This Arizona mortgage calculator will help you understand what your monthly mortgage payments will be if you decide to head out west in the pursuit of sand and sun. Phoenix, Arizona, has one of the hottest housing markets for inflow from other parts of the United States, along with cities in Nevada, California, Florida, Texas, and South Carolina.

This Arizona mortgage calculator will help you understand what your monthly mortgage payments will be if you decide to head out west in the pursuit of sand and sun. Phoenix, Arizona, has one of the hottest housing markets for inflow from other parts of the United States, along with cities in Nevada, California, Florida, Texas, and South Carolina.

Arizona housing market 2023

The median sales price of a single-family home in Arizona in July 2023 was $456,100, down 1.5% year over year. Despite a severely restricted home supply of just two months, a drop in total homes for sale of 29% year over year for July 2023, coupled with a drop in sales prices relative to asking price, is making Arizona look like a much softer market than it has been in years

CIties like Payson and Lake Havasu City are still posting double-digit sales price growths of 26.6% and 11.5% respectively, but the bottom half of the top 10 Arizona cities with the fastest growing sales prices in Arizona are under 5%, which is not at all impressive in the current housing market. This all may point to a more affordable Arizona just around the corner.

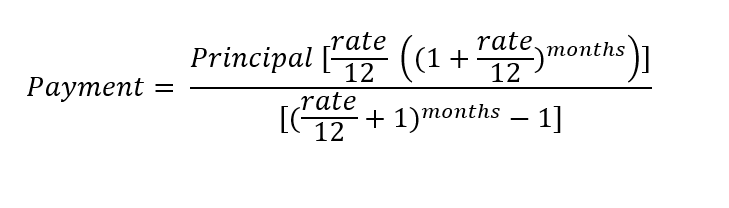

How do I calculate my mortgage payment?

We recommend using a mortgage calculator for Arizona. The formula to calculate a payment by hand is quite complex. It looks like this:

Arizona mortgage rates have risen dramatically in the past year, and continue to creep up, making it harder than ever to afford a mortgage loan. This is why it's very important to meet with the best mortgage lenders in your area, so you can make the most of your mortgage dollars. To calculate your monthly mortgage payments in Arizona, you'll need to enter in your estimated mortgage loan amount, the term of your loan, and the rate you think you'll be eligible for.

The term of your loan is the number of years you have to repay your mortgage. Keep in mind that the higher your credit score, the more likely you'll be to get the most competitive rate available.

What other costs do I have to pay?

There are other monthly expenses you'll need to account for, like homeowners insurance and property taxes. When you use our mortgage calculator for Arizona, remember that property taxes paid as a percentage of owner-occupied homes are on average equal to 0.72%. Property taxes may change based on your county.

Homeowners may also be part of a homeowners association (HOA) and have to pay a monthly HOA fee on top of their mortgage payment. HOA fees usually cover the maintenance of common areas, and often include services like trash pickup. To enter these additional costs into the above mortgage calculator for Arizona, just click "Additional inputs" (below "Mortgage type").

You may also need to account for private mortgage insurance (PMI). Homeowners will have to pay PMI if they don't make at least a 20% down payment on their home. Our tool will help break down these varied costs so you can see what your monthly mortgage payments will look like in different scenarios. If you want to refinance an existing mortgage, our Arizona mortgage calculator can also help you determine your monthly payment -- and you can check out our list of the best refinance lenders to get that process started.

Things to know before buying a house in Arizona

Before you buy a home in Arizona, it's important to make sure you have your finances in order. You will need:

- A good credit score

- A low debt-to-income ratio

- A steady source of income

- A 20% down payment saved, to avoid having to pay PMI

- Additional money outside of your down payment to cover ongoing maintenance, repairs, and other emergencies

There are also some specific issues you should be aware of when buying a home in Arizona. Arizona is known for its desert climate, which comes with great weather, with hot summers, mild winters, and low humidity all year round. Arizona has some large cities such as Phoenix and Tucson, but there are many smaller cities and towns to consider.

Despite the 30% increase in home values during this past year, homes in Arizona are also less expensive than homes in states like California, where costs have soared. It is important to know what you want, find the ideal location, and work with the right agents and mortgage lenders to find the best price and rates.

Learn more: Home buyer checklist

Tips for first-time home buyers in Arizona

Here are some important tips for first-time home buyers to help them navigate the process. There are several programs available for first-time home buyers through the Arizona Department of Housing, or ADOH. The Arizona Industrial Development Authority's HOME Plus program is the only state-run home buyer down payment assistance program available statewide, providing up to 5% down payment assistance to qualified applicants, along with reduced mortgage insurance premiums on conventional mortgage loans.

The Home Plus Program helps creditworthy renters who can qualify for a mortgage, but cannot afford the down payment and or closing costs, with the funds needed to move forward. Borrowers cannot exceed an annual income of $126,351 and must complete a home buyer education course before closing. Credit score minimums will be based on the loan program that the applicant chooses.

First-time home buyer loans and programs

Here are other first-time home buyers programs to consider and explore:

- FHA loans are mortgages back by the Federal Housing Authority and require a 3.5% down payment.

- VA loans are for military service members and require a 0% down payment.

- USDA loans are government-backed loans for eligible properties and require a 0% down payment.

- Fannie Mae and Freddie Mac offer conventional loans that require a 3% down payment.

Budget requirements

Once you have decided on the best program and have shopped around with different lenders, it is important to decide on a home-buying budget. Many experts recommend that your monthly house payment (including additional costs) be no more than 30% of your monthly income.

It is also important to maintain a good credit score, so don't apply for any credit cards or other loans right before your house search. Credit report inquiries will impact your credit score. You should also have enough money saved for closing costs, and other expenses that may come up during the home-buying process.

Read more: Best mortgage lenders for first-time home buyers

Still have questions?

Here are some other questions we've answered:

FAQs

-

If you qualify for down payment assistance through Arizona's Home Plus Program, you won't need to provide a down payment for your mortgage. Other zero-down-payment mortgage options include VA and USDA, but if you don't qualify for these, you can bring as little as 3% down to closing by using a conventional mortgage. FHA mortgages also have low down payments, as low as 3.5%.

-

On average, new home loans in Arizona require $4,701 in closing costs. However, if you're looking to refinance, expect to pay just $1,798.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.