12 Ways to Generate a Higher Income in Retirement

12 Ways to Generate a Higher Income in Retirement

Boost your income in a meaningful way

The more money you have access to during retirement, the more comfortable your senior years are apt to be. These strategies can help you boost your income, but some of them may require you to act quickly.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Invest your IRA or 401(k) wisely

Investing your retirement savings in stocks is a good way to score higher returns in your account that give you more spending power later in life. Even though it's wise to shift toward safer investments as retirement nears, you should still aim to keep a good chunk of your savings in stocks.

ALSO READ: How to Retire With $2 Million on the Average American's Salary

Previous

Next

2. Put money into a health savings account

The great thing about a health savings account (HSA) is that the funds you put into your account can be used at any time. If you fund an HSA aggressively and avoid tapping that account during your working years, you'll have more income at your disposal in retirement.

Previous

Next

3. Choose a Roth savings account

When you take withdrawals from a traditional IRA or 401(k), those distributions are subject to taxes. Roth IRA and 401(k) withdrawals, however, aren't taxable, so you'll get to keep that money for yourself.

Previous

Next

4. Own dividend stocks

Dividend stocks can do more than just gain value in time. They can also serve as a steady stream of income. Dividends are commonly paid quarterly, and you can use that money as income during retirement to cover your expenses. Or, you can reinvest your dividends to help yourself grow even more wealth.

Previous

Next

5. Buy REITs

REITs, or real estate investment trusts, allow you to invest in real estate without actually owning property. One of the best features of REITs is that they tend to pay much higher dividends than stocks, since they're required to pay out a minimum of 90% of their taxable income to shareholders. The result? More incoming cash for you.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Rent out a portion of your home

If you own a larger home, renting part of it out could give you another retirement paycheck to enjoy. This option especially works if your home has a finished basement or garage that can serve as a separate, private living space.

Previous

Next

7. Load up on municipal bonds

Municipal bonds differ from corporate bonds in that the interest they pay is exempt from federal taxes. And if you buy municipal bonds issued by your state of residence, you'll avoid state and local taxes on that income, too. Municipal bond interest is generally paid twice a year, so you can look forward to that extra income at preset intervals.

Previous

Next

8. Boost your earnings for a higher Social Security benefit

Social Security could end up becoming an important income source for you in retirement. You can score a higher benefit by boosting your earnings during your working years. That could mean growing your skills to earn raises at your main job, or increasing your wages via a series of side gigs.

Previous

Next

9. Delay your Social Security filing

You're entitled to your full Social Security benefit based on your wage history once you reach full retirement age, which is either 66, 67, or somewhere in between, depending on your year of birth. But if you delay your filing beyond full retirement age, you can score a higher benefit -- for life.

Previous

Next

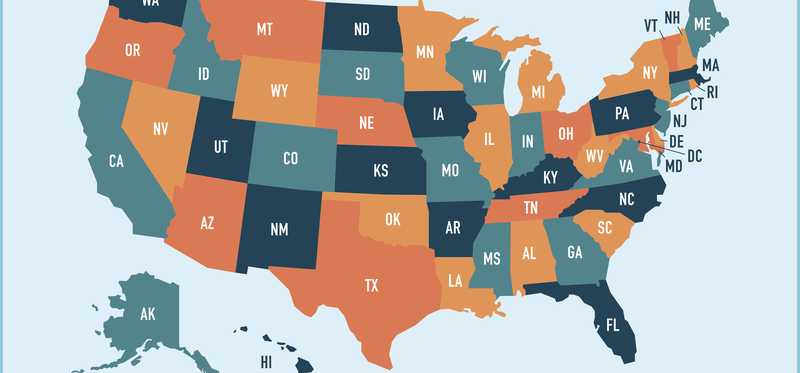

10. Move to a state that doesn't tax Social Security

Most states don't tax Social Security, but there are 13 states that do. If you want to keep your benefits in full, you may want to avoid settling down in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

11. Start a business

Many retirees struggle with boredom. Starting a business is a great way to not only fill your days but also earn more money.

Previous

Next

12. Get a flexible part-time gig

You may not want to take on the financial risk of starting a business of your own in retirement. If that's the case, look at picking up flexible work that you can do at your own pace, like driving for a ride-hailing service or consulting in your spare time. You can even try turning a hobby into a gig.

Previous

Next

A higher retirement paycheck could be yours

Boosting your retirement income could make it possible to achieve your goals and enjoy that stage of life to the fullest. It pays to incorporate some or even all of these strategies into your plans so that money worries don't come into play during your senior years.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.