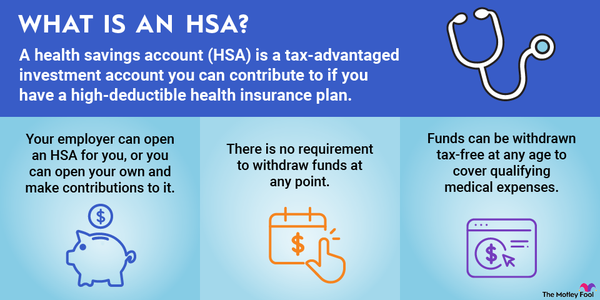

A health savings account (HSA) can be used to save for medical care or as a retirement savings account. You own your HSA funds, even if your employer opens the account for you, so you can take your money with you if you leave your job.

The process of moving your money from one HSA into another is called an HSA rollover. Here's how it works.

Does it roll over?

Does an HSA roll over?

First things first: The money in any HSA is yours to keep, even if your employer provided the account and made an HSA contribution on your behalf. You don't have to spend the money on healthcare in the year you make contributions. It remains available indefinitely until you decide to withdraw it. The money simply carries over from year to year and is yours to keep.

If you leave your job, you can take all your HSA money with you using a rollover. And if you opened an HSA with a bank or brokerage and want to switch to a different one, a rollover also gives you the option to do so.

Rollover options

HSA rollover options

There are actually two processes to move your HSA funds into a new account:

- A trustee-to-trustee transfer: The trustees administering your HSA move your money to a different HSA provider. This is done upon your request -- your trustee won't simply move your HSA money without you asking them to. But you don't have to be involved in the process of receiving and redepositing your HSA money. The trustee moves the funds into your new account for you, usually after you submit written forms requesting the move.

- An HSA rollover: This occurs when your HSA provider sends you a check for the money in your account and you deposit it into a new HSA within 60 days. You can face penalties if you do not make your HSA rollover contribution by this deadline.

HSA transfers and HSA rollovers accomplish the same thing, but you play a more active role in a rollover. You're limited to one rollover every 12 months, and you risk owing income taxes plus a 20% penalty for a nonqualified withdrawal if you don't redeposit your HSA funds within 60 days.

Transfers eliminate these risks. There's no chance of incurring a penalty -- your money is deposited directly into your new HSA for you, meaning you don't have to worry about depositing the funds -- so you should always opt for a transfer if you can.

Rules and questions

Common HSA rollover questions

Rolling over an HSA can be confusing. Here are some answers to questions you may have about the process. These can help you make informed choices about what you do with the money in your HSA.

What happens to your HSA when you quit a job?

When you leave your job for any reason, you still get to keep all your HSA money. You can elect to leave the money invested with your current employer and make withdrawals whenever you wish, or you can transfer or roll over the HSA.

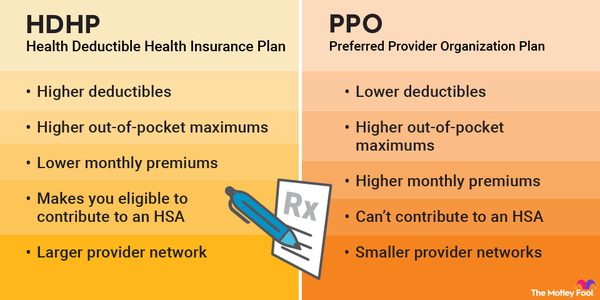

However, if you stop participating in the high-deductible health plan that made you eligible for the HSA, you will no longer be able to make new contributions to your HSA.

What happens to unused HSA funds?

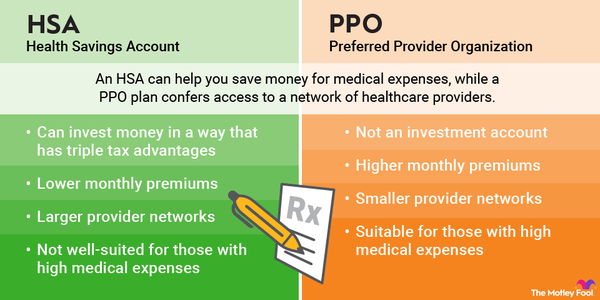

Unlike a flexible spending account (FSA), HSA money isn't "use it or lose it." Your money can stay in your account for as long as you'd like. You can withdraw it tax-free to use for medical expenses at any time or withdraw it for any purpose after age 65 without penalty (although you would owe ordinary income tax if the funds are not used for medical expenses).

If you don't spend all your HSA funds, the unused money simply carries over, or rolls over, from year to year. It stays in your account, and you don't have to do anything to make that happen unless you want to move the money into a different HSA.

Do HSA funds roll over from year to year?

HSA funds carry over from year to year, but this is different from an HSA rollover. Any contributions you make and gains from investments can remain in your account for as long as you'd like. The money is simply carried over from year to year until you choose to withdraw it.

What's the difference between an HSA transfer and a rollover?

An HSA transfer occurs when your HSA trustee directly moves your money into your new HSA for you. With an HSA rollover, the trustee sends you the money, and you must deposit it into your new HSA within 60 days.

Why should I do an HSA rollover?

If you are changing jobs, doing an HSA rollover may make sense if:

- You'd prefer not to leave an old employer with an account that you must remember to manage.

- You prefer to move your money to a different HSA provider offering better investment options, lower fees, or other advantages than your former employer's plan.

HSA rollover rules

The IRS establishes the HSA rules, so these regulations should apply to anyone doing a rollover. Here are some of the rules you should know about:

- HSA funds belong to you, even if your employer made contributions to the account.

- HSA funds carry over from one year to the next if you don't use them -- they are not use-them or lose-them funds, unlike those in an FSA.

- If you leave your job, you can usually leave your HSA funds where they are, roll them over to an HSA with your new employer, or roll them into an HSA you open with a provider of your choosing.

- If you open your own HSA, you can choose to roll over the funds to a new HSA provider.

- You can only do one HSA rollover every 12 months.

- You cannot roll over HSA money into a 401(k) or 401(k) money into an HSA.

The process

How to roll over HSAs

The process of rolling over an HSA is simple:

- Step 1: Contact your plan administrator to initiate a rollover. You can typically contact your provider online or via phone using the number on the back of your HSA card or in your plan paperwork.

- Step 2: Receive a check from your HSA provider.

- Step 3: Deposit the check into an HSA with your new provider within 60 days.

It is critical that you get your money deposited in time to avoid having your withdrawal counted as a distribution that triggers taxes and penalties.

Considerations

Things to consider before transferring old HSA funds

Before you transfer old HSA funds into a new HSA, consider:

- What monthly maintenance fees are you incurring on your current account, and what would you incur on your new account?

- What HSA investment options are available in your existing HSA versus the new account you're considering rolling your money into?

- How do you manage your money in your current account versus your new account, and do you have online access to review your balance and investment returns or to change your investment mix?

- Is there a rollover or transfer fee?

- How long will the transfer process take, and will you need access to the HSA funds during the process?

If you have a low HSA balance, expect to incur medical expenses soon, and there's a transfer fee, it may make sense to simply spend down your balance on qualified medical expenses rather than move the funds to a new HSA. But a rollover may make sense for you if you have a substantial amount of money in your HSA and can reduce your maintenance fees or gain access to better investment options.

Related investing topics

Carefully consider whether an HSA rollover is right for you

When leaving a job, carefully think about whether it makes sense to keep your HSA with your current plan administrator or roll it over. If you determine you want to move your HSA funds to a new account, a trustee-to-trustee transfer will simplify the process.

However, both a transfer and a rollover provide the flexibility to move HSA funds to a new provider of your choosing. So, going through the paperwork may be well worth doing if you've found one you'd prefer.

FAQ

HSA rollovers in 2023 and 2024: FAQ

Is there an HSA rollover limit?

You can only do an HSA rollover once every 12 months.

Can I roll over my HSA to another HSA?

If you are leaving your job or otherwise want to switch HSA plans, you have the option of doing a rollover from your existing account into a new one.

Can I roll over my HSA to a 401(k)?

You cannot roll over HSA funds into a 401(k). You also cannot roll over 401(k) money into an HSA.

Can I roll over my IRA to my HSA?

You can roll over funds from an IRA to an HSA, but you must be eligible to make HSA contributions and cannot roll over more than the annual contribution limit for the year. You're also allowed only one IRA-to-HSA rollover in your lifetime.