A number of retirement plans are available to business owners, independent contractors, and people who work for themselves outside of traditional employment.

These plans provide tax advantages for contributions, but each has different rules, requirements, and contribution limits. It’s important for the self-employed and those working in the gig economy to choose the type (or types) most suitable for their needs and follow IRS rules for contributions.

Self-employed people can also contribute to a taxable brokerage account, but such accounts don’t give you the same tax advantages as these plans.

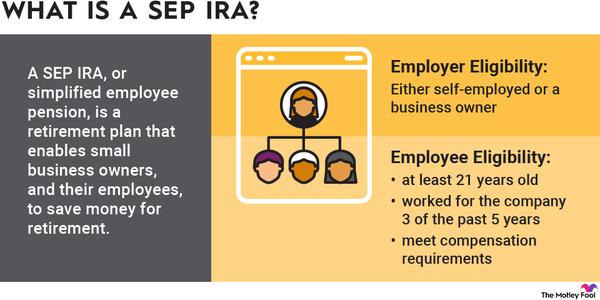

1. SEP-IRAs

SEP-IRAs, or Simplified Employee Pension IRAs, offer a low administrative burden and high contribution limits. Because of those high limits, they have mostly replaced Keogh plans, which were common before 2001 but are now referred to as qualified plans and have largely fallen out of favor.

Self-employed individuals can contribute to SEP-IRA plans, as can business owners -- however, business owners must make contributions for all employees at the same fixed percentage of employee pay. You can make deductible contributions equaling the lesser of:

- 25% of net self-employment earnings (net profit minus your SEP contribution and half of self-employment taxes)

- Up to $69,000 in 2024 ($66,000 in 2023)

SEP-IRAs do not allow additional catch-up contributions.

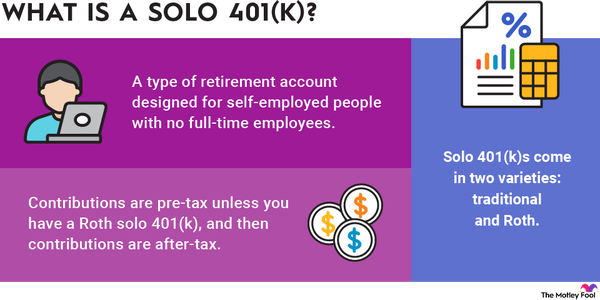

2. Solo 401(k)s

Solo 401(k)s are similar to employer-provided plans and offer high contribution limits, but there’s also a relatively high administrative burden, and some brokerage firms charge fees for solo 401(k)s. You cannot contribute to these accounts if you have employees other than your spouse. However, you can choose whether to opt for a traditional 401(k) that you contribute to with pre-tax dollars or a Roth IRA that you contribute to with after-tax dollars (but which allows tax-free withdrawals in retirement).

You can make contributions to a solo 401(k) as both employee and employer, with the total equaling $69,000 in 2024 ($66,000 in 2023). Those who are 50 or older are eligible for an additional $7,500 catch-up contribution in both 2023 and 2024, bringing the total contribution limit to $76,500 in 2024 ($73,500 in 2023). The contributions break down as follows:

- Up to $23,000 as an employee in 2024 ($22,500 in 2023). Catch-up contributions are also made as an employee.

- As an employer, up to 25% of net self-employment earnings or the maximum of $69,000 in 2024 ($66,000 in 2023). Net self-employment earnings are equal to net profit minus your SEP contribution (excluding any catch-up contribution) and half of self-employment taxes.

If you have a spouse who is employed by and earns income from this business in some capacity, you can make the same contributions for each of you.

3. SIMPLE IRAs

SIMPLE IRAs provide a low administrative burden, a larger contribution limit than traditional or Roth IRAs, and the ability to contribute more money to your own retirement account than to those of your employees. You are eligible for a SIMPLE IRA as a self-employed worker or if you have a business with up to 100 employees.

Both employees and employers can contribute to an individual’s SIMPLE IRA:

- Employee contributions are limited to 100% of salary or $16,000 in 2024 ($15,500 in 2023), whichever is less. Those who are age 50 or over can make an additional catch-up contribution of up to $3,500 in both 2023 and 2024.

- Employers may choose one method: fixed contributions of 2% of employee compensation on earnings of up to $345,000 in 2024 ($330,000 in 2023), or matching contributions of up to 3% of employee compensation.

4. Traditional or Roth IRAs

Traditional IRAs andRoth IRAs aren’t exclusively for the self-employed, but people who work independently or who own their own business can contribute to these plans. Traditional IRAs allow you to make tax-deductible contributions, and Roth IRAs allow for after-tax contributions, with money growing tax-free. There is low administrative burden, you contribute to the accounts as an individual rather than as your own employer, and there’s a combined contribution limit for traditional and Roth IRAs of $7,000 in 2024 ($6,500 in 2023). If you’re 50 or over, you’re eligible for an additional $1,000 catch-up contribution in both 2023 and 2024, bringing your total contribution limit to $8,000 in 2024 ($7,500 in 2023).

If you or your spouse has access to another workplace retirement plan, there are income limits. If you exceed them, you will not be eligible to contribute to a Roth IRA at all, or to make tax-deductible contributions to a traditional IRA.

5. Profit-Sharing Plans

Profit-sharing plans give workers a share of company profits based on either quarterly earnings or annual earnings. Businesses of any size can create a profit-sharing plan, and these plans can be created in addition to other retirement plans -- but there is a high administrative burden.

As a business owner, you can choose whether to contribute to employee profit-sharing plans, but cannot discriminate in favor of highly compensated employees. These plans are often linked with 401(k) plans, but only employers contribute to profit-sharing plans. You can make contributions based on a set formula that you establish, with maximum contributions up to whichever of the following is lowest:

- 25% of compensation

- $69,000 in 2024 ($66,000 in 2023). For those 50 and older, this annual maximum is $76,500 in 2024 ($73,500 in 2023)

6. Money Purchase Plans

Money purchase plans differ from profit-sharing plans because employers are required to contribute for plan participants and contributions are not variable from year to year based on company profitability. When you establish this plan, you must establish the contribution rate. Money purchase plans have a high administrative burden, but a pre-approved plan can be easier to establish. You can contribute as an employer with maximum contributions equaling whichever of the following is lowest:

- 25% of compensation

- $69,000 in 2024 ($66,000 in 2023) for those under 50. Anyone 50 or older is eligible for catch-up contributions, increasing these limits to $76,500 in 2024 ($73,500 in 2023).

Pick the best self-employed retirement plan for you

The best self-employed retirement plan depends upon your needs. Key factors to consider include:

- Whether you wish to contribute as an employer, employee, or both

- The amount you wish to contribute

- Whether you have other employees working for you and, if so, if you wish to contribute to their retirement plans as well

- Whether you want to make contributions for both you and your spouse

- Whether you’d prefer to make tax-deductible contributions or tax-free withdrawals

- The level of administrative burden you wish to assume when establishing and maintaining your plan

The chart below will help you to determine which plan may be best for you.

| Plan Type | Who Contributes | Administrative Burden |

|---|---|---|

| SEP-IRA | Employers only | Medium |

| Solo 401(k) | Employers and employees | High |

| SIMPLE IRA | Employers and employees | Medium |

| Traditional or Roth IRA | Individuals | Low |

| Profit-sharing plan | Employers only | High |

| Money purchase plan | Employers only | High |