You probably don’t like spending your Monday morning painstakingly entering into your accounting software every bill you received in the last week. Perhaps only the promise of doughnuts gets you through your monthly bank reconciliation.

Artificial intelligence (AI) is poised to shape the future of accounting, which could take your least favorite bookkeeping tasks off your plate.

Overview: What is artificial intelligence (AI) accounting?

When I hear AI accounting, I imagine an iRobot-type contraption wearing a transparent green visor sitting in the corner of an office (Google “robot accountant” if you need a visual). In reality, AI accounting looks decidedly different. AI systems built into your accounting software help make short work of repetitive accounting tasks, making bookkeeping less of a chore.

If you’ve ever pushed off bookkeeping for your small business, you know how tedious recording dozens of transactions at once can get. AI accounting analyzes your business’s transactions to shorten the time it takes to record sales and business expenses, reconcile accounts, and generate tax documents.

Beyond bookkeeping -- the process of tracking business transactions -- AI helps auditors identify fraud and unusual transactions that warrant further investigation. An artificial intelligence audit system detects patterns consistent with fraud faster and more precisely than humans.

Can artificial intelligence replace accountants in the future?

Accounting involves repetition. You’ll know that from doing your first bank reconciliation. Where there’s monotony, AI can step in to help. That begs the question: Will accountants exist 10, 15 years from now? Will I hand over my paper tape calculator to a robot?

Of course, we can’t know exactly what the accounting profession will look like in a decade, but speculation is part of the human condition. We expect accounting is here to stay, though it might look vastly different as AI technology advances.

We’ve all seen a sensational headline that reads something like this: “10 Professions AI Will Take in the Next 5 Years.” Accounting often makes an appearance. Curiously, you can find just as many articles vouching for the human accounting profession’s longevity.

The reason for the dichotomy is accounting jobs don’t all look the same. One accountant’s job might align closer to a payroll administrator or bookkeeper, while another might be responsible for building a financially sustainable growth plan for a business.

Yet another could be advising clients on tax-advantaged business strategies. There’s not much overlap among these roles, making it hard to pinpoint the entire profession’s trajectory.

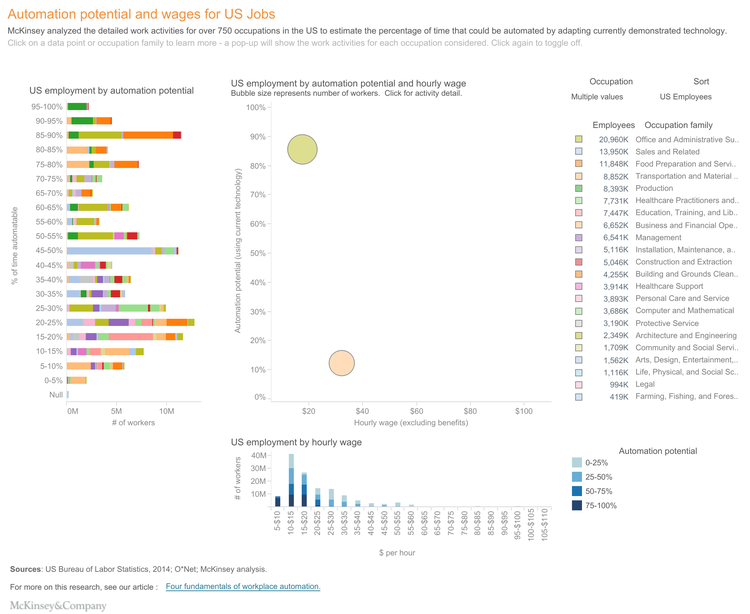

In January 2020, McKinsey & Company released a report on the effect robotics, AI, and machine learning will have on U.S. jobs, including those in the accounting industry. The company examined the “automation potential” for more than 750 job titles based on the percentage of time spent on tasks that a computer could complete using today’s technology.

Accounting shows up in two job descriptions: one that describes administrative bookkeepers and another that refers to auditors, tax accountants, and managerial accountants.

Current technology can complete 86% (top left bubble) of the average bookkeeper’s tasks. Image source: Author

The outlook for bookkeepers looks somewhat bleak: 86% of tasks could be automated. Bookkeepers' roles include recording transactions and completing reconciliations, both of which accounting software can already complete -- with a human's help. Payroll administrators, included in this category, spend time filing paperwork, a job more efficiently executed by payroll software.

The second camp of accountants, including auditors and management accountants, shows a 12% automation potential. Management accountants spend time devising streamlined business processes that maximize efficiency. AI hasn't yet gotten a handle on creating cost-cutting protocols, though it's excellent at following them.

So, will green-visor-wearing accountants be replaced by green-visor-wearing robots? Some, maybe. Those whose jobs revolve around repetitive tasks might see their positions made redundant in the coming years, but those who work on the strategy side of accounting shouldn’t be packing up their cubicles just yet.

The 5 accounting tasks artificial intelligence can do

Accounting software companies invest heavily in AI research and development to save business owners hours on tasks ranging from the mind-numbingly menial to the overly complex. Check out some of the small business accounting tasks AI can accomplish in the background.

1. Bookkeeping

AI has enabled business owners to keep their books with little to no accounting knowledge. Where only 10 years ago every business owner needed to learn how to reconcile a general ledger, you could go years now without knowing what that is.

Many accounting software packages, such as QuickBooks Online, analyze your bank transactions and recommend where to categorize them based on how you’ve recorded similar transactions before. That’s AI at work, processing your past actions -- and perhaps those of other customers -- to predict future actions.

Intuit, which owns QuickBooks, told investors in 2019 about plans to implement new AI features, such as automated transactions. AI in accounting software can also catch errors, like duplicate transactions.

2. Payroll

AI has yet to pervade payroll, but a Bloomberg Tax report cites its impending presence. Instead of having someone spend hours reviewing and approving employee timesheets, an AI system could mark irregular timesheets for a human’s review, and approve the rest.

AI's implications for payroll could spell out significant gains in efficiency for companies with hundreds of employees. Current payroll systems can flag when an employee reports 400 hours worked in a week or when an employee bills a client project that she's not assigned to. An AI payroll system can look deeper, potentially uncovering instances where employees overreport their hours, accidentally or fraudulently.

3. Forecasting

Cash flow is critical to small business growth. When you’re short on money, it’s hard to grow your business. A business flush with cash might be missing out on an opportunity to accelerate its investments. AI accounting systems have implemented cash flow forecasting tools that can estimate your company's future cash position, barring major one-time purchases.

For example, QuickBooks offers a cash flow planner that anticipates your business's cash position up to 90 days in the future. Xero, another popular accounting software, has a technology that predicts your bank balance up to 30 days in the future.

4. Tax preparation

Can your tax accountant recite the more than 80,000-word tax code? Intuit’s AI-powered Tax Knowledge Engine probably can. Not that it’s a competition or anything.

When you're using tax software, there's likely some machine learning going on behind the scenes. If you've read any of The Ascent's tax-related content, you know your eligibility for certain deductions and tax credits relies on no fewer than a million factors. An AI-backed system automatically analyzes your company's financials to pull out potential tax savings for your small business.

5. Accounts payable and accounts receivable

Humans like routines, sometimes to a fault. If you only pay bills on the second Thursday of every month, you might be missing out on early payment discounts for invoices received at the beginning of the month.

An AI accounts payable (AP) system could process your bills the moment they're received and alert you of chances to pay early for a discount. You can integrate apps like Roger with your accounting software to automate AP. Similar apps can help you process and approve expense reports faster.

Likewise, AI-aided accounts receivable (AR) systems can more accurately predict when your customers will pay based on their payment history. AI AR systems are less ubiquitous than automated AP systems, but you can expect to see these features rolling out in the coming years.

How accountants can benefit from using AI

Small business accountants should embrace, not fear, AI. The Journal of Accountancy published an interview with three CPAs who agreed that AI has and will continue to improve their work lives, mainly by cutting out low-value tasks that a computer could more efficiently complete.

Accountants who leverage AI can spend more time doing the work they were trained to do, from analyzing financial statements to advising executives and clients.

See you in the future, maybe

I can't know if my job will be around in the next few decades, but what I know for certain is that AI can make accountants' jobs now more exciting by taking care of our least favorite tasks. And if a robot replaces me in the future, I hope it enjoys my cubicle.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.