The Sun Belt region has been one of the hottest areas for real estate in recent years, and North Carolina has been an especially strong market. North Carolina has a mild climate compared to many other areas of the country, and has above-average job and wage growth. Combine these things with a relatively affordable cost of living, and it's easy to see why North Carolina has a lot of newcomers and housing demand has soared.

With that in mind, here's a quick guide to the current state of the North Carolina housing market, some important things to know before you buy a home in North Carolina, and some valuable resources and tips for first-time homebuyers. Go ahead, calculate your future mortgage payment with our North Carolina mortgage calculator, which can help you set your budget.

The Sun Belt region has been one of the hottest areas for real estate in recent years, and North Carolina has been an especially strong market. North Carolina has a mild climate compared to many other areas of the country, and has above-average job and wage growth. Combine these things with a relatively affordable cost of living, and it's easy to see why North Carolina has a lot of newcomers and housing demand has soared.

With that in mind, here's a quick guide to the current state of the North Carolina housing market, some important things to know before you buy a home in North Carolina, and some valuable resources and tips for first-time homebuyers. Go ahead, calculate your future mortgage payment with our North Carolina mortgage calculator, which can help you set your budget.

North Carolina housing market 2022

Real estate prices have increased sharply throughout much of the United States over the past few years, and North Carolina has been no different. As of August 2023, the median home value in North Carolina had increased by 4.3% over the past year, slightly outpacing the 3.0% change in the median United States home value.

Despite ongoing increases in North Carolina home values, it remains a relatively low-cost place to live. The state's median sales price of $368,100 is roughly 12.5% lower than the national average of $420,846. And it's worth noting that North Carolina is a large state, and therefore has a variety of major real estate markets, ranging from major metropolitan areas to beach towns to popular mountain destinations. Here's a look at some of the most significant North Carolina real estate markets and how they're doing.

| Metropolitan Area | Median Home Value | 1-Year Change |

|---|---|---|

| Charlotte | $387,200 | 1.9% |

| Raleigh | $420,000 | -4.3% |

| Winston-Salem | $277,000 | 6.0% |

| Wilmington | $417,000 | 7.5% |

| Greensboro | $266,200 | 7.5% |

| Fayetteville | $220,300 | 11.0% |

| Durham-Chapel Hill | $412,600 | -1.3% |

How do I calculate my mortgage payment?

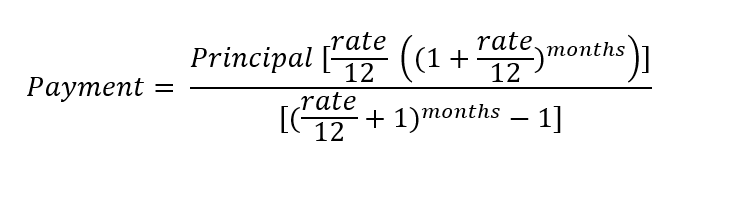

If you're mathematically inclined and want to know where the numbers come from, we'll walk you through the process. If you're perfectly content to use our North Carolina mortgage calculator, feel free to skip this part. First, the three variables in the calculation:

- Principal (P): How much money you borrowed originally, not your loan's current balance. If your initial loan amount was $325,000, that's the principal amount you use to calculate your mortgage payment.

- Interest rate (r): While the loan's APR gives you a better picture of the actual cost of borrowing money, including things like origination fees, use the loan's nominal interest rate to calculate your mortgage payment. Before using the mortgage formula, convert your interest rate to a decimal. Then, convert it to a monthly interest rate (because you're calculating your monthly mortgage payment). For example, a 7.5% interest rate would be 0.075 in decimal form, and then you'd divide by 12 to get 0.00625.

- Number of payments (n): The number of payments in your mortgage term. To determine this, simply take the number of years in the loan's term and multiply by 12. For mortgages of 30 and 15 years, you'll use 360 and 180 monthly payments, respectively.

Now that you're familiar with the variables, here's the mortgage payment calculation formula:

The result of this calculation is your monthly mortgage payment, including just the principal and interest you pay. Depending on the amount of your down payment, you may also pay PMI (private mortgage insurance) and other costs. Your lender will almost certainly require that you pay a proportional amount of your property taxes and insurance along with your monthly payment, and don't forget about your HOA fees, if applicable.

If you want to get the best deal you can on your mortgage rate, make sure to check with the best mortgage lenders for quotes before you choose a mortgage. It might just be a few dollars today, but those dollars really add up over time.

Things to know before buying a house in North Carolina

Your mortgage payment isn't the only thing to consider when you buy a home in North Carolina. Here are a few others to keep in mind.

Property taxes

When it comes to real estate property taxes, North Carolina is cheaper than average, with just fourteen states with lower property tax rates. The typical North Carolina homeowner pays 0.78% of their home's assessed fair market value annually, so if you purchase a $350,000 home, expect to pay about $2,730 in taxes your first year. This figure will fluctuate both with changes to the tax rate and the assessed value of your home over time.

You'll probably have to pay a few months' worth of taxes as part of your closing costs, and your lender typically requires that you pay a 12th of your anticipated tax bill along with your mortgage payment.

Insurance costs

The national average for homeowners' insurance is about $2,777 per year for $300,000 in coverage. In North Carolina, the average homeowner now pays just 9% over this amount, $3,031., As with property taxes, your lender is likely to require that you incrementally pay your insurance premium with your mortgage payments, and will pay the annual bill on your behalf to your insurance company.

Credit score requirements

This isn't a North Carolina–specific rule, but it's worth mentioning. In order to obtain a mortgage, you need to meet the minimum credit standards for whichever loan program you plan to apply for. For an FHA mortgage, this typically means you need a minimum score of 580. Conventional mortgages have requirements of 620 or higher, depending on your income and other qualifications.

Rental restrictions

This one is especially worth paying attention to if you plan to buy a second home, or if you're planning to buy a primary residence and want to occasionally rent it out. Many homes, particularly in locations popular with tourists like the mountains or beach areas, have rental restrictions that you should be aware of before buying.

LEARN MORE: Home Buyer Checklist

Tips for first-time home buyers in North Carolina

The North Carolina Housing Finance Agency has an excellent first-time buyers program known as the NC Home Advantage Mortgage. Essentially, this combines fixed-rate mortgages with down payment assistance programs that provide as much as 5% of the home's value. First-time buyers who qualify for the NC Home Advantage Mortgage can also qualify for as much as $15,000 in down payment assistance, structured as a 0% interest, deferred second mortgage eligible for complete forgiveness after 15 years.

READ MORE: Best Mortgage Lenders for First-Time Home Buyers

Still have questions?

Here are some other questions we've answered:

FAQs

-

If you're eligible for down payment assistance in North Carolina, you may be able to purchase a home with nothing down, although if you aren't, you can still qualify for a zero down loan through VA or USDA programs. Otherwise, you'll need at least 3% down for a conventional mortgage, or 3.5% for an FHA.

-

North Carolina has relatively inexpensive closing costs, with home buyers bringing an average of $3,406 to closing. If you want to refinance your home, you'll need just $2,660 on average.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.