Average Closing Costs: What Will You Pay?

Closing costs on a home can amount to thousands of dollars. They add up to between 2% and 5% for the buyer and 6% and 10% for the seller.

That's a significant cost to factor in when buying a home.

Read on for the most recent data on how much closing costs are on a house.

Key findings

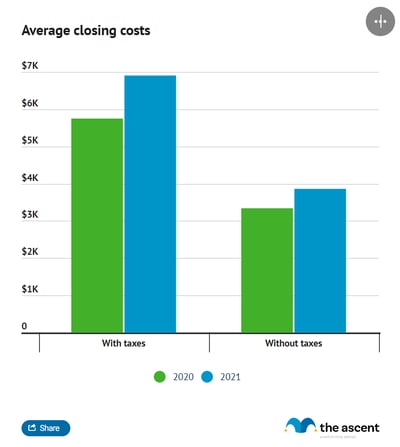

- Average closing cost: The average closing costs in the United States totaled $6,905 including taxes, in 2021, the most recent year data is available.

- Closing costs as a percentage of sales price: Closing costs amounted to 1.81% of the average home sales price in 2021.

- Highest closing costs: The District of Columbia has the highest closing costs, at $29,888 with taxes.

How much are closing costs?

Average closing costs in the United States: $6,905

The average closing costs on a house, if you include taxes, are $6,905 as of 2021, according to the most recent data published by CoreLogic. That's 1.81% of the average home purchase price that year.

Without taxes, the average closing costs are $3,860.

Average closing costs by state

Which states have the highest closing costs?

States with the highest closing costs, including taxes

- District of Columbia average closing costs with taxes: $29,888

- Delaware average closing costs with taxes: $17,859

- New York average closing costs with taxes: $16,849

- Maryland average closing costs with taxes: $14,721

- Washington average closing costs with taxes: $13,927

States with the highest closing costs, excluding taxes

- District of Columbia average closing costs without taxes: $6,502

- New York average closing costs without taxes: $6,168

- Hawaii average closing costs without taxes: $5,897

- California average closing costs without taxes: $5,665

- Massachusetts average closing costs without taxes: $4,904

States with the highest closing costs as a percentage of the home purchase price

- Delaware closing costs as a percentage of home purchase price: 5.4%

- Pennsylvania closing costs as a percentage of home purchase price: 4.3%

- District of Columbia closing costs as a percentage of home purchase price: 3.9%

- Maryland closing costs as a percentage of home purchase price: 3.7%

- New York closing costs as a percentage of home purchase price: 3.1%

States with the lowest average closing costs including taxes

- Maryland average closing costs including taxes: $14,721

- Oklahoma average closing costs including taxes: $2,893

- West Virginia average closing costs including taxes: $3,406

- Iowa average closing costs including taxes: $3,146

- Kentucky average closing costs including taxes: $2,808

States with the lowest average closing costs excluding taxes

- Missouri average closing costs without taxes: $2,061

- Indiana average closing costs without taxes: $2,200

- Nebraska average closing costs without taxes: 2,210

- Arkansas average closing costs without taxes: $2,281

- West Virginia average closing costs without taxes: $2,465

States with the lowest closing costs as a percentage of the home purchase price

- Mississippi average closing costs as a percentage of purchase price: 0.1%

- Alaska average closing costs as a percentage of purchase price: 0.1%

- Wyoming average closing costs as a percentage of purchase price: 0.7%

- Missouri average closing costs as a percentage of purchase price: 0.8%

- Montana average closing costs as a percentage of purchase price: 0.8%

Counties with the highest closing costs

These counties have the highest average closing costs:

- New York, New York average closing costs with taxes: $58,619

- Dukes, Massachusetts average closing costs with taxes: $28,724

- Kings, New York average closing costs with taxes: $28,239

- Queens, New York average closing costs with taxes: $25,848

- Richmond, New York average closing costs with taxes: $24,579

Markets with the highest closing costs

- Vineyard Haven, Massachusetts average closing costs with taxes: $28,724

- Bremerton-Silverdale-Port Orchard, Washington average closing costs with taxes: $16,003

- Salisbury, Maryland-Delaware average closing costs with taxes: $15,723

- Dover, Delaware average closing costs with taxes: $13,799

- New York-Newark-Jersey City, New York-New Jersey-Pennsylvania average closing costs with taxes: $13,596

15 states with no real estate transfer taxes

These are the states with no real estate transfer taxes, which should result in lower closing costs.

- Alaska

- Arizona

- Idaho

- Indiana

- Louisiana

- Kansas

- Mississippi

- Missouri

- Montana

- New Mexico

- North Dakota

- Oregon (outside of Washington County)

- Texas

- Utah

- Wyoming

Who pays closing costs?

Home buyers and sellers pay for different closing costs.

Closing costs for home buyers are generally tied to their mortgage lender, so shopping around for a mortgage can provide some options when it comes to lender fees. It's also possible to shop around for some third-party fees. Home loan estimates will show which closing costs are included.

Sellers are also responsible for some closing costs, including the new buyer's title insurance and real estate commissions for both the buyer and the seller. They may also have to pay prorated property taxes and homeowners association (HOA) fees.

Closing costs for buyers

Closing costs for buyers are split into lender fees and third-party fees. Lender fees are that which are required to process and finalize a home loan. Third-party fees are paid to companies that help the lender with tasks required to finalize the loan, like a title search or appraisal.

Below is a breakdown of which lender fees and third-party fees that buyers are responsible for.

Lender fees

Lenders fees include:

- Loan application fee

- Prepaid interest

- Discount points (also known as mortgage points) to reduce the interest rate

- Origination fee or loan fee

- Broker fee

- Underwriting fee

- Mortgage insurance

- Rate lock or rate lock extension fee

Third-party fees

Third-party fees include:

- Title search

- Lender's title insurance

- Borrower's title insurance

- Appraisal fee

- Pest inspection fee

- Flood hazard determination fee

- Credit check fee

- Settlement or escrow agent fee

- Attorney fee (in states where borrowers need a real estate attorney)

- Deed recording fee

- Property transfer tax

- Courier fee

- Wire transfer fee

- Condo certification fee

- Homeowners association certification fee

- Loan document preparation fees

- Prepaid homeowners insurance

- Escrow reserves

- Prepaid property taxes

- Prepaid flood insurance

- Notary fees

- VA funding fee, FHA upfront mortgage insurance premium, or USDA guarantee fee

Closing costs for sellers

Home sellers are responsible for fewer fees than buyers, although they can sometimes add up to be more expensive than what the buyer is responsible for.

Sellers are responsible for these closing costs:

- Transfer taxes

- Title fees

- Escrow fees

- Prorated property taxes (if the home is sold before taxes are due)

- HOA fees (if there are any due before the buyer moves in)

- Realtor commissions

Note that the seller is responsible for paying the commissions of both the buyer's and seller's real estate agents. Those commissions alone can cost the seller upward of 6% of the sale price of the house.

How to pay for closing costs

As the buyer, there are several ways to cover your closing costs on a mortgage.

- Pay cash out of pocket at the closing table. This option can be the least expensive in the long run if you can afford to part with the cash now and plan to keep your loan for a long time.

- Ask the lender to pay your closing costs. Your lender may be willing to cover some or all of your closing costs in exchange for a higher interest rate. This option might be best if you don't have extra cash or if you don't plan to keep your loan for a long time. Paying a higher interest rate for a few years can be less expensive in the long run.

- Roll your closing costs into your mortgage. Instead of paying cash upfront or paying a higher interest rate, you can finance a larger sum by tacking your closing costs onto the loan principal. Your monthly payment will be slightly higher, and you'll pay interest on the additional amount you're financing. If you're close to the upper limit of what a lender will give you, this might not be possible.

- Ask the seller to pay your closing costs. If you're buying a home and not refinancing, the seller might be willing to cover part or all of your closing costs. If the seller pays them, it's called a "seller concession" or a "seller credit," and you might have to pay more for the house to make up for it. As a result, asking the seller to pay your closing costs can end up being just another way of financing them, especially in a seller's market. In a buyer's market, you'll have more negotiating power.

Closing costs for VA loans

VA loans are available to veterans, service members, and surviving spouses for home buying, building, or refinancing.

In addition to the bevy of benefits that come with VA loans, home buyers financing with a VA loan cannot be charged lender fees over 1% of the VA loan amount.

However, buyers that make use of a VA loan will be charged with a VA funding fee, which is a charge that ranges from 0.5% to 3.6% of the total amount of the VA loan used to finance the home purchase.

Closing costs for FHA loans

Federal Housing Administration (FHA) loans are mortgage origination loans meant to assist first-time home buyers or those seeking a lower down payment. FHA loans are provided by FHA-approved mortgage lenders and those seeking FHA loans must meet certain requirements.

Buyers financing with an FHA loan will face similar closing costs that they would using a conventional loan, but financing with an FHA loan provides options for avoiding those costs upfront at closing.

Buyers using an FHA loan can use money from family, employers, unions, charities, and government programs towards closing costs or a down payment. Some banks and government housing agencies also provide closing cost assistance for home buyers using FHA loans.

FHA loan users can also roll closing costs into their home loan by either increasing their interest rate or requesting that the lender pay the closing costs and add those costs to the loan.

Finally, under FHA rules, sellers may pay closing costs amounting up to 6% of the home sales price. Sellers may be inclined to do this to finalize a sale.

Will the NAR settlement impact closing costs?

The National Association of Realtors (NAR) settlement does not directly impact closing costs but may affect the price of real estate transactions as well as how they are structured and negotiated, which could influence overall costs, including closing costs.

The settlement does not prevent sellers from offering concessions to buyers, including contributions toward the buyer's closing costs.

How to save on closing costs

Your efforts to save money on closing costs shouldn't just focus on limiting the cash you bring to the closing table. You should take steps to lower the costs themselves, too.

- Get loan estimates from at least three lenders. Make sure you're getting estimates for the exact same type of loan, so you can make an accurate comparison of the closing costs.

- Shop around for the closing services you're allowed to choose your own vendor for. The Consumer Financial Protection Bureau recommends shopping around for title insurance as a way to save a few hundred bucks.

- Go ahead and finance them. If you're planning to keep your loan for only a few years, paying a lot of cash upfront for that loan could be more expensive than making a higher monthly payment.

- Ask about closing cost grants. If you're a low- to moderate-income home buyer, you might qualify for a closing cost grant, depending on what's available where you live.

- Ask a relative to help you out with a gift: If you can demonstrate to your family that you've been financially responsible, they may be happy to help with a cash gift to put toward your down payment or closing costs. The lender may require a gift letter to prove that you didn't borrow the funds.

Your first closing cost quote isn't always the best one you'll get. Shopping around with different lenders and vendors and negotiating with the seller can yield savings. Patience, persistence, and thoroughness are key to finding the best deal on closing costs, even amid the excitement of being on the cusp of homeownership.

Sources:

- ClosingCorp (2022). "Average Closing Costs for Purchase Mortgages Increased 13.4% in 2021, CoreLogic's ClosingCorp Reports."

- Consumer Financial Protection Bureau (n.d.). "Closing on Your New Home."

- Consumer Financial Protection Bureau (n.d.). "Loan Estimate Explainer."

- National Association of Realtors (n.d.). "Summary of Real Estate Transfer Taxes by State."

- Zillow (2022). "United States Home Prices & Values."

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.