Digital banking has made it possible to bank with little personal contact and paperwork. We may live in a modern world, but tried-and-true banking methods still exist and are often necessary. Checks and checkbooks are still very much a part of everyday banking. Knowing how to write a check is a necessary banking skill.

Checks are used to pay other people, pay employees, and pay for purchases and services. There are a number of circumstances that require a checkbook. Writing a check isn't complicated, but it's an often-overlooked life skill. Use our step-by-step guide to learn how to write a check.

What is a check?

A check is a document (usually a small slip of paper) that can be used to withdraw money from a checking account. Checks can be cashed or deposited by the recipient for the amount written on the check.

A paper check has long been an effective payment method. But the paper check has become less common as technology shifts the world towards credit card payments and online banking. Checks are still common enough for many banks to include check deposit features in their mobile apps. You can also write a check for cash, take it to the bank, and withdraw cash from your account. This is one way to avoid ATM withdrawals when you need cash.

Most checking accounts still come with check-writing privileges. But not all online checking accounts provide access to paper checks. Some banks also offer checks for non-checking accounts -- like money market accounts.

If you're looking for a checking account, check out our list of the best checking accounts for recommendations.

TIP

If you're looking for more in-depth information on checking accounts, here are a few we've reviewed:

How to write a check in six steps

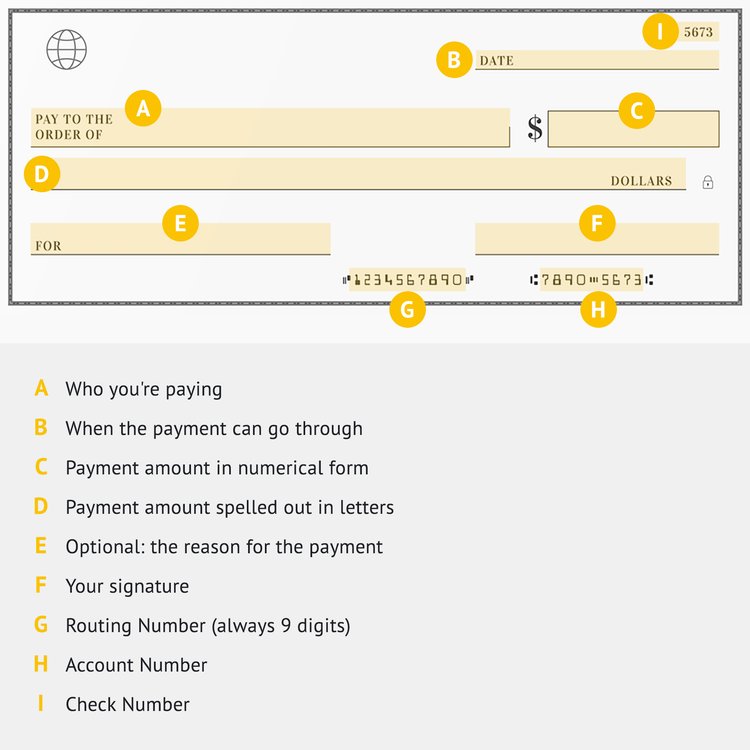

Here are the six steps involved when writing a check:

- Fill out the date: The upper right-hand corner of the check is where you'll add the date.

- Add a payee: Checks include a line that says, "Pay to the order of." This is where you'll add the name of the person, company, or organization you are paying.

- Write the numerical check amount: Add the payment amount in the box to the right of the payee line. You'll end up writing the payment amount twice. In this instance, write the amount numerically ("$100," not "One Hundred Dollars"). It's good practice to write the amount as close to the left-hand border of the box as possible. This can help prevent someone from adding additional numbers to the amount.

- Write out the check amount in words: Under the payee line is a spot to write out the check amount using words. If the check amount is $152.86, you'll write it out as: "One-hundred fifty-two dollars and 86/100." Take time to make sure that both check amounts match up.

- Add a note: Any details you want to add to your check go on the line marked "Memo." Some payees require you to list specific information on the memo line like a checking account number or Social Security number. You can also make a personal note, like "Rent payment." If your checkbook keeps carbon copies of each check, having a note in the memo line can help you remember what the check was for.

- Sign the check: No check is complete and valid without a signature. When you fill out a check, your signature goes on the line in the bottom right corner of the check.

Checks are still a reliable way to pay other people and make purchases. Knowing how to write a check correctly gives you another option for making payments.

Where is the routing number on a check?

The routing number is the first number printed on the bottom-left side of a check. Every bank has its own nine-digit routing number. Routing numbers are sometimes referred to as a routing transit number or an ABA routing number.

Where is the account number on a check?

Your bank account number is also featured on your checks. It's the second set of numbers on the bottom of a check following the routing number. Account numbers are typically 10 to 12 digits.

Still have questions?

Here are some other questions we've answered:

FAQs

-

A check is a financial document that allows the check holder to receive money from the check writer's bank account. A check must be signed by the check writer to be valid.

-

You write a check by filling out the date, the person or organization you are paying, and the check amount (numerically and written out in words). Your check is valid once you add your signature. You can also add reminder notes or account information in the check's memo section.

-

Always include cents when you write a check. Write the cents after the dollar amount and decimal point. When writing out the check amount, start with the dollar amount, followed by the word "and." Then write out the number of cents as a fraction. For example, 35 cents is written as 35/100. If you are writing a check for $100, you would write the cents as 00/100.

-

A check for one thousand dollars would be written numerically as $1,000.00. In words, it would be written as: "One thousand dollars and 00/100."

-

The routing number is the nine-digit number listed on the bottom-left side of a check. It's the first number listed on the bottom of a check and comes before the account number.

-

Your bank account number is the second set of numbers printed on the bottom of a check following the routing number. Most account numbers are 10 to 12 digits long.

Our Banking Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.