You probably expect to get some money from the government in retirement, but how much you get depends on the Social Security benefits formula. Many don't understand how this formula works or when it applies, but it's not too difficult to figure out as long as you're comfortable with some basic arithmetic. Below, we'll break it down step by step so you can better estimate how much money you'll get from the program.

What is it?

What is the Social Security benefits formula?

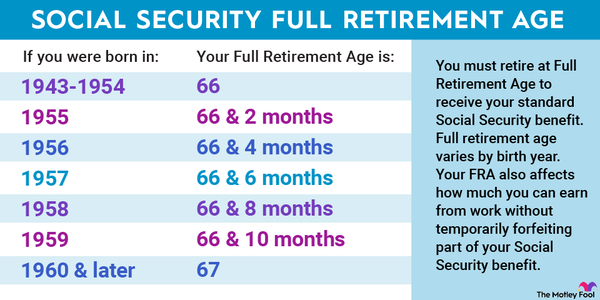

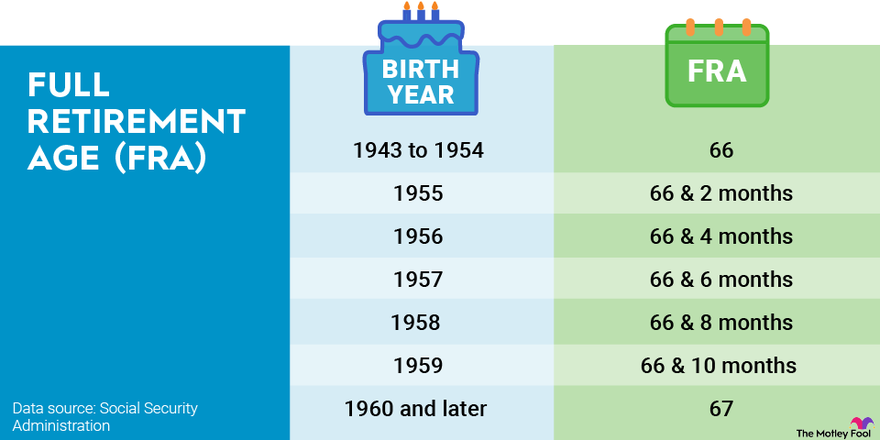

The Social Security benefits formula is what the government uses to determine your primary insurance amount (PIA). That's the benefit you're entitled to if you sign up at your full retirement age (FRA). This is 67 for anyone born in 1960 or later.

Before the government can use the benefits formula, it must calculate your average indexed monthly earnings (AIME). This is your average monthly earnings over your 35 highest-earning years, adjusted for inflation. We'll talk more about calculating that below.

Once the government knows your AIME, it gets plugged into the Social Security benefits formula in effect during the year you turned 62. The result is your PIA. But that's not always the same as your monthly benefit.

Some people choose to apply for Social Security before or after their FRA. If you claim early, you can start receiving benefits as soon as you turn 62. You'll get more checks this way, but each one will be smaller. You can also delay benefits and your checks will grow a little each month until you reach your maximum benefit at age 70.

In both of these cases, the government runs an additional calculation to determine how to adjust your PIA to determine your final monthly benefit.

Formula

Social Security benefits formula 2023

The Social Security formula for the year 2023 -- which applies to anyone born in 1961 -- is as follows:

- Multiply the first $1,174 of your AIME by 90%.

- Multiply any amount between $1,174 and $7,078 by 32%.

- Multiply any amount over $7,078 by 15%.

- Add the results from the three steps above and round to the next lowest $0.10.

So for example, if your AIME was $3,000, you would do the following:

- Multiply the first $1,174 by 90%, giving you $1,056.60.

- Multiply the remaining $1,826 by 32%, giving you $584.32.

- Multiply any amount over $7,078 (in this case $0) by 15%, giving you $0.00.

- Add the results from the three steps above, which gives you $1,640.92.

In the formula above, $1,174 and $7,078 are known as the bend points. These are the only parts of the Social Security benefits formula that change from one year to the next. You can find the bend points for any previous year on the Social Security Administration website.

Calculating your benefits

How to calculate your Social Security benefits

If you simply want to know how large your Social Security checks will be if you sign up at a certain age, you can figure this out by creating a my Social Security account. But if you want to understand how the government arrived at this number, you can duplicate its work by taking the following steps:

1. Determine your wages for each year you've worked

The federal government keeps track of how much money you've paid Social Security taxes on each year in your earnings record. You can view this in your my Social Security account.

For most people, their actual income and the income they've paid Social Security taxes on are the same. But this isn't always the case with high earners. In 2024, for example, you only pay Social Security taxes on the first $168,600 you earn. This amount is slightly higher than the 2023 Social Security maximum taxable amount of $160,200. In other words, if you earned $200,000 in 2023, but your earnings record only shows $160,200 for 2023, that's not a mistake, even though your actual income for the year was much higher.

2. Adjust your wages for each year for inflation

The government uses the Average Wage Index (AWI) to adjust your wages for inflation so it can accurately pick out the years you've earned the most. You can view the AWI for all previous years going back to 1951 on the Social Security Administration's website.

The AWI you use to adjust your wages is the one that was in effect in the year you turned 60. You divide this AWI by the AWI for the year you're adjusting wages for. The result is your index factor. Multiply this by your income as reported in your earnings record for that year to get your index-adjusted wages.

For example, if you turned 60 in 2022 (meaning you become eligible for benefits in 2024, when you turn 62), you'd use the 2022 AWI of $63,795.13 as your benchmark. If you earned $50,000 in 2015 and you want to calculate your index-adjusted income for that year, you'd do the following:

- Divide the 2022 AWI of $63,795.13 by the 2015 AWI of $48,098.63, giving you an index factor of about 1.326.

- Then you'd multiply your $50,000 in income from 2015 by 1.326 to give you an index-adjusted income of $66,300 for that year.

If that's a little too much math for you, you can skip the first step and go straight to the indexing factors. The Social Security Administration keeps lists of all the indexing factors for all years. You just have to enter the year you turn 60 and it will give you the index factors to use. Then all you have to do is multiply those indexing factors by your income for the appropriate year.

3. Calculate your AIME

After you've adjusted your income for inflation, total up the income from your 35 highest-earning years. If you didn't earn income in at least 35 years, then total your income for all the years you've worked.

Next, divide this total by 420 -- the number of months in 35 years -- which will give you your AIME. It may not be as high as you expect if you worked fewer than 35 years because you'll have some zero-income years factored into your calculation.

4. Apply the Social Security benefits formula

Once you know your AIME, you can plug it into the Social Security retirement benefits formula as outlined above. But remember to choose the correct formula for your age. You should use the one that was in effect in the year you turned 62 regardless of whether you signed up for benefits at that age.

The results you get from this step will give you your PIA. If you choose to sign up at your FRA, that's also how much you'll get for a benefit. But if you sign up before or after your FRA, there are a few extra steps to calculating your monthly benefit.

5. Adjust your PIA up or down as necessary

To do this step, you need to know what your FRA is. Here's a table to help you figure that out:

If you claim Social Security early, the government reduces your checks by:

- 5/9 of 1% per month up to 36 months

- 5/12 of 1% for each additional month if you claim more than 36 months early

For example, if your FRA is 66 and you claimed at 62, you'd lose 5/9 of 1% from your checks for each of the first 36 months you claimed early. So you'd multiply (((5/9) x 0.01) x 36) x 100 and you'd get a 20% reduction. But that's not all.

Then, you have to add a further 5/12 of 1% monthly deduction for claiming checks between 62 and 63. So you'd take (((5/12) x 0.01) x 12) x 100 and you'd get an additional 5% decrease. Added together, the two steps above result in 25% smaller checks for claiming at 62 as opposed to waiting until 66.

For those who choose to delay benefits past their FRA, the process is pretty similar. You add 2/3 of 1% per month for every month you delay past your FRA. However, this only continues until you turn 70. After that, your benefit won't grow any more.

6. Subtract your Medicare Part B premiums if necessary

The five steps above will tell you the kind of benefit you're entitled to based on your work history and claiming age, but that's not always the same as your take-home benefit. Seniors on Medicare have their Part B premiums automatically deducted from their Social Security checks.

In 2023, that was $164.90 per month, but it's increasing to $174.70 in 2024. If you're not on Medicare yet, you won't have to worry about this until you sign up for it.

7. Round your benefit amount down to the nearest dollar

The final step in calculating your take-home Social Security benefit is to round your answer from Step 6 down to the nearest dollar. Even if your result from the previous step was $1,680.99, you'd still round down to $1,680 rather than rounding up to $1,681.

A quick word on cost-of-living adjustments (COLAs)

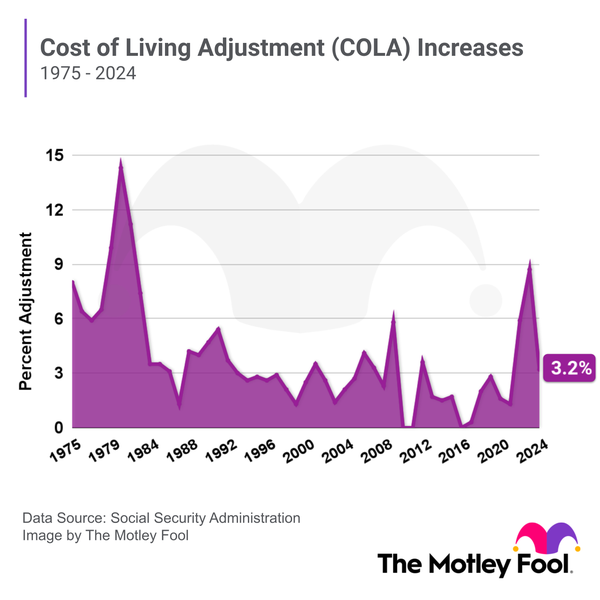

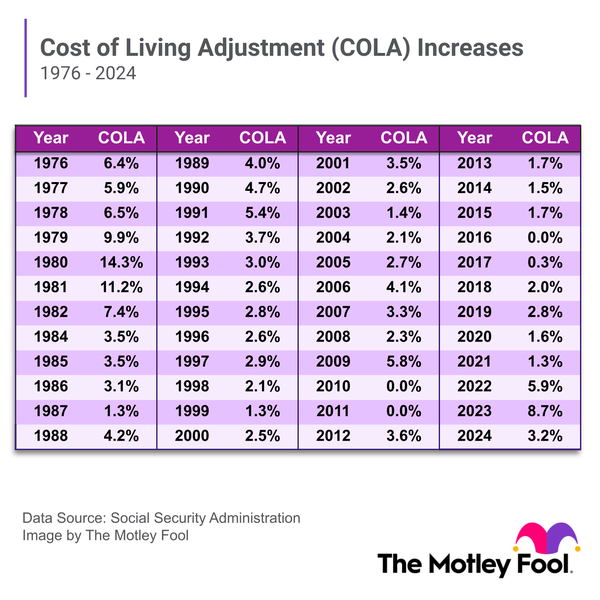

Every year the government administers a cost-of-living adjustment (COLA) to help seniors' Social Security checks keep up with inflation. But it doesn't add the COLA to your take-home check. It adds it to your PIA.

If you want to calculate the size of your checks for next year, look at your PIA for the current year and add the COLA. For example, the 2024 COLA is 3.2%, so you'd take your 2023 PIA and multiply it by 1.032 to get your 2024 PIA. Then you proceed with Steps 5 to 7 above to determine your new take-home benefit for the next year.

Importance

Why is the Social Security benefits formula important?

Once you understand how the government calculates your Social Security benefit, you can use this information to boost your own benefit. For example, if you didn't know that the government based your benefit on your 35 highest-earning years, you might have retired before you worked that long. That would have resulted in zero-income years being included in your benefit calculation.

Understanding how your FRA plays into your benefit calculation can also help you choose the best time to sign up. This depends on your life expectancy and financial circumstances.

You can use the steps above to calculate your benefit at various claiming ages. Then multiply each of these monthly benefits by 12 to get your estimated annual benefit. You then multiply this figure by the number of years you expect to claim to get your estimated lifetime benefit. For example, if you expect a $2,000 monthly check at your FRA of 67 and believe you'll live to 87, you'd have an estimated lifetime benefit of $480,000.

Related retirement topics

The bottom line

The Social Security benefits formula might seem complicated, but it's not too difficult once you break it down. You may not be able to precisely calculate your benefit if you're too young for Social Security, but keeping these guidelines in mind can help you squeeze the most money possible out of the program.

Expert Q&A on Social Security

Keri Dogan

The Motley Fool: Because of the COVID-19 pandemic, many Americans now fear they won’t be able to retire. What is your advice for someone who may be worried about retiring because of recent financial setbacks?

Keri Dogan: Concern about retirement income is mounting among Americans approaching retirement, with many worried they won’t have enough money to last their lifetime. This is especially true given the uncertain world we live in, due in part to the pandemic, as well as market volatility and inflation so top of mind this past year.

If you are still in your saving years, retirement savers justifiably concerned about the impact of market volatility may be reassured to know there are important arguments that can reinforce one’s faith in looking long-term and not making changes based on short-term economic swings. One of these is the profound impact making continuous contributions over even a relatively short period of time can have on one’s retirement readiness. For example, if you contributed the 2021 maximum $6,000 IRA contribution at age 25 and keep it going all the way to age 70, you would have amassed $1,440,5928 by retirement. Even shorter term, according to Fidelity’s analysis, the average 401(k) balance for people who have been in their same plan with the same employer for just a 5-year continuous period is more than double the average retirement account balance. This can make a huge difference.

If you are near or entering retirement, as a general rule of thumb, Fidelity believes that day-to-day, must-have expenses in retirement like housing, food, and health care, are best covered by lifetime guaranteed income sources, such as Social Security, pensions, or income annuities. If you can afford to, consider paying nice-to-have, more easily adjusted expenses with your withdrawals from savings. Another factor is the age at which you stop working. Most people are eligible to receive Social Security benefits as early as age 62, but those benefits increase if you wait until your full retirement age (usually 67) and rise even more if you delay until age 70. The earlier you retire, the more you will have to rely on savings to meet your income needs, because your Social Security payments will be lower. So, if you retire but can afford to wait to draw down Social Security until you are 67-70, that may be helpful—and also, don’t forget about the possibility of working part time in retirement.

The Motley Fool: According to a recent survey by The Motley Fool, men were most likely to say, "I rely on Social Security benefits a little," while women were most likely to say, "I rely on them a lot." Men were also more likely to be "slightly worried" about losing their benefits, while women were most likely to be "very worried." Why do you think men seem to fare better than women in retirement years and have more confidence in their financial stability? What are the potential implications of this trend?

Keri Dogan: One factor may be that women are more likely than men to live longer, with a statistically good chance of living into their mid-90s. That means, naturally, they need their income to last longer. Longer lives mean more years to enjoy, but it also requires anticipating more expenses in retirement, especially higher health care costs.

Because women are likely to live into their 90s, Social Security is a critical component of retirement income. That is why it is important for women to understand Social Security eligibility to claim maximum monthly benefits. Making the decision as to when to take the initial benefit will permanently impact how much is received monthly.

It also means women have a greater need to have a comprehensive retirement plan in place. And yet, according to Fidelity research, only 68% of women say they do have a financial plan in place. Planning can have a powerful impact on a feeling of financial wellness, and what we have observed is that greater planning leads to an increased sense of confidence in a variety of areas, both short- and long-term. While men tend to feel like their financial lives are more in control than women, women’s confidence matches that of men when they have a plan in place.

The Motley Fool: When asked about the 8.7% cost-of-living adjustment for Social Security benefits in 2023, 55% of respondents said they didn’t think it was enough. Why do you think retirees feel this way when it's one of the biggest COLAs in history? Did the SSA make a mistake in not raising it more?

Keri Dogan: This year's increase is the largest in a generation and is definitely a helpful boost for many retirees, especially those who are looking to live within their Social Security budget.

The increase could help ease the pain of record inflation for many retirees struggling with rising costs for everything from gas to groceries. And while many retirees are not as adversely impacted by inflation in some areas (i.e. gas for travel and food costs, as their needs here may not be as great), they especially feel the pinch when it comes to rising health care costs. We also see that retirees are already adept at reducing their essential and discretionary spending and have been throughout the pandemic.

While the concern retirees may feel about the size of the increase is understandable, one piece of advice for retirement savers—or those in retirement—is to try not to worry too much. Based on what we know about retirees and their satisfaction once they get to retirement, most aren’t spending as much as they could be and yet they’re feeling pretty good about where they are – satisfied with retirement and at the same/higher standard of living compared to pre-retirement. In fact, Fidelity analyzed extensive spending data and found that most people needed to replace between 55% and 80% of their pretax, preretirement income after they stopped working to maintain their lifestyle in retirement.