Your All-Encompassing Guide to Bank Reconciliations

In this day of electronic banking, many people believe completing a bank reconciliation is no longer necessary. However, small business owners and bookkeepers need to remember that yes, banks do make mistakes, and one of the best ways to find those mistakes is by reconciling all of your bank accounts monthly.

Completing a bank reconciliation entails matching the balances on your bank statement with the corresponding entries in your accounting records. The process can help you correct errors, locate missing funds, and identify fraudulent activity.

It’s true that most accounting software applications offer bank connectivity, which can speed up the reconciliation process immensely. However, connecting your accounting software to your bank or financial institute does not take the place of doing a month-end bank reconciliation.

In this guide, we’ll explain exactly why doing a bank reconciliation is so important, and give you step-by-step instructions on how to complete one.

Overview: What is bank reconciliation?

A bank reconciliation helps ensure that your ending bank statement and your general ledger account are in balance.

Remember, your cash or bank accounts in your general ledger should reflect the same activity that is on your bank statement. If it doesn’t, you need to determine what’s missing. Figure out if it’s missing from the bank statement balance or the general ledger balance, and then reconcile the two numbers.

How to do a bank reconciliation

Most business owners receive a bank statement, either online or in the mail, at the end of the month. Most business accounts are set up to run monthly, though some older accounts may have a mid-month end date.

If that’s the case, the statement can still be reconciled, you’ll just have to run a general ledger report ending on the same day as the bank statement. For instance, if your bank statement period is 1/11/2020 through 2/10/2020, you would run a general ledger or trial balance for that same period.

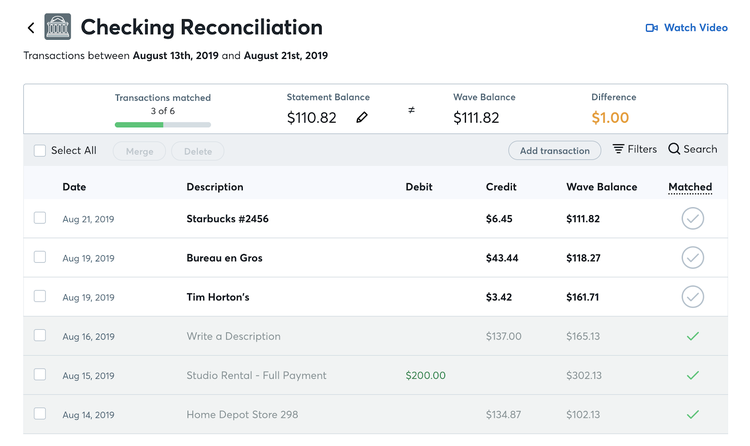

Fortunately, many accounting software applications include a bank reconciliation template or form in the application, which allows you to easily reconcile any of your bank accounts that are connected to your software.

Wave Accounting offers easy reconciliation for all connected accounts. Image source: Author

However, for those preferring to not connect their bank accounts to their software, or for any business using software that doesn’t offer a connectivity option, here are the steps to follow in order to reconcile all of your bank accounts.

Step 1: Prepare your reconciliation form

Your bank reconciliation form can be as simple or as detailed as you like. Below is a good example of a simple reconciliation form. For example, your bank statement shows that your ending balance is $11,450, while your G/L balance according to your trial balance is $10,850.

The goal is to get your ending bank balance and ending G/L balance to match.

Bank Reconciliation

For Period Ending 1/31/2020

| Bank Balance | G/L Balance | |

|---|---|---|

| Ending Balance as of 1/31/2020 | $11,450 | $10,850 |

| Ending Balance |

Tips for preparing your reconciliation form

While completing a bank reconciliation is not difficult, it does require that you pay attention to detail. Pay particularly close attention to the following:

- Double check that your dates match: You’ll never be able to reconcile your accounts properly if your dates don’t match up. If your bank statement is dated 1/30/2020, you’ll want to run your trial balance as of 1/30/2020. If not, you’ll spend a lot of time on a reconciliation that you’ll likely never balance.

- Be sure to use the ending bank balance: If you’re new to reconciling bank statements, it’s easy to jot down the beginning balance rather than the ending balance. Again, attention to detail will help.

Step 2: Compare deposits

If you commonly make deposits into your account, you’ll want to compare your bank account deposit totals to those listed in your general ledger. Remember, banks make mistakes, too, with transposition errors common. Be sure all of your bank deposits match.

Tips for verifying bank deposits

This is an important step. For instance, what happens if you have a deposit in the amount of $850 that is recorded properly in the G/L, but the bank leaves off the zero, recording the deposit as $85 instead?

That means your account could quickly become overdrawn, with penalties and fees adding up in a matter of days. This is probably the most important step in the entire bank reconciliation process.

- Record your cash deposits in the G/L in the same amount as the deposit: While this may sound confusing, what it means is don’t post three deposits together in one lump sum in your G/L while keeping them separate when depositing. For instance, you have three separate deposits on January 15 in the amount of $250, $600, and $99.50. Instead of recording them as $949.50, record them separately, the same way they were deposited.

- Don’t assume the bank is always right: We trust our money with banks every day, and for the most part, there are no problems. However, it only takes a few minutes to check the accuracy of your deposits. Assume nothing.

Step 3: Compare checks and adjust bank total

It’s common for your bank statement to have a higher ending balance than your G/L account shows. While it may be tempting to assume you have more money in the bank than you think, it’s a safe bet that the difference is checks and other payments made that have not yet hit the bank.

The easiest way to check for this is to print a check register for the month and compare it to the checks that have cleared the bank. Any checks that have been issued that haven’t cleared the bank must be accounted for under your bank balance column.

For instance, you paid two vendors by check on January 31. Those payments are recorded in your G/L, but they have yet to hit the bank. You need to subtract both checks from your bank balance, as well as any other checks listed in your check register that haven’t cleared.

Bank Reconciliation

For Period Ending 1/31/2020

| Bank Balance | G/L Balance | |

|---|---|---|

| Ending Balance as of 1/31/2020 | $11,450 | $10,850 |

| Check # 2100 | ( $400) | |

| Check # 2101 | ( $425) | |

| Ending Balance |

Tips for finding outstanding checks

When you're completing a bank reconciliation, the biggest difference between the bank balance and the G/L balance is outstanding checks.

- Print a check register and compare it to the checks that have cleared: The easiest way to check for outstanding checks is to print a check register and compare it to checks that have cleared. If this step isn’t completed, the bank balance will be overstated.

- Check ACH transfers as well: Not all ACH payments happen immediately. If you pay vendors by ACH transfer, it’s possible that a payment made late in the month will not clear the bank until the following month. Be sure to check all outgoing payments, no matter what form they may take.

- Be sure to include outstanding checks from previous months: Remember to check each month to be sure that any outstanding checks from the previous month have cleared the bank. If they haven’t, you will have to continue to put them on the bank reconciliation form until they clear, or until you cancel the check in order to reissue a new one.

Step 4: Find G/L adjustments

Notice that the bank reconciliation form above still does not balance, even after including the outstanding checks. This means the bank has made an adjustment to your account that has not been recorded in your G/L.

These items are typically service fees, overdraft fees, and interest income. You'll need to account for these fees in your G/L in order to complete the reconciliation process.

Tips for finding G/L adjustments

The easiest way to find these adjustments when completing a bank reconciliation is to look at the bank fees. You’ll also want to look at any miscellaneous deposits that haven’t been accounted for. Once you locate these items, you'll need to adjust your G/L balance to reflect them.

For instance, the bank charged your business $30 in service fees, but it also paid you $5 in interest. Below is an example of a completed bank reconciliation statement.

Bank Reconciliation

For Period Ending 1/31/2020

| Bank Balance | G/L Balance | |

|---|---|---|

| Ending Balance as of 1/31/2020 | $11,450 | $10,850 |

| Check # 2100 | ( $400) | |

| Check # 2101 | ( $225) | |

| Bank Fees | ( $30) | |

| Interest Income | $ 5 | |

| Ending Balance | $10,825 | $10,825 |

- Check the bank for any service fees: Service fees will not be included in your G/L balance since they weren’t charged to your account until the end of the bank statement period. These will need to be adjusted in your G/L.

- Check for any unaccounted for deposits as well: Your bank may pay you monthly interest, or someone may have transferred money to your account that has not been accounted for in your G/L. Any deposits in transit that are not already posted to your G/L will need to be added and a journal entry created in order for your reconciliation to balance.

Step 5: Create journal entries

The final step in the bank reconciliation process is to record journal entries to complete the balancing process.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/31/2020 | Cash | $5 | |

| 1/31/2020 | Interest Income | $5 | |

| 1/31/2020 | Bank Fees | $30 | |

| 1/31/2020 | Cash | $30 |

You will be increasing your cash account by $5 to account for the interest income, while you’ll be reducing your cash account by $30 to account for the bank service fee.

Tips for creating journal entries

Remember that items such as outstanding checks do not need be recorded into the G/L since they are already there. However, anything that affects the G/L such as unexpected deposits, interest income, or service fees will need to be recorded.

- Look for items not already accounted for: Since part of the bank reconciliation process includes matching checks and deposits, you’ll want to look for anything that does not fit into these categories, as well as items such as a check that clears that does not belong to your business or a deposit you did not make.

- Don’t forget to complete the necessary journal entries: While it’s exciting to get your bank reconciliation form to balance, it’s easy to overlook bank reconciliation journal entries. Be sure you see the process through and that your new G/L report reflects the new entries before closing entries are completed.

FAQs

-

Any accounts that are active should be reconciled at month end, even if there are only a few transactions.

-

If you’ve entered adjustments for both your bank balance and your GL balance, and there is still a bank reconciliation problem, you will need to continue to review both your bank statement and your G/L to locate the missing item.

This may require going back several months in order to find the issue, which is why reconciling each month is so important.

-

If you’re doing a bank reconciliation for the first time, it can be helpful to look at a bank reconciliation example to ensure that you’re doing it properly.

Bank reconciliations are a must

Among the various accounting terms and processes you need to understand, such as preparing a budget or tracking business expenses, perhaps one of the most important is completing the bank reconciliation process for all of your active bank accounts.

Designed to keep your bank and your G/L in balance, the bank reconciliation process also helps you correct possible errors, account for uncashed checks, and even locate missing deposits. Don’t underestimate the importance of this very important tool.

If you’re interested in automating the bank reconciliation process, be sure to check out some accounting software options.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles