40 Pretty Easy Ways to Spend Less Money

40 Pretty Easy Ways to Spend Less Money

Spend less and save more

If you're like most people, you'd like to spend less and save more because you have some rather important financial goals, such as sending a kid or two to college, paying off your home, and retiring comfortably. That's easier said than done, though.

Fortunately, there are lots of not-too-painful ways to spend less and thereby save more. Here are 40 of them to consider. Not every one will work for you, but more than a few should. If just seven of the ideas below help you save, say, $150 per year, that's worth more than a thousand dollars in savings!

Previous

Next

1. Install water-saving shower heads

Close to 17% of the water we use in our homes is for our showers, and the average American family's water bill was recently about $70 per month, or about $840 per year. One way to shrink those numbers is by installing water-saving shower heads. Don't assume that they will constrict water flow to an irritating trickle -- good ones won't. Look up "low flow shower head" on Amazon and you'll see lots of options with four and a half to five stars. Shower heads with the "WaterSense" label should use no more than two gallons per minute, vs. the 2.5 or more that standard shower heads do. That's 20% less and it could save you $30 or more annually. If you have very old shower heads, dating before 1980, those use five gallons per minute, so you might save much more. Water-saving toilets will increase your savings further, though they cost more than a shower head.

Previous

Next

2. Make your coffee at home

This suggestion has been made many times, but in large part that's because it's so powerful. If you grab a latte from a coffee shop down the street on your way to work each day, that could be costing more than $4 a pop. Over the course of a year, it's about $1,000. How much does it cost to make your own coffee at home? Well, it will all depend on the coffee you buy and how you prepare it, but estimates range from about $0.15 to $0.25 per cup. A $0.25 cup made each weekday for a year will total less than $75 -- representing considerable savings. Just cut back to a latte every other day and you can still save hundreds of dollars.

Previous

Next

3. Don't order drinks at restaurants

Going out to eat is often a treat, but the food alone might be enough of a treat. Consider opting for water in restaurants instead of a $3 soda, lemonade, or coffee, or a $5 beer, a $7 wine, or a $10 mixed drink. If you tend to go through two mixed drinks when dining out once a week, that's $20 times 52 weeks, or a total of more than $1,000. Cut back to just one drink, and you'll still save a lot. Buying five beers a week at $5 each comes to $1,300. Spend a few minutes evaluating how much you drink and what it costs. See whether you have a saving opportunity there.

Previous

Next

4. Call your cable company for a better deal

Many people sigh heavily every few months and call their cable company, complaining about escalating bills and getting lower rates. Consider joining their ranks if you're not already among them. Cable companies are always offering various special deals and rates -- typically ones that expire after a set number of months. Call your provider and tell them you're unhappy with how much you're paying and ask how your bill can be lowered. There's a good chance you may end up paying $20 or $30 less per month -- for at least half a year or a year. If not, shop around for a better cable deal from another company -- or cut the cord entirely.

ALSO READ: Saving Money Was Never Easier With These 10 Mobile Apps

Previous

Next

5. Impose a waiting period for big purchases

This pretty easy way to spend less is mostly psychological: When you find yourself about to make a major purchase -- perhaps a fancy large-screen TV or a new set of golf clubs -- stop yourself and wait at least a day and ideally a week before pulling the trigger. There's a good chance that the urge will pass or you'll find yourself thinking about how else you might spend that money.

Previous

Next

6. Ask your credit card company to waive your annual fee

Most credit cards don't charge annual fees, but if yours does, you're probably forking over around $75 to $100 annually, with some folks paying $500 or more. A simple phone call could wipe that out or reduce it. According to a report by CreditCards.com, 82% of cardholders who called their card companies were successful in lowering or eliminating their annual fee. About a third negotiated the fee to a lower amount, and about half got it waived entirely.

Better still, 89% of cardholders were given a higher credit limit when they asked for one, and 87% got a late fee waiver while 69% of those who asked for a lower interest rate got one. A lower rate can be particularly meaningful. The average household is carrying about $6,577 in revolving credit card debt. If you're carrying $6,000 in debt at a 20% interest rate, that's $1,200 in interest owed annually. If you can get the rate down to 16%, you'll pay only $960, saving $240. (Better still, get that debt paid off pronto!)

Previous

Next

7. Buy in bulk

There are plenty of jokes about buying in bulk at warehouse chains such as Costco (Nasdaq: COST), such as this tweet by @amour72mg: "I'm going to Costco tomorrow. Anyone need 7 lbs of cheese?" That may be amusing, but if you or your household consumes a fair amount of cheese, that large quantity isn't so unreasonable. Buying your household staples in volume is often a smart, money-saving move. Not always, but often. Make a note of the things you consume a lot of and then compare the prices at your regular shopping location (such as your supermarket) with the prices at your favorite warehouse store. A comparison of prices at a Costco and a Walmart (NYSE: WMT) earlier this year by the folks at kitchn.com found prices lower at Costco by 11% for milk, by 16% for eggs, and by 30% for wild Alaskan salmon. (Prices were lower at Walmart for some items, though, such as sliced turkey and paper towels.)

Previous

Next

8. Cut the cable cord

The average cable and satellite TV bill was recently around $101, which costs typical consumers about $1,200 annually, a rather significant sum. (That's up some 53% over the previous 10 years.) If you cut that cord and opt to stream your video entertainment instead, you can save quite a bit. For example, Netflix (Nasdaq: NFLX) charges between $8 and $14 per month, while Hulu charges between $8 and $12, and an Amazon.com (Nasdaq: AMZN) Prime subscription costs $119 per year, or about $10 per month. Those three together will give you gobs of content for $36 or less per month. Instead of that, or in addition to it, you might opt for Sling TV. Its most basic line-up, Sling Orange, recently cost about $20 per month and offered 30 channels, including AMC, BBC America, Cartoon Network, Comedy Central, Disney, ESPN, IFC, and TBS. For $40 per month, you can get dozens of channels including lots of sports.

ALSO READ: Is Cable Dying? Where Cord Cutting Stands Now

Previous

Next

9. Wear sweaters at home in the winter

It's perhaps obvious that you can save money in winter by wearing sweaters around the house and keeping the thermostat set lower. But just how much might you save? Well, the folks at the Marion Institute suggest that wearing an ordinary sweater can make you feel about two degrees warmer, while a heavy sweater can make a four-degree difference. They note that each degree lower you keep your house can save you about $26 on your heating bill. So that wool might net you a solid $100 each winter. Other estimates say that you can save about 1% to 3% off your heating bill for every degree by which you lower the thermostat for The amount saved will vary by household, of course, and by sweater. If you spend $1,000 on heat during a typical winter and can shave 6% off that, you're looking at saving $60 per year -- and $600 over a decade.

Previous

Next

10. Call around for better insurance deals

This extremely easy tip might take you an hour or less and save you hundreds of dollars per year: Shop around for better insurance rates every year. Each insurer uses different formulas to determine their rates, and each probably will offer you a different price for the same coverage. A little time spent calling a few insurers and getting quotes for the coverage you want can lead to some hefty savings on your home insurance, car insurance, and other kinds of insurance. Do this regularly, too, because different insurers might offer the best deal in different years. (Know, too, that another way to save on insurance is to bundle your policies -- an insurer might give you a discount on all your policies if you have two or more policies with it.)

Previous

Next

11. Spend more -- for some items

When faced with the choice to buy a higher- or lower-priced version of some product, the lower price can often seem to be the smarter choice -- why pay $55 when you might pay $46 instead, right? That's often the case, but not always. With certain products (or services), big and small, it's sometimes better to spend more. With houses, for example, you needn't go for the 5,200 square foot mini-mansion, but if you go as far as you can in the opposite direction, settling for an inexpensive house that needs a lot of work and is perhaps on a busy street near the town dump, you might have trouble unloading it one day. With cars, pay as much attention to a model's reliability and cost of ownership as its price, because some inexpensive cars can end up costing you a lot in repairs or insurance. Buying an energy-saving appliance that costs a little more can save you money in the long run, too. It can also be worth spending a little more on your clothes, if it means you're getting higher quality, longer-lasting garments that you'll wear for a long time.

Previous

Next

12. Eat the food in your freezer

Many people have freezers that are chock full of foods that they rarely eat, leaving the appliances essentially as long-term storage facilities. You might save a lot of money -- and even enjoy a fun challenge if you determine to consume half or all of what's in there. Perhaps make a game of it, having household members guess how many meals you can get out of your freezer contents and then seeing what the number turns out to be. It wouldn't be unusual to have more than $100 or possibly $200 or more in frozen meats and other treats in your freezer. Consuming them instead of buying new items from the supermarket can boost your savings for a month or two.

ALSO READ: 20 Terrible Ways to Save Money (That People Have Actually Tried)

Previous

Next

13. Look into refinancing your mortgage

We've had many years of ultra-low mortgage interest rates now, but they've finally started inching up. Gobs of homeowners have already taken advantage of the low rates and refinanced their home loans, but if you haven't, it might still be worth looking into. One rule of thumb suggests that it's worth it if you can get a new interest rate that's at least a percentage point lower than your current one. As an example, imagine that you took out a $200,000 30-year 6% fixed-rate mortgage a decade ago, in 2008, and that your monthly payments are $1,199. If you refinance into a new 30-year loan at 5%, your payments will drop to $898, saving you $301 per month! (That's a hefty $3,600 per year.) Of course you'll now have 30 years of payments ahead of you again. You might instead refinance into a 15-year loan that will end sooner, or you might just plan to make some prepayments in order to shorten the life of your loan.

Previous

Next

14. Join a CSA for veggies

Another easy way to spend less is to buy a community supported agriculture (CSA) subscription, which will get you many weeks of produce from local farmers. It's often organic produce, too -- which can be better for your health -- and buying it through a CSA can be cheaper than from your local grocer. Prices vary widely, but a recent look online found a New Hampshire-based CSA program offering 18 weeks of produce for around $380 and a Kentucky-based CSA program charging $649 for 22 weeks' worth. That averages about $20 to $30 per week for a variety of veggies and fruits that have just been harvested. Think about what you spend on produce at your local supermarket (and what organic produce would cost you), and see how much you might save.

Previous

Next

15. Pay bills online

With most of our postage stamps labeled as "Forever," many of us no longer even know what the cost of a first-class stamp is. Well, since January of 2018, it has been $0.50. That may not seem like much, but it can add up if you mail out a lot of checks and letters every month. Go ahead and keep sending loved ones letters and greeting cards, but consider paying your bills online. If you pay 10 bills each month, that's $5 going out the door that probably doesn't have to -- $60 per year. Your bank or credit union very likely offers free online bill paying, and making use of that can be faster and easier than paying by check (or telephone), saving you money in the process. You can even set up many bills to be paid automatically, reducing your chances of paying a bill late and having your credit record dinged.

Previous

Next

16. Don't think of the mall as entertainment

A 2016 Gallup survey found that 26% of Americans -- and 39% of Millennials -- shop for fun. In other words, the malls and other shopping venues are full of people who are not there because they really need a new jacket or have to replace a laptop -- instead, they just went shopping because it's something to do, and something fun for them. Many malls are now entertainment destinations -- not just because they offer movie theaters and perhaps a gaming center, but because shopping is seen by plenty of people as an activity to engage in, whether you're in need of any items or not. If you're one of these people and you change your mindset so that you only hit stores when you need something, you can save a lot of money. If you used to shop for fun every other week, spending, say, $50 each time, that's $1,300 in unnecessary spending you can avoid.

ALSO READ: How to Start Saving Money in 2018

Previous

Next

17. Make gifts instead of buying them

It's easy to spend a lot of money on birthday and holiday gifts -- especially if you have a large family. Spend just $40 per gift twice a year for six loved ones and you're looking at $480 per year. Have 10 people you give generously to? That's a hefty $800. You can save all of that, or part or half of it, by making gifts instead of buying them. If this idea is sounding a little lame, give it more thought. Here, for example, are some money-saving ideas:

- If you're a knitter, you might knit scarves, socks,

coasters, or sweaters for your friends.

- If you're handy with fabric and a sewing machine, you can

make neckties for the guys in your life.

- Some crafty time spend with felt can result in colorful

coasters.

- From photo websites or sites such as zazzle.com,

cafepress.com, redbubble.com, or merch.amazon.com, you can order inexpensive

mugs, calendars, t-shirts, and more -- personalized with photos or your artwork.

- You might make copies of your favorite recipes and have

them bound into books.

- If you're a wood crafter, your friends might like cutting

boards with your designs burned or carved in them.

- You might learn to make scented candles or perfumes.

- Many people would enjoy a custom-selected playlist of

music from you.

A little time spent Googling for do-it-yourself gift ideas will turn up myriad other possibilities, with some inspirational photos, too.

Previous

Next

18. Review credit card statements for surprises

Here's a quick and easy way to spend less money: Grab a stack of your credit card statements and scrutinize them. There's a good chance you'll run into a handful of surprise charges. Some may be due to fraud, but many may be ones you authorized long ago and forgot about, such as subscriptions to magazines you no longer want or read or a gym membership you never use. Many are charges you once authorized, but they may have doubled in size over time, without needing your approval. Here's another example: Some people have been finding charges from hotels appearing on their statements after they checked out and paid their bill, for items they never consumed from the fridge in their room or for phone calls they never made. Hospitals have been known to charge you for some additional expenses beyond the main bill you paid, too. Lots of companies rely on your never looking closely at your credit card statement -- especially for relatively small charges. Question or cancel some surprises you find in your statements and you might net tens or hundreds of dollars.

Previous

Next

19. Don't buy bottled water

If you stop buying bottled water, you can save some potentially significant dollars. Perhaps you buy a 24-bottle case of water for $4 twice a month at your supermarket. That's almost $100 per year for something you can get just about for free from your tap at home. If you're in the habit of paying $1 or $2 for a bottle of water in the course of your day, that can amount to $350 to $700 per year. Instead, spend a few dollars on a reusable water container or two and enjoy having more money in your pocket.

Previous

Next

20. Automate some savings

A great way to spend less is to simply have less on hand to spend. You can do that by automating some savings. Many employers will let you specify that a set amount is routed from your paycheck to a certain bank account or two each pay period. You might, for example, have $300 sent to a savings account every pay period, and thereby end up with $7,200 in savings each year. (For best long-term results, of course, invest that money in stocks.) This strategy will not only help you spend less, but it will also guarantee that you're regularly socking money away for your future. It's also smart to make good use of a 401(k) account at work, if you have one, and aim to increase the percentage of your income you contribute to it each year.

Previous

Next

21. Increase deductibles

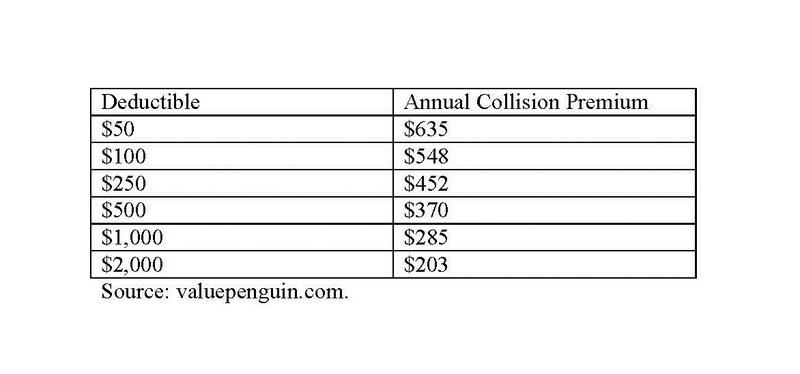

Another good way to save money and to spend less is by increasing the deductibles on various insurance policies. The higher your deductible, the lower the monthly premium. The folks at valuepenguin.com looked at sample premiums at different deductible rates for a 34-year-old married man with a 2010 Toyota Camry and got the following results:

You can easily save $100 or more by hiking your deductible -- especially if the policy is one you aren't likely to make a claim against very frequently, as is often the case with car insurance. Here's an important caveat, though: Be sure that you can manage paying the deductible if and when you need to. If you would have trouble paying a $1,000 deductible, don't sign up for one.

Previous

Next

22. Inflate your tires

Keeping your car's tires properly inflated not only makes for safer driving, but it can save you money, too. The Department of Energy notes that, "Under-inflated tires increase a vehicle’s resistance, require the engine to work harder, and use more fuel... By keeping tires inflated to the recommended pressure, drivers can improve their gas mileage by up to 3% -- the equivalent of saving up to $0.10 per gallon of gasoline." If you drive 12,000 miles per year and average 25 miles per gallon, you're going to use 480 gallons of gas. Saving $0.10 per gallon can save you around $48 -- per year. The savings can be higher if you drive more miles per year, if gas prices are on the high side, or if your car is relatively fuel-inefficient.

Previous

Next

23. Plan meals

A lot of household dollars get spent on an impromptu basis when whoever usually makes dinner comes home without a dinner plan and decides to just order dinner delivered or to take the family out to dinner. That can cost as much as $30 or $50 or more, depending on the food or restaurant you choose, and if it happens twice a week, it adds up to several thousand dollars! This spending can be reduced by being more deliberate and having meals planned. You might plan just once a week, on the weekend, perhaps preparing and freezing a few meals in advance. Or you might tape a meal plan on the fridge and make sure to take any frozen necessities out of the freezer before leaving for work.

Previous

Next

24. Quit the gym

Gym memberships can be very worthwhile if you frequent the gym regularly and make good use of it. But many people sign up, pay every month, and then never go. Two years ago, USA Today noted that the average gym membership cost close to $60 per month, and that 67% of memberships were not used. If those numbers reflect you, you're paying around $700 per year -- for nothing! (You may not even be aware of it, if you signed up long ago and don't pay much attention to your credit card statements.) Consider canceling your membership in order to save a lot of dollars. Remember that you can get good exercise just by biking or walking or running around your neighborhood -- for free.

Previous

Next

25. Pass up appetizers and desserts

Do you eat out, say, once a week? And do you order an appetizer and dessert when you eat out? If so, you might be paying about $8 for that calamari and perhaps $5 for that key lime pie, adding something like $13 to your bill. Over the course of a year, that comes to $676. Focusing only on the main course can save you dollars -- and calories, too, boosting your health. Drink water instead of a beer or soda and you can save even more.

Previous

Next

26. Use cash-back credit cards

If you use a credit card a lot and you're not getting cash back each time you do so, you could be missing out on lots of dollars. There are cards that offer anywhere from 1% to 2% back on every purchase, and some that pay up to 5% or 6% back on certain purchases, such as those at supermarkets or certain retailers. If you spend $250 per month at Amazon.com, for example, and earn 5% back on most purchases there, you'll essentially be spending 5% less while saving about $150 annually. There are lots of great credit cards out there, so make sure you're using one that serves you best. If you travel a lot, your best bet might be a card that offers travel rewards and discounts -- and if you're in debt, focus not on cash back but on paying off your debt, perhaps with the help of a 0% intro APR card or a balance-transfer card.

Previous

Next

27. Delete shopping apps

The apps on your smartphone can make all kinds of things easier -- but they can be costly, too, if they're encouraging you to spend money. That's often the case with apps tied to retailers and marketplaces such as eBay (Nasdaq: EBAY), Etsy (Nasdaq: ETSY), Amazon.com, and letgo, OfferUp. If you're someone who likes to spend time browsing on such sites -- and to click the "Buy" button -- you could save some significant dollars by deleting those apps. Making it harder to spend your money is an effective way to spend less.

Previous

Next

28. Follow the sales and use coupons

Whether you do most of your shopping online or in brick-and-mortar establishments or both, you can save a lot of money and spend less by using coupons, coupon codes, and waiting for sale prices. At Amazon.com, for example, you might park items of interest in your cart and then wait to be alerted when their prices fall. With purchases at most major e-commerce sites, you should look for any available coupon codes before checking out. Sites such as retailmenot.com and couponcabin.com offer up lots of codes that might get you free shipping, 20% off your purchase, or some other great deal. If you can save just $10 per week using coupons, that's more than $500 per year! A little searching online or in your local newspaper can yield coupons and sale prices at brick-and-mortar stores you frequent, too.

Previous

Next

29. Scrutinize your spending

One way to spend less is to take a close look at how you spend your money. A very close look. Grab the last three months' worth of your various credit card statements and your checkbook. (Many credit cards offer annual summaries of your spending -- visit your cards' websites and see if you can access those, as they'll offer even more information with even less work required.) Tally up your spending across your various spending categories -- such as groceries, restaurants, gas, tolls, clothing, electronics, cable, postage, hobbies, and so on. You might find, for example, that your restaurant spending totaled $2,500 -- far more than you thought it did. If so, you can aim to cut back a little on dining out. You can probably find ways to cut back your spending on at least a handful of categories, if any have consumed a surprising number of your dollars.

Previous

Next

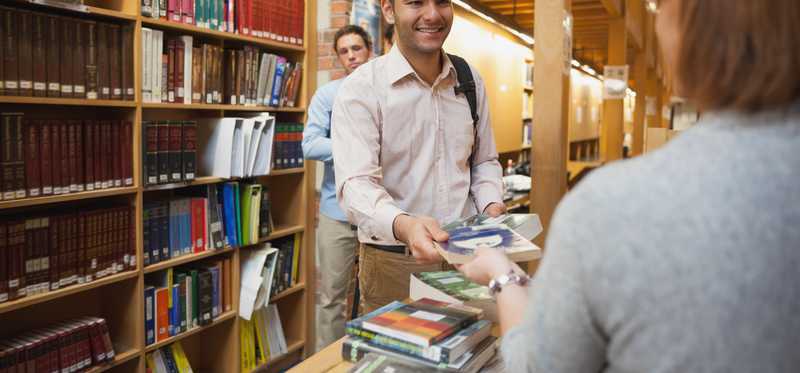

30. Get in the library habit

Buying a book is not typically a costly proposition. You can buy many new books online or in bookstores for around $10 to $20, and many used books can be found for just a few dollars. But those modest sums can add up if you tend to buy a lot of books. If your night stand has a pile of books stacked on it, and your bookcases are overflowing, you might be a serial book buyer who could save a lot of money by simply making more use of your local public library. Libraries these days offer much more than physical books, too, such as audiobooks, movies, museum passes, and more. If you can avoid buying just one $20 book per month, that's $240 saved in a single year.

Previous

Next

31. Try store brands more often

Brands are big business -- with brands such as Apple (Nasdaq: AAPL), Disney (NYSE: DIS), and Starbucks (Nasdaq: SBUX) estimated to be worth $146 billion, $33 billion, and $32 billion, respectively, per the folks at Brand Value. You might prefer to own an iPhone, show your kids Disney movies, and buy your coffee from Starbucks, but many items with unknown or lesser brands can be perfectly satisfactory, too. Your local supermarket and discount stores, not to mention pharmacies, probably have their own brands available next to name-brand items. In many cases, store brands are actually made by the name-brand companies. Costco's Kirkland Signature batteries, for example, have been made by Duracell, while some of Costco's Kirkland coffees have been made by Starbucks. Walmart's Great Value peanut butter has been made by the maker of Peter Pan peanut butter. Opting for store brands more often can save you 10% or more on lots of purchases.

Previous

Next

32. When shopping, put something back

Here's a game you can play with yourself to help you spend less: When you're shopping and are just about ready to roll your cart over to the cashier, stop for a minute and pick at least one item to put back. There's a good chance that you have three shirts in your basket when two (or one) will suffice. Your grocery cart may have a few packages of snacks that you could do without. Even at an electronics store, there's a good chance you're holding something you don't really need as you approach the check-out station.

ALSO READ: You Won't Believe What the Average American Spends on Impulse Buys

Previous

Next

33. Wash clothes in cold water

According to the folks at Energy Star, nearly 90% of the energy a washing machine uses is for heating water. It used to be that washing clothes in warm or hot water was a good idea in order to get them as clean as possible. Today, though, detergents have been made more effective, and those designated as cold-water detergents are dedicated to getting your clothes just as clean with hot water. The Department of Energy has noted that, "Using warm water instead of hot can cut a load's energy use in half, and using cold water will save even more." Cold water can even help clothes last longer! Other money-saving laundry tips are avoiding half-full loads, using lower heat settings (even if it takes longer to dry), cleaning the lint filter before every load, and air-drying clothes when possible.

Previous

Next

34. Eat less meat

Eating less meat can be good for your cholesterol levels -- and it can save you money, too. The average price of ground beef recently averaged $3.73 per pound in U.S. cities, while the price of ham averaged $2.90 per pound, chicken breasts were $3.24 per pound, and steak meat averaged $7.70 per pound. Contrast that with $1.18 per pound for pasta, $0.69 for rice, $0.73 for potatoes, and $1.31 for beans. You needn't become a vegetarian, but cooking less meat at home (and ordering fewer fancy steaks at restaurants) is a good way to keep more dollars in your pocket. One way to do so is not to eat meat less often, but just to use less meat, such as by incorporating some meat in your pasta dish instead of having a full steak meal.

Previous

Next

35. Ask about any discounts

Perhaps surprisingly, there are many discounts to be had just by asking. At many stores, whether focused on shoes, housewares, construction materials, or electronics, you can request to speak with a manager and ask what discount might be available. Many managers have the power to offer you a lower price. One way to do ask is inquire if the quoted price is the best they can offer you. Or ask if there's any way the price can be lowered, (to keep you from going to a competitor.) Another way is to offer to pay cash, thereby saving the retailer the several percentage points of the purchase that they would have to fork over to the credit card processor. If you're a senior citizen, there are gobs of senior discounts just for you -- and it pays to ask about what discount might be available. Try checking with just about any company you regularly do business with to ask what better deal you might get -- that includes your cable company, your insurance companies, your cell phone provider -- even your doctor's office.

Previous

Next

36. Leave your credit cards at home

Studies have shown that we tend to spend a lot more money when we pay with plastic than when we pay with cash. In one famous study at MIT, researchers had their subjects bid on tickets to see a Boston Celtics basketball game, and those who were told they would pay with credit cards bid nearly twice what the cash-payers bid. Credit cards are useful, and it can be hard to be without them, so at the very least, be mindful of your spending with them, and ask yourself now and then if you would be making the same purchase if it were with cash. If you can swing it, do leave your cards at home and see how you do spending only cash.

Previous

Next

37. Look into solar power

Imagine generating all the electricity you need on your own, from solar panels, instead of buying it from a utility company. Clearly, you might save a lot. If your electricity bills average $200 per month, that's $2,400 per year that you could save. But wait -- there's the cost of buying and installing the solar panels to consider. According to the folks at lendedu.com, "On average, after tax incentives, a typical residential setup costs anywhere from $12,500 to $16,000 in upfront costs. For the average homeowner, it will take between seven to 14 years to pay back the initial investment fully." If you're going to be in your home a long time, getting solar-powered can be well worth it. Even if you sell and move earlier than planned, the solar system is likely to be a plus for whoever buys your home.

Previous

Next

38. Eat lunches out instead of dinners

Most of us enjoy going out to dinner now and then, but if you do so with any regularity, the costs can add up. A dinner for two with drinks and a tip can easily top $50 if not considerably more. Do that once a week and it will cost you at least $2,600 -- if not $3,000 or $4,000 or more. One way to cut that spending down is to reduce your frequency of eating out. Another way is to go out for lunch instead of dinner, as lunch prices tend to be significantly lower. Skip the drinks and you can save a lot more, as drinks can easily cost $5 apiece or more.

Previous

Next

39. Pay credit cards off in full

If you're mired in credit card debt, you're probably wishing you'd paid your bills off in full on time. If you're free of credit card debt, you might not appreciate the full value of doing so. Imagine that you owe $8,000 on credit cards, as plenty of people do. If your interest rate is a not-uncommon 18%, you're looking at paying $1,440 per year in interest -- just handing over all those dollars to the credit card company in exchange for nothing. Worse, if you pay very little each month, your debt can grow faster than you're paying it off, with your balance owed ballooning over time. Miss a payment? Some cards will immediately jack your interest rate up to 25% or even close to 30%! Paying 25% on $10,000 is a whopping $2,500 -- per year. If you pay down your debt or just never get deep in debt, you can spend a lot less in interest.

Previous

Next

40. Make your roof white

Solar panels can be an even better option than this, but if that seems too daunting or onerous a proposition at the moment, you might consider covering your roof with an energy-saving reflective material. The folks at Energy Star have recommended this, noting that a sixth of all the electricity generated in the U.S. goes toward air conditioning buildings and that roofing products certified as Energy Star products can reduce cooling needs by 10% to 15% while reducing the temperature of a roof by up to 50 degrees. There's even a cool roof calculator you can use to help determine how much you might save. Another option is a green roof -- covered with vegetation. It can serve as insulation and can keep a house cooler in summer and warmer in winter.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Selena Maranjian owns shares of Amazon, Apple, Costco Wholesale, Netflix, Starbucks, and Walt Disney. The Motley Fool owns shares of and recommends Amazon, Apple, Netflix, Starbucks, and Walt Disney. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool recommends Costco Wholesale, eBay, and Etsy. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.