Investing in a Roth IRA is a great way to save for the future since it will yield you tax-free income in retirement. But, for high-income earners, there's a way to save even more than the $7,000 contribution limit for the 2024 tax year ($6,500 in 2023), or $8,000 if you're older than 50 ($7,000 in 2023). It's the mega backdoor Roth IRA, a trick that could boost your annual Roth IRA contributions to well over $30,000 each year.

What is it?

What is a mega backdoor Roth IRA?

High earners are prohibited from making Roth IRA contributions. Contributions are also off-limits if your filing status is single or head of household with an annual income of $161,000 or more in 2024, up from a $153,000 limit in 2023. For those who are married filing jointly, the income limit is $240,000 in 2024, up from $218,000 in 2023.

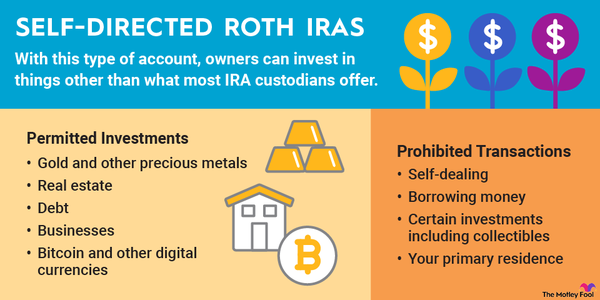

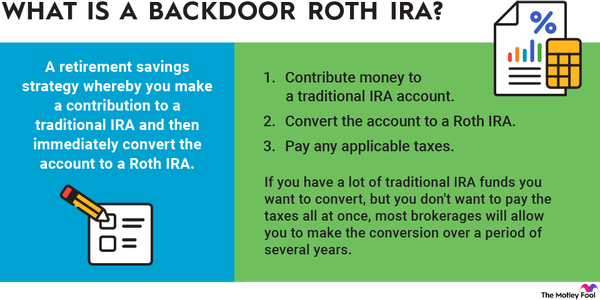

Therefore, a backdoor Roth IRA offers a workaround: Earners may contribute money to a nondeductible traditional IRA and then convert it to a Roth IRA. A mega backdoor Roth IRA uses the same conversion technique but could significantly lower or eliminate the tax liability on the conversion.

Here's a checklist to determine if a mega backdoor Roth IRA is possible for you:

- You earn more than $161,000 if your filing status is single or head of household in 2024 (or $153,000 in 2023). For married couples filing jointly, the limit is $240,000 in 2024 (or $228,000 in 2023).

- You max out your employer's annual 401(k), 403(b) or 457 plan, or your solo 401(k). The pre-tax contribution limits are $23,000 ($30,500 if you're 50 or older) in 2024. The limits increased from $22,500 ($30,000 if you're 50 or older) in 2023.

- Optional, but you max out your annual, nondeductible traditional IRA contributions of $7,000 ($8,000 if you're 50 or older) in 2024, or $6,500 ($7,500 if you're 50 or older) in 2023.

- Also optional, you can afford to make additional after-tax contributions over and above the annual 401(k) limit. These limits are $23,000 (or $30,500 for ages 50 and up) in 2024, up from $22,500 (or $30,000 for ages 50 and up) in 2023.

- Your employer's retirement plan allows for in-service distributions -- a fancy term for withdrawal -- of these after-tax contributions. This is also an option if you plan to leave your job in the near future and plan to make a rollover to a Roth IRA.

Creating a mega backdoor Roth IRA

How to create a mega backdoor Roth IRA

To invoke the powers of the mega backdoor Roth IRA, first consider maxing out your other retirement savings options. For 2024, make sure that you're contributing the maximum pre-tax $23,000 ($30,500 if you're older than 50) per year to your 401(k). Check with your company's HR department for help with this.

Second, make the maximum nondeductible traditional IRA contribution of $7,000 ($8,000 if you're 50 or older) to your traditional IRA account for 2024. Make sure you have a Roth IRA account opened as well. If you don't already have both, you can easily open either kind with most brokers.

Next, start making after-tax 401(k) contributions. (Remember, this is different from Roth 401(k) contributions!) Once you're ready, get in touch with your 401(k) provider to make an in-service distribution of your after-tax contributions into your Roth IRA.

Alternatively, if you're unable to make in-service distributions, you can still make after-tax contributions to your 401(k) and move those funds to your Roth IRA when you leave your job.

Contribution limit

Mega backdoor Roth IRA contribution limit

As with all retirement savings, the amount you can contribute to a mega backdoor Roth IRA is capped each year. Calculating what you can contribute depends on maximum 401(k) contribution limits and whether your employer offers a matching contribution on your deposits. Here's how to calculate your mega backdoor Roth IRA contribution limit:

- For 2024, total 401(k) contributions (pre-tax, after-tax, employer matching contributions, and any other non-elective employer contributions) are capped at $69,000, up from $66,000 for 2023. If you're 50 or older, the limit is $76,500, up from $73,500 in 2023.

- Subtract the $23,000 pre-tax contribution you make ($30,500 if you're older than 50) from the annual max 401(k) contribution limit for 2024.

- The resulting maximum mega backdoor Roth IRA contribution for 2024 is $46,000, up from $43,500 in 2023 if your employer makes no 401(k) contributions on your behalf.

- If your employer does make matching 401(k) contributions, subtract that amount as well. For example, if you make $200,000 per year and your employer makes a 3% match, subtract the additional $6,000 in matching contribution ($200,000 x 0.03), leaving a maximum mega backdoor Roth IRA limit of $40,000 in 2024.

Taxes

Mega backdoor Roth IRA taxes

With a normal backdoor Roth IRA, you owe income taxes on the amount of money you converted to a Roth IRA to the extent that your traditional IRA holdings were initially deductible. Similarly, with a mega backdoor Roth IRA, your after-tax contributions are nontaxable. Only investment earnings on after-tax contributions are taxable at your current income tax rate at the time of the withdrawal for deposit to your Roth IRA.

There's a way to avoid those taxes, though. If you make frequent withdrawals of after-tax money (perhaps monthly or quarterly) or you leave your contributions in a money market fund, the earnings should be minimal. Also, if your investments don't yield any return over a given period (or have a tough stretch and lose money), there are no applicable taxes.

This can be tricky if you are making after-tax contributions and your employer doesn't allow for in-service withdrawals. You can still contribute after taxes and transfer the funds to a Roth IRA when you leave your job, but any earnings on after-tax investments could create a sizable tax bill. Consider investing those after-tax funds anyway and transferring the earnings to a traditional IRA instead to avoid the tax bill.

Should I use one?

Should I use a mega backdoor Roth IRA?

You should stick with a regular backdoor Roth IRA conversion if your income level isn't high enough. The same applies if you can't max out both your annual 401(k) and traditional IRA contributions, or your employer doesn't allow for in-service withdrawals.

But if you meet the income and savings requirements, a mega backdoor Roth IRA is a great vehicle for diversifying your retirement income -- granting you both tax-deferred income (taxable at the time of withdrawal) on your pre-tax contributions and tax-free income on your after-tax contributions (if funds are transferred to a Roth IRA). Plus, a mega backdoor Roth IRA can avoid the taxable event that a normal backdoor Roth IRA conversion often creates.