You're free to withdraw money from any of your retirement accounts at any time, but the federal government may swoop in demanding taxes and penalties if you don't heed all of its rules.

Restrictions on Roth IRAs aren't as stringent as those on tax-deferred retirement withdrawals because you've already paid taxes on your Roth IRA contributions, but there are still some rules you need to be aware of before withdrawing funds. Here's a closer look at how Roth IRA distributions work.

Withdrawing Roth IRA contributions

You can withdraw Roth IRA contributions tax- and penalty-free at any time because you paid taxes on these funds in the year you contributed them. There are no age restrictions and no limits on how much of your Roth IRA contributions you can withdraw at a time.

Whenever you take a Roth IRA distribution, your contributions always come out first, followed by your Roth IRA conversions, if any, in order from the oldest to the most recent. Earnings come out last.

Withdrawing Roth IRA conversions

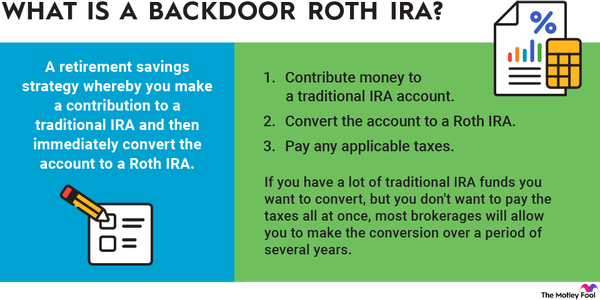

It's called a Roth IRA conversion when you pay taxes on tax-deferred savings to reclassify them as Roth savings. But the IRS doesn't treat these funds exactly the same as contributions you make directly to a Roth IRA. Conversions are subject to a five-year rule.

This rule enables you to withdraw your converted funds penalty- and tax-free once the money has been in your account for at least five years. The five-year countdown begins on Jan. 1 of the year you do the conversion. So if you convert $5,000 from a traditional IRA to a Roth IRA on Sept. 1, 2024, your countdown begins Jan. 1, 2024. You will pay a 10% early withdrawal penalty if you take the money out before Jan. 1, 2029, unless you qualify for one of the exceptions below.

If you do multiple Roth IRA conversions, each one has its own five-year rule. You must be mindful of how long each conversion has been in your account before you withdraw the funds to avoid accidentally incurring penalties.

Withdrawing Roth IRA earnings

You need to meet two criteria if you want to withdraw Roth IRA earnings penalty- and tax-free. First, you must be at least 59 1/2, and second, you must have had your Roth IRA for at least five years before making the withdrawal.

If you have multiple Roth IRAs, the clock starts on the date you open your first Roth IRA. Once you've hit five years, this requirement is automatically fulfilled for all your Roth IRAs, even if you haven't had the one you're withdrawing from for five years.

You could face taxes, penalties, or both if you fail to meet these requirements. Those 59 1/2 or older who have not had their Roth IRAs for at least five years before withdrawing earnings will owe taxes on their earnings but will not pay the 10% early withdrawal penalty.

Those younger than 59 1/2 who have not had their Roth IRAs for five years will pay taxes and a 10% early withdrawal penalty on earnings, although they may be able to waive the penalty if they meet one of the qualified exceptions discussed below.

Adults younger than 59 1/2 who have had their Roth IRA for five years or more could also face taxes and an early withdrawal penalty, although both are waived for those who are permanently disabled or who use their withdrawal to make a first home purchase (maximum $10,000). If you don't meet one of these criteria, you can still waive the penalty if you meet one of the exceptions below.

Exceptions to the early withdrawal penalty

You can avoid the 10% early withdrawal penalty on Roth IRA earnings and conversion withdrawals if you meet one of the following exceptions:

- You're 59 1/2 or older

- You're totally and permanently disabled

- You're purchasing a first home (maximum $10,000 withdrawal)

- You're taking substantially equal periodic payments (SEPPs)

- You're paying for unreimbursed medical expenses exceeding a certain percentage of your adjusted gross income (AGI)

- You're paying for your medical insurance premiums during a period of unemployment

- You're paying for higher education expenses

- You're paying back taxes to the federal government because of a levy placed against your Roth IRA

Rules regarding these exceptions can change with time. For example, in 2020, withdrawals for medical expenses that exceeded 10% of your AGI qualified as a penalty-free withdrawal, but the government lowered this to medical expenses exceeding 7.5% of your AGI for 2021. The limit remains at 7.5% for 2022, 2023, and 2024. So always research the qualified exceptions in the year you plan to make an early withdrawal to avoid surprises.

How to make a Roth IRA withdrawal

You can make a Roth IRA withdrawal by requesting that your Roth IRA provider transfer your funds to your bank account or send you a check. You should be able to initiate this through your online account, or you can reach out to your Roth IRA provider directly to get help.

Before you withdraw any money from your Roth IRA, think the decision through carefully. Figure out whether you'll owe taxes or penalties, and consider how your decision will affect the growth of your retirement savings to decide if it's the right move for you.