When should you start Social Security? This is a complicated question because the right answer depends on many factors, including your health, goals for retirement, and marital status.

Social Security benefits can be claimed anytime between the ages of 62 and 70. However, the earlier you claim benefits, the smaller your monthly check will be. You'll want to consider whether you want more but smaller checks, or fewer but larger checks, when deciding when to claim Social Security.

This guide will explain everything you need to know to help you make the right choice about when to first file your claim for retirement benefits with the Social Security Administration.

What is full retirement age?

Understanding your full retirement age is essential to determining when you should claim your Social Security benefits for the first time.

Every retiree has a standard benefit, called their Primary Insurance Amount (PIA). The amount is calculated using a formula that awards you benefits equal to a percentage of wage-adjusted average earnings in the 35 years you made the most money.

You will receive benefits exactly equal to your PIA if you get your first Social Security check right at your full retirement age (FRA). The FRA was 65 for everyone when Social Security was created, but 1983 changes resulted in the FRA gradually moving later for anyone born in 1943 or after.

For people born after 1943, the FRA is between 66 and 67, depending on their birth year. Full retirement age is 67 for anyone born in 1960 or later.

If you claim benefits before full retirement age, you are subject to early filing penalties that reduce monthly Social Security checks by:

- 5/9 of 1% for each of the first 36 months before your FRA (this adds up to a 6.7% annual reduction)

- 5/12 of 1% for any prior month before your FRA (this adds up to a 5% annual reduction)

Because of these early filing penalties, claiming Social Security at 62 -- five years before a FRA of 67 -- will result in a 30% reduction to your PIA.

By contrast, anyone who waits to file for benefits until after their FRA receives delayed retirement credits that increase their PIA by 2/3 of 1% per month. That adds up to an 8% annual increase.

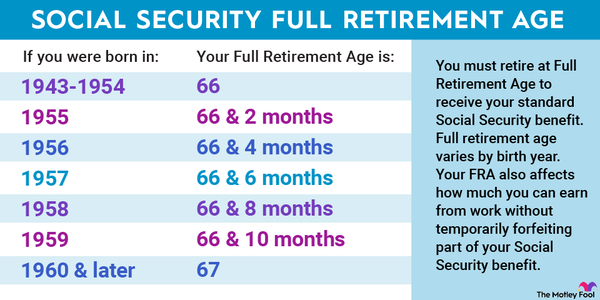

Table of full retirement ages

Your full retirement age depends on when you were born. The table below shows the FRA that applies to you based on your birth year.

| Year of Birth | Full Retirement Age |

|---|---|

| 1943-1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 or later | 67 |

Starting Social Security at 62

The age of 62 is the soonest you can claim Social Security retirement benefits. Many people claim at this age because:

- They want to retire early (or early retirement is necessary due to health issues, family matters, or a lack of job opportunities) and cannot afford to do so without Social Security.

- They would prefer to have their retirement benefits while young and healthy.

- They want to preserve their savings rather than relying solely on their investment accounts to support them in retirement.

Unfortunately, if you start receiving Social Security at 62, you will get hit with the maximum amount of early filing penalties. If you retire at 62 when your FRA is 67, you will see your benefit reduced by 30%. If you would have received $1,500 at your FRA, you will receive only $1,050 per month at 62.

The reduction in benefits is permanent. Your benefits will not jump back up at full retirement age, and you will never catch back up to the monthly amount you would have received if you had waited. However, you will get more checks than someone who delayed claiming their first Social Security retirement benefit.

If you would prefer to get Social Security income for more years and you are OK with receiving a reduced monthly benefit, this may be the best option.

Delaying Social Security

Delaying Social Security is an alternative option. If you wait even one month beyond age 62, technically you have delayed Social Security beyond the time when you could have received benefits. However, you do not start receiving delayed retirement credits until you have waited beyond your full retirement age.

When you delay the start of your Social Security income, you miss out on receiving months or even years of payments. It's a good idea to calculate your breakeven point, which means figuring out how long it will take you for the higher payments you get later to make up for forgone income.

Say you would have received a $1,500 benefit at a full retirement age of 67. If you claim at 62, you receive only $1,050 per month. But if you delayed until 70, you would receive a 24% increase to your standard benefit. That's because of delayed retirement credits, which can be earned each month after FRA until age 70. Your benefit at 70 then would be $1,860 per month.

To calculate your breakeven point:

- Determine how much income you will miss out on. If you wait from age 62 to 70, that would mean missing out on eight years of monthly payments of $1,050 per month. You would forgo $100,800.

- Calculate how much higher your monthly payment is due to delaying. At 70, a monthly payment of $1,860 per month would be $810 per month higher than the payment you would have received at 62.

- Determine how many months of higher payments are required to make up for missed income. If you divide $100,800 by $810, you'll see you'd need to receive this extra money for 124.4 months or 10.37 years.

The increase in your monthly benefit due to delaying is substantial, but you must wait many years to really increase your checks. This must be taken into account in your retirement planning since you may need to work until very late in life -- or survive on savings for many years -- if you hope to put off claiming your Social Security benefit.

Related Social Security Topics

How to decide when to start Social Security

You do not have to claim Social Security right when you retire, but many people do. It is important to take Social Security benefits into account when deciding on your preferred retirement age and on how much you need to have invested to supplement Social Security.

There are many factors to consider when you decide when to claim your Social Security benefit, including the following:

How is your health?

Your health situation can affect when you claim Social Security.

If you do not expect to live very long, an early Social Security benefits claim might be the better option. You may not live long enough to break even for a delayed claim.

If you expect to live for a very long time, you could potentially get more lifetime Social Security benefits by delaying your claim. Once you break even for missed benefits, if you live longer and continue receiving checks, you end up netting more money in total from the Social Security Administration.

How long will you be able to continue working?

If you are interested in early retirement or suspect you will need to retire early because of factors outside your control (such as job loss or health or family issues), you must consider whether you can live without Social Security and rely solely on your savings for a period of time.

If you can't, then an early Social Security claim may be your only option.

Will you work after claiming Social Security?

Working on Social Security is allowed. However, if you have not yet reached your full retirement age and you earn above a certain threshold, you will see your Social Security benefits reduced.

Eventually, your benefit is recalculated at full retirement age to account for the forfeited payments due to earning too much. But it often makes little sense to claim Social Security only to lose some or all of your checks because you earn too much.

What will you do for insurance?

If you are thinking about early retirement, consider where your medical insurance will come from if you retire before you become eligible for Medicare coverage. You generally cannot qualify for Medicare until age 65.

If you need to keep working for insurance purposes, you may decide to put off your Social Security claim until you have actually left the workforce.

Do you qualify for any other Social Security benefits?

There are other Social Security benefits available besides retirement benefits. For example, you may be entitled to Social Security Disability Insurance (SSDI) if you are too disabled to work.

If you are in your early 60s and become too sick or hurt to maintain your career, claiming disability benefits rather than just getting retirement benefits at 62 could help you avoid early filing penalties.

If your spouse passed away, you may also be entitled to a survivor benefit. You may be able to claim this money and put off starting your own retirement benefits until later in life.

Have you worked for at least 35 years?

Your Social Security benefits are based on average wages in the 35 years that your earnings were the highest.

If you have not worked for 35 years, benefits should still be available as long as you earned a sufficient number of work credits. This means working for at least 10 years and earning a set minimum in each of those 10 years.

However, a work history that's shorter than 35 years will result in a reduced benefit. That's because some years of no wages will be considered when the Social Security Administration calculates your primary insurance amount.

Are you married?

If you are married, it's best to work with your spouse to create a Social Security claiming strategy that maximizes family benefits available.

In some cases, it is best for a lower earner to claim their Social Security early so a higher earner can put off a claim for benefits. This gives the couple some money to live on while maximizing the larger Social Security benefit.

However, if you did not earn much or did not work at all, you may rely on spousal benefits rather than retirement benefits. These are available based on your spouse's work record, but you can't claim them until the primary earner has claimed their own benefits. In some circumstances, it makes sense for the primary earner to claim benefits as soon as possible to open the door to spousal benefits.

Will your spouse need a survivor benefit?

Survivor benefits are available when one partner passes away. When either spouse dies, the remaining widow(er) gets to keep the higher of the two benefits that were coming into the household.

If you are the higher earner, your early claim could end up shrinking the survivor benefits your spouse gets. This could create financial hardship after you die, so you may wish to avoid this.

The bottom line

Retirement planning is a complicated process, and it can be especially confusing to determine the best age to claim Social Security. But if you consider things like your chosen retirement age, your spouse's future financial security, and your health status, you can make a plan that works for you.

Social Security FAQs

Is it better to collect Social Security at 66 or 70?

Whether it is better to collect Social Security at 66 or 70 depends on many factors. You will have a smaller benefit if you claim Social Security at 66 rather than at 70, but you will also get an extra four years of checks.

You should calculate how long it will take you to break even for the income you miss out on by waiting. If you don't expect to live long enough, an early claim is better. But if you expect to live longer, you could end up with more lifetime benefits -- and more financial security later in life -- if you delay your claim.

At what age is Social Security no longer taxed?

Your age is not relevant under the rules determining when Social Security is taxed. You will be taxed on Social Security benefits only if your countable income exceeds a certain amount.

Countable income is half your Social Security income, some tax-free income (municipal bond interest, for instance), and all taxable income. If your countable income is above $25,000 as a single tax filer, or $32,000 as a married joint filer, you will owe tax on part of your benefits.

You may be able to avoid tax on Social Security by opting for a Roth IRA for your retirement savings. Distributions from a Roth IRA are not part of countable income, so it will be easier to remain under the earnings limit at which benefits become taxable.

Can you collect Social Security at 65 and still work full time?

You may be able to collect Social Security at 65 and still work full time, but it is unlikely you will receive your full benefit.

The age of 65 is earlier than the full retirement age (FRA), and if you work before your FRA, you forfeit some of your benefits temporarily if you earn too much money.

Since you will not hit FRA during the entire year if you are 65 and working, you will lose $1 in benefits for every $2 earned above $22,320 (as of 2024). This earning limit changes annually.

Eventually, at FRA, your benefits are recalculated to account for this money -- but entire checks can be forfeited in the meantime based on your earnings.