One of the first choices a retail business will make is how to account for inventory.

While it seems simple at first glance -- “just count everything in the stock room and that’s our inventory” -- small changes in your inventory accounting method can lead to big changes in costs of goods sold and net income down the line.

The three main ways to account for inventory are FIFO, LIFO and average cost. In this article, we’ll focus on the most popular: the FIFO system.

Overview: What is FIFO?

FIFO stands for: first in first out. It is the most intuitive bookkeeping method for inventory. The first units purchased will be the first units applied to cost of goods sold.

In most businesses, this is also how the inventory is sold - for example, you will never see a grocery store putting its newest gallons of milk in the front of the shelf.

Because of the simplicity in bookkeeping and the close relation to real life, FIFO is the preferred method for most businesses and the IRS.

How to calculate FIFO

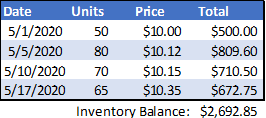

Take a look at the table below for an example of inventory purchases over a few weeks:

Sample Inventory Table 1 Image source: Author

In this example, the current total for inventory on the balance sheet would be $2,692.85. If the business then sold 70 units, the inventory balance would decrease by $702.40 (50 x $10.00 + 20 x $10.12) and the cost of goods sold for the purchase would be the same amount.

Your accounting software will then wipe off the 5/1 purchase and decrease the 5/5 purchase to 60 units to use for the next sale.

Sample Inventory Table 2, after first sale Image source: Author

In this example, the cost of goods sold (CoGS) would be calculated as the transaction happens. CoGS can also be calculated at the end of the period with the following formula: Beginning Inventory + Purchases - Ending Inventory = Costs of Goods Sold.

Use this as a check at the end of the month (by subtracting out the amount for each sale using the time of sale calculation above), to ensure that calculations are being done correctly.

FIFO vs. LIFO: What’s the difference?

The other commonly used inventory accounting method is LIFO, or last in first out. In this method, the most recently purchased units are expensed first. Using our original table from above, the cost of goods sold for the sale would be $723.50 (65 x $10.35 + 5 x $10.15) - a $21.10 or 3% difference.

This may not seem like a lot, but for businesses doing sales in the millions or billions of units and businesses that do not have high mark-ups it makes a big impact.

This is where strategy comes in. For most raw material inventory, prices are generally inflationary -- that is, they go up over time, like the cost of face masks or secondhand Tom Brady Tampa Bay Buccaneers jerseys.

That means the most recent prices will usually be higher than older prices, so using LIFO will increase CoGS and decrease the gross margin and net income.

Following the same logic, if inventory prices are deflationary, like they were for oil or secondhand Tom Brady New England Patriots jerseys in Spring 2020, FIFO will lead to reduced net income.

Businesses trying to reduce their tax burden will often elect to use LIFO when their prices are inflationary even if they do not physically sell newer units first. Using LIFO decreases book net income, but actual cash flow increases because they pay less in taxes.

If an owner is looking to sell their business or if distributions are calculated based on net income (with inflationary inventory prices), the business may choose to use the FIFO method to keep net income high.

Benefits and disadvantages of using the FIFO method within your small business

I’m sure this is more than you ever expected to learn about inventory accounting methods, so let’s recap the advantages and disadvantages of using FIFO and then conclude here.

Advantages of FIFO

- FIFO likely best matches your financial statements with your actual practices. Unless you sell an unusual product, it’s likely that you try to sell the oldest items first to keep them from becoming stale. FIFO allows you to account for inventory the same way.

- External auditors, the IRS and other regulatory boards likely prefer FIFO. You won’t necessarily be penalized for using LIFO or average cost, but if you’re switching constantly, these organizations will take notice.

- You’ll likely have higher profits. If your material costs are inflationary, then you will be using the lower cost units of inventory in CoGS calculations. This helps if you are trying to sell your business, calculating distributions based on net income or if a third party like a bank is evaluating your repayment ability.

Disadvantages of FIFO

- You’ll likely have higher profits. Higher profit is not always a good thing. I had an accounting professor in college whose mantra was, “Defer, defer, defer … die.” Generally, it is better to defer taxes to a later date. Of course, you can’t escape the IRS so those taxes will be due someday, and, for most small business owners, dying isn’t the best option.

- You could be overstating profits. Beyond deferring taxes, it’s possible that if your business has a slow inventory turn you could be applying costs for materials that were purchased long ago at prices far lower than the current market price. This could create a situation where overstated net income leads to more aggressive expansion or leverage than what is supported by the actual cash flow of the business.

Is FIFO the way to go?

One of the key accounting guidelines of accounting is the matching principle, which dictates that a company should do its best to report revenue or expenses in the same period that they are incurred. The FIFO method is the best way to do this when accounting for inventory.

Using a counterintuitive method like LIFO, or even worse, switching between methods based on how you want net income to look will serve only to increase how complicated your accounting is and add questions to the auditor’s list.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.