More employers are offering a Roth option in their 401(k) plans, giving employees flexibility in how they save for retirement. Unlike with a traditional 401(k) account, employees pay income tax on their contributions to a Roth 401(k) account in the year they make them, but they won't pay any taxes on qualified distributions in retirement.

Employees who have access to a Roth 401(k) account need to be mindful of annual contribution limits when electing their salary deferrals.

Roth 401(k) contribution limits

For 2023, employees can contribute the $22,500 standard contribution limit to a Roth 401(k) and an additional $7,500 catch-up limit for those 50 and older. The base contribution limit for 2024 is $23,000, but catch-up contributions remain at $7,500.

Importantly, those limits apply across all 401(k) accounts. So if you're splitting your contributions between a Roth account and a traditional account in the same 401(k) plan, the total still needs to be within the aforementioned limits.

If you participate in multiple 401(k) plans, you need to be even more mindful of the limits. It's very easy to exceed the 401(k) contribution limit when you have two separate plans with two different plan administrators who don't communicate with each other.

An important note: The annual employee contribution limits are separate from employer contributions, otherwise known as the company match. The IRS has much higher limits for total combined contributions from employees and employers. The combined limits are $66,000 in 2023 and $69,000 in 2024. These limits don't include catch-up contributions, so it's possible for someone age 50 or older to save $73,500 in 2023, or $76,500 in 2024.

Note that employer contributions have always tax-deferred with no Roth option for tax years 2023 and earlier. But starting in 2024, employers will be able to match contributions in post-tax Roth accounts.

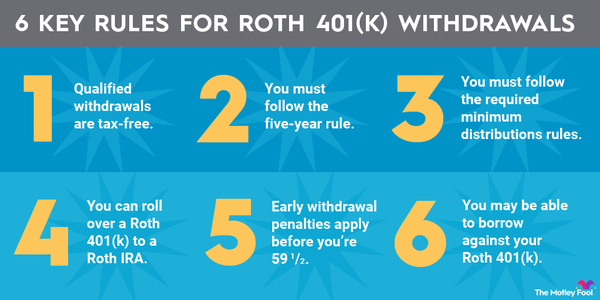

Roth 401(k) withdrawals

As long as you make a qualified withdrawal from your Roth 401(k), you won't pay any taxes.

The first step in making sure a withdrawal is qualified is having the account for five years. Withdrawing earlier than five years after establishing the account comes with taxes and a penalty. At the time of the withdrawal, the account holder must be at least 59 1/2 years old. There are some exceptions if the original account holder passes away or becomes disabled.

You may be familiar with the rule of 55, which allows 401(k) account holders to tap their retirement savings early if they separate from service in the year they turn 55 or later. Roth 401(k)s also make an exception for the rule of 55, but early withdrawals still have significant drawbacks. While account holders won't face a penalty for withdrawals before 59 1/2, they'll still have to pay taxes on the portion of the withdrawal attributable to the earnings in the account.

Like traditional 401(k)s, Roth 401(k) accounts are subject to required minimum distributions (RMDs) starting at age 73 for the 2023 tax year. However, per the new Secure Act 2.0 rules, RMDs are no longer required for Roth 401(k)s in 2024 and subsequent tax years.

Consider Roth IRAs

If you're considering a Roth 401(k), you might also consider a Roth IRA. A Roth IRA is even more flexible than a Roth 401(k) account. The only drawback is that the contribution limits are much lower. Individuals can contribute up to $6,500 in 2023, or $7,000 in 2024. There's an extra $1,000 catch-up contribution allowed for those 50 and older.

Besides giving you more investment options, the Roth IRA can be even more advantageous for avoiding taxes and penalties than the Roth 401(k). But if you roll over the 401(k) account into a new Roth IRA account, the five-year period before you can withdraw funds starts over.

With a Roth IRA, you can withdraw your contributions at any point without taxes or penalty. When you make an early withdrawal from a Roth 401(k), however, gains are mixed in with contributions, so some of the withdrawal amount is taxable and penalized. So if you think you might need access to some of your funds before age 59 1/2, a Roth IRA may work better than a Roth 401(k).