COLA stands for cost-of-living adjustment. It's an inflation-based increase that's rolled out annually to all Social Security and Supplemental Security Income (SSI) recipients.

What is the COLA for Social Security in 2024?

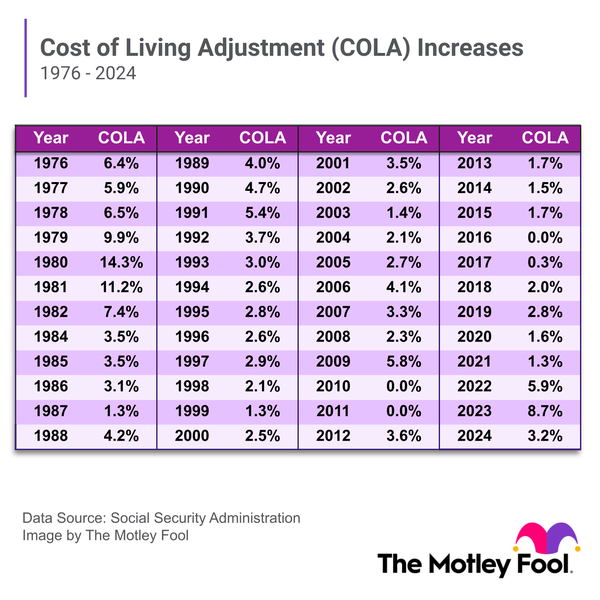

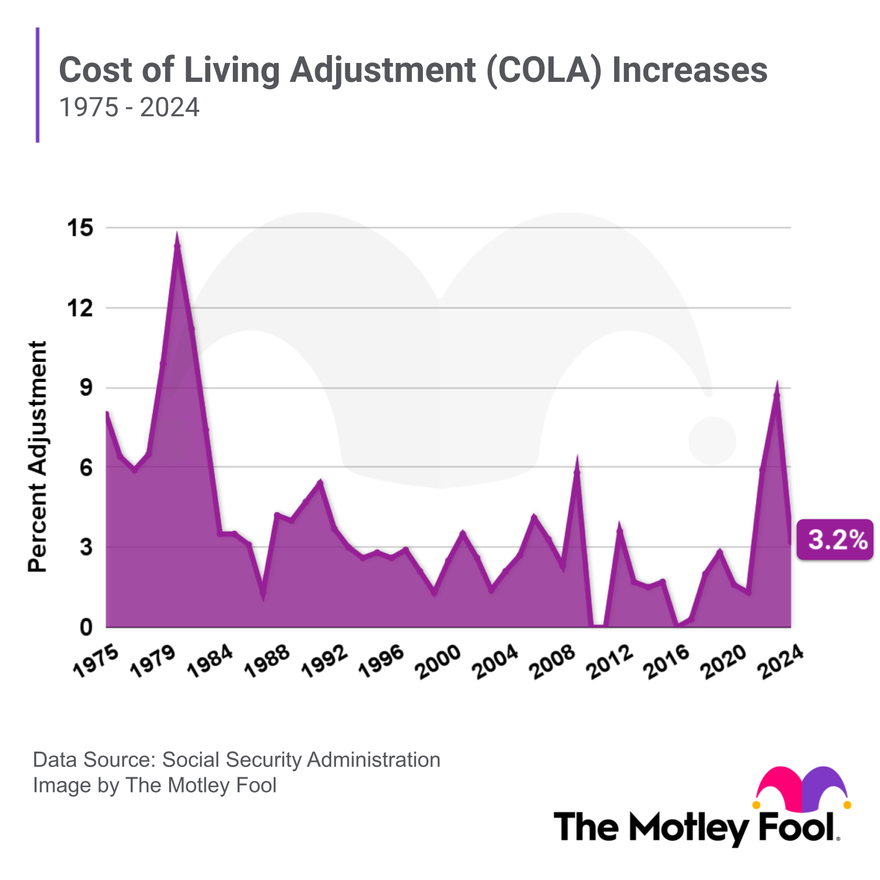

The Social Security COLA for 2024 is 3.2%. The Social Security Administration (SSA) announced the official 2024 COLA on Oct. 12, 2023, following the release of September 2023 inflation data.

The COLA will bump the average retired worker's monthly payment from $1,848 to $1,907, a $59 increase. The COLA takes effect in December, and the updated benefits are paid out starting in January 2024.

The 2024 Social Security raise is substantially lower than the 8.7% beneficiaries received in 2023. In fact, the 2023 increase was the highest since 1981 and the fourth-largest COLA in the program's history.

In the decade from 2010-2019, COLAs were 2% or less in eight out of 10 years. But soaring inflation triggered by the COVID-19 pandemic resulted in the highest COLA in more than 40 years.

Inflation in July, August, and September 2023 determined the COLA that Social Security and SSI beneficiaries will receive in 2024.

Social Security COLA FAQs

How is the COLA determined?

The COLA computation relies on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers -- also known as the CPI-W. Like other measures for inflation, the CPI-W is calculated monthly by the Bureau of Labor Statistics.

Each year, the SSA averages the CPI-W value for the third-quarter months of July, August, and September. The average is then compared to the same value for the prior year. If the current year's average is higher, then the percentage increase is the COLA.

For example, the third-quarter CPI-W for 2023 was 301.236. In the previous year, the average was 291.901. The percentage difference here was 3.2% -- and that became the 2024 COLA. Social Security and SSI recipients will see their benefits increase by that percentage in January 2024.

Related retirement topics

Will Medicare premiums increase in 2024?

The 2024 Social Security COLA is lower than last year's gigantic COLA, but there's another unwelcome development for millions of seniors: Medicare participants will pay higher premiums next year.

Recipients saw their Medicare Part B premiums drop by about 3% in 2023. In 2024, however, Medicare Part B monthly premiums will rise by $9.80. That means Social Security beneficiaries won't see their full 3.2% COLA reflected in their monthly benefit, as most recipients have Part B premiums deducted from their benefits.

By law, Medicare Part B premiums cannot increase by more than the COLA in the same year.

Expert Q&A on Social Security and Retirement

Geoffrey Sanzenbacher

The Motley Fool: When asked about the 8.7% cost-of-living adjustment for Social Security benefits in 2023, 55% of respondents in a recent Motley Fool survey said they didn’t think it was enough. Why do you think retirees feel this way when it's one of the biggest COLAs in history? Did the SSA make a mistake in not raising it more? Are Social Security COLAs fair annual increases in your opinion?

Geoffrey Sanzenbacher: “The SSA COLA Adjustment is based on the CPI-W for urban wage earners and clerical workers from the third quarter of the prior year to the third quarter of the current year. The COLA has always been based on this number, which is generally quite close to the more traditionally cited measure of inflation, the CPI-U (Consumer Price Index for all Urban Consumers). This year, the CPI-W used to adjust Social Security was actually higher than the CPI-U (which went up 8.3 percent over the same period). So, in this sense, the adjustment seems fair -- it more than accounted for the traditional measure of inflation. That being said, certain expenses increased more than both the CPI-U or CPI-W. Fuel is about 11 percent higher than it was a year ago. Food is similarly about 11 percent higher. So, to the extent that these prices loom large in seniors' minds and are a larger share of seniors' budgets, then it could make sense that there is some feeling of inequity. Of course, other goods -- like clothing -- have gone up less than the adjustment (about 5 percent). So, it seems on the whole fair to me, although I understand the perception.”

The Motley Fool: Because of the COVID-19 pandemic, many Americans now fear they won’t be able to retire. What is your advice for someone who may be worried about retiring because of recent financial setbacks?

Geoffrey Sanzenbacher: “I would give the same advice I generally give -- if at all possible, try to work a bit longer. This will not only give you more time to save, allow you to delay claiming Social Security (and increase your benefit by 7-8 percent forever), but it will also allow you to avoid pulling money out of the stock market before it fully recovers from its recent downturn. Right now, the labor market is still pretty tight, so working a bit longer is a reasonable option.”

The Motley Fool: In 2019, the average retirement account savings for American households was $65,000 with the average American under 35 having $13,000 saved for retirement. Why do you think this average is so much lower than what experts typically expect Americans to have?

Geoffrey Sanzenbacher: “The biggest reason the typical American has little in their account is because our 401k system does not have universal coverage. Leakages (early withdrawals) and fees play a smaller role. Expanding programs like state-run Auto-IRAs is one way to fix this issue, but a federal program would likely work much better.”

The Motley Fool: There are no hard and fast rules about when to retire or how much we should have saved, but what three pieces of advice would you give someone who is just starting their first retirement savings account?

Geoffrey Sanzenbacher: “Three simple pieces of advice: 1) make sure you get your entire employer match; 2) put your money into a S&P Index Fund that has a low expense ratio (something less than 0.25 percent of assets); and 3) don't look at it...ride out the lows and be happy you are buying cheap.”