Perhaps you’re under the mistaken impression that expense reports are only necessary for large businesses with thousands of employees.

While it’s true that mid-sized and large businesses process thousands of expense reports annually, an expense report is just as important for small businesses, and it some ways, it may be even more important.

Another myth is that expense reports are only a necessity for your employees. Not true.

An expense report is a necessity for any employee who wants to be reimbursed for the business expenses they’ve incurred such as mileage, gas, or meals.

But as the owner of the business, you should also be keeping track of any business expenses you may incur yourself.

While the necessity may be different, creating an expense report can assist you immensely in your regular business operations, letting you know exactly how much you’ve spent on gas, mileage, or transportation for the year.

This information can be invaluable when preparing your business tax returns, or even for creating financial projections for the following year.

How you can create your own expense report

- Expense reports are not just for your employees. Completing an expense report for your own expenses will help you better track your spending levels.

- Most accounting software applications do not offer the ability to create an expense report. Instead, they work with third-party applications to capture receipt images, record expenses, and create expense reports.

- If you’re looking for free expense report templates, check out the ones offered in Microsoft Excel. It has several variations available for tracking expenses, and it also offers a mileage log and a template to estimate costs.

What is an expense report?

An expense report tracks expenses that have been incurred during the course of performing necessary job duties. An expense report can be many things: a mileage log used for reimbursement, a receipt of hotel and parking expenses, or an account of meals and entertainment expenses.

What information is commonly found on an expense report?

- Expense date

- Type of expense (meals, lodging, parking, mileage, etc.)

- Total amount of the expense

- The account the expense should be charged to

- A subtotal for each expense by category

- A grand total of all expenses

- A subtraction of any cash advances

- The total due to the employee

In the past, creating an expense report has been a dreaded task, but the introduction of expense report apps, as well as easy-to-use templates, has made the process less tedious.

In many cases, expense reports are typically used to itemize employee expenditures for which that employee is requesting reimbursement, but expense reports can also be used to justify expenses incurred when using company-provided credit cards as well.

Benefits of using an expense report

There are more than 30.2 million small business owners as of 2018, and they’re likely producing a lot of expense reports.

Of course, business owners are the main beneficiary of expense reports. Having an itemized report from your employees (or yourself) allows you to see exactly how much your travel-related expenses really amount to.

Having this information at your fingertips also allows you to better budget for those expenses, or perhaps cut down on travel if costs are excessive.

How to create an expense report

If you’re using small business accounting software such as QuickBooks Online, Xero, or FreshBooks, you likely know that it’s not possible to create an expense report in these and similar applications.

Instead, most small business accounting software applications have partnered with third-party expense report apps that were created specifically to manage expenses and create expense reports.

You might also be using one of the free templates that can be found on the internet, or a Microsoft Excel template.

There are a variety of ways to create an expense report depending on your business, the accounting software you use, and how automated you’d like the process to be. Regardless of the tools you’re using, the most important thing is that you create one.

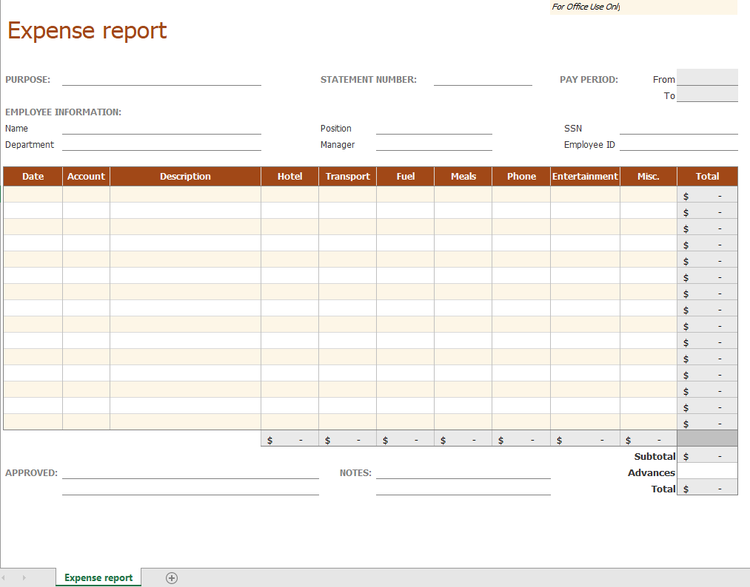

Use one of the templates available online

Many smaller businesses opt to use a common expense report template like the one offered by Excel. Excel templates can be downloaded easily and allows you to input line item data into the appropriate columns, where it will be automatically calculated.

This Excel template tracks expenses by category with automatic calculation. Image source: Author

Source: Microsoft Excel software.

This Excel spreadsheet can be particularly handy for small businesses that wish to track expenses without the added cost of purchasing additional software.

The default business expense categories included in the template are convenient, and they can be easily edited if you wish. You can always add an additional column if you have other expenses that don’t fall into these categories.

Of course, the information on the spreadsheet will need to be keyed into your accounting software in order to process any reimbursements due your employees -- and to ensure your business expenses are accurate and up to date in your accounting software application.

Use accounting software

While accounting software plays a vital role in the expense management process, most of the small business accounting software applications on the market today do not offer a way to create an expense report.

Instead, you can opt to use one of the many third-party expense management apps that are designed just for that purpose.

Use expense management software

Certify offers direct integration with QuickBooks Online, while Abacus integrates with QuickBooks Online, Sage, and Xero.

ReceiptBank is another affordably priced expense management software application that automates the entire report creation process. Even Zoho offers an Expense Management app designed to integrate with Zoho Books.

The benefit of using these third-party applications is the level of automation they bring to the process of creating an expense report.

These applications are designed to do the following:

- Capture receipt images

- Reconcile expenses with financial institutions

- Create expense reports automatically

- Route to the appropriate individual(s) for approval

Expense report templates

While there are a lot of expense report templates available on the internet, your best bet may be to use one of the many expense report templates available in Excel.

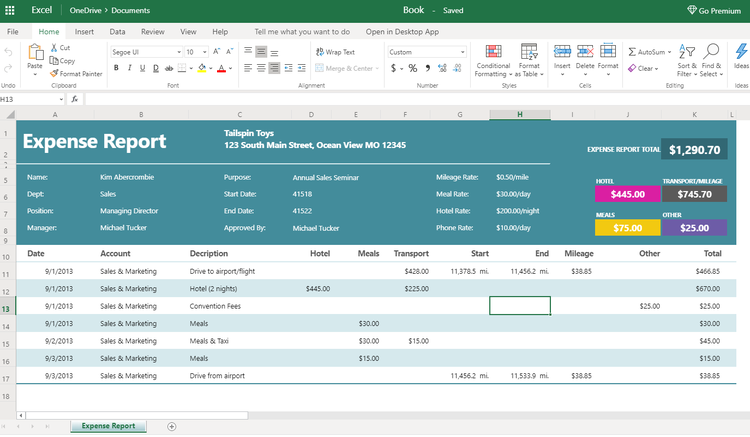

Excel’s Expense Report with Mileage

The Expense Report with Mileage template provides you with the ability to adequately track common expenses including hotel, meals, and transportation, but the really useful part is its ability to track transportation-related costs.

Microsoft Excel’s Expense Report with Mileage nicely tracks transportation and mileage. Image source: Author

Source: Microsoft Excel software.

You can enter your starting and ending mileage, and the spreadsheet will automatically calculate the related mileage expense. The interface is pleasantly laid out and displays totals for each of the included categories at the top of the spreadsheet that can be easily dropped into your accounting software in order to process reimbursements or just keep track of the charges.

Excel’s Travel Expense Calculator

While not an expense report template, the Travel Expense Calculator provides you and your employees with an easy way to calculate potential expenses by entering transportation, lodging, and meal expenses, with columns for each. This can prove to be a useful tool to determine if a trip is financially viable prior to incurring the costs, and it can be especially useful if your business operates on a tight budget.

Excel’s Mileage Log and Expense Report

The Mileage Log and Expense Report can be an indispensable tool for anyone who spends a lot of time on the road, and it’s available to both you and your employees.

Expense reporting for your business

Whether you’re a one-person operation, or you manage a staff of 10, expense reporting is an essential part of your business operation. If you or your employees find yourselves on the road (or at airports) a lot, it’s worth the time to investigate the best way to create expense reports.

It will be time well spent!

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.