Southwest is a popular travel partner available with the Chase Ultimate Rewards program. If you have one of Chase's travel cards and you want to transfer Chase points to Southwest, you'll get a 1:1 transfer ratio. That means 1,000 Chase Ultimate Rewards points are worth 1,000 Southwest Rapid Rewards points.

Here's everything you need to know to transfer Chase points to Southwest, including which Chase credit cards offer this option, how the transfer process works, and how to maximize the value of your points when booking a flight.

What you need to transfer Chase points to Southwest

Before you begin, you'll need:

- A Chase credit card with travel rewards in the Ultimate Rewards program

- A Southwest Rapid Rewards account

- At least 1,000 points to transfer

Is your card eligible?

The following Chase travel credit cards allow you to transfer your points to travel partners:

|

|

|

| Chase Sapphire Preferred® Card | Chase Sapphire Reserve® | Ink Business Preferred® Credit Card |

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

|

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Apply Now for Chase Sapphire Reserve®

On Chase's Secure Website. |

Apply Now for Ink Business Preferred® Credit Card

On Chase's Secure Website. |

|

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

|

Welcome Offer: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. 60,000 bonus points |

Welcome Offer: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠. 60,000 bonus points |

Welcome Offer: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Earn 100,000 bonus points |

|

Rewards Program: Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. 5x on travel purchased through Chase Travel℠, 3x on dining and 2x on all other travel purchases |

Rewards Program: Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases. 5x points on flights and 10x points on hotels and car rentals through Chase Travel℠. |

Rewards Program: Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchases-with no limit to the amount you can earn. Earn 3 points per $1 in select business categories |

|

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

Intro APR: Purchases: N/A Balance Transfers: N/A |

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

|

Regular APR: 21.49%-28.49% Variable |

Regular APR: 22.49%-29.49% Variable |

Regular APR: 21.24%-26.24% Variable |

|

Annual Fee: N/A $95 |

Annual Fee: N/A $550 |

Annual Fee: N/A $95 |

|

Highlights:

|

Highlights:

|

Highlights:

|

|

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Apply Now for Chase Sapphire Reserve®

On Chase's Secure Website. |

Apply Now for Ink Business Preferred® Credit Card

On Chase's Secure Website. |

Show More

Show Less

Show Less

|

||

How to transfer Chase points to Southwest

Transfer Chase points to Southwest in minutes by following these steps:

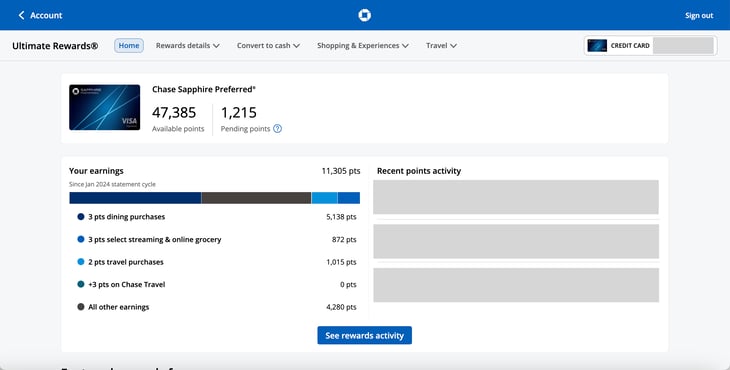

1. Log in to your account on the Chase Ultimate Rewards site.

You can also log in to your Chase credit card account, and then go to the Ultimate Rewards page from there. If you have multiple Chase credit cards, you'll need to select the one with the points you'd like to use after logging in.

Image source: Brooklyn Sprunger

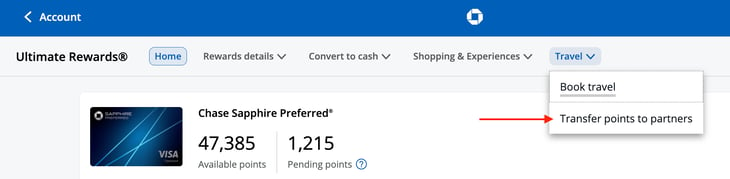

2. Select "Transfer to Travel Partners."

You'll find this option in the "Travel" dropdown menu.

Image source: Brooklyn Sprunger

3. Go to the Southwest listing and select "Transfer Points."

It's listed under the Airlines section in alphabetical order.

Image source: Brooklyn Sprunger

4. Choose a recipient for the transfer.

Chase requires you to transfer points to yourself or a member of your household whom you've set up as an authorized user on your account. When you've chosen a recipient from the dropdown menu, you'll need to enter their Rapid Rewards account number.

5. Decide how many points to transfer.

You must transfer points in increments of 1,000.

6. Submit the transfer.

Chase provides a review with all the transfer details. From this screen, you can transfer Chase points to Southwest.

Transfers are normally instant. Chase says that most transfers process by the next business day, but may take up to seven business days. However, based on cardholder reports, transfers almost always happen right away.

Keep in mind that transfers are one way. After you transfer Chase points to Southwest, there's no option to cancel or transfer them back later. That's why you should find the flight you want to book first, and then make the transfer.

How to book an award ticket with Southwest

If you've ever booked a flight with Southwest in cash, doing so with points is almost the same. From the Southwest homepage, enter all the details for your desired flight, including the departure city, arrival city, and your travel dates. In the top-right corner of the flight search, click "Points."

TIP

When booking a trip in points, you can toggle to view the prices in dollars and points on the search results page. This allows you to quickly check what kind of value you'll get with potential award tickets.

The search results will display all the flight options for your chosen dates. If your travel dates are flexible, the Low Fare Calendar shows you the best deals for traveling on each day of the month. After you've chosen your itinerary, Southwest will provide a breakdown of your trip details -- including the cost in points and any additional fees.

Click "Continue," and if you haven't logged in to your Rapid Rewards account yet, Southwest will prompt you to do so at this point. Enter your username and password, and then you can confirm your trip.

Maximizing value when you transfer Chase points to Southwest

You don't need to worry about award availability or searching for rare, high-value redemptions with Southwest. Unlike many airlines, it lets you book any seat with cash or points. Award ticket prices are tied to cash prices, and you typically get about $0.014 to $0.018 per Southwest point no matter what you book.

The key to getting the most value when you transfer Chase points to Southwest is booking Wanna Get Away fares. This is the cheapest fare option, both in dollars and points. Anytime tickets usually cost two or three times as much, and Business Select tickets are slightly more than that.

Since Southwest's seats are the same throughout the aircraft, it's best not to spend more points on those premium fares. There aren't any big differences on award tickets that make Anytime or Business Select fares worth more.

Should you transfer Chase points to Southwest or redeem through Chase's portal?

Chase gives you the option of booking travel through the Chase Travel portal. If you have the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card, you can redeem points toward travel purchases at a rate of $0.0125 per point. With the Chase Sapphire Reserve®, you get $0.015 per point.

Booking a flight this way also generally earns you points with the airline. Award tickets don't earn points, giving the Chase Travel portal an edge in that regard.

You could compare the value you'll get on a flight with each method to see which is the better deal. If that's too time consuming, here's a simpler solution based on which credit cards you have:

- Transfer Chase points to Southwest if you have the Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card.

- Redeem Chase points through the Chase Travel portal if you have the Chase Sapphire Reserve®.

Southwest flights don't show up through the Ultimate Rewards flight search, so you'll need to call Chase Travel at 1-866-951-6592 to book one.

Chase's Southwest credit cards

If you're a frequent flyer with Southwest, you may want to consider one of the Southwest credit cards. There are three personal credit cards that Chase and Southwest offer together:

|

|

|

| Southwest Rapid Rewards® Priority Credit Card | Southwest Rapid Rewards® Premier Credit Card | Southwest Rapid Rewards® Plus Credit Card |

|

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Rating image, 4.00 out of 5 stars.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

|

Apply Now for Southwest Rapid Rewards® Priority Credit Card

On Chase's Secure Website. |

Apply Now for Southwest Rapid Rewards® Premier Credit Card

On Chase's Secure Website. |

Apply Now for Southwest Rapid Rewards® Plus Credit Card

On Chase's Secure Website. |

|

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

|

Welcome Offer: Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening. Earn 50,000 points |

Welcome Offer: Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening. Earn 50,000 points |

Welcome Offer: Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening. Earn 50,000 points |

|

Rewards Program: Receive 7,500 anniversary points, 4 upgraded boardings per year when available, and a $75 Southwest® travel credit each year. Enjoy benefits including 3X points on Southwest purchases, 2X points on local transit and commuting, including rideshare, 2X points on internet, cable, and phone services; select streaming, 10,000 Companion Pass® qualifying points boost each year, and more. 1X-3X points |

Rewards Program: Receive 6,000 anniversary points each year. Enjoy benefits including 3X points on Southwest® purchases, 2X points on local transit and commuting, including rideshare, 2X points on internet, cable, and phone services; select streaming, 2 Early Bird Check-In® each year, 10,000 Companion Pass® qualifying points boost each year, and more. 1X-3X points |

Rewards Program: Receive 3,000 anniversary points each year. Enjoy benefits including 2X points on local transit and commuting, including rideshare, 2X points on internet, cable, and phone services; select streaming, 2 Early Bird Check-In® each year, 10,000 Companion Pass® qualifying points boost each year, and more. 1X-2X points |

|

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

|

Regular APR: 21.49%-28.49% variable |

Regular APR: 21.49%-28.49% variable |

Regular APR: 21.49%-28.49% variable |

|

Annual Fee: N/A $149 |

Annual Fee: N/A $99 |

Annual Fee: N/A $69 |

|

Highlights:

|

Highlights:

|

Highlights:

|

|

Apply Now for Southwest Rapid Rewards® Priority Credit Card

On Chase's Secure Website. |

Apply Now for Southwest Rapid Rewards® Premier Credit Card

On Chase's Secure Website. |

Apply Now for Southwest Rapid Rewards® Plus Credit Card

On Chase's Secure Website. |

Show More

Show Less

Show Less

|

||

All three airline cards offer sign-up bonuses, yearly anniversary points bonuses, and earn Rapid Rewards points on your purchases. A big perk is that those points count toward a Southwest Companion Pass. You need to either earn 135,000 qualifying points or take 100 qualifying one-way flights in a calendar year to get a Companion Pass.

If you're a loyal customer of Southwest, then getting one of these cards makes sense. You'll be well on your way toward gaining a Companion Pass, which is a fantastic benefit if you have someone who flies with you frequently. You'll also pick up some bonus points every year.

The Chase Ultimate Rewards cards offer much more versatile travel points, though. You can transfer Chase points to Southwest and many other airline and hotel partners, or you can redeem them through the Chase Travel portal. If you want more flexibility when redeeming your travel rewards, one of those cards is the better choice.

Booking a Southwest flight with Chase points

Once you know how to transfer Chase points to Southwest, it's a fast and simple process. While Southwest may not have a glamorous first-class product or a ton of international routes, its prices are among the very best. Those low prices and the Companion Pass make Southwest especially useful for families looking to take an affordable vacation. Keep an eye on the deals and you could score roundtrip tickets without dipping too far into your points.

Still have questions?

Here are some other questions we've answered:

FAQs

-

Yes. You can transfer Chase points to Southwest online or by phone, and after you transfer them, they're converted to Southwest Rapid Rewards points.

-

Points normally transfer from Chase to Southwest instantly, according to cardholder reports. Chase says that most transfers process by the next business day, but it can take up to seven business days.

-

To transfer Ultimate Rewards to Rapid Rewards, follow these steps:

- Log in to your Ultimate Rewards account.

- Select "Transfer to Travel Partners."

- Select Southwest under the Airlines section.

- Provide the recipient's Rapid Rewards account number. You can transfer Chase points to yourself or a member of your household who's on your Chase credit card account as an authorized user.

- Enter the number of points and submit the transfer.

Our Credit Cards Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.