If you're planning to buy a home in Tennessee, it's useful to understand the current housing market conditions and what your mortgage might cost each month. We built this free Tennessee mortgage calculator to help estimate your total monthly mortgage payment on your new home. Take it for a test drive today. If you want to know what your all-in mortgage payment is likely to be, including taxes, insurance, and HOA dues, you can include them in the calculation by clicking "Show Additional Inputs" below the calculator. This will open up additional calculator fields for you to enter that information.

If you're planning to buy a home in Tennessee, it's useful to understand the current housing market conditions and what your mortgage might cost each month. We built this free Tennessee mortgage calculator to help estimate your total monthly mortgage payment on your new home. Take it for a test drive today. If you want to know what your all-in mortgage payment is likely to be, including taxes, insurance, and HOA dues, you can include them in the calculation by clicking "Show Additional Inputs" below the calculator. This will open up additional calculator fields for you to enter that information.

Tennessee housing market

Tennessee has traditionally been a relatively inexpensive real estate market compared to the rest of the U.S., but it's seen a great deal of price appreciation since the pandemic started. The median sales price for single family homes in Tennessee in August 2023 is $389,100, according to Redfin data. This is about 7% lower than the median home sales price in the United States in second quarter 2023, which currently sits at $416,100.

Real estate prices have been on the rise throughout the United States since 2020. This has been fueled by a historically low supply of homes and persistent buyer interest in most markets. Nationwide, the median home sales price has increased by about 26.5% over the past three years, up from $329,000 in 2020. Tennessee's market has been even hotter -- the typical single family home for sale has seen an exponential rise from $282,600 in August 2020 to $389,100 in August 2023, a 37.7% increase in value in just three years.

Although this is a dramatic jump in such a short period, the growth seems to be slowing a bit, with prices in August 2023 just 5.4% higher than the same period the year prior, well below the year-over-year peak of 25.3% growth in May 2022.

How do I calculate my mortgage payment?

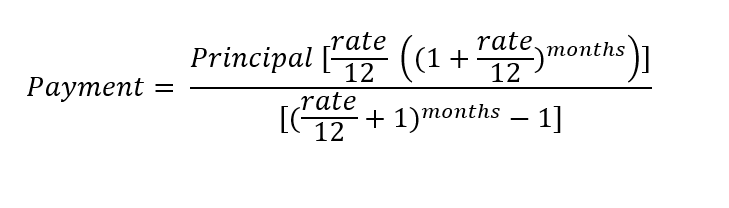

The short answer is that it's tough to calculate a mortgage payment by hand. The easiest way to do it is with a Tennessee mortgage calculator like the one at the top of this article. But if you insist on doing it the long way, here's the mortgage payment formula.

Let's say you're borrowing $400,000 to buy a home and take out a 30-year mortgage at 7.5% interest.

You would use 400,000 as the principal, 360 for the number of months, and 0.075 as the interest rate. This would result in a monthly principal and interest payment of about $2,802.

Whether you are mathematically inclined and want to calculate your payment by hand or you're using a Tennessee mortgage calculator, it's important to understand the different types of costs that go into your mortgage payment.

One common misconception among first-time buyers is that the mortgage payment is only made up of principal and interest on the money you borrow. Although this is a common way to see the calculation online, it's only because this is the easiest way to compare apples to apples, since insurance, taxes, mortgage insurance, and HOA fees can vary widely between houses and even from town to town within a metro area.

The components of most mortgage payments are listed below.

Home price and down payment

The first component of your mortgage payment is repaying the principal -- that is, the amount of money you borrowed from the mortgage lender. This is determined by two main factors: the amount you agree to pay for the home, and your down payment.

For example, if you agree to buy a home for $400,000 and put 10% ($40,000) down, your principal loan amount will be $40,000 (home value) - $40,000 (down payment) = $360,000 (amount from your lender).

Keep in mind that if you bring less than a 20% down payment to the closing table, you may also be required to pay mortgage insurance. Costs vary depending on the program, but it can add a substantial amount to each month's payment.

You can vary the amount of your down payment and home value in the above Tennessee mortgage calculator to get an idea of how the principal affects your monthly mortgage payment.

Interest

Your interest rate determines the fee you'll pay for borrowing money. This is given as an annual percentage. In our Tennessee mortgage calculator above, you can experiment with different interest rates to see how they impact your mortgage payment.

Over time, you'll see that your principal payment will grow as your interest shrinks, according to your bank's amortization calculation. This ensures that you are always paying a steady principal and interest payment, while still paying the note off in full at the end of the term. You can also read more about loan amortization.

Your lender is required to give you a full amortization schedule at closing, so you can see how the makeup of your loan payments will change over time.

Mortgage term

Most home buyers in the United States choose a 30-year mortgage term with a fixed interest rate. There are other terms available, ranging from 10 to 30 years. Usually, a longer term means a lower monthly payment, but it also means you'll pay more interest over time.

And generally speaking, you can get a lower interest rate if you're willing to choose a shorter term.

Wondering how this affects you? Try using the Tennessee mortgage payment calculator above to calculate the monthly payment for a 20-year loan term versus a 30-year loan term. You can even look up 20-year mortgage interest rates to get an idea of the difference in interest costs.

Property taxes and insurance

Virtually all mortgage lenders require homeowners to pay property taxes and insurance along with their mortgage payments. That way, the lender is assured these expenses are getting paid. For this reason, mortgage payments are often referred to as PITI (principal, interest, taxes, and insurance).

These expenses can be tough to estimate before you start to shop for a home. If you don't know these numbers yet, don't panic -- we've auto-filled example numbers into the Tennessee mortgage calculator above, so you can get a rough estimate of monthly mortgage costs. Once you decide on a particular home, exact numbers for these items won't be hard to find. Property taxes are publicly available, and you can get a homeowners insurance quote easily.

It's also worth noting that if you live in a neighborhood with a homeowners or condo association, it's not uncommon for the lender to ask you to pay those dues with your monthly mortgage payment as well. We have a place for you to include this in the Tennessee mortgage calculator above (click "Additional Inputs").

Things to know before buying a house in Tennessee

Tennessee has below-average property tax rates. The median property tax bill in Tennessee is 0.68% of your home's assessed value, according to tax-rates.org. This makes Tennessee one of the 10 states with the lowest taxes.

However, it's worth noting that property taxes can vary significantly depending on where you are within Tennessee. You might want to look up the property taxes of a few areas you're considering moving to, then use those numbers in the above Tennessee mortgage calculator to get a more accurate idea of your potential mortgage payments.

According to insurance.com, a homeowner in Tennessee can expect to pay about $3,712 for $400,000 in coverage, which is 15% higher than the national average.

Tips for first-time home buyers in Tennessee

Tennessee has an excellent loan program for first-time home buyers called the Great Choice Home Loan program, created by the Tennessee Housing Development Agency. The loan is designed for households of mid-to-moderate incomes, which vary by county.

The Great Choice Home Loan is a 30-year, fixed-rate mortgage product that requires a minimum credit score of 640 from everyone on the application. Loans have a minimum 3.5% down payment because they are insured by either FHA or USDA-RD. But homeowners who use the program can also use the Great Choice Plus down payment assistance program to get up to $6,000 more towards their down payment and closing costs. To be clear, the down payment assistance is a second loan, not a grant.

Whether you're buying for the first time or refinancing an existing property, make sure you shop around with the top mortgage lenders or best refinance lenders to get the right deal for you. Use a Tennessee mortgage calculator (like the one above) to make sure your mortgage fits your budget.

Still have questions?

Here are some other questions we've answered:

FAQs

-

You may not need a significant down payment to buy a home in Tennessee, especially if you qualify for a zero down payment program through VA or USDA. Other programs, like FHA, only require a 3.5% down payment and conventional loans can be secured with as little as 3% down.

Down payment assistance is also available through the Great Choice Home Loan Program.

-

You can expect to pay an average of $3,911 in closing costs on a new home purchase in Tennessee. However, you'll only need $2,436 to close a mortgage refinance in the state.

Our Mortgages Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Please note that this calculator is not personalized financial advice and should not be considered or used as such. Nor are we promising that by use of this calculator, will you be able to save more money, preserve wealth, or otherwise.