If you’ve just started your business, chances are that you have yet to create a budget. But it’s difficult to grow your business, meet any short- or long-term goals, or obtain outside investors or financing without accurate financial projections, which requires a small business budget.

Creating a budget also plays an important role in the the accounting cycle, which ensures that all financial transactions are properly accounted for.

And while the act of creating a budget may seem daunting, it’s much like creating a personal budget. You identify what you own of value (your assets), estimate your upcoming expenses, and account for and grow your revenue base.

If you know how to create an expense report or how to write an invoice, and are comfortable with the basics of bookkeeping, you can certainly handle business budget planning.

By creating, and more importantly, following a budget, you can eliminate wasteful spending, develop plans to expand your revenue base, and work toward your set goals in a productive fashion.

5 types of budgets for businesses

Budgets help businesses track and manage their resources. Businesses use a variety of budgets to measure their spending and develop effective strategies for maximizing their assets and revenues. The following types of budgets are commonly used by businesses:

1. Master budget

A master budget is an aggregate of a company's individual budgets designed to present a complete picture of its financial activity and health. The master budget combines factors like sales, operating expenses, assets, and income streams to allow companies to establish goals and evaluate their overall performance, as well as that of individual cost centers within the organization.

Master budgets are often used in larger companies to keep all individual managers aligned.

2. Operating budget

An operating budget is a forecast and analysis of projected income and expenses over the course of a specified time period.

To create an accurate picture, operating budgets must account for factors such as sales, production, labor costs, materials costs, overhead, manufacturing costs, and administrative expenses. Operating budgets are generally created on a weekly, monthly, or yearly basis. A manager might compare these reports month after month to see if a company is overspending on supplies.

3. Cash flow budget

A cash flow budget is a means of projecting how and when cash comes in and flows out of a business within a specified time period. It can be useful in helping a company determine whether it's managing its cash wisely.

Cash flow budgets consider factors such as accounts payable and accounts receivable to assess whether a company has ample cash on hand to continue operating, the extent to which it is using its cash productively, and its likelihood of generating cash in the near future.

A construction company, for example, might use its cash flow budget to determine whether it can start a new building project before getting paid for the work it has in progress.

4. Financial budget

A financial budget presents a company's strategy for managing its assets, cash flow, income, and expenses. A financial budget is used to establish a picture of a company's financial health and present a comprehensive overview of its spending relative to revenues from core operations.

A software company, for instance, might use its financial budget to determine its value in the context of a public stock offering or merger.

5. Static budget

A static budget, unlike a flexible budget, is a fixed budget that remains unaltered regardless of changes in factors such as sales volume or revenue. A plumbing supply company, for example, might have a static budget in place each year for warehousing and storage, regardless of how much inventory it moves in and out due to increased or decreased sales.

How to make a budget for your small business

One of the easiest and most accurate ways to create a budget is to review your revenue and costs for the past year and use those numbers when creating your new budget.

If your business is brand new, you’ll have to be a bit more creative, relying on obtaining numbers from the last few months, or researching similar businesses to obtain accurate estimates on revenue and expenses.

However you do it, learning budgeting for business is a lot easier than you imagine.

Step 1: Review your revenue

The first step toward creating a budget is to examine your revenue: not just the total for any given time, but specifics, such as months when revenue rose or dipped. This is particularly important for managing cash flow.

For instance, many retailers earn a large part of their yearly revenue in the months of November and December, while January and February typically are very slow in sales.

Knowing this information and including it in your budget can help you be better prepared for both the busy and the slow months.

Step 2: Take a look at your fixed expenses

As a small business owner, you should know what your regular monthly expenses are. If you know how to track business expenses such as rent, insurance, salaries, and utilities, you can create a budget.

Factoring these items into your budget helps to ensure that you’re accounting for these expenses properly.

Step 3: Factor in variable expenses

Whether in our personal lives or in business, we need to factor in variable expenses.

For instance, you may need to hire a temp if your office manager becomes unexpectedly ill. Other variable costs can include advertising and marketing, as well as postage or printing costs. Travel is another cost that may be planned (you know you’re going to a convention in May), but the final cost is not yet known.

Factoring in variable expenses can help with your bottom line. Don’t be conservative in estimating these costs, You’d rather they be too high, leaving you more money than expected for the month than the opposite.

Step 4: Include one-time and unexpected costs

While it may seem counterintuitive to include unexpected costs into your budget when they haven’t even occurred yet, you can safely assume that something unexpected will happen.

Your computer crashes and needs to be repaired, or worse, replaced. Or maybe your company car dies. These are both examples of unexpected costs. You can also plan for one-time costs.

For instance, you know you’ll be upgrading employee laptops in December. This allows you to plan for this expense in advance, ensuring that the funds should be available.

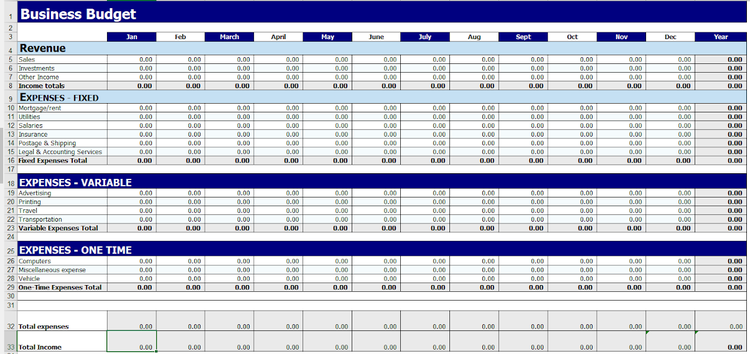

Step 5: Put all your information into a budget format

The ideal situation is to prepare your budget details in your accounting software application.

However, not all accounting software, particularly those designed for small businesses, include a budgeting feature. In that case, you can use Microsoft Excel or similar spreadsheet software to prepare your budget.

This Microsoft Excel spreadsheet can be used to create your business budget. Image source: Author

One of the main advantages of preparing a budget in your accounting software application is that you can track budget versus actual revenue and expenses. This lets you see how accurate (or not) your budget is, allowing you to perhaps make some mid-year adjustments.

Things to consider when making a budget for your business

Creating a budget is a great first step toward managing your business properly. However, it’s important when creating your budget that you do your best to make it as accurate as possible. There are numerous ways to do that, including the following:

1. Be conservative with revenue

When entering revenue totals, be conservative. At the beginning of the year, we're all optimistic. But be sure when you budget your revenue, you enter numbers that are as accurate as possible.

When planning for revenue growth, be conservative as well, perhaps budgeting for a 5%-10% growth for the year. If you exceed that level, great. You’ll have money to spare. But if you don’t, you’ll end up with a loss, which is not where you want your business to be.

2. Plan for growth

Planning for growth is important when calculating budget revenue, but you’ll have to account for added expenses as well.

Yes, if your business grows, your revenue will increase, but so will your overhead, as you increase advertising, add employees, and pay additional taxes. So when planning for business growth, be sure to factor in your increased expenses as well.

3. Unexpected expenses

This is an important one. One catastrophe can be disastrous for your business, particularly if you operate on limited cash flow.

When budgeting, just assume that your business will have at least one major unexpected expense during the year. If it doesn’t, great. You can bank that money for when the unexpected does occur.

4. Long-term goals

Before completing your budget, you might want to consider your long-term goals.

Do you plan on increasing your customer base each year by 5%? Perhaps you’re working out of your home, but plan on renting or buying a building for your business in the next year or two.

Be sure to factor that into your budget, and plan your income and expenses accordingly.

The best accounting software for tracking your small business budget

Not every accounting software application offers budgeting capability, but the following small business accounting software applications do.

If you’re looking to make the move to accounting software, or are looking for an application that allows you to create and manage a budget for your business, be sure and check out these applications.

1. Xero

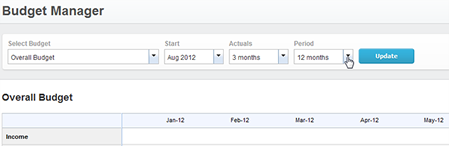

Xero lets you easily create a budget using their Budget Manager feature. You can choose your start date for any budget, and prepare a budget of 3, 6, 12, or 24 months. Xero also allows you to compare any created budget to actual totals, to see how far under or over budget your company is.

The Budget Manager lets you choose start date, actuals, and period of time for each budget. Image source: Author

You can copy budget details from actuals for the prior year, copy data from an existing budget, or create a new budget from scratch. Adjustments can be made for each budget period, so you can adjust the amount each month to increase budgeted totals by a set amount or by percentage. This is a great way to budget for growth.

2. QuickBooks Online

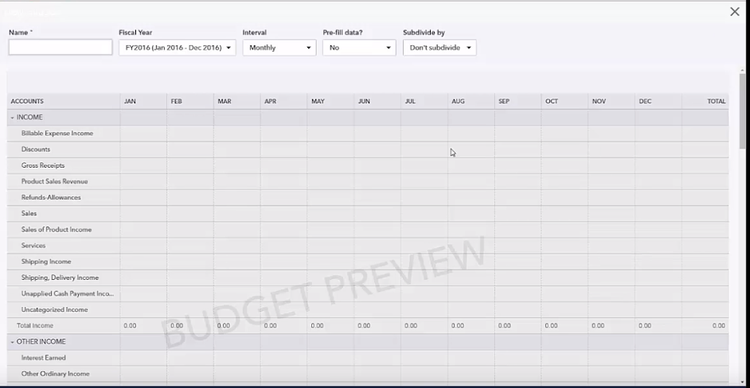

The budgeting feature in QuickBooks Online lets you create a yearly budget easily. Just choose the correct fiscal year, click on the “Add Budget” button, and start entering budget details.

You can choose to pre-fill budget data using actual QuickBooks Online data or just create a budget from scratch. You have the option to create a monthly, quarterly, or yearly budget, and can choose to subdivide your budget by customer, class, or location, or just enter a single total into the appropriate fields.

The Budget Preview feature lets you preview your newly created budget for accuracy. Image source: Author

Budget data can be edited when desired, and to get a sense of your business performance, run the Budget vs. Actuals report, which displays current company performance to date.

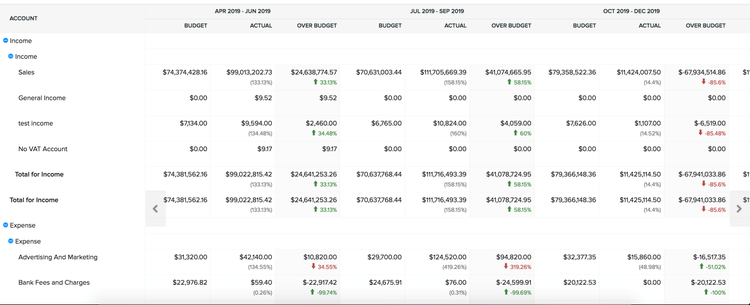

3. Zoho Books

Zoho Books offers excellent budget creation capability, offering three ways to enter budget data:

- Auto-fill budget information based on current income and expense accounts

- Pre-fill from last year’s actual numbers

- Start from scratch, entering budget numbers manually

Like Xero, Zoho Books lets you enter budget numbers for a single period, then specify a percentage increase or decrease in budgeted numbers.

For instance, if your short-term plan for this year is to increase your revenue by 5% each quarter, you can enter that information in Zoho Books, and it will automatically calculate the 5% increase and auto-fill the rest of the budget. You can also apply a fixed amount for each period.

Zoho Books offers a comprehensive budget management feature with multiple entry options. Image source: Author

At the end of the specified budget period, you can compare actuals against your budgeted amounts to view business performance and make any adjustments going forward.

Get started on your budget today

Now that you know how easy it is to prepare a budget for your small business, what are you waiting for?

Completing a budget for your business will provide you with the information you need to grow your business, plan for the unexpected, and stay on track for the future.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.