit 59 1/2.

Having access to money is vital for retirees, especially if you end up having to retire early or unexpectedly. Knowing the rules about getting access to your 401(k) at age 55 or older can be a lifesaver for your finances.