Early retirement can be an ambitious financial goal, but with the right plan in place, you can reach it. Here's a seven-step course of action that can help you determine if early retirement is possible, and what you'll need to do to make it happen.

Seven steps to retire early

- Determine how much income you'll need in retirement.

- Figure out how much will come from Social Security and other fixed sources.

- Calculate your "number."

- Take stock of where you stand.

- Make a savings and investment plan.

- Account for healthcare and other concerns.

- Stick to the plan.

Let's take a closer look at each of these steps.

1. How much income you'll need

1. Determine how much income you'll need in retirement

Many people (incorrectly) start their retirement planning by coming up with a number. You'll often hear statements like, "If I can get to $1 million in my investment accounts, I'll be able to retire."

This logic is faulty, and here's why: It's not about how much money you have in the bank -- it's about how much sustainable income you can create from the money and other retirement income sources at your disposal.

For example, to achieve the same standard of living, someone who will receive $5,000 per month between pensions and Social Security won't need to save nearly as much as someone whose only fixed income source is a $1,500 Social Security benefit.

The standard rule of thumb is that you'll need about 80% of your pre-retirement income to maintain the same standard of living. According to this rule, someone with a $100,000 salary would need about $80,000 in annual income after they retire.

This can be adjusted higher or lower, depending on your circumstances, and it may be a smart idea to consult with a financial planner to help with this step. If you plan to travel extensively or pursue expensive hobbies after retiring, you may want to aim for a higher level of income. Conversely, if you plan to live a simpler life in retirement, you may be able to get by with significantly less.

2. How much will come from each source

2. Figure out how much will come from Social Security and other fixed sources

Without getting too far into the weeds about how Social Security works, the first thing you should do when you have an income goal in mind is consider how much of it is going to come from fixed, reliable sources.

Now, if you plan to retire years before you're eligible for Social Security, it's probably best to leave that out of your early retirement calculations. However, if you have any pensions or annuities that will kick in right away after you retire, they should certainly be taken into account here.

As an example, let's say that in Step 1, you determined you'll need $60,000 per year in annual income after retirement ($5,000 per month). If you can count on a $2,000 monthly pension, this means that you'll need to create an income stream of only $3,000 from your savings.

Pension

3. Calculate your "number"

3. Calculate your "number"

Here's the step where you determine your savings target. Take the amount of income you'll need to produce from your savings. Then, decide how much you can safely withdraw from your retirement savings in perpetuity.

Most retirement planners use some variation of the "4% rule." This essentially says that you can withdraw 4% of your savings during your first year of retirement and can adjust this amount upward for cost-of-living increases in subsequent years without much fear of running out of money. This "rule" isn't perfect, but it's a good starting point.

Calculating the 4% rule is rather easy. Simply take your annual retirement income needs from savings that you calculated in the previous step and multiply by 25.

For example, if you need $3,000 per month from your savings ($36,000 per year), multiplying by 25 gives you a target retirement savings goal of $900,000.

4. Take stock of where you stand

4. Take stock of where you stand

The next step is to conduct an honest assessment of where you stand and how feasible early retirement might be. If you're 45 and want to retire at 55 but have a $20,000 retirement savings balance, you may have a tough time building up your savings to a desirable level. On the other hand, if you need $900,000 in savings to retire in 10 years and you already have $500,000, you might be in pretty decent shape.

To help, here's a quick chart to help determine how your existing savings could reasonably be expected to grow between now and your retirement, based on an average annual return of 7% from your investments:

| If you plan to retire in... | $50,000 could grow to... | $100,000 could grow to... | $500,000 could grow to... |

|---|---|---|---|

| 5 Years | $70,128 | $140,255 | $701,276 |

| 10 Years | $98,358 | $196,715 | $983,576 |

| 15 Years | $137,952 | $275,903 | $1,379,516 |

| 20 Years | $193,484 | $386,968 | $1,934,842 |

| 30 Years | $380,613 | $761,226 | $3,806,128 |

You can use these charts to adjust the numbers to your current savings. For example, if you want to retire in 10 years and have $200,000 saved, simply double the appropriate number in the $100,000 column.

5. Make a plan

5. Make a savings and investment plan

Here's the step where an experienced financial advisor (such as a Certified Financial Planner®) really adds value. Obviously, if you determined a savings target and you've already achieved it, you're in good financial shape to retire early.

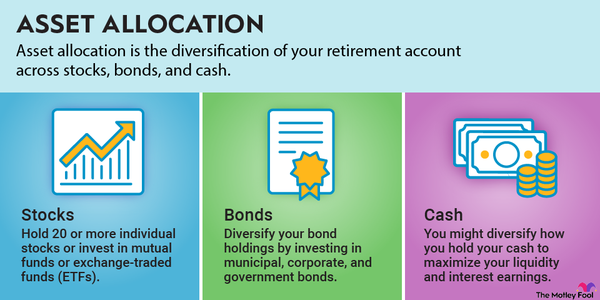

On the other hand, a financial advisor can help you determine (among other things) how much you should save and invest each month to reach your goal and whether your investment strategy is too risky or too conservative. A financial advisor can tell you if your current income will be enough to save or if you may want to consider taking on a side hustle to boost your savings.

6. Account for healthcare and other concerns

6. Account for healthcare and other concerns

Here's one thing that many people who dream of early retirement fail to consider: What happens next? How will you spend your time after you retire? Will you get a part-time job? Pursue a hobby? Travel the world? There are far too many possibilities to mention all of them here, but the point is that not having a plan is one of the most common reasons people end up regretting their early retirement.

It's also important to have a plan when it comes to healthcare. If you aren't familiar with it, the age of eligibility for Medicare is 65, regardless of when you retire or claim Social Security. You may be fortunate enough to have a job that will let you keep your current health plan after retirement (many public sector jobs, in particular, allow this), but if not, you need to plan where your health insurance will come from and how you're going to pay for it.

7. Stick to the plan

7. Stick to the plan

Finally, if your goal is to retire early, it's important not only to develop goals and a course of action, but also to stick with your plan. One suggestion is to make your savings and investment plan automatic. For example, if you and your financial planner determine that you should save $500 per month in your brokerage account, set up an automatic transfer to make sure it actually happens every month.

Early retirement is certainly an ambitious financial goal, but it can be far easier with the proper planning. These steps can get you well on your way toward financial freedom years before the average American leaves the workforce.

Related Retirement Topics

FAQ

How to Retire Early FAQs

What is the fastest way to retire early?

There's no shortcut to retiring early (in most cases). The most surefire way to retire early is to maximize your savings, especially in retirement accounts, and to invest wisely, while at the same time minimizing your living expenses.

What is the 4% rule for early retirement?

The 4% rule of retirement says that you can safely withdraw 4% of your savings during your first year of retirement, and give yourself cost-of-living adjustments for inflation in subsequent years. If you do this, your money has an excellent chance of lasting for at least 30 years after retirement.

What is a good monthly retirement income?

A good rule of thumb is that you'll need about 80% of your pre-retirement income to maintain the same standard of living after retirement. So, if you're making $5,000 per month, a good monthly retirement income target would be $4,000. This can come from a combination of Social Security, retirement savings, pensions, annuities, and other sources.