Florida has long been a popular real estate market for a variety of home buyers, from first timers to retirees due to its easy beach access and endless summertime climate. Despite that, Florida's median home price is still rather affordable compared with many other desirable areas -- you might be surprised how much house you can buy.

Here's our quick guide to the current Florida housing market, important things to keep in mind before buying a home in Florida, and valuable resources for first-timers. Use our Florida mortgage calculator to help set your budget for your home in the Sunshine State.

Florida has long been a popular real estate market for a variety of home buyers, from first timers to retirees due to its easy beach access and endless summertime climate. Despite that, Florida's median home price is still rather affordable compared with many other desirable areas -- you might be surprised how much house you can buy.

Here's our quick guide to the current Florida housing market, important things to keep in mind before buying a home in Florida, and valuable resources for first-timers. Use our Florida mortgage calculator to help set your budget for your home in the Sunshine State.

Florida housing market

Although Florida's median sales price gains have slowed considerably compared to last year, they were still up 2.5% year over year in August 2023.

Despite a rapid rise in home prices during the pandemic, Florida's real estate market is still relatively affordable compared to those in many other parts of the United States. The median home value in Florida is $404,300 as of August 2023, about 6.43% lower than the national median home sales price in third quarter 2023: $430,300.

Median days on market are up to 43 days as of August 2023, 13 days more than the same period in 2022. Despite just three months of inventory in August 2023, the same as the year prior, homes are only bringing 97.4% of their asking prices, and fewer homes sold above their listing price in August 2023 than in the year prior. However, homes with price drops have also decreased, so this all may be pointing to the overall Florida real estate market simply finding some balance for the first time in a very long time.

It's also worth noting that Florida has many big real estate markets, each of which has its own pricing dynamics and trends. Here's a snapshot of some of the main Florida markets:

| Metropolitan Area | Median Home Value | 1-Year Change |

|---|---|---|

| Jacksonville | $308,500 | 2.6% |

| Tallahassee | $276,500 | 22.8% |

| Orlando | $365,000 | 2.0% |

| Tampa | $454,500 | 19.6% |

| Fort Myers | $379,450 | -3.9% |

| Fort Lauderdale | $499,950 | -7.0% |

| Miami | $560,000 | 7.7% |

How do I calculate my mortgage payment?

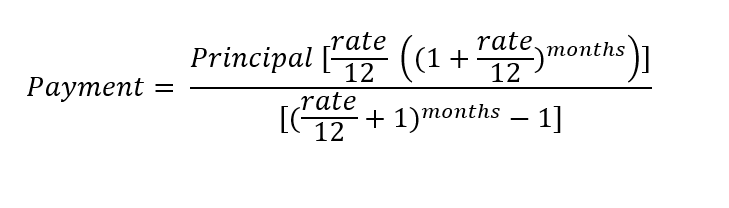

While the formula isn't easy, you can calculate your mortgage payment manually. Fortunately, unless you really want to, there's no need to calculate your mortgage payment from scratch -- simply use our handy Florida mortgage calculator above. To do it manually, start with the three variables that affect the principal and interest portion of your mortgage payment:

- Principal (P): How much money you originally borrowed. If your initial loan amount was $400,000, that's the principal amount you use to calculate your mortgage payment -- not your current balance.

- Interest rate (r): While the loan's APR gives you a better picture of the actual cost of borrowing money, for the purposes of calculating your mortgage payment, use the loan's interest rate. One caveat, though -- before you use the mortgage formula, convert your interest rate to a decimal, and then to a monthly interest rate (because you're calculating your monthly mortgage payment). For example, if your loan's interest rate is 7.5%, convert it to 0.075, then divide that by 12, which gives you a monthly rate of 0.00625. Note that if you have an adjustable-rate mortgage, the calculation only tells your mortgage payment for the initial rate-locked period.

- Number of payments (n): How many monthly payments you'll make on your mortgage. Take the number of years in the loan's term and multiply by 12. The two most common mortgage terms are 30 and 15 years, which translate to 360 and 180 monthly payments, respectively.

Here's how these three variables fit into the formula to calculate your monthly mortgage payment, which we'll call "M":

It's also worth noting that this formula only calculates the principal and interest portion of your mortgage payment. Most lenders require that you pay a monthly portion of your property taxes and insurance along with your principal and interest payment, and some even make you pay your HOA fees. For this reason, lenders often abbreviate your mortgage payment as PITI (principal, interest, taxes, and insurance).

Things to know before buying a house in Florida

While most of the things to know before buying a home in Florida apply pretty much everywhere (like credit scoring requirements), there are a few state-specific things to know.

Termites

Termites are a potential problem everywhere, but can be an especially big problem in warmer climates. Pay extra attention to any termite damage found during your home inspection.

Insurance considerations

If you plan to buy in an area (like most of Florida) that is particularly flood-prone or hurricane-prone, your mortgage lender might require you to carry flood insurance, windstorm insurance, or both, in addition to standard homeowners insurance. It's also getting increasingly difficult to find adequate homeowners insurance coverage at all for homes along the coast or that are regularly in the path of hurricanes, so be sure to check with your insurer before you start looking for homes in a particular area to be sure they will write insurance there.

Homestead exemption

If you plan to live in the house you're buying in Florida, there's a special tax exemption (known as the Homestead Exemption), that excludes the first $25,000 of your home's assessed value from all property taxes, and can exempt your property from an additional $25,000, excluding the applicable school taxes.

Here's how this works: If you're eligible for the full exemption, the first $25,000 of your home's assessed value would be wholly exempted, then you'd pay all the taxes that applied to the second $25,000 assessment, and the third $25,000 would be exempted from non-school taxes. Anything beyond $75,000 in assessment value would then be taxed wholly. So, if your home was assessed at $100,000, you'd pay no tax on $25,000, you'd only pay school tax on $25,000, and you'd pay full tax on $50,000.

You apply for this once when you buy the house, and it renews every year.

Rental restrictions

In many parts of Florida, there are restrictions, taxes, and local rules that govern the use of real estate as a rental property. This is especially worth keeping in mind if you plan to buy a home in one of the more tourism-driven areas of Florida. For example, in Key West you cannot rent a home for less than 30 days without a special (expensive) license. So, if you plan to list on Airbnb or something similar, do your homework first.

Learn more: Home buyer checklist

Tips for first-time home buyers in Florida

Florida has some of the best assistance programs for first-time home buyers. The nonprofit Florida Housing Finance Corporation has a first-time mortgage program that combines a 30-year fixed-rate mortgage with a second mortgage -- with no monthly payments -- that provides up to $10,000 towards the down payment and closing costs, among other options. There are three programs:

- Florida Assist Second Mortgage Program (FL Assist): Provides $10,000 as a second mortgage at 0% interest and no payments. The loan doesn't come due until the home is sold or you refinance.

- HFA Preferred Grants: Borrowers who qualify can get 3% to 5% of their home's purchase price in the form of down payment assistance, which is fully forgiven after five years.

- Florida Homeownership Loan Program: Up to $10,000 as a second mortgage at 3% interest with a 15-year repayment term.

Check Florida Housing's website for the current details on these and other programs for first-time home buyers in Florida.

Read more: Best mortgage lenders for first-time home buyers

Still have questions?

Here are some other questions we've answered:

FAQs

-

If you qualify for assistance under a Florida first-time home buyer program, you may not need a down payment at all for your mortgage. However, if you don't, you can still often secure a conventional loan with just 3% down, or an FHA loan with 3.5% down. Some home buyers may also be eligible for zero-down programs available through the VA and USDA.

-

Florida has some of the most expensive closing costs in the United States, on average. You can expect to pay about $8,554 in closing costs for a home purchase in Florida, or $5,821 for a refinance.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.