What is a traditional IRA?

A traditional IRA is a tax-deferred retirement account you open outside of an employer’s retirement plan. In certain cases, you’ll receive a tax deduction equal to your contribution. However, the extent of this deduction varies based on your income and tax filing status.

Once you’ve deposited money into your traditional IRA, you can invest in a tax-deferred manner. That is, your money will not be taxed until you withdraw it, presumably in retirement. During your working career, money invested in a traditional IRA will grow and compound without any annual tax assessment.

In short, traditional IRAs offer an additional vehicle to save for retirement and also offer potential tax advantages depending on your total financial picture. If you’re willing to commit to investing for the long term, a traditional IRA can grow to large sums in a tax-advantaged fashion.

What rules apply to traditional IRAs?

Age-related contribution rules: You can contribute to a traditional IRA at any age -- as long as you have earned income of at least your contribution amount.

Contribution limits: For the 2023 tax year, the IRA contribution limit is $6,500 for both a traditional and a Roth IRA. In 2024, the limit is $7,000. Depending on your income and tax filing status, you may be able to deduct the full amount of your contribution.

If you’re older than age 50, you’re eligible to contribute an extra $1,000 for the 2023 and 2024 tax years, or a total of $7,500 (2023) or $8,000 (2024). This is known as a catch-up contribution.

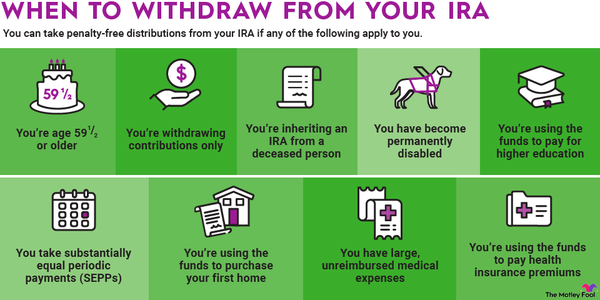

Withdrawal rules: You are eligible to withdraw from a traditional IRA without penalty at age 59 1/2. If you withdraw from a traditional IRA before then and don’t have a qualifying reason, you’ll pay income taxes on the withdrawal, as well as a 10% early withdrawal penalty.

Additionally, you must take required minimum distributions (RMDs) beginning at age 73. RMDs are mandatory minimum withdrawals from your retirement account that you’re required to make so you’ll eventually pay income tax.

The amount of your annual RMD is based on your life expectancy as calculated by IRS actuaries. Your RMD will be taxed as ordinary income, so it is important to plan for the impact of your RMDs ahead of time.

Deduction eligibility: Your eligibility to take a tax deduction for your traditional IRA contribution hinges on three factors: your income, your tax filing status, and whether or not you are covered by a retirement plan at work such as a 401(k).

For single filers covered by a retirement plan at work:

| 2023 Modified AGI* | 2024 Modified AGI | Maximum Tax Deduction |

|---|---|---|

| $73,000 or less | $77,000 or less | $6,500 ($7,500 for ages 50 and up) in 2023; $7,000 ($8,000 for ages 50 and up) in 2024 |

| Between $73,000 and $83,000 | Between $77,000 and $87,000 | A reduced amount |

| More than $83,000 | More than $87,000 | None |

For joint filers covered by a retirement plan at work:

| 2023 Modified AGI | 2024 Modified AGI | Maximum Tax Deduction |

|---|---|---|

| $116,000 or less | $123,000 or less | $6,500 ($7,500 for ages 50 and up) in 2023; $7,000 ($8,000 for ages 50 and up) in 2024 |

| Between $116,000 and $136,000 | Between $123,000 and $143,000 | A reduced amount |

| More than $136,000 | More than $143,000 | None |

For single filers NOT covered by a retirement plan at work:

| 2023 Modified AGI | 2024 Modified AGI | Maximum Tax Deduction |

|---|---|---|

| Any | Any | $6,500 ($7,500 for ages 50 and up) in 2023; $7,000 ($8,000 for ages 50 and up) in 2024 |

For joint filers NOT covered by a retirement plan at work, and spouse IS NOT:

| 2023 Modified AGI | 2024 Modified AGI | Maximum Tax Deduction |

|---|---|---|

| Any | Any | $6,500 ($7,500 for ages 50 and up) in 2023; $7,000 ($8,000 for ages 50 and up) in 2024 |

For joint filers NOT covered by a retirement plan at work, but spouse IS:

| 2023 Modified AGI | 2024 Modified AGI | Maximum Tax Deduction |

|---|---|---|

| $218,000 or less | $230,000 or less | $6,500 ($7,500 for ages 50 and up) in 2023; $7,000 ($8,000 for ages 50 and up) in 2024 |

| Between $218,000 and $228,000 | Between $230,000 and $240,000 | A reduced amount |

| More than $228,000 | More than $240,000 | None |

Can you transfer a traditional IRA?

Generally, you can transfer a traditional IRA to another brokerage platform or merge your traditional IRA with an existing one. When you transfer your traditional IRA, it’s especially important to make sure that the tax status of the receiving account matches that of your starting account.

For example, if you want to roll over a traditional IRA to another traditional IRA held at another institution, this will generally not cause a taxable event. If, however, you wanted to roll over your traditional IRA to a Roth IRA, the amount rolled over would be considered taxable income (this is otherwise known as a Roth conversion). For this reason, it’s critical that you understand the potential tax implications of the rollover before you complete one.

What are the beneficiary distribution options?

When a traditional IRA owner dies, there are many different scenarios that may take place -- depending on who is listed as the beneficiary. Keep in mind that a traditional IRA is usually made up of pre-tax contributions, so within a traditional IRA is an embedded tax liability that ultimately needs to be paid, even if over time.

If the original account holder is your spouse, you will have the option to merge the money with your own traditional IRA and realize no tax consequence. Alternatively, when a traditional IRA becomes the property of a non-spouse beneficiary, it is now considered an inherited IRA and typically must be distributed within 10 years for accounts inherited after Jan. 1, 2020, under the SECURE Act of 2019 rules.

What are the pros and cons of a traditional IRA?

| Pros of a traditional IRA | Cons of a traditional IRA |

|---|---|

|

· Potential tax deduction now · No age limit for contribution · Tax-deferred growth · Extra retirement savings vehicle (regardless of retirement plan coverage through employer) · Could create tax diversification if you already have significant Roth assets · Wide array of investment options · Can easily be rolled over to accounts with similar tax treatment |

· Potential higher tax rate in retirement · Limited tax benefits, even if you are eligible for the full deduction · Limits backdoor Roth IRA potential · RMDs increase taxable income in retirement · Not the most efficient to receive as a beneficiary due to embedded tax liability · Recent elimination of stretch IRA (account must be liquidated by beneficiary within 10 years) · Complicated rules |

Is a 401(k) a traditional IRA?

No. A 401(k) is an employer retirement plan that is commonly offered as a workplace benefit. These plans share some characteristics with traditional IRAs, but they are entirely different accounts and have many different rules.

A traditional IRA is an independent retirement account that you can open on your own, wholly separate from your employer. The rules surrounding these accounts are different, depending on your personal circumstances.

Is a rollover IRA a traditional IRA?

A rollover IRA is an individual retirement account that has been transferred from an employer-sponsored retirement plan such as a 401(k).

A rollover IRA may be categorized as a traditional IRA, but it may also be categorized as a Roth IRA. From the opposite perspective, a traditional IRA may also be a rollover IRA, but it does not necessarily have to be a rollover IRA.

Where can I find the best traditional IRA?

Many of the online discount brokers -- think Fidelity, Vanguard, and Charles Schwab -- are great options for opening a traditional IRA. You can also check out The Motley Fool’s page on traditional IRAs to find the best option for you.

Related Retirement Topics

What to do next

Before opening a traditional IRA, you will need to evaluate your entire financial situation. This means looking at your assets, income, tax filing status, and then determining if you’re covered by a retirement plan at work.

A traditional IRA might be a great way to score a tax break and take advantage of tax-deferred growth. If you’re a high earner and ineligible for a deduction, you might consider other options. Regardless, it pays to know when a traditional IRA makes sense, and, most importantly, when it makes sense for you.