A target date fund is a type of mutual fund structured to make it easier for investors to maintain a desirable asset allocation over time.

While young investors should allocate the most money to higher-risk assets like stocks, investors nearing retirement are advised to structure their portfolios more conservatively. Most investors rebalance their portfolios manually, but owning shares in a target date fund automates the rebalancing process.

What is a target date fund?

What is a target date fund?

The specific asset mix of a target date mutual fund is determined by when the investors in that particular fund need to access their invested dollars. Investors in target date funds, which often have names such as the 2030 Fund or the 2040 Fund, generally have similar investment time horizons.

How does a target date fund work?

How does a target date fund work?

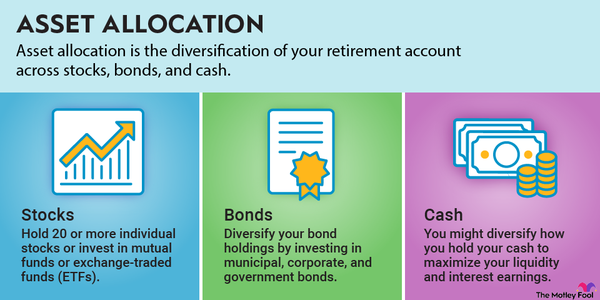

Money invested in a target date fund is pooled and then invested into a mix of securities. Riskier assets, such as stocks, initially comprise the majority of the fund's portfolio. Over time, the mix of securities slowly shifts, with the portfolio increasingly allocated to more conservative investments.

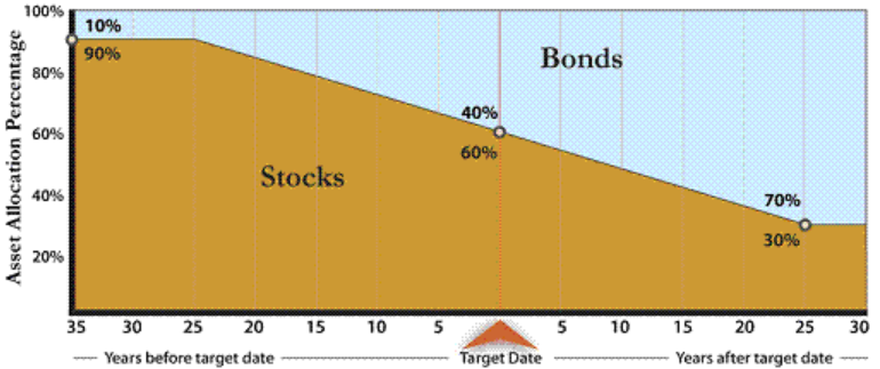

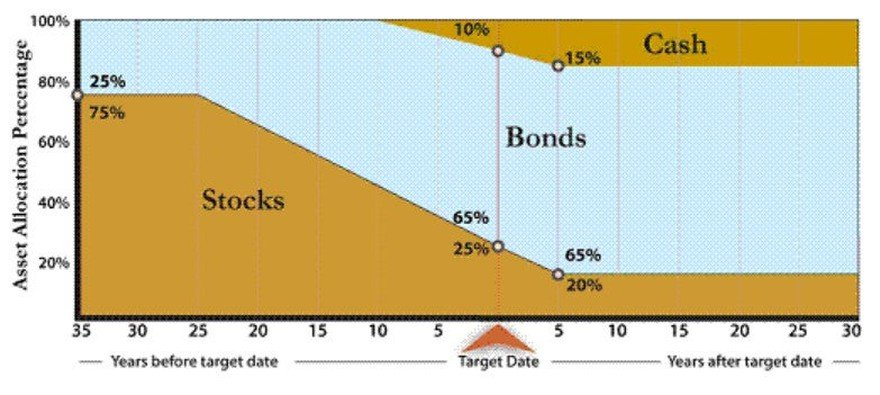

Each target date fund has a "glide path," which refers to how the fund's asset mix changes over time. Every target date fund has its own glide path, meaning that the mix of investments changes at different rates among different target date funds.

The two charts below show two different glide paths for target date funds. While their glide paths and the types of assets held differ, both gradually shift over time toward holding more conservative investments.

Who should use a target date fund?

Who should use a target date fund?

If learning about asset allocation and remembering to rebalance your portfolio over time isn't appealing to you, you may want to consider investing in a target date fund. These types of funds can enable a set-it-and-forget-it approach to investing for retirement or college by allowing you to simply buy shares in a fund with a timeline that is right for you.

Many workplace 401(k) retirement plans offer target date funds for their employees. Investors in individual retirement accounts (IRAs) have the option of accessing target date funds as well.

But before you decide to invest in a target date fund, be aware that you'll pay a fee for the convenience of automatic rebalancing. Target date funds charge expense ratios that can be as high as around 1%. That said, some target date funds invest only in low-cost exchange-traded funds (ETFs), which enables them to keep their expense ratios as low as 0.1%.

Pros and cons of target date funds

Pros and cons of target date funds

Pros

- Simplicity: Most 401(k) plans only offer one target date fund (with multiple options for the target date). If you invest in a target date fund, you don't need anything else in your retirement portfolio.

- Automation: Target date funds automate the process of adjusting your asset allocation. You don't need to ever manually rebalance your portfolio if you invest in a target date fund.

Cons

- Lack of customization: Every investor in a target date fund has the same asset allocation, regardless of their individual risk tolerances or investing goals.

- Potentially high fees: With the expense ratios of many target date funds approaching 1%, the fees associated with target date funds can significantly lower your investment returns. While 1% might not sound like a lot, the nature of compound interest means that small annual fees can add up to substantial lost value for your portfolio over time.

- Lack of control: Investors in target date funds don't get to choose which specific securities the target date funds invest in.

Compound Interest

Target date funds versus mutual funds

Target date funds versus mutual funds

Target date funds are a specific type of mutual fund. Thousands of different mutual funds are available for investors, each with the purpose of pooling and investing money into a mix of different assets.

Mutual funds, including target date funds, can be actively or passively managed. Mutual funds that are passively managed simply track a financial index and therefore tend to have lower fees.

Target date funds versus index funds

Target date funds versus index funds

Target date funds are those that automatically rebalance over time to achieve a specific asset allocation on a target date, while index funds are those that track stock market indexes such as the S&P 500 (SNPINDEX:^GSPC).

Target date index funds are target date funds that invest only in index funds. Target date index funds typically have lower fees than other target date funds because they are passively managed. A fund manager of a target date index fund simply selects which indexes to track rather than actively managing investments in other types of assets.