When you retire, you’ll likely rely on your retirement accounts to provide income to supplement Social Security. To ensure your money lasts, you’ll need to decide on a retirement withdrawal strategy.

A retirement withdrawal strategy can help you determine a safe amount of money to take out of your investment accounts each year. The strategy you choose will dictate how much income you make available for yourself, which in turn affects your quality of life in retirement. If you pick the right withdrawal strategy, it will protect against your accounts running dry while you’re still relying on your savings.

There are a number of common retirement withdrawal strategies to consider.

The right strategy will depend how much money you have saved, how concerned you are about running short of money in retirement, whether you’re considering extreme early retirement using the Financial Independence Retire Early (FIRE) strategy, and how much income your investments need to produce.

Whatever strategy you select, you must withdraw enough money from tax-advantaged investment accounts -- such as your SEP, SIMPLE, or traditional IRA or your 401(k) -- to meet the IRS rules for required minimum distributions (RMDs). RMD rules mandate you withdraw a certain portion of your investment account balance each year after you reach age 72. If you don’t, you’re subject to a 50% tax penalty on the amount you failed to withdraw.

The 4% rule

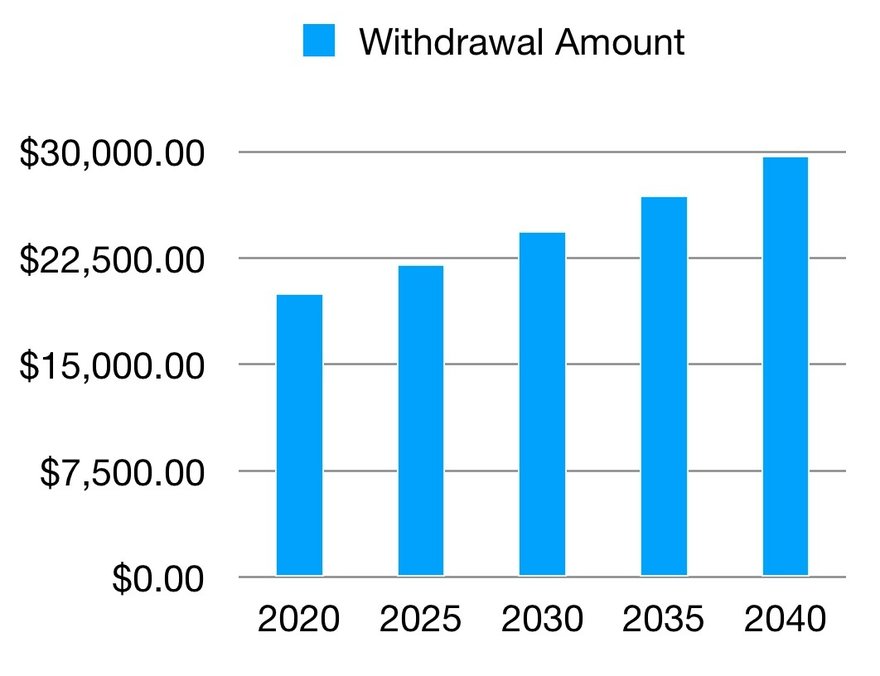

If you follow the 4% rule, you’ll withdraw 4% of your investment account balance in your first year of retirement. Each year, you’ll increase the amount to keep pace with inflation, the rising cost of goods and services.

If you follow the 4% rule and begin retirement with a nest egg of $500,000, you would withdraw $20,000 during your first year of retirement. If there’s 2% inflation (which is the Federal Reserve’s target rate of inflation), you would withdraw $20,400 the following year.

The major benefit of the 4% rule is that it’s a simple approach and you're buying power keeps pace with inflation. However, with rising interest rates and increased market volatility, there’s a risk you could run out of money using this approach. This rule also doesn’t provide flexibility to adjust based on the performance of your investments.

The chart below shows the income that would be available to you over a 20-year retirement if you had retired with $500,000 in 2020 and followed the 4% rule (assuming a 2% inflation rate). If you followed this withdrawal schedule and your investment account earned an average 3% annual return throughout your retirement, your balance at the end of 20 years would be approximately $243,518.

Fixed-dollar withdrawals

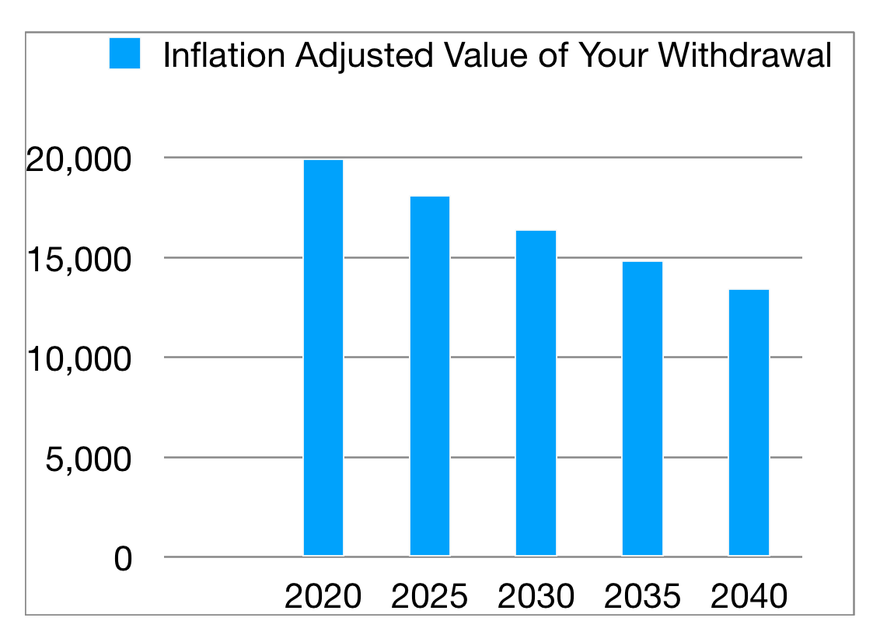

Fixed-dollar withdrawals involve taking the same amount of money out of your retirement account every year for a set period. For example, you may decide to withdraw $20,000 annually for the first five years of retirement and then reassess.

The major benefit of fixed-dollar withdrawals is that you have a predictable annual income and can determine the amount to withdraw based on your budget in your first year as a retiree. However, there are substantial downsides. If you don’t increase your withdrawal amount, you’ll lose buying power over time as a result of inflation. And if you set your fixed-dollar amount too high, you risk running out of money in retirement.

The table below shows the approximate purchasing power of a $20,000 annual withdrawal over time (again assuming 2% inflation).

Fixed-percentage withdrawals

Fixed-percentage withdrawals involve withdrawing a fixed percentage of your account balance every year -- for example, taking out 3.5% or 4% of your total invested funds every single year. With this approach, the amount you withdraw will vary as your investment account balance rises and falls.

This differs from the 4% rule both because you might choose a different percentage of your account balance to withdraw and because you keep the percentage the same every year instead of starting with a 4% withdrawal and adjusting upward based on inflation.

The major benefit of this approach is that this system naturally adjusts your withdrawals to respond to market fluctuations. Unfortunately, if you choose too large a percentage, you risk being left with too little money. Your income also changes from year to year, so it can be difficult to make financial plans.

Systematic withdrawals

Systematic withdrawals leave your principal invested throughout the entirety of your retirement. You withdraw only the income your investments produce from interest or dividends.

The major benefit of this approach is that you cannot run out of money in your retirement account. Unfortunately, your nest egg needs to be quite large to provide enough income for you to live on. Your income will also vary from year to year, depending on market performance. This again makes it difficult to create a financial plan. And if your investment gains don’t keep pace with inflation, you could see your buying power fall.

Buckets

When you implement a buckets strategy, you have three separate sources of retirement income:

- A savings account that holds approximately three to five years’ worth of living expenses in cash

- Fixed-income securities, including government and corporate bonds or certificates of deposit

- Equity investments

With this approach you draw from your savings account to cover your expenses and refill that “bucket” with money from the other two. This enables you to avoid selling assets at a loss. When you refill your savings account, you do so either by selling stocks if the market is up or selling your fixed income securities if they’ve performed well. If both stocks and bonds are down, you continue to draw from your savings.

The major benefit of this approach is that you have more control over when you sell investments and can potentially grow your investment account balance over time. However, it can quickly become time-consuming, and you still need to use another method to determine how much you can afford to spend each year.