The chart of accounts lists all the accounts found in your general ledger, including both temporary and permanent accounts. It’s necessary to properly manage the financial transactions that your business makes.

Overview: What is a chart of accounts?

One of the first things you learn in accounting 101 is the importance of the chart of accounts. The backbone of your entire business, the chart of accounts is where all of your general ledger accounts reside. The chart of accounts records every financial transaction that your business has made.

It will be different for each business type, with a manufacturing company using a different chart of accounts than a service business or a nonprofit organization.

When set up properly, your chart of accounts can provide you with detailed information about your business. And it helps to ensure that the information you do retrieve, such as financial statements, give an accurate representation of your business.

How does a chart of accounts work?

Every time you deposit a payment, record a bill that needs to be paid next month, or send an invoice to a customer, it’s recorded in the general ledger using the accounts found in your chart of accounts. The chart of accounts contains five types of accounts:

- Asset accounts: Assets are anything that your business owns

- Liability accounts: Liabilities are anything that your business owes

- Equity accounts: Equity represents ownership of the business

- Revenue accounts: Revenue is the money earned from goods and services

- Expense accounts: Expenses are considered the cost of doing business

The first part of your chart of accounts houses balance sheet accounts such as assets, liabilities, and equity, while the second part of your chart of accounts lists your income statement accounts, which are revenue and expenses.

Every chart of accounts is structured this way, though you can add additional accounts or sub-accounts to better track transactions specific to your business type.

Examples of a chart of accounts

The accounts in a chart of accounts will vary depending on your business size and type. Below is an example of a chart of accounts for a small service business. The chart contains all five account types found in all accounting chart of accounts.

| Account Number | Account Name | Account Type |

|---|---|---|

| 1000 | Cash | Assets |

| 1010 | Savings Account | Assets |

| 1020 | Accounts Receivable | Assets |

| 1030 | Computers | Assets |

| 2000 | Accounts Payable | Liabilities |

| 2010 | Notes Payable | Liabilities |

| 3000 | Owner Equity | Equity |

| 3010 | Owner Withdrawals | Equity |

| 4000 | Service Payment Earned | Revenues |

| 5000 | Administrative Payroll | Expense |

| 5010 | Rent | Expense |

| 5020 | Utilities | Expense |

| 5030 | Office Supplies | Expense |

The best accounting software for chart of accounts

Managing your chart of accounts is much easier when using accounting software. Whether you’re a one-person operation or have a staff of 10, here are some good choices to simplify chart of accounts management for your business.

1. Kashoo

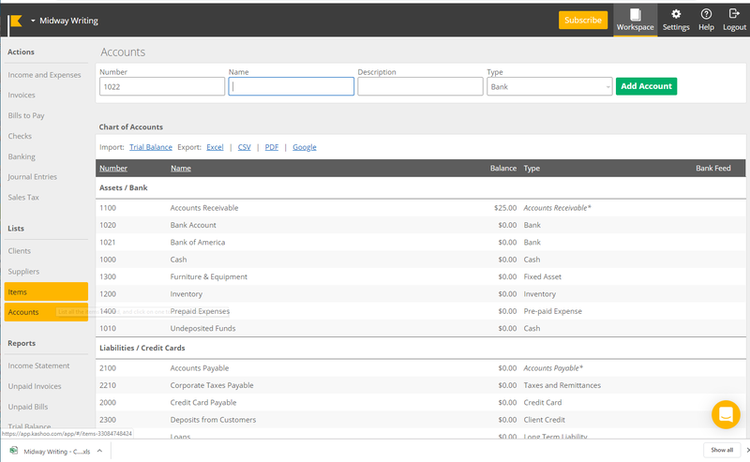

An excellent choice for sole proprietors and new businesses, Kashoo combines an easy-to-use interface with solid accounting capability, including a default chart of accounts. Unlike other software applications, Kashoo does not include an option for importing an existing chart of accounts.

Kashoo’s chart of accounts is completely customizable. Image source: Author

Kashoo uses a basic chart of accounts structure which allows new users to choose their business type during product setup. Kashoo then creates the appropriate chart of accounts during the setup process.

Kashoo’s chart of accounts includes five account types: Assets, Liabilities, Equity, Income, and Expense, with the ability to create sub-accounts if necessary.

This structure, while simple, is sufficient for small businesses that don’t need to track inventory or purchase returns and allowances. Kashoo does fall short on reporting options, with limited reports available, though the application can run basic financial statements.

Kashoo’s pricing is straightforward and all-inclusive. The cost is $199/year, or $19.99/month, with no extra charge for additional users or features.

2. QuickBooks Online

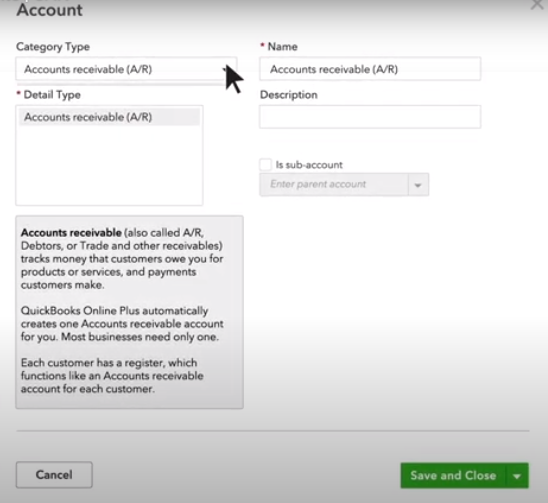

QuickBooks Online is well suited to a variety of small businesses, from the one-person operation to the growing business. QuickBooks Online offers a customizable chart of accounts structure and online banking, expense management, sales, and invoicing.

It also offers the option to upload an existing chart of accounts if you wish.

QuickBooks Online makes it easy to add a new account to your chart of accounts. Image source: Author

QuickBooks Online includes a default chart of accounts that can be easily customized to better suit your business. You can add departments or segments in your chart of accounts for better tracking.

Although you are limited to 250 accounts, that should be sufficient for most small businesses. In addition, QuickBooks Online offers good reporting options, including standard financial statements and reports designed for your accountant or CPA.

QuickBooks Online pricing starts at $10/month for the Simple Start plan, though most small and growing businesses would benefit most from the Plus plan, available for $35/month for the first three months.

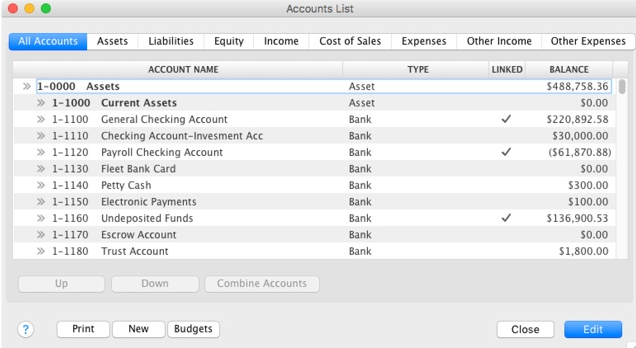

3. AccountEdge Pro

AccountEdge Pro is well-suited for small and growing businesses, offering a wide variety of features including a customizable chart of accounts, along with sales, time and billing, inventory, and payroll modules. AccountEdge Pro gives you the option to upload your own chart of accounts.

AccountEdge Pro offers default numbering for all account types. Image source: Author

If you choose not to upload an existing chart of accounts, you can choose from 100 chart of accounts templates in AccountEdge Pro, or you can create your own. The default chart of accounts includes account numbers and a number designating the account type. The numbers are:

- Assets

- Liabilities

- Equity

- Income

- Cost of Sales

- Expense

- Other income

- Other expense

For instance, all of your asset accounts will use the number 1, followed by four numbers (1-XXXX), while all of your liability accounts would start with the number 2 (2-XXXX).

This is a great structure for businesses that manufacture or sell products, and it’s a good fit for those looking for more flexibility in their chart of accounts structure. In addition, you can add sub-accounts for more in-depth tracking capability.

Reporting options in AccountEdge Pro are excellent, with customizable financial statements available.

AccountEdge Pro has a one-time fee of $399 for the on-premise application, while Priority Zoom, the cloud application, is $50/month, with both plans supporting up to five users.

The chart of accounts is the heart of your business

Whether you’re a freelancer, a sole proprietor, or have been in business for years, your chart of accounts is the most important component of your business.

Every single transaction you make, from recording your operating expenses to managing your accounts payable is recorded in your chart of accounts. But remember, if your chart of accounts is not set up properly, your financial statements won’t be accurate.

The best way for you or your bookkeeper to manage your chart of accounts is by using accounting software tailored for your business type. If you’re interested in a better accounting software solution for your business, check out The Ascent’s accounting software reviews.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.