Most workers have heard of 401(k) plans and their usefulness in saving for retirement, but other tax-favored retirement savings vehicles are available to certain employees. For those who work in education, medical professions, or nonprofit organizations, many employers offer 403(b) plans.

403(b) contribution limits

403(b) plans are similar in many ways to 401(k)s, and one thing they have in common is that they enable you to make large contributions toward retirement.

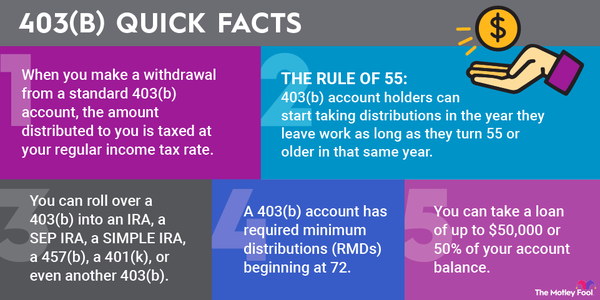

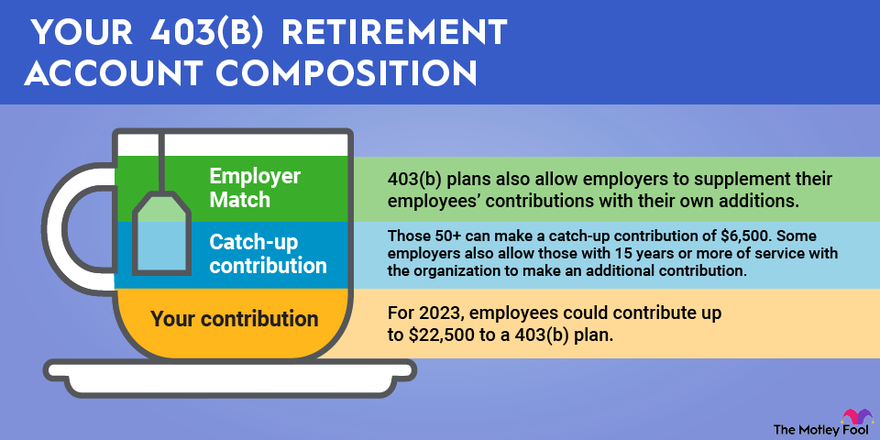

For 2023, employees could contribute up to $22,500 to a 403(b) plan. This contribution limit increases to $23,000 in 2024. Those 50 and older can make a catch-up contribution of $7,500 in 2023 and 2024, bringing the total eligible contribution limit to $30,000 in 2023 and $30,500 in 2024.

In addition, some employers integrate into their plans an additional catch-up contribution option that allows those who have 15 years or more of service with the organization to make an additional contribution of up to $3,500 in both 2023 and 2024.

Let's look more closely at 403(b) plans to see how those who have access to these plans can put them to maximum advantage.

403(b) basics

403(b) plans get their name from Section 403(b) of the Internal Revenue Code, which sets forth the tax breaks that they offer, as well as the restrictions on the plans. 403(b) plans are available to public schools and employers that qualify as tax-exempt charitable organizations. Most of the workers you'll find with access to 403(b) plans therefore tend to work for schools, nonprofit hospitals and healthcare providers, and charities.

403(b) plans also allow employers to supplement their employees' contributions with their own additions. Discretionary or matching contributions from employers are permitted, up to a total combined maximum of $69,000 in employer and employee contributions for those younger than 50 in 2024 ($76,500 for those 50 or older). For 2023, that limit was $66,000 ($73,500 for those 50 or older).

However, employer contributions aren't quite as common or as generous as in the 401(k) realm, typically because the nonprofit nature of these businesses doesn't give them as much latitude to offer top-end benefit packages.

One thing to be aware of is what investment options your 403(b) plan offers. Originally employers had to use annuity products from insurance companies to get the tax benefits of 403(b)s, and although those restrictions have gone away to allow traditional mutual funds and similar investments, some plans nevertheless have higher-cost annuities that aren't ideally suited to every investor's needs.

Roth or regular?

The high amounts that you can save in a 403(b) plan make them quite useful. As with 401(k)s, there are traditional or Roth 403(b) plans, with employers having the option to give workers access to both.

Traditional 403(b)s involve saving pre-tax money and letting it grow tax-deferred within the account. As an example, if your total income from work is $50,000, and you contribute $5,000 to your 403(b), your gross income will drop by that $5,000 to $45,000. Thereafter, you won't have to pay income tax on the investment income that your 403(b) account generates. Only when you withdraw money in retirement will you pay income tax on what you take out.

Roth 403(b)s involve saving after-tax money and letting it grow tax-free within the account. As long as you meet the requirements, you'll never pay tax again on Roth 403(b) money, even when you withdraw it in retirement.

Maxing out your savings

If you can save in a 403(b) plan, it usually makes sense to do so, especially if you want to put as much money aside as possible. Alternatives such as IRAs are available, but IRA contribution limits -- just $7,000 in 2024, up from $6,500 in 2023, plus a $1,000 catch-up contribution in both years if you're 50 or older -- are quite a bit more limited.

403(b) plans aren't as popular as their 401(k) counterparts, but 403(b)s serve a key role in ensuring retirement security and success in financial planning. If your employer sets up a high-quality plan with good investment choices, a 403(b) can be exactly what you need to reach your retirement goals.