This Is How Credit Card Companies Hauled in $176 Billion in 2020

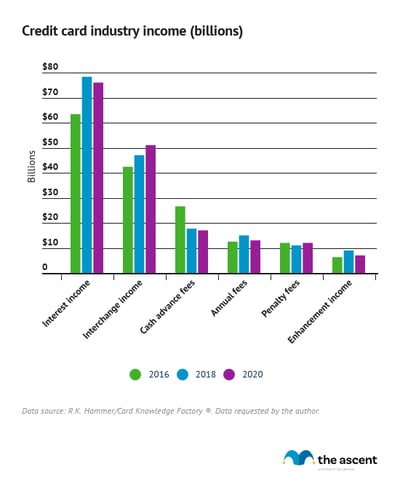

Credit card companies were able to bring in $176 billion in 2020, despite the COVID-19 pandemic creating an economic shock that the world has yet to fully recover from.

That’s according to data from research firm R.K. Hammer, which shows that the credit card industry’s income in 2020 was just $2 billion below 2018 levels.

Used properly, a credit card can be among the most powerful financial tools available to consumers. The best credit cards offer cash rewards or travel rewards, sign-up bonuses, 0% APR offers, and no annual fees.

But credit card companies still make money off cardholders, even with all those perks. The main sources of revenue for credit card companies are interest income and interchange income.

Some useful definitions

Before diving further into the data, some terms could use defining:

- Interest income is earned when customers keep a revolving balance and pay interest.

- Interchange income is from fees paid by merchants when a transaction is carried out. Credit card companies charge this fee because they take on risk and process transactions. These fees vary.

- Cash advance fees are paid by customers when they borrow cash against their credit limit.

- Annual fees are yearly payments that keep a customer’s account open.

- Penalty fees are imposed when a customer makes a late payment.

- Enhancement income comes from services that can come with a user's card or are available through it, such as insurance products.

Key findings

- Credit card companies posted $176 billion in income in 2020, down from $178 billion in 2018. Interest fees accounted for $76 billion and interchange fees accounted for $51 billion in 2020.

- Visa posted $6.13 billion in revenue in the second quarter of 2021. Data processing, the plumbing of transactions that Visa supports and associated fees, accounted for $3.33 billion.

- Mastercard posted $4.53 billion in revenue in the second quarter of 2021. Fees associated with transaction processing -- what Mastercard does to authorize, clear, and settle transactions -- accounted for $2.6 billion.

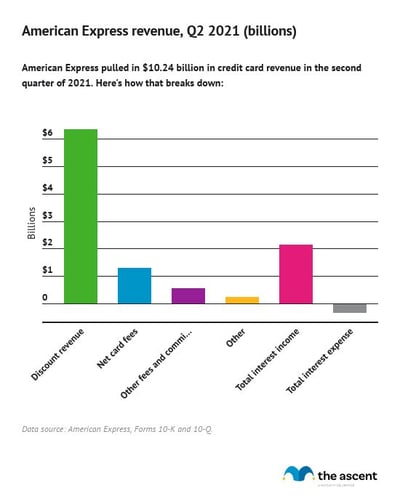

- American Express posted $10.24 billion in revenue in the second quarter of 2021. Discount revenue, how American Express describes fees it charges merchants when a customer uses an American Express card, accounted for $6.33 billion.

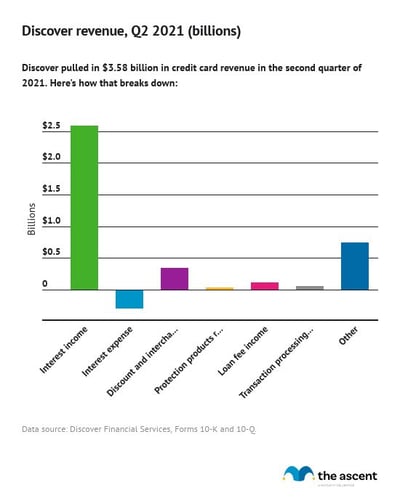

- Discover posted $3.58 billion in revenue in the second quarter of 2021. Interest income accounted for $2.59 billion.

- Wells Fargo posted $1.36 billion in credit card revenue in the second quarter of 2021. Card interchange and network revenue accounted for about $900 million.

- JPMorgan Chase posted $1.65 billion in credit card revenue in the second quarter of 2021. It earned $5.97 billion in merchant and interchange fees, but spent $4.28 in rewards costs and partner payments.

Credit card companies reported $176 billion in income in 2020; interest fees accounted for $76 billion

Credit card companies hauled in $176 billion in income in 2020, according to data from industry research firm R.K. Hammer.

Despite the pandemic, credit card industry income came in just $2 billion lower than in 2018, and still managed to outpace the $163.2 billion brought in in 2016.

Interest income made up 43% of industry income in 2020. Interchange income made up 29%. No other major category accounted for more than 10% of industry income.

While credit card companies are certainly raking in money from consumers through interest and other fees, the good news for the average credit card user is that most of those fees are avoidable.

Credit card users can avoid paying interest and penalty fees by paying off their credit card balance every month. Cash advance fees can be dodged by withdrawing cash with a debit card instead of a credit card. And some of the best credit cards will simply not have an annual fee.

| Credit card industry income, 2016 (billions) | Credit card industry income, 2018 (billions) | Credit card industry income, 2020 (billions) | |

|---|---|---|---|

| Interest income | $63.4 | $78.3 | $76 |

| Interchange income | $42.4 | $47.0 | $51 |

| Cash advance fees | $26.6 | $17.7 | $17 |

| Annual fees | $12.5 | $15.0 | $13 |

| Penalty fees | $12.0 | $11.0 | $12 |

| Enhancement income | $6.3 | $9.0 | $7 |

| Total income | $163.2 | $178.0 | $176 |

How Visa posted $6.13 billion in net revenue in the second quarter of 2021

Visa secured $6.13 billion in net revenue in the second quarter of 2021, after accounting for $2.13 billion spent on client incentives.

"Other revenues" made up the largest share of Visa’s revenue. This segment includes license fees required to use the Visa brand, fees collected for account holder services, revenue collected from optional services or product enhancements for customers, and other activities.

Data processing revenues, earned for authorization, clearing, settlement, network access, and other services that enable transactions, brought in $3.33 billion in revenue for Visa.

Service revenues, collected from client usage of Visa products and separate from data processing, accounted for $2.83 billion in revenue.

International transaction revenues are generated when cross-border transactions or currency conversions occur, which earned Visa $1.7 billion.

| Visa revenue, Q2 2021 (billions) | |

|---|---|

| Service revenues | $2.83 |

| Data processing revenues | $3.33 |

| International transaction revenues | $1.70 |

| Other revenues | $4.09 |

| Client incentives | -$2.13 |

| Net revenues | $6.13 |

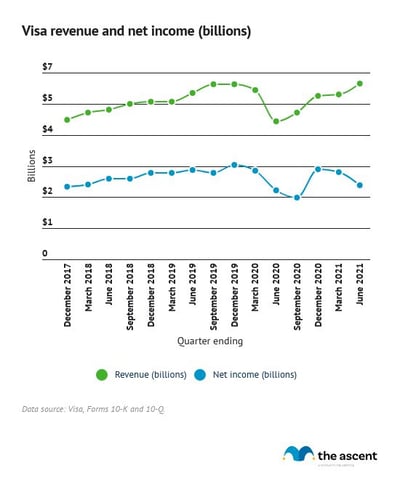

Visa’s net income in the second quarter of 2021 was $2.58 billion

Visa’s net income in the second quarter was $2.58 billion, reflecting operating expenses of $2.07 billion and an effective income tax rate of 41.3%.

Visa’s net income was depressed in the second and third quarters of 2020 and subsequently recovered. Whether lower earnings in the second quarter of 2021 is a blip or suggests another pullback from consumers amid the Delta wave of the pandemic remains to be seen.

| Visa revenue (billions) | Visa net income (billions) | |

|---|---|---|

| June 2021 | $6.13 | $2.58 |

| March 2021 | $5.73 | $3.03 |

| December 2020 | $5.69 | $3.13 |

| September 2020 | $5.10 | $2.14 |

| June 2020 | $4.80 | $2.40 |

| March 2020 | $5.90 | $3.08 |

| December 2019 | $6.10 | $3.30 |

| September 2019 | $6.10 | $3.00 |

| June 2019 | $5.80 | $3.10 |

| March 2019 | $5.50 | $3.00 |

| December 2018 | $5.50 | $3.00 |

| September 2018 | $5.40 | $2.80 |

| June 2018 | $5.20 | $2.80 |

| March 2018 | $5.10 | $2.60 |

| December 2017 | $4.86 | $2.54 |

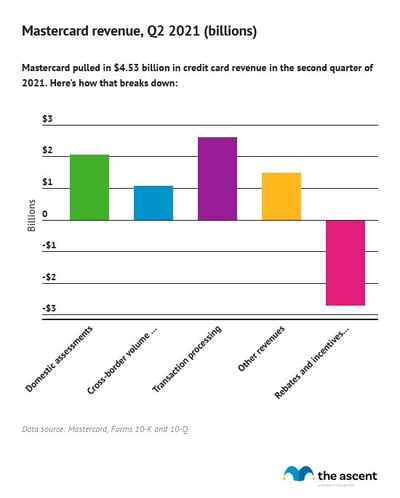

How Mastercard posted $4.53 billion in net revenue in the second quarter of 2021

Mastercard reported $4.53 billion in net revenue in the second quarter of 2021 after accounting for $2.69 billion in spending on rebates and incentives for cardholders and merchants.

Fees attached to domestic assessments and transaction processing make up the bulk of Mastercard’s revenue. These are fees charged to card issuers and acquirers at various steps of the transaction process and are essentially tolls for using Mastercard’s payment network.

| Mastercard revenue, Q2 2021 (billions) | |

|---|---|

| Domestic assessments | $2.056 |

| Cross-border volume fees | $1.076 |

| Transaction processing | $2.612 |

| Other revenues | $1.475 |

| Rebates and incentives (contra-revenue) | -$2.691 |

| Net revenue | $4.528 |

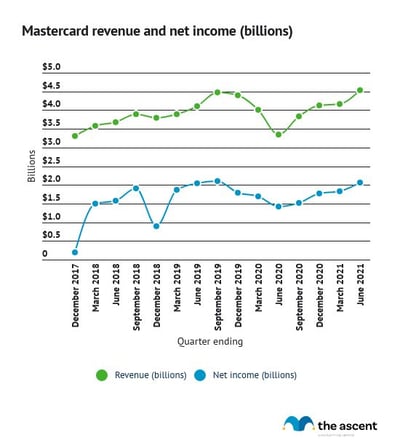

Mastercard’s net income in the second quarter of 2021 was $2.07 billion

Mastercard posted a net income of $2.07 billion in the second quarter of 2021, after taking into account $2.2 billion in operating expenses and a 16.6% effective income tax rate.

Like Visa, Mastercard saw depressed revenue and net income in 2020 as the pandemic roiled the economy, and net income has begun to bounce back to pre-pandemic levels.

| Mastercard revenue (billions) | Mastercard net income (billions) | |

|---|---|---|

| June 2021 | $4.53 | $2.07 |

| March 2021 | $4.16 | $1.83 |

| December 2020 | $4.12 | $1.78 |

| September 2020 | $3.84 | $1.51 |

| June 2020 | $3.34 | $1.42 |

| March 2020 | $4.00 | $1.70 |

| December 2019 | $4.40 | $1.80 |

| September 2019 | $4.47 | $2.11 |

| June 2019 | $4.11 | $2.05 |

| March 2019 | $3.90 | $1.86 |

| December 2018 | $3.80 | $0.90 |

| September 2018 | $3.90 | $1.90 |

| June 2018 | $3.67 | $1.57 |

| March 2018 | $3.58 | $1.49 |

| December 2017 | $3.30 | $0.20 |

How American Express posted $10.24 billion in revenue in the second quarter of 2021

American express reported $10.24 billion in revenue in the second quarter of 2021, with discount revenue -- how the company refers to fees it charges merchants when transacting with an American Express card -- making up about 62%.

American Express has a reputation for merchant fees higher than what Mastercard or Visa require; however, merchants are willing to accept that fee to service American Express customers because they are generally wealthier than other cardholders.

Income from interest and net card fees, which refers to revenue earned from annual membership fees, accounted for $2.14 billion and $1.29 billion in revenue, respectively.

| American Express revenue, Q2 2021 (billions) | |

|---|---|

| Discount revenue | $6.33 |

| Net card fees | $1.29 |

| Other fees and commissions | $0.56 |

| Other | $0.25 |

| Total interest income | $2.14 |

| Total interest expense | -$0.32 |

| Total revenue | $10.24 |

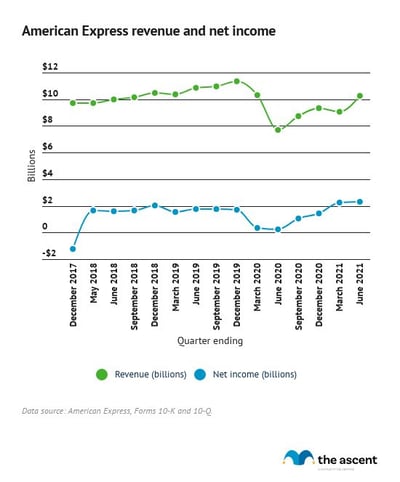

American Express’ net income in the second quarter of 2021 was $2.28 billion

American Express posted a net income of $2.28 billion in the second quarter of 2021, accounting for $7.91 billion in expenses and an effective tax rate of 22.4%.

American Express, unsurprisingly, took a significant revenue and net income hit in 2020 but began to rebound to pre-pandemic net income in the last three quarters.

| American Express revenue (billions) | American Express net income (billions) | |

|---|---|---|

| June 2021 | $10.24 | $2.28 |

| March 2021 | $9.06 | $2.24 |

| December 2020 | $9.35 | $1.44 |

| September 2020 | $8.75 | $1.07 |

| June 2020 | $7.68 | $0.26 |

| March 2020 | $10.31 | $0.37 |

| December 2019 | $11.37 | $1.69 |

| September 2019 | $10.99 | $1.76 |

| June 2019 | $10.84 | $1.76 |

| March 2019 | $10.36 | $1.55 |

| December 2018 | $10.47 | $2.01 |

| September 2018 | $10.14 | $1.65 |

| June 2018 | $10.00 | $1.62 |

| March 2018 | $9.72 | $1.63 |

| December 2017 | $9.71 | -$1.21 |

How Discover posted $3.58 billion in net revenue in the second quarter of 2021

Discover reported $3.58 billion in net revenue in the second quarter of 2021, led by $2.59 billion in interest income.

No other source of revenue accounted for more than three quarters of a billion dollars in the second quarter of 2021.

| Discover revenue, Q2 2021 (billions) | |

|---|---|

| Interest income | $2.59 |

| Interest expense | -$0.29 |

| Discount and interchange revenue, net | $0.34 |

| Protection products revenue | $0.04 |

| Loan fee income | $0.11 |

| Transaction processing revenue | $0.06 |

| Other | $0.74 |

| Net revenue | $3.58 |

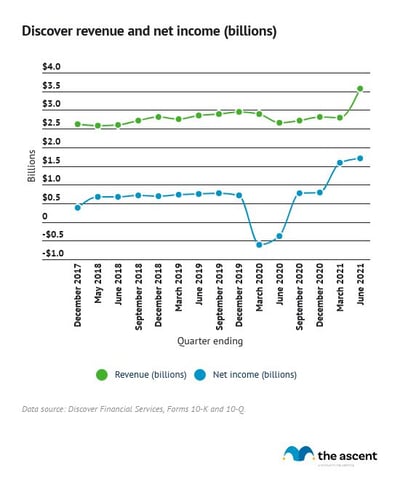

Discover’s net income in the second quarter of 2021 was $1.7 billion

Discover posted a net income of $1.7 billion in the second quarter of 2021, surpassing pre-pandemic income and bouncing back from a stretch of losses in the first and second quarters of 2020.

Discover reported $1.22 billion in expenses and an income tax rate of 23.6% in the second quarter of 2021.

| Discover revenue (billions) | Discover net income (billions) | |

|---|---|---|

| June 2021 | $3.58 | $1.70 |

| March 2021 | $2.80 | $1.59 |

| December 2020 | $2.82 | $0.80 |

| September 2020 | $2.71 | $0.77 |

| June 2020 | $2.66 | -$0.37 |

| March 2020 | $2.89 | -$0.61 |

| December 2019 | $2.94 | $0.71 |

| September 2019 | $2.90 | $0.77 |

| June 2019 | $2.85 | $0.75 |

| March 2019 | $2.76 | $0.73 |

| December 2018 | $2.81 | $0.69 |

| September 2018 | $2.72 | $0.72 |

| June 2018 | $2.60 | $0.67 |

| March 2018 | $2.58 | $0.67 |

| December 2017 | $2.61 | $0.39 |

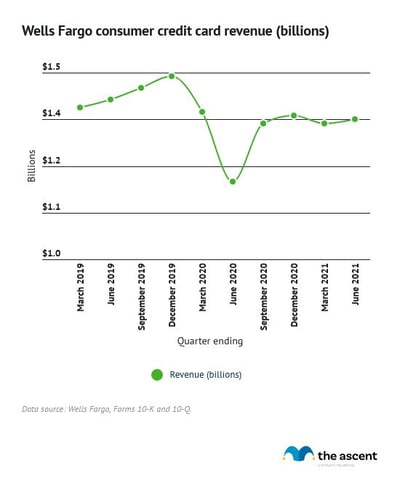

How Wells Fargo posted $1.36 billion in consumer credit card revenue in the second quarter of 2021

In the second quarter of 2021, Wells Fargo reported $1.36 billion in credit card revenue from its consumer banking and lending segment, which serves consumers and small business, nearing pre-pandemic revenue.

Interchange and network revenues made up $900 million in card revenue for Wells Fargo.

| Wells Fargo consumer credit card revenue (billions) | |

|---|---|

| June 2021 | $1.36 |

| March 2021 | $1.35 |

| December 2020 | $1.37 |

| September 2020 | $1.35 |

| June 2020 | $1.20 |

| March 2020 | $1.38 |

| December 2019 | $1.47 |

| September 2019 | $1.44 |

| June 2019 | $1.41 |

| March 2019 | $1.39 |

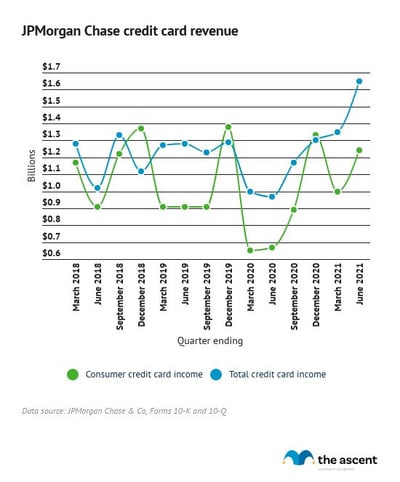

How JPMorgan Chase posted $1.65 billion in net credit card revenue in the second quarter of 2021

JPMorgan Chase pulled in $1.65 billion in net revenue from credit cards in the second quarter of 2021, slightly exceeding net revenue posted by that segment before the pandemic.

Interchange and merchant processing generated $5.97 billion in revenue, while Chase spent $4.28 billion on rewards and partner payments.

The consumer and community banking segment of JPMorgan Chase, which serves consumers and small businesses, posted $1.24 billion in credit card income in the second quarter of 2021, which is roughly what that segment was pulling in before the pandemic.

| JPMorgan Chase credit card income, Q2 2021 (billions) | |

|---|---|

| Interchange and merchant processing income | $5.97 |

| Rewards costs and partner payments | -$4.28 |

| Other card income | -$0.05 |

| Total card income | $1.65 |

| JPMorgan Chase consumer credit cardincome (billions) | JPMorgan Chase total credit card income (billions) | |

|---|---|---|

| June 2021 | $1.24 | $1.65 |

| March 2021 | $1.00 | $1.35 |

| December 2020 | $1.33 | $1.30 |

| September 2020 | $0.89 | $1.17 |

| June 2020 | $0.67 | $0.97 |

| March 2020 | $0.65 | $1.00 |

| December 2019 | $1.38 | $1.29 |

| September 2019 | $0.91 | $1.23 |

| June 2019 | $0.91 | $1.28 |

| March 2019 | $0.91 | $1.27 |

| December 2018 | $1.37 | $1.12 |

| September 2018 | $1.22 | $1.33 |

| June 2018 | $0.91 | $1.02 |

| March 2018 | $1.17 | $1.28 |

How do credit card companies make money with cash back cards?

Cash back credit cards provide customers with a set percentage back on purchases, but how is that a profitable play for credit card companies?

Most cash back programs come with an annual limit on cash back that a customer can receive, which ensures that the value of cash back rewards a credit card company pays its customers doesn’t exceed the revenue it brings in from other sources, like interchange and other processing fees, interest, and penalty fees.

More customers generate more revenue from those streams, so the goal for most credit card companies is to grow their membership as much as possible. Promising cash back rewards is a great way to do that.

How do credit card companies make money with balance transfer cards?

Balance transfer credit cards that offer low or even 0% interest for new customers can be a great way to save money while paying off credit card debt, but how do credit card companies make money by picking up members and not charging them interest?

With balance transfer credit cards, credit card companies forgo initial interest revenue for new members that generate revenue from interchange and other processing fees.

Credit card companies may charge a balance transfer fee, usually a percentage of the amount that is being transferred onto the new card.

Of course, customers that use balance transfer credit cards still have to pay off the amount transferred before the end of the introductory period if they want to avoid interest charges.

Sources:

- American Express, Forms 10-K and 10-Q. “Earnings & SEC Filings.”

- Discover Financial Services, Forms 10-K and 10-Q. “SEC Filings.”

- JPMorgan Chase & Co, Forms 10-K and 10-Q. “SEC Filings & Other Disclosures.”

- Mastercard, Forms 10-K and 10-Q. “SEC Filings.”

- R.K. Hammer/Card Knowledge Factory ®. Data requested by the author.

- Visa, Forms 10-K and 10-Q. “SEC Filings.”

- Wells Fargo, Forms 10-K and 10-Q. “SEC and Other Regulatory Filings.”

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.