When purchasing a home, it's important to make sure that you can afford your monthly payments. You'll need to pay more than just interest and principal on your mortgage each month -- there are additional homeownership costs such as property taxes, insurance, and HOA fees to figure in.

Factors such as your down payment, interest rate, home price, and loan term will all affect your monthly bill. Use our Connecticut mortgage calculator to figure out what your monthly payments might look like.

When purchasing a home, it's important to make sure that you can afford your monthly payments. You'll need to pay more than just interest and principal on your mortgage each month -- there are additional homeownership costs such as property taxes, insurance, and HOA fees to figure in.

Factors such as your down payment, interest rate, home price, and loan term will all affect your monthly bill. Use our Connecticut mortgage calculator to figure out what your monthly payments might look like.

Connecticut housing market

Connecticut is a hot real estate market -- home values have increased in the past year. Currently, the state has some of the most expensive homes in the country. That's no surprise considering its proximity to New York City and Massachusetts.

This can create affordability challenges for buyers, especially for first-time home buyers and those who are downsizing their homes. The median home sales price for a single-family home in July 2023 was $483,700, according to Redfin data. That means Connecticut residents are paying slightly more than the national median in the second quarter of 2023 of $416,100. As a result, the average mortgage payment in Connecticut is higher than other areas, too.

Most of the population lives within the cities of Bridgeport, New Haven, Hartford, Stamford, and Waterbury. Homeowners will find that these areas may have a mix of listing prices. For example, in the Stamford area (close to New York City), the median home price in the first quarter of 2023 was $600,700, according to National Association of Realtors data. On the other hand, the Hartford area (further up the coast) had a much lower median price of $314,900 during the same period..

How much does this difference in home cost affect your monthly mortgage payment? Our mortgage calculator for Connecticut can help you estimate your monthly mortgage payments for higher-priced metropolitan areas as well as more affordable suburban homes. (If you're not sure where to start with interest rates, check out our guide to current Connecticut mortgage rates.) Experiment with different numbers to pinpoint housing costs that fit your budget and lifestyle.

How do I calculate my mortgage payment?

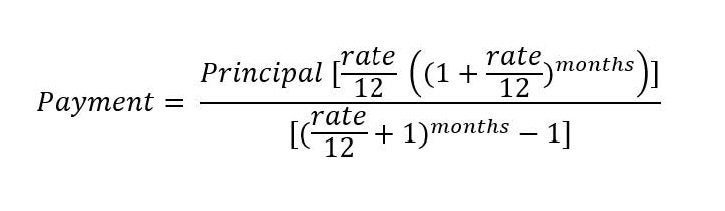

We recommend using a mortgage calculator for Connecticut. The formula to calculate by hand can be quite complex. It looks like this:

On top of the principal and interest calculated in this formula, you'll need to add monthly insurance costs and taxes. Property taxes and homeowners insurance are normally paid monthly to your lender. Your lender sets these aside in a separate escrow account, then pays them to the appropriate organizations once a year. Our Connecticut mortgage calculator allows you to add taxes and insurance to your monthly payment.

When you use our mortgage calculator for Connecticut, remember that state property tax rates in this state average 1.63%. That's among the highest in the country, according to TaxRates.org.

The mortgage calculator for Connecticut also has an option to enter your down payment amount. If you save up for a higher down payment, you won't need to borrow as much and your monthly mortgage costs will be lower.

Don't forget: If you make a down payment that's less than 20% of the home's final selling price, you'll need to pay for private mortgage insurance (PMI). This typically costs between 0.465% to 1.5% of your loan amount each year, depending on your credit score and down payment. You can also add PMI costs to the above calculator.

The many, varied costs of a monthly mortgage payment can be difficult to calculate by hand. Our Connecticut mortgage calculator takes all these factors into account to give you a comprehensive estimate of your monthly mortgage payment. It'll also help you compare various scenarios (such as different interest rates and home prices).

To enter these additional costs into the above mortgage calculator for Connecticut, just click "Additional inputs" (below "Mortgage type").

Things to know before buying a house in Connecticut

Buying a home is a major undertaking. Here are a few things you'll want to remember when purchasing a house in Connecticut:

- Home inspection costs

- Closing costs

- Appraisal costs

- Title insurance costs

- Taxes

- And more

Check out our guide to mortgages to make sure you have all the information you need before getting started. Below, we'll go into these factors in more detail.

First, you'll want to pay for your own home inspection. This typically ranges from $392 to $532 for a 1,500 square foot home. The final amount depends on the size of the home and whether you want additional tests conducted. Sellers in Connecticut are required to provide a property disclosure, but that's not always as reliable as paying for an official inspection. Wouldn't you want to find out about any potential issues in your future home?

Another added expense is closing costs. You'll pay these when you sign the final paperwork. Residents of Connecticut can expect to pay an average of $8,821 in closing costs. You'll need to pay fees to various parties, such as a real estate attorney, mortgage lender, your county, and your state. These can include origination fees, administration fees, and underwriting fees. Note that origination fees differ from lender to lender, which is one of the reasons it's crucial to shop around for the best mortgage lender.

There are other costs to prepare for. These can include a home appraisal, mortgage points, title insurance credit reports, flood certification, and surveys. Title insurance is mandatory -- it protects you against financial loss from easements, undisclosed liens, or other types of future title disputes. Finally, don't forget taxes. Home buyers in Connecticut need to pay a conveyance tax to transfer property titles.

Tips for first-time home buyers in Connecticut

If you are a first-time buyer in Connecticut, there are several steps you should take before you apply for a mortgage. Some of the ways to boost your chances of mortgage approval include:

- Paying down debt

- Checking your credit score

- Reviewing your personal budget

- Calculating how much house you can afford

- Rate shopping for the best mortgage rates

- Getting prequalified with multiple lenders

The credit score needed for a mortgage varies by lender. If you don't need to move immediately, it's helpful to wait until you have a good credit score. Buyers with high credit usually qualify for lower interest rates. That can save you thousands of dollars over the life of your home loan.

If your credit score is low but you need to move now, check out our list of best mortgage lenders for poor credit. We also have a guide on how to boost your credit score.

There are a few first-time home buyer programs in Connecticut. These are also open to people who haven't owned a home in the past three years. If you qualify, you can receive assistance on things like your down payment. In some cases, these programs offer lower interest rates.

The Connecticut Housing Finance Authority (CHFA) has three programs with different eligibility requirements:

- Government Insured Mortgage Program: This program offers below-market interest rates on mortgages. Home buyers need to meet the eligibility requirements and complete an education class before closing. CHFA-approved lenders can help you start the process.

- CHFA Down Payment Assistance Program: This is a low-interest loan that goes toward your home's down payment. Applicants must first qualify for a mortgage with a CHFA-approved lender.

- HFA Advantage® and HFA Preferred™ Loan Programs: These mortgages avoid both upfront and monthly insurance costs. Home buyers need to complete an education course before the closing.

- Time To Own -- Forgivable Down Payment Assistance Program: This program provides down payment assistance of up to 20% for down payments and 5% for closing costs, with a cap of $25,000 or $50,000, depending on where your home is located in Connecticut.

Even if you don't qualify for any of the above programs, there are plenty of ways to save on your monthly mortgage payments. The best place to start is by rate shopping at the best rated mortgage lenders. By looking at various mortgage offers, you can build an idea of the average mortgage payment in Connecticut -- and find out which lenders offer the best terms and rates.

Still have questions?

Here are some other questions we've answered:

FAQs

-

Connecticut not only has a very nice down payment assistance program that can cover your costs entirely, depending on the cost of your home, you can also qualify for a zero down payment using a VA or USDA loan. If those aren't an option, you'll be able to pay just 3% down with a conventional mortgage or 3.5% with an FHA.

-

You can expect to pay $8,821 in closing costs on average for a home purchase in Connecticut, or $2,678 if you're refinancing your mortgage.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.