Are You Well-Paid? Compare Your Salary to the Average U.S. Income

KEY POINTS

- COMPARE YOUR SALARY: Understand how your paycheck measures against the national average income by considering factors like occupation, age, gender, and location.

- INFLATION IMPACT: Median U.S. household income decreased by 2.2% from 2021 to 2022 after adjusting for inflation, highlighting the economic challenges many face.

- ADDRESS GENDER GAP: Despite progress, a significant gender pay gap persists across various sectors, with men generally earning more than women.

When you look at your paycheck, are you happy with what you see? Or do you wonder if you should make more?

While your industry and position largely dictate your earnings, you may want to know how your salary compares to the national average income of your peers or the general population. After all, the more you make, the more you can (usually) save for an emergency or retirement.

Wonder no more. Here's a deep dive into Americans' earnings by factors such as occupation, age, gender, and location so you can get a sense of how your paycheck stacks up.

Jump To

Average U.S. household income in 2022: $105,555

The average U.S. household income in 2022 was $105,555, while the median U.S. household income was $74,580.

Adjusting for inflation, median household income dropped 2.2% from 2021 to 2022. Adjusting for inflation, the median household income has declined every year since 2019, when it was $78,250.

When the median is considerably lower than the average, it means that there are outliers on the top end. In short, a few people who make a lot of money boost the average. So $61,937 may be a more accurate representation of typical household earnings.

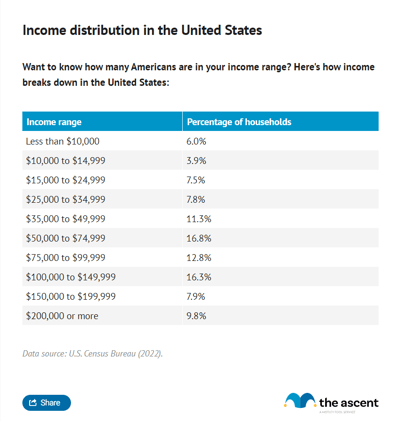

Here's a more in-depth breakdown of what U.S. households are making:

Fifty percent of American households earn less than $75,000 per year. Just 37% of American households earn more than $100,000.

Average U.S. income versus average U.S. salary

With few exceptions, we aren't reporting the median and average salary in this article. Instead we're mostly reporting income. The U.S. Census Bureau tracks earnings, composed mostly of salary and wages, and income, which includes all sources of money that people bring in.

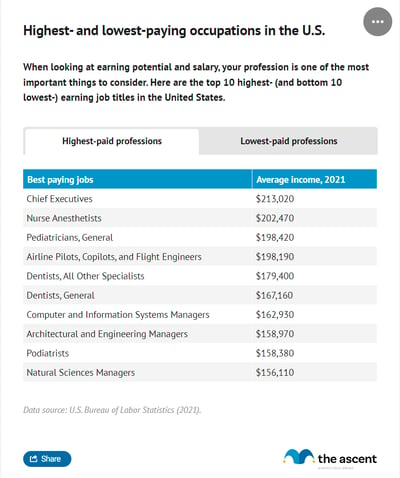

Lowest and highest paying jobs

The industry you work in largely influences your earnings potential. Not surprisingly, most of the top paying occupations require advanced degrees and specialized training. Here are the 10 highest-paying occupations and lowest-paying careers.

It's easy to be jealous of those who have the highest-paying jobs. But remember, many of those same people are hundreds of thousands of dollars in debt from having gone to medical or dental school. Will they come out ahead eventually? Maybe. But for many people in the medical field, for example, it takes several decades to recoup that investment.

Most U.S. workers don't earn anything close to what the 10 highest-paid professions bring in. And workers in the lowest paying careers really struggle to make a livable wage.

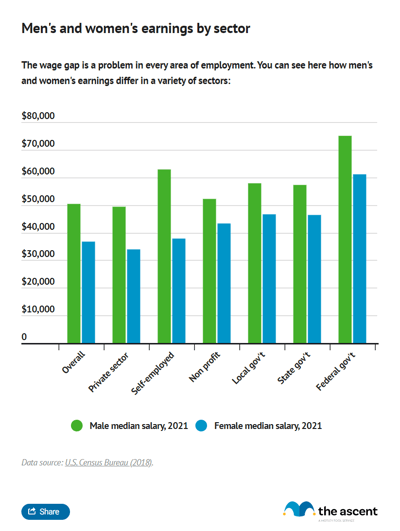

U.S. income by gender

The gender pay gap persists, with men continuing to out-earn women overall and within the same broad sectors of the workforce. Men earned a median salary of $52,612 in 2022 while women earned $39,688, 75% of men's salaries.

The gender wage gap exists throughout the economy. The gender pay gap is most significant among self-employed workers. Self-employed women make $41,789, just 65% of the $64,546 that self-employed men earn.

Gender pay disparity is also particularly pronounced in the private sector. Men employed by private companies have a median salary of $52,004 while women earn $36,739, which is a 71% gender wage gap.

The gender income gap exists among government workers, too. Here are the median earnings for men:

- $60,349 for local government workers

- $59,373 for state government workers

- $78,250 for federal government workers

Here's what those numbers look like for women:

- $48,406 for local government workers

- $59,373 for state government workers

- $78,250 for federal government workers

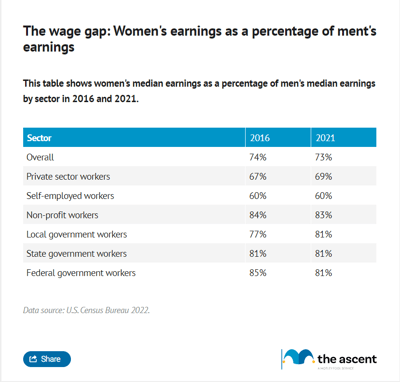

While women's salaries have grown since 2016, sometimes at a faster rate than men's, a dent hasn't been made in unequal gender pay. Gender equality is still far off, as women are making almost the same percentage of what men make as they did in 2016.

Women's earnings as a percentage of men's earnings

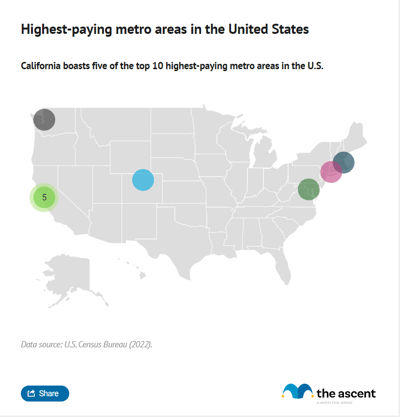

U.S. metro areas with the highest pay

Despite a shift towards remote work in recent years, breaking down median household income by metropolitan statistical areas (MSAs) reveals that geography still plays a significant role in earnings. So we took a look at median incomes by U.S. metro areas.

Americans in the San Jose-Sunnyvale-Santa Clara, CA MSA earned a median income $148,900 in 2021 while those in the Pine Bluff, AR MSA earned a median income of just $44,263.

It's no surprise that other high-tech hubs like the San Francisco-Oakland-Berkeley region, the Seattle-Tacoma-Bellevue MSA, and the Boston-Cambridge-Newton MSA made the top ten.

Of course, it's easy to be tempted to move to one of these metros in the hopes of snagging a massive pay boost. But remember, some of these cities are among the most expensive in the country to live in, so what you might gain in earnings, you'll likely end up spending on rent and other expenses. You may be better off finding a city that's known for high salaries and a low cost of living.

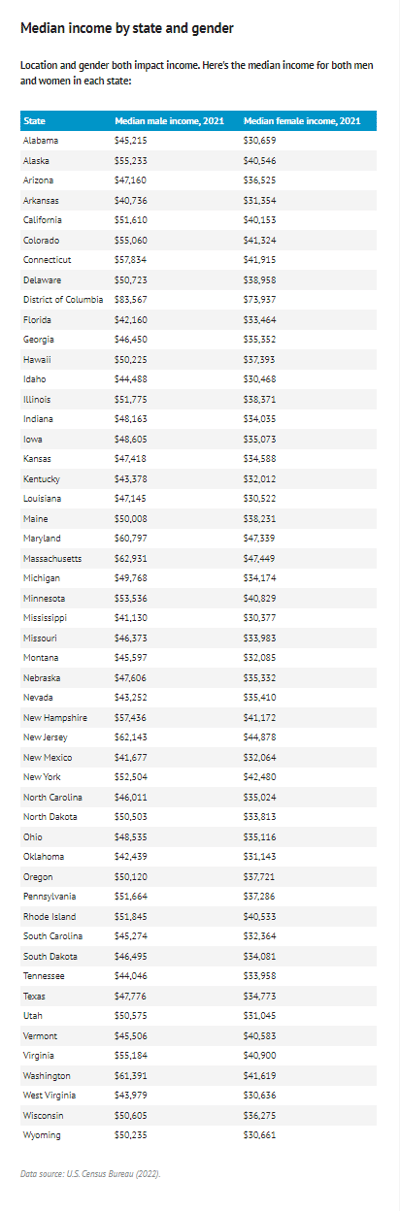

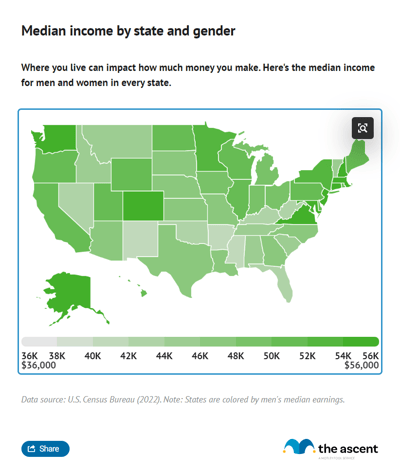

Median income by state

Income also varies by state -- the median household income in Washington, D.C. was $101,027 in 2022 while the median household income in Mississippi was almost half that, at $52,719.

Looking at the median income by state also reveals that the gender pay gap exists throughout the United States. In no state do women earn more than men.

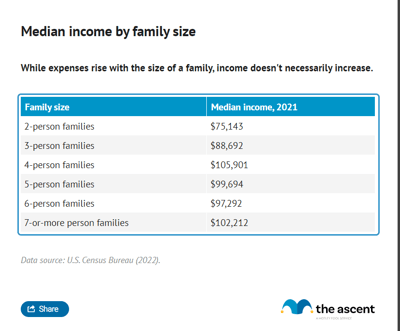

U.S. median family income by family size

The average family income changes based on the number of people in your household. The more bodies you need to feed and clothe, the harder it is to keep up with your expenses.

Here's how median family income in the U.S. income breaks down by family size:

U.S. median family income peaks with four-person families at $113,919 and levels off at around $107,000 for families of five or larger. The largest jump in median income occurs between families of three and families of four. The former has a median income of $95,770, while the latter pulls in $113,919.

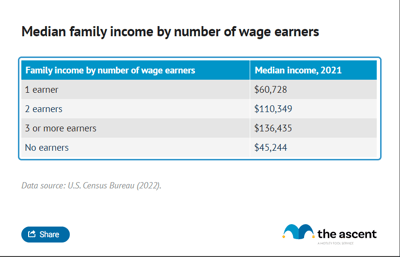

U.S. income by number of wage earners

The number of wage earners in a family naturally affects median family income. The median income for families with one wage earner is $63,534, while with two wage earners the median income jumps to $117,107.

Families with more wage earners unsurprisingly have a higher median income, although returns diminish above two wage earners. This is likely because high school or college-age children make up for the additional wage earners and bring in much less than their parents.

The need for multiple incomes often poses challenges with regard to having children. Many families can't afford child care, but they also can't afford to slash their household income in half. It's a tricky problem with no particularly good solution at present.

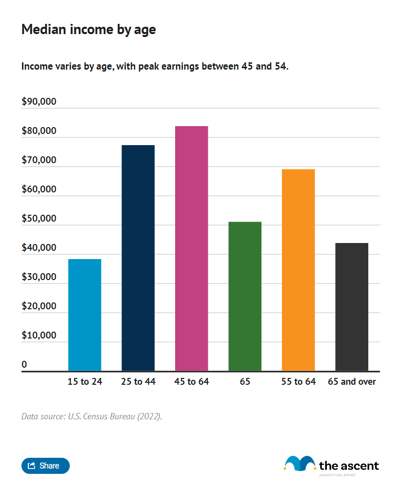

U.S. income by age

As workers progress in their careers their median income generally rises. But median income by age peaks before declining as Americans near retirement.

Here's a breakdown of median U.S. income by age group:

Americans aged 45 to 64 earn more money than their younger and older counterparts. Workers under 25 and over 64 earn the least.

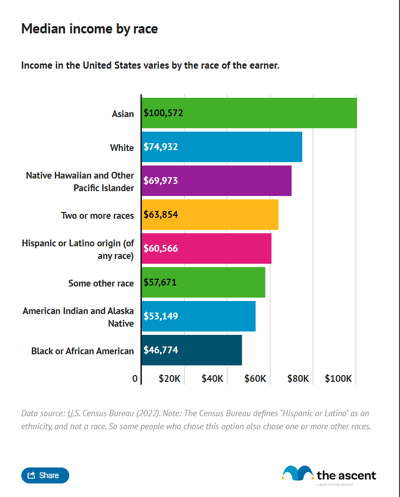

U.S. income by race

Looking at median income by race, Asian Americans earn the most, making $106,954 a year, while Black or African American earners make the least, bringing in a median of $51,374.

Examining income by race in America reflects racial disparities in education and opportunity more generally.

For example, fewer Black Americans aged 25 and older have completed high school or have a bachelor's degree than any other race other than Hispanic Americans, according to Pew. Meanwhile, a higher percentage of Asian Americans have reached those educational milestones than any other race, per Pew. A similar percentage of white and Asian Americans live in poverty while a much higher percentage of Black and Hispanic Americans live in poverty, which can make it more difficult to move up the income ladder.

How does your income stack up?

Now that you have a better sense of how much Americans earn on a national level and how those earnings break down by factors such as gender, race, age, occupation, and location, you can take a closer look at your circumstances and see if any changes are in order. Of course, you can't change your race or age, but a couple of things you can change are the industry you choose to work in and the state or metro area you choose to call home.

That said, you don't need to make such drastic changes to boost your earnings. If you're happy with your line of work and enjoy the area you live in, try learning new job skills to make yourself a more valuable employee. Doing so could result in a nice raise.

Similarly, research salary data for your industry and present it to your employer if you see that you're statistically underpaid given your position and line of work. And finally, don't hesitate to dust off your resume and see what opportunities are out there. You may find that there's a nearby company that will pay you what you're worth if your current employer won't.

And, of course, don't forget that it's not always how much money you make -- it's how you use it.

How to stretch your income

Here are a few steps you can take to passively boost your savings and make the most of your income:

- Pay down debt: Debt can make it difficult to save or invest.

- Budgeting apps can help uncover ways to cut costs and focus funds on paying off debt. Review our best budgeting apps to get organized and start saving.

- Balance transfer credit cards can simplify paying off credit card debt. We've compiled some of the best balance transfer credit cards to help you save while paying off debt.

- Personal loans can be used to consolidate high interest rate debt into a single, likely lower, interest rate line of credit. Our experts have reviewed and ranked some of the best personal loans for debt consolidation.

- A mortgage refinance could potentially net thousands in savings. Check out our list of some of the best mortgage refinance lenders to see if you can save.

- Align credit card rewards with spending: Translate recurring expenses into cash back or other rewards by finding a credit card that fits your spending. If you're thinking of applying for a credit card, our experts have compiled some of the best credit cards for 2023.

- Open a high-yield savings account: Review the best high-yield savings accounts to find a solution that keeps your money accessible and growing.

- Open a brokerage account to invest for the long term: If you're interested in starting your investment journey, our experts put together a list of some of the best stock brokers.

Sources

- Pew (2021). "Racial and ethnic gaps in the U.S. persist on key demographic indicators."

- U.S. Bureau of Labor Statistics (2022). "May 2022 National Occupational Employment and Wage Estimates."

- U.S. Census Bureau (2023). American Community Survey - Table B24082, "Sex by Class of Worker and Median Earnings in the Past 12 Months (in 2022 Inflation-Adjusted Dollars)."

- U.S. Census Bureau (2023). American Community Survey - Table S1901, "Income in the Past 12 Months (in 2022 Inflation-Adjusted Dollars)."

- U.S. Census Bureau (2023). American Community Survey - Table S1903, "Income in the Past 12 Months (in 2022 Inflation-Adjusted Dollars)."

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.