A Roth IRA is a tax-advantaged retirement account that you invest in with after-tax money, which may make you eligible to take tax-free distributions. Distributions are tax-free only if they are "qualified" distributions. It's important to understand the rules for when a distribution is qualified so you don't lose the tax benefits of a Roth IRA.

Do they have mandatory distributions?

Do Roth IRAs have mandatory distributions?

Most tax-advantaged retirement accounts, including traditional 401(k)s and IRAs, are subject to mandatory minimum distributions (RMDs). This means you must begin withdrawing money from retirement accounts at age 73 or be subject to penalties. But required minimum distribution rules don't apply to Roth IRAs. You can leave your money in your Roth IRA for as long as you live.

Traditional accounts are subject to RMDs because contributions were made with pre-tax dollars and money in the account grew tax-free. The IRS wants to make sure this money is taxed during your lifetime. Since Roth IRA contributions were made with after-tax dollars, this isn't as applicable for these accounts.

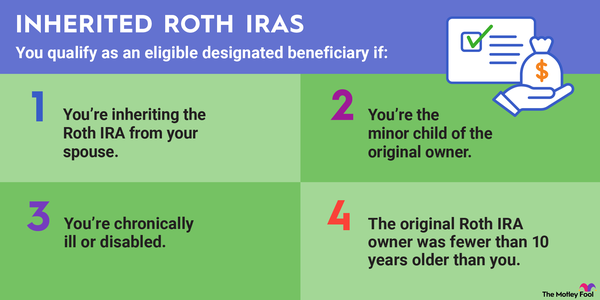

However, most nonspouses who inherit IRAs are subject to mandatory distributions and must liquidate the entire account within 10 years of inheriting it. Spouses can avoid these mandatory distributions if they choose to treat the inherited Roth IRA as their own. And certain individuals, such as minor children, those who are chronically ill or disabled, and those who are not more than 10 years younger than the original accountholder, fall within an exception and are subject to different rules.

Early distributions

Can I take an early distribution from my Roth IRA?

Because you contribute to a Roth IRA with after-tax dollars, you can withdraw your contributed funds at any time. However, you will be subject to taxes on gains at your ordinary income tax rate if you take an early distribution. If you are younger than 59 1/2, you'll also be subject to a 10% penalty. There are, however, some exceptions to these rules.

You can take tax- and penalty-free early distributions before age 59 1/2 if you made your first contribution to your Roth IRA at least five years previously and one of the following applies:

- You become disabled under the IRS definition.

- You're withdrawing a maximum of $10,000 to build, buy, or rebuild your first home.

- You die and the distribution is taken by your heirs.

There are also times when you can avoid the penalty for an early distribution but not the ordinary income tax on gains. This can happen if:

- You withdraw money to pay unreimbursed medical expenses exceeding a certain percentage of your income.

- You're using the money to pay medical insurance premiums after you've lost your job.

- You're using the funds for qualified educational expenses.

- You're paying back taxes to the government because you are subject to an IRS levy.

Taxes

Taxes on Roth IRA distributions

If you have met the requirements for a qualified distribution, you will not be taxed on your Roth IRA distributions. You meet these requirements if you are at least 59 1/2 or if you fall into one of the exceptions above, such as if you're withdrawing no more than $10,000 to use toward the cost of buying, building, or rebuilding a first home or you've become disabled as defined by the IRS.

In all circumstances, however, you must meet the five-year rule requirements in order for a distribution to be qualified and enable you to avoid taxes on your distribution. There are actually two different five-year rules since there's a separate rule when you have converted a traditional account to a Roth IRA.

It's also important to remember that if you are taxed on distributions, you will be taxed only on gains. You can withdraw money you contributed to the account tax-free at any time since you made contributions with after-tax funds.

The five-year rule

The five-year rule for initial Roth IRA contributions

To take tax-free distributions from a Roth IRA, you must not begin taking money out until at least five years have passed from the time you made your first Roth IRA contribution.

However, the clock doesn't start ticking on the day you put the money into your account. Instead it begins on the first day of the tax year in which you made your contribution. If you make your contribution on April 10, 2024, but designate it as a contribution for the 2023 tax year, then the clock starts ticking on Jan. 1, 2023, and the five-year period ends January 1, 2028.

The five-year rule supersedes other rules. That means that if you have met other requirements, but you did not make your contribution more than five years ago, you cannot take a tax-free distribution.

The five-year rule for Roth conversions

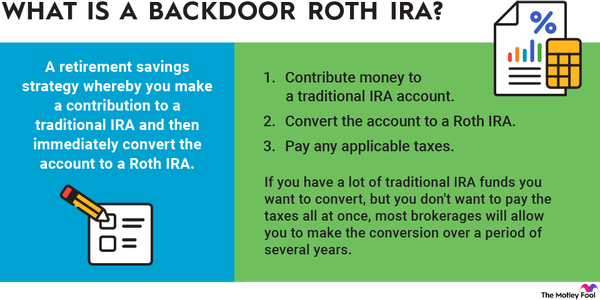

If you converted a traditional IRA or 401(k) to a Roth account, a different five-year rule applies.

If you withdraw money from a converted traditional account and you aren't yet 59 1/2, you will have to pay the 10% penalty for all early withdrawals. This includes paying the penalty on the amount that was converted, even though you were already taxed on the money when you did the conversion.

The five-year clock restarts with any new conversion that you do. Like other five-year rules, it starts ticking on Jan. 1 of the year you do the conversion.

It is important to understand both of these five-year rules so you can be sure you make qualified distributions and don't lose the tax break for Roth accounts. After all, you have worked hard to earn your retirement nest egg, and the last thing you want to see is the government eating into your distributions when you need them most.