The typical workplace 401(k) plan offers limited investment choices. If you're an avid investor, you may prefer more flexibility in what you can invest in.

A self-directed 401(k) plan may be just what you need. It offers something known as a "brokerage window" through which your employer may allow you to invest part or all of your 401(k) plan as you see fit. Your employer decides whether to offer this feature, as well as the types of investments you can choose from.

Self-directed 401(k) plans follow the same rules and requirements as other 401(k) plans. If your employer allows self-directed 401(k) plans, make sure you know these Internal Revenue Service (IRS) rules before you make account contributions.

Self-directed 401(k) rules and requirements

1. Annual contribution limits

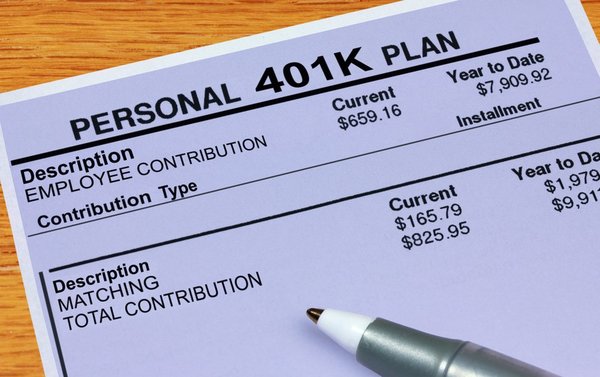

The limit on your elective deferrals -- the maximum amount you can have deducted from your taxable income and placed in your 401(k) account -- is $23,000 for 2024 ($22,500 for 2023). The limit is increased regularly for inflation. If you're age 50 or older at the end of the year, you can make additional elective deferrals of up to $7,500 for both 2023 and 2024.

Your employer can also make additional contributions for you up to a maximum contribution limit of $69,000 in 2024 ($66,000 in 2023). For those younger than 50 and eligible for catch-up contributions, the maximum limit, including employer contributions, is $76,500 in 2024 ($73,500 in 2023) for those 50 and older.

If you work for only one company during the year, you shouldn't have to worry about going over the limit for your 401(k) plan contributions since your employer calculates this limit for you. If you work for more than one company, however, it's easy to go over the limit since one employer doesn't know how much another has already let you contribute.

If you overcontribute to your 401(k), it's your responsibility to notify your plan administrator and have the excess contribution returned to you before the tax deadline for the following year. Otherwise the excess contribution does not reduce your taxable income, and you must pay tax on it when you withdraw it. That means the same income is taxed twice. Leaving excess deferrals in your account can also cause the IRS to disqualify your plan.

2. Disqualified investments

If you have a self-directed 401(k) plan through your employer, don't take the "self-directed" part too literally. Your employer can still limit the types of investments you make. Some employers may limit you to mutual funds, for example.

You also won't get away with investing in anything for which you may receive an immediate benefit. You can't, for example, use your 401(k) to buy your personal home. And forget using your 401(k) to buy collectible automobiles, art, or vacation properties that you expect to use. You can't pay yourself to manage your own 401(k) plan investments either.

If your employer allows it, however, you can invest in securities, investment real estate, gold, currency, and other investments.

3. Transactions between related parties

Don't entangle your 401(k) plan with your family members. For this purpose, "family members" are your parents, grandparents, children, grandchildren, or spouse's children or grandchildren.

This means you can't lend your 401(k) money to any of these relatives, let them live in property owned by your 401(k) plan, invest that money in your relatives' businesses, or otherwise cause your family members to benefit from your 401(k) investments.

Related Retirement Topics

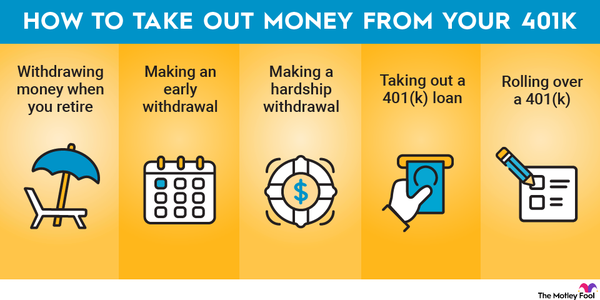

4. Distributions

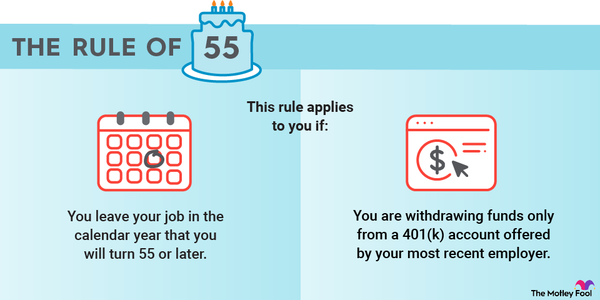

The rules for taking distributions from a self-directed 401(k) plan are the same as those for any other 401(k) plan. If you take an early withdrawal before age 59 1/2, you may have to pay a 10% penalty to the IRS in addition to ordinary income tax unless you meet an exception.

Your employer's 401(k) plan may allow for hardship withdrawals when you have immediate and serious financial needs.

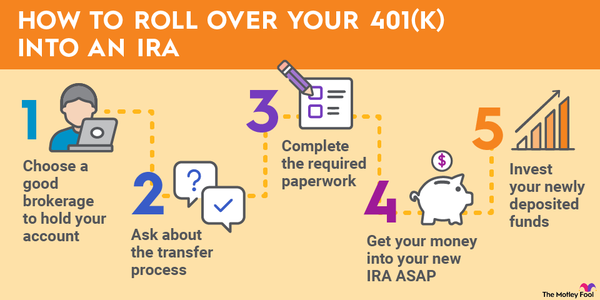

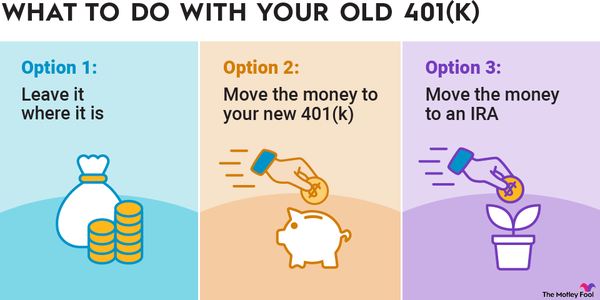

If you leave your job, you can roll over a self-directed 401(k) plan to another qualified retirement plan or IRA just as you can with any other 401(k) plan. As long as you move your money into another tax-advantaged account, the transaction shouldn't be a taxable event.

It's your money, and you should be able to buy and sell investments as you choose, taking the risks and reaping the rewards. If your employer offers a self-directed 401(k) plan, you can do just that.