Funding a Roth IRA is the best way to take advantage of current low income tax rates and set yourself up for years of tax-free income in retirement. However, people with high incomes are not allowed to contribute to a Roth IRA directly. For them the only way into a Roth is through the back door -- with a strategy appropriately known as the backdoor Roth.

Understanding how they work

Understanding backdoor Roth IRAs

Here's the key point to know before we go any further. Even though there are income limits on Roth contributions, there aren't any limits on Roth conversions. You can earn as much as you want and still convert a traditional IRA to a Roth.

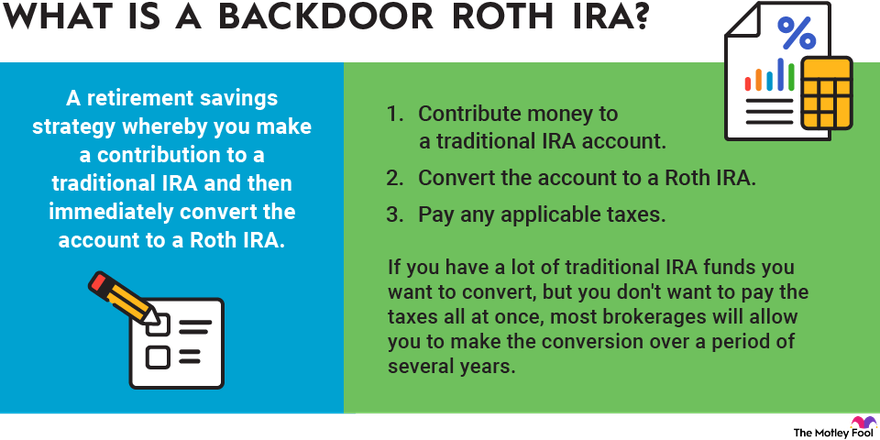

A backdoor Roth IRA is a retirement savings strategy whereby you make a contribution to a traditional IRA, which anyone is allowed to do, and then immediately convert the account to a Roth IRA.

First, let's take a step back and see if you can contribute to a Roth IRA directly.

For you to contribute directly to a Roth IRA, your income must be under a threshold dependent on your tax filing status. If your income is above a defined upper limit, also known as the phase-out limit, then you can't contribute to a Roth IRA at all. Within a range just below that upper limit, only partial Roth IRA contributions are allowed. The IRS sets these limits each year. Here's a look at the 2023 and 2024 limits:

Contribution limits for 2023 and 2024

Roth IRA contribution limits for 2023 and 2024

| Tax Filing Status | Maximum AGI for Full Roth Contribution | Phase-Out (Upper) Income Limit |

|---|---|---|

| Single, head of household, or married filing separately IF you didn't live with your spouse during the year | $138,000 (2023); $146,000 (2024) | $153,000 (2023); $161,000 (2024) |

| Married filing jointly or qualifying widow or widower | $218,000 (2023); $230,000 (2024) | $228,000 (2023); $240,000 (2024) |

| Married filing separately IF you lived with your spouse at any point during the year | $0 | $10,000 |

If your income is above the phase-out limit, you're out of luck for making a direct Roth contribution. But you can still make a contribution to a traditional IRA, and that's where the backdoor Roth strategy comes in.

Backdoor Roth IRA contribution limit

The IRA contribution limit for 2023 is $6,500 per person, or $7,500 if the account owner is 50 or older. In 2024, the contribution limits rise to $7,000, or $8,000 for those 50 and older. So if you want to open an account and then use the backdoor IRA method to convert the account to a Roth IRA, that's the maximum you can contribute for those tax years.

It's worth noting that you can make IRA contributions until the tax deadline, so if you make your contribution after New Year's Day, you can effectively make two years' worth of contributions at once.

Taxes

Backdoor Roth IRA taxes

When you convert a traditional IRA to a Roth IRA, any amount that you received a traditional IRA tax deduction on will be considered taxable income.

For example, let's say that you contributed $5,000 to a traditional IRA in 2023 and claimed it as a deduction on your 2023 tax return. If you then convert the account to a Roth IRA in 2024, the account value at the time of the conversion (even if it's more than $5,000) would be considered taxable income, which you would report (and pay tax on) on your 2024 tax return.

On the other hand, if you make a nondeductible traditional IRA contribution or if you immediately convert the account after making a traditional IRA contribution, there generally won't be any taxes due on the conversion.

I use the word "generally" because, unfortunately, if you have additional traditional IRA assets, then there's another problem. The IRS won't let you treat the conversion as coming solely from the non-deductible IRA. Instead you'll have to include a portion of the conversion in your taxable income, based on the pro-rata value of your nondeductible and other traditional IRA assets. That's generally not desirable, so if you have extensive retirement assets in deductible traditional IRAs, you should think twice before trying to do a backdoor Roth.

How to do a conversion

How to do a backdoor Roth IRA conversion

The backdoor Roth IRA method is pretty easy. The general steps are:

- Contribute money to a traditional IRA account, making sure your brokerage offers Roth conversions (most do).

- Convert the account to a Roth IRA. Typically this just involves a short form, which your brokerage can provide and process.

- Pay any applicable taxes. You have until the tax deadline for the year in which the conversion was made to pay any applicable taxes on the converted account, but it's a smart idea to consider sending the money to the IRS right away.

If you have a lot of traditional IRA funds you want to convert, but you don't want to pay the taxes all at once, most brokerages will allow you to make the conversion over a period of several years.

Related retirement topics

Should I do a backdoor Roth IRA?

As you can see, the backdoor Roth strategy can be valuable in getting money into a tax-free account. And, with the possibility that tax rates go higher from here, getting money into Roth IRAs now could pay off in the long run. But it isn't right for everyone. So it's important to ask yourself (or your financial advisor) whether a Roth IRA makes sense for you or not. If you make too much to contribute to a Roth IRA directly, the answer might be no.

Think of it this way. If you are in a low tax bracket -- say 10% or 12% -- right now, it can make great financial sense to lock in your current tax rate by contributing to a Roth IRA and to not have to worry about taxes in retirement. On the other hand, if you're in a relatively high tax bracket right now and you qualify for the traditional IRA tax deduction, a traditional IRA might make more sense when it comes to tax optimization.

There's more tax certainty with a Roth IRA since there's no way to know what U.S. tax brackets will look like by the time you're ready to retire. Plus there are other benefits, such as no required minimum distributions (RMDs) and the ability to withdraw contributions whenever you want, that add value to the Roth IRA.

Just because everyone can use the backdoor method of contributing to a Roth IRA doesn't mean that everyone should. Before you start the process, make sure it's truly the best move for your retirement strategy.