If you're looking to buy a home in Indiana, it's important to understand what your monthly mortgage payments will be once you sign your loan. That way, you can make sure those payments fit comfortably within your budget. Use our Indiana mortgage calculator to run the numbers and get a sense of your mortgage payments based on the amount you borrow.

If you're looking to buy a home in Indiana, it's important to understand what your monthly mortgage payments will be once you sign your loan. That way, you can make sure those payments fit comfortably within your budget. Use our Indiana mortgage calculator to run the numbers and get a sense of your mortgage payments based on the amount you borrow.

Indiana housing market

Indiana is a notably affordable place to buy a home. The median home sales price in August 2023 was $254,600, significantly below the national average during the same month of $420,284.

However, due to this incredible affordability, the housing market is also incredibly competitive. The median days on market for homes in Indiana in August 2023 was just 18 days, which is a year-over-year increase of two days. Although 38.2% of homes had a price drop before selling during August 2023, the average home still had a sales price that was 98.6% of its list price.

Even though home prices are up across much of Indiana, you'll see that the major metro areas have experienced very different levels of growth.

| Metro Area | Q1 2023 Median Sales Price | Year-over-year change (%) |

|---|---|---|

| Fort Wayne | $205,400 | 4.1% |

| Gary – Hammond | $236,900 | 1.4% |

| Indianapolis – Carmel – Anderson | $289,300 | 6.5% |

| South Bend – Mishawaka | $183,000 | 8.7% |

Indiana's current mortgage rates are also quite competitive. The mortgage rate you qualify for depends on a number of factors. These might include your credit score, income, and existing debt. However, you can use the current average Indiana mortgage interest rate with our simple Indiana mortgage calculator to estimate monthly payments.

How do I calculate my mortgage payment?

To calculate your monthly mortgage payments in Indiana, just take your loan amount, its term (the number of years you'll be paying it back), and your rate, and plug them into our Indiana mortgage calculator.

Based on a rate of 7.5% and a 30-year term, a $200,000 mortgage in Indiana will cost you $1,398 a month for principal and interest on your loan. But there are other expenses you need to tack on to see what your total monthly housing costs will be. These include:

- Property taxes: Generally, property taxes will be included in your monthly mortgage payment and added on top of your principal and interest payment. You’ll pay 1/12 of your annual taxes each month so your mortgage company can pay the full amount when they’re due.

- Homeowners insurance: Like taxes, your homeowners insurance will generally be included in your mortgage payment. You'll also pay approximately 1/12 of your homeowners insurance each month.

- Private mortgage insurance (PMI): Private mortgage insurance applies when you don’t have at least a 20% down payment. Prices will vary based on your loan program and your own credit-worthiness.

- Homeowners association (HOA) fees: You're responsible for these fees if you buy a home that's part of one of these associations

It's these added costs that can really catch you off guard as a first-time home buyer, so use our Indiana mortgage calculator to see exactly how your monthly payments might break down.

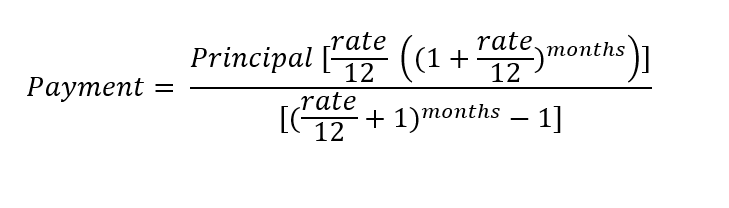

If you want to calculate your mortgage payment for yourself, you can use this formula:

Things to know before buying a house in Indiana

True, housing in Indiana is relatively affordable compared to home costs in the rest of the country. But you still should, of course, make sure your income can support your mortgage payments.

The 30% rule

As a general rule, your mortgage payment should not eat up more than 30% of your gross pay. By "mortgage payment," we're not just talking about principal and interest on your loan. Rather, we're talking about principal and interest plus all of the items bulleted above: taxes, insurance, etc. This means that if your pre-tax pay is $5,000 a month, you should not spend more than $1,500 a month on your mortgage payment and the above expenses (in fact, it may be difficult to qualify for a larger mortgage than your finances will support).

Maintenance costs

However, that 30% rule doesn't include maintenance.

Home maintenance is often a variable expense. You might, for example, spend more money on maintenance during the winter months than in the summer, or vice versa.

Property maintenance generally amounts to 1% to 4% of your home's value per year. What does that mean for you? If you buy a home worth $200,000, budget $2,000 to 8,000 each year for maintenance. The older your home, and the more maintenance has been deferred, the more this is likely to cost.

This estimate applies to general maintenance, but major repairs are a separate category, so make sure you have a decent chunk of money in emergency savings in case big issues arise.

Tips for first-time home buyers in Indiana

Buying a home for the first time can be a nerve-wracking experience -- and an expensive one at that, even in a state like Indiana where homes are relatively affordable. Here are a few things to remember as you buy your first home.

Look for first-time home buyer programs

Thankfully, there are a number of programs that could help you afford your first home.

One option is the First Place Program, which offers first-time buyers down payment assistance of up to 6%. Under this program, you get a 30-year fixed FHA or conventional loan, provided you have a minimum credit score of 640 and your debt-to-income ratio is less than 45%. Or you can qualify with a minimum credit score of 680 if your debt-to-income ratio is above 45%, but below 50%.

You may also qualify for a Mortgage Credit Certificate, a certificate issued by some state or local governments that gives you a tax credit for some of the mortgage interest you pay, up to $2,000 annually, for the life of your original home loan.

If you're a U.S. veteran, you might also qualify for a VA loan, so check out the best VA mortgage lenders to see what offers you're eligible for.

Secure the best interest rate

If you're applying for a home loan, it pays to gather offers from several mortgage lenders rather than going with the first offer you receive. Each lender sets its own rates, so you can realize significant savings sometimes from simply shopping around. If you gather a few offers, you can use our Indiana mortgage calculator to compare your costs with each.

Keep in mind that there are steps you can take to snag the best mortgage rates possible. These include:

- Boosting your credit score

- Paying off existing debt to lower your debt-to-income ratio

- Saving for a significant down payment

- Staying in your job and field of employment for the long term

The more stable your finances seem to lenders, the less lenders will charge you for your mortgage.

Are you ready to get a mortgage in Indiana?

If you're certain you want to settle down in Indiana, then it definitely pays to use our Indiana mortgage calculator to get a sense of your monthly payment. That way, you can factor that payment into your budget and make sure you're truly comfortable with it. Remember, while homes may be affordable in Indiana, you want to make sure the property you buy is actually affordable to you.

RELATED: You're also going to need homeowners insurance. Check out our guide to homeowners insurance in Indiana.

Still have questions?

Here are some other questions we've answered:

FAQs

-

If you can take advantage of a down payment assistance program in Indiana, you may not need to bring a down payment to closing. Otherwise, you can come to closing with as little as 3% with a conventional loan or 3.5% for an FHA loan. VA and USDA both have zero down programs, but have limited eligibility.

-

Indiana is one of the cheapest states for closing costs. The average home purchaser only needs $2,200 to close their new mortgage, or $1,447 for a refinance.

Getting pre-approved for a mortgage loan is an important step in the home buying process. Our experts recommend mortgage pre-approval before you begin looking at houses or deciding on a real estate agent.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.