An adjusted trial balance is an internal document that summarizes all of the current balances available in general ledger accounting. The adjusted trial balance is prepared to show updated balances after adjusting entries have been made.

We’ll explain more about what an adjusted trial balance is, and what the difference is between a trial balance and an adjusted trial balance.

Overview: What is an adjusted trial balance in accounting?

An adjusted trial balance is created after all adjusting entries have been posted into the appropriate general ledger account. The adjusted trial balance is completed to ensure that the period ending financial statements will be accurate and in balance. In addition, an adjusted trial balance is used to prepare closing entries.

How to prepare an adjusted trial balance

Preparing an adjusted trial balance is the sixth step in the accounting cycle. An adjusted trial balance is prepared by creating a series of journal entries that are designed to account for any transactions that have not yet been completed.

These items include payroll expenses, prepaid expenses, and depreciation expenses. Here are the steps used to prepare an adjusted trial balance:

- Run an unadjusted trial balance. This provides an initial summary of your general ledger accounts prior to entering any adjusting entries.

- Make any adjusting entries that are needed. Adjusting entries can include adjustments for prepayments, interest and depreciation expense, and payroll accruals.

- Run the adjusted trial balance. You can ensure that the entries have posted correctly by comparing the initial trial balance totals with the adjusted trial balance totals.

Example of an adjusted trial balance

To understand what an adjusted trial balance is, we first have to view an unadjusted trial balance as well as the necessary journal entries to complete in order to prepare an adjusted trial balance.

Step 1: Run an unadjusted trial balance

| Account | Debit | Credit |

|---|---|---|

| Cash | 10,000 | |

| Accounts Receivable | 7,000 | |

| Prepaid Rent | 3,100 | |

| Inventory | 15,000 | |

| Accumulated Depreciation | 5,500 | |

| Accounts Payable | 10,000 | |

| Notes Payable | 3,000 | |

| Common Stock | 10,000 | |

| Revenue | 19,100 | |

| Payroll Expense | 6,000 | |

| Rent Expense | 3,000 | |

| Utilities Expense | 1,000 | |

| Depreciation Expense | 2,500 | |

| TOTALS | 47,600 | 47,600 |

The above trial balance is a current summary of all of your general ledger accounts before any adjusting entries are made. Debits and credits should always match in a trial balance. Remember not to confuse adjusting entries with closing entries.

Closing entries are completed after the adjusted trial balance is completed.

Step 2: Enter adjusting journal entries

| Account | Debit | Credit |

|---|---|---|

| Rent Expense | 700 | |

| Prepaid Rent | 700 | |

| Depreciation Expense | 300 | |

| Accumulated Depreciation | 300 |

The above journal entries were made in order to account for depreciation expenses and prepaid rent.

Step 3: Run an adjusted trial balance

| Account | Debit | Credit |

|---|---|---|

| Cash | 10,000 | |

| Accounts Receivable | 7,000 | |

| Prepaid Rent | 2,400 | |

| Inventory | 15,000 | |

| Accumulated Depreciation | 5,800 | |

| Accounts Payable | 10,000 | |

| Notes Payable | 3,000 | |

| Common Stock | 10,000 | |

| Revenue | 19,100 | |

| Payroll Expense | 6,000 | |

| Rent Expense | 3,700 | |

| Utilities Expense | 1,000 | |

| Depreciation Expense | 2,800 | |

| TOTALS | 47,900 | 47,900 |

As you can see by the adjusted trial balance example above, some of the account totals have now been updated. In this example, the adjusted trial balance shows the changes that affected both the rent and depreciation accounts.

For instance, we expensed rent for the month, so we needed to reduce the prepaid rent amount. For depreciation, depreciation expense increased, while accumulated depreciation increased as well.

In addition, your adjusted trial balance is used to prepare your closing entries, which is the next step in the accounting cycle.

FAQs

-

An adjusted trial balance provides you with the summary totals of all of your general ledger accounts after adjusting entries have been made.

-

Both the unadjusted and the adjusted trial balance are listings of the ending balances of all of your general ledger accounts.

-

Adjusting entries typically include payroll accruals, prepayment adjustments, and depreciation expenses that have not yet been recorded.

Best accounting software for preparing an adjusted trial balance

While you can create an adjusting trial balance manually, or by using spreadsheet software, it’s far easier to do so when using accounting software. Here are some of The Ascent’s top picks for creating an adjusted trial balance.

For more about these and other accounting software options, check out our accounting software reviews.

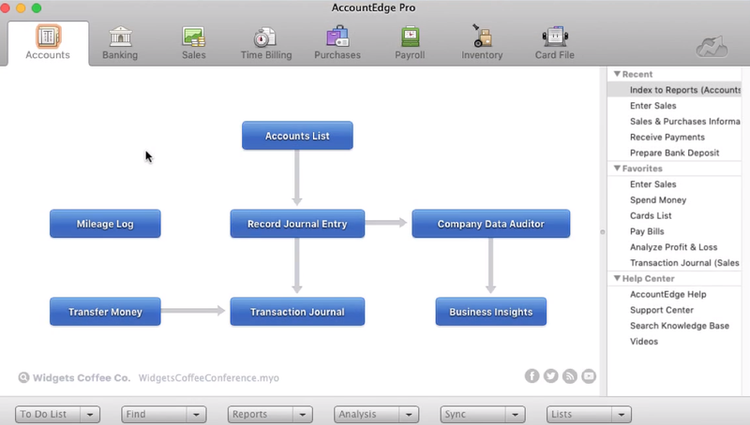

1. AccountEdge Pro

AccountEdge Pro is designed for small and growing businesses. It offers both on-site installation as well as cloud access, and is a good fit for growing businesses that are looking for accounting software that can grow with them.

AccountEdge Pro offers an easily navigated user interface. Image source: Author

AccountEdge Pro includes an excellent selection of financial reports including a trial balance summary report and a trial balance detail report that provides details on all general ledger accounts currently being used.

AccountEdge Pro pricing varies, depending on whether you choose the on-premise application or opt for cloud connectivity. AccountEdge Pro’s on-site application charges a one-time fee of $399, while the cloud application, Priority Zoom, starts at $50/month for up to 5 users, with additional licenses $50/month.

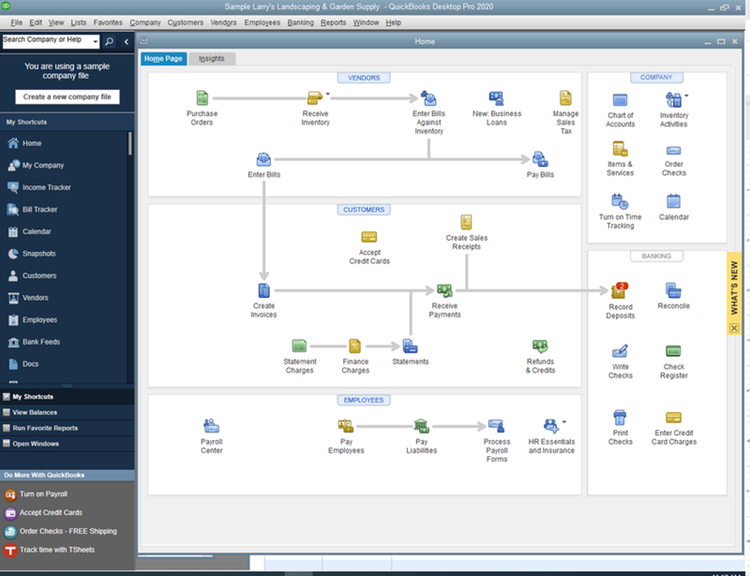

2. QuickBooks Desktop

QuickBooks Desktop was one of the first accounting software applications to replace common accounting terms such as accounts payable and accounts receivable with more familiar terms such as bills and money owed.

As an added bonus, QuickBooks Premier and Enterprise also include industry-specific features designed for nonprofits, manufacturing, or retail businesses.

QuickBooks Desktop features are categorized in centers for easier system navigation. Image source: Author

QuickBooks Desktop includes excellent reporting and report customization options and includes both a summary and detailed trial balance as well as a working trial balance, which shows beginning totals, adjustments, and ending balances.

QuickBooks Desktop offers three plans; Pro, which is $299.95/year, Premier, at $499.95/year, and Enterprise at $849.10/year.

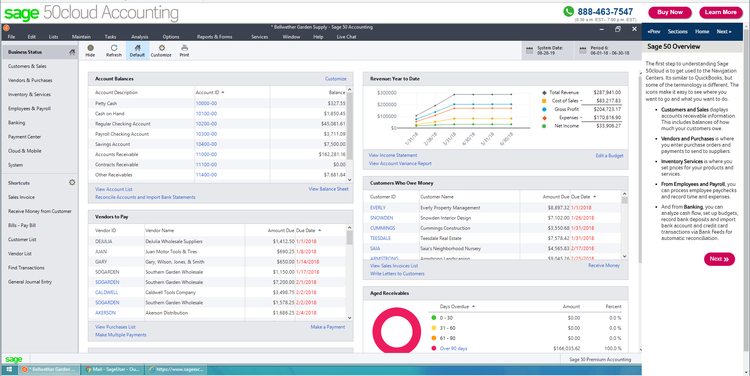

3. Sage 50cloudaccounting

A good choice for small and growing businesses, Sage 50cloudaccounting offers a long list of features that business owners will appreciate, such as complete customer and vendor management, integration with Microsoft 365, and solid inventory management.

Sage 50cloudaccounting offers three plans, making it easy to scale up to the next plan if necessary.

Sage 50cloudaccounting offers a comprehensive company overview dashboard. Image source: Author

Sage 50cloudaccounting offers both a summary and detailed trial balance report, along with a comparative trial balance that allows you to compare trial balance totals for two periods. There are also net changes for the period trial balance report that provides a good view of all changes made during an accounting period.

Multi-period and departmental trial balance reports are available as well. Sage 50cloudaccounting offers three plans; Pro, which is $278.98 annually, Premium, which runs $431.95 annually, and Quantum, with pricing available from Sage.

The adjusted trial balance is key to accurate financial statements

Before posting any closing entries, you want to make sure that your trial balance reflects the most accurate information possible.

Both the unadjusted trial balance and the adjusted trial balance play an important role in ensuring that all of your accounts are in balance and financial statements will reflect the most accurate totals.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.