Deciding what to do with your inheritance can be complicated, whether you're inheriting cash, real estate, or other valuable items. Getting a substantial windfall can create a lot of mixed feelings, especially if you were close to the person who left the inheritance to you. Read on, and we'll go through what to expect from an inheritance and what you can do with one.

What to do with an inheritance: First steps

What to do with an inheritance: First steps

There's no reason to rush into any decisions right away -- you can let your inheritance sit until you've finished processing your grief, even if that takes months. What's important is that you take care of your emotional needs first.

When you're ready to deal with your inheritance, it's vital that you bring in experts who can help you handle the inheritance and its ramifications. Experts such as financial planners, tax lawyers, certified public accountants (CPAs), real estate agents, and estate planners are a good first line of defense, depending on what you've inherited. They can give you some idea of how to handle what you've got and what it may cost you to keep or dispose of it.

Armed with that information, you can choose what to do with your found assets. However, don't make a move until you really understand your responsibilities, including any tax implications that may be involved.

Asset

What to do with a cash inheritance

What do I do with a cash inheritance?

If you've received a cash inheritance, maybe in the form of an old savings account or checking account, the options are limitless. Here are a few options to consider with a cash inheritance:

Pay down your debt. Your loved one probably wanted to make your life easier by leaving you money. If you have debts, pay those down first, especially if they're high-interest. The more monthly payments you can reduce, the more wiggle room you will have moving forward.

Donate some to a favorite charity. You could consider splitting your inheritance with a charity your loved one supported. For example, if your aunt was devoted to rescuing cats, you could give part of your inheritance to local cat rescues or the American Society for the Prevention of Cruelty to Animals (ASPCA) in her honor.

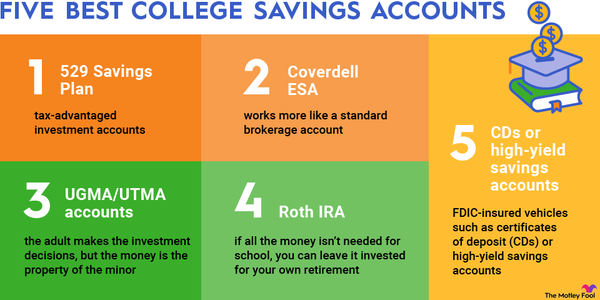

Open a savings account. Having an emergency fund that will get you through three to six months without income is always helpful. A CD or money market account can earn you high interest rates, but even a basic savings account at the right bank can do the same.

Savings Account

Invest your windfall. If you're interested in investing your money in a way that helps it grow even faster than it would with a savings account, high-yield bonds can be very safe vehicles through which to do this. If you're willing to take more risk, consider investing in stocks or exchange-traded funds. These are all excellent choices if you're investing for retirement.

If you've never invested before, consult an expert before you drop all your cash into the next hot start-up. Some companies sound really good and innovative until you start examining their cash flow statements.

Note that the rules can differ if you've inherited a 401(k) or another retirement account, so consult with a tax professional in this situation.

I inherited a house

I inherited a house

Inheriting a house can be a huge boon to your finances, especially if you're currently renting. You have a few options with your newfound property:

Move in. The most obvious answer to inherited real estate is to ditch your rent and move into the free house. You'll still be responsible for taxes, insurance, and maintenance, but not having a house payment or rent hanging over your head is amazingly freeing.

Rent it. If you haven't decided what to do with Grandma's house just yet, you can always rent it out for a little while. Without making substantial upgrades, you may be unable to charge premium rent.

However, if you've been considering keeping it and making it your own, the income you can get from it is still more than you'd get from leaving it empty. Call a property manager for help if you need to find good tenants and have someone handle the marketing and management.

Sell it. Many people get into huge trouble when trying to sell a house they've inherited. They either go in with a full remodel, spending tens of thousands of dollars on a house that might just as easily find a buyer in its current condition (even if the sales price is a little lower), or they contact a company that will buy the house as it sits. Both are setups for disaster.

Before you do anything, consult a few local real estate agents for advice and then do the math. What does it cost to remodel versus what you'll earn from the sale of the house? What would you walk away with if you sold the house as-is? How much is the house really worth compared to what the guy who will close in a week will give you?

What if I inherited a car, jewelry, or other items?

What if I inherited a car, jewelry, or other items?

If you inherited something else, like jewelry, a car, antique furniture, or other items, you may need extra help liquidating them if you choose not to keep them. After all, a houseful of memories is a lot to deal with. That's why there are estate dealers who do nothing but clean out estates, arrange for auctions, and donate what can't be sold to charity.

You almost certainly won't get the full value of the items through an estate dealer. However, the time investment it takes to comb through that many items can be enormous.

If you've only inherited a single vehicle or some small pieces, you can have them appraised before deciding what to do with them. A vehicle can easily be sold (or kept) if you have the title transferred into your name and pay the applicable fees in your area. You can sell jewelry and other objects to collectors or keep them for sentimental reasons.

Carefully consider what you'll do with objects you've inherited, especially if you're still grieving when thinking about disposing of them. You may regret selling them later when you have a clearer head, so another option is always placing them in climate-controlled storage.

What about the taxes?

What about the taxes?

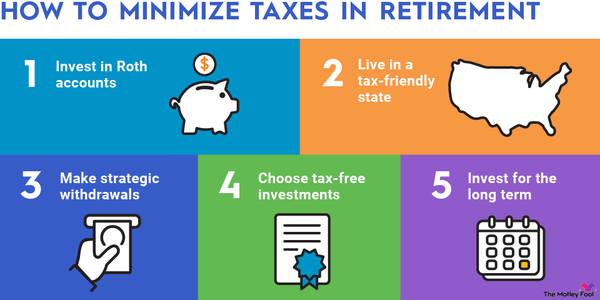

The taxes on an inheritance shouldn't be much of a burden since the estate tax, paid by the person's estate before you receive the inheritance, doesn't kick in until the estate is worth $12.92 million in 2023. Some states levy an estate tax that kicks in at lower thresholds, though.

The tax you may be responsible for, inheritance tax, only exists in six states: Iowa, Kentucky, Maryland, New Jersey, Nebraska, and Pennsylvania. If you live in one of these states, your CPA or attorney will be your best source of advice.

You may also owe taxes on an inherited IRA or other retirement account when you withdraw the money. Again, be sure to seek advice from a tax professional.

Taxes on a real estate inheritance are a bit different. In general, if you live in the house for at least two years, you can make up to $250,000 profit on it if you're single, or $500,000 if you're married, before capital gains taxes kick in.

Otherwise, you might still be able to shelter some or all of the value from taxation. When you sell a home, you must report your gain or loss relative to the amount you paid for the house. For example, if your Great Aunt Mary bought her house for $50,000 in the 1990s and sold it before her death for $250,000, she'd have to pay tax on $200,000 worth of gain.

However, since you inherited it, the cost basis -- the value that the capital gain is based on (Great Aunt Mary's $50,000) -- doesn't apply in the same way. Your cost basis isn't her $50,000 but rather the value of the house on the day you inherited it: $250,000. So, if you turn around and sell the property for $250,000 in a month, you wouldn't necessarily owe any capital gains tax on the property.

You will still have to pay certain fees and taxes required by your state and municipality that are always part of a real estate transaction. But these are typically small compared to capital gains taxes.

Always consult with a CPA or attorney before making any serious financial decisions of this nature, as the rules change frequently. There may be additional considerations for your specific location or situation.

Related investing topics

Making the most of your inheritance

If you've inherited property, cash, or real estate from someone, it can help ease the pain of losing them just a little bit. But deciding what to do with an inheritance comes with its own challenges. You may have to deal with disposing of unwanted property and potential tax implications. Before you do anything with the property, make sure to consult with experts who can guide you through the process.

FAQs

Inheritance FAQs

What is considered a large inheritance?

According to the Federal Reserve's 2019 Survey of Consumer Finances, the average inheritance is $46,200, but this includes all families. People earning at or below 50% of the average income in the U.S. receive $9,700 on average, versus the top 1% of earners who receive an average $719,000 inheritance.

What should I do with an inheritance of $100,000?

If you inherit $100,000, you have a lot of options. You can pay off your highest-interest debts, save money for emergencies, or give some to charity. You might consider using it as a down payment on a house or adding it to your child's college fund. Most importantly, you should consult with a professional to help you navigate the benefits and consequences of your inheritance.

Do you have to report inheritance money to the IRS?

Many inheritances are not taxable since they're generally of a fairly small value, but if you have any doubt, you should ask a tax professional. Even if your inheritance isn't considered taxable by the IRS, it may still be taxable by your state or local government.