Do you remember getting your first smartphone? Mine was a BlackBerry Bold. At the time, people marveled at the idea of checking emails and making phone calls on the same device.

We expect more out of our smartphones these days. We complain when our iPhones freeze up when they’re streaming to our TVs, making video calls to friends, and sending emails simultaneously.

Business owners should expect more from their accounting software, too. Enter the FreshBooks’ mobile app: a solution for self-employed people looking to keep their books updated while they’re away from the office.

Overview: What is FreshBooks?

FreshBooks is accounting software that helps small businesses issue invoices to customers, track business expenses, and create financial statements. Geared for one-person and startup businesses, FreshBooks sports a Ascent score of 9.2 out of 10 for its easy-to-use interface and live customer support.

When you sign up for a FreshBooks account -- which will run you between $14.99 and $49.99 monthly -- you get access to its mobile app available on Android and iOS devices. There’s also a 30-day free trial that lets you test out the service before you commit.

5 features of the FreshBooks mobile app

The FreshBooks app takes accounting on the go, making it easier to record business transactions before you get back to the office.

1. Invoicing

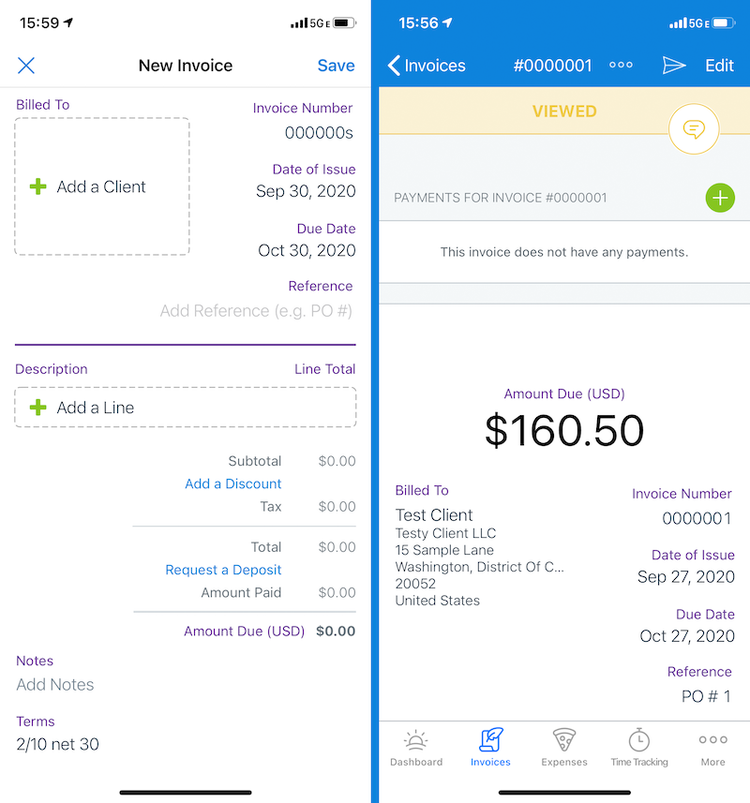

The FreshBooks mobile app gives you no excuse to get lazy about sending out invoices on time. Like the web-based version of FreshBooks, you can fill in client information as you fill in an invoice. This feature is ideal for freelancers who often work with new clients.

As an accounting tutor, I would often have to wait to send invoices until I got home from sessions with students because of my clunky invoicing system. Had I used FreshBooks mobile at the time, I likely would have invoiced faster, thereby decreasing my days sales outstanding.

Businesses with standard services and rates can save them into the app to speed up the invoicing process.

The FreshBooks app tracks when a customer has viewed your invoice. Customers can pay using FreshBooks Payments, although fees apply.

FreshBooks lets you know when a client has viewed your invoice. Image source: Author

2. Expense tracking

For many, expense tracking is a Sunday project where you turn your jacket pockets inside out and let all of your business receipts from the week rain down onto your dining table. Then, painstakingly, you enter each expense into your accounting software.

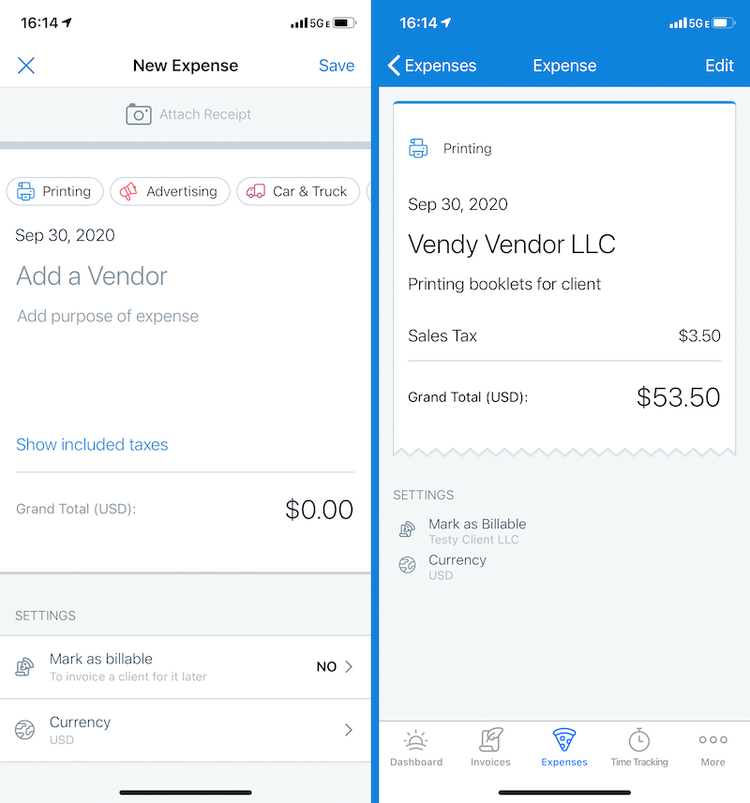

FreshBooks integrates with your business bank account or credit card to import your business expenses, which is a common accounting software feature. For expenses paid in cash, you can use the app to enter the expense amount, vendor, and category. Don’t forget to snap a photo of your receipt for safekeeping.

The app includes an option to bill your client for expenses. You can include a photo of the receipt in the client’s invoice or add a markup.

You can mark expenses as billable to your clients. Image source: Author

Immediately recording cash transactions reduces the likelihood of missing out on deductible business expenses. The expenses you enter in the app will appear in your company’s income statement.

3. Time tracking

FreshBooks’ time tracking feature is ideal for businesses that charge clients by time worked. The mobile app lets users either log time worked or start a timer within the app.

Either way, FreshBooks stores the time worked, client, project, service, and notes. You can also track time for non-client work.

The time tracking and invoices work together. The app can populate a new invoice with information entered in the time tracking feature.

FreshBook’s time tracking feature integrates with its invoicing feature. Image source: Author

4. Mileage tracking

In other articles, I’ve recommended taking pictures of your odometer before and after business trips to track mileage. I still stand by that as the most accurate way to track mileage. But for those who won’t go through the hassle, FreshBooks’ mileage tracking might be a good option.

The app detects when you’re in a car and estimates the approximate IRS vehicle use deduction you can get based on the IRS mileage reimbursement rate.

The FreshBooks’ mileage tracking feature only works when it can track you at all times. Image source: Author

The catch: It’s not great. You have to let the application track you at all times, and you’ll have to manually throw out personal car rides. The “missing trip” in the screenshot would lead you to believe that’s for entering rides the app missed, but you can’t. It just notifies FreshBooks there was an error in tracking your ride.

You can easily disable the mileage tracking feature.

5. Estimates and proposals

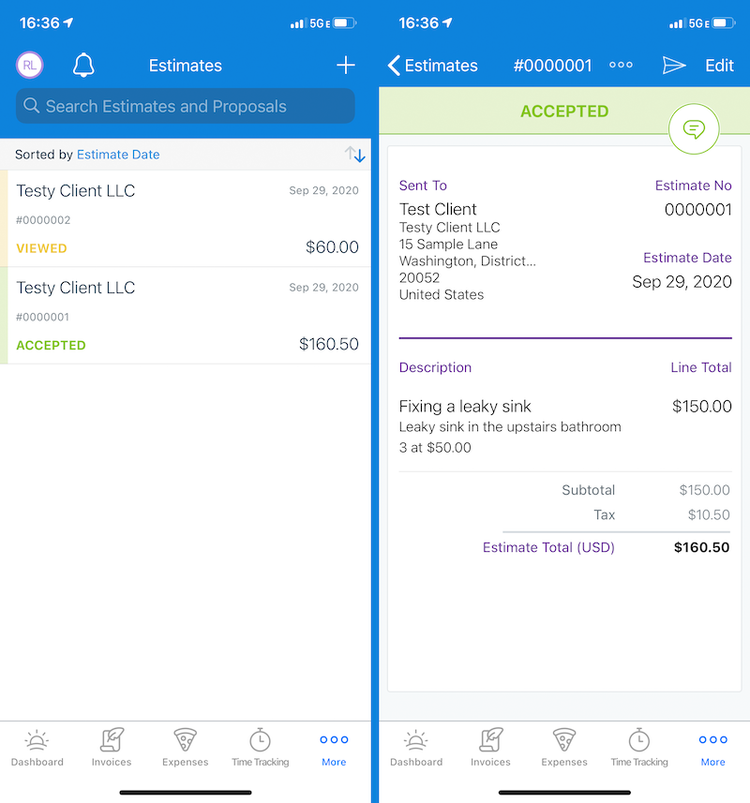

You can draft project estimates and proposals in real time using the FreshBooks mobile app. The experience of creating an estimate or proposal mimics preparing an invoice. Your customers receive an email prompting them to accept the estimate or proposal.

Proposals provide more scope than an estimate. Where estimates tell customers how much they should expect to pay for a service, a proposal also lays out your plan to execute the project. You can create both types of business documents within the app.

Like invoices, you can see when a client views estimates and proposals. When clients accept an estimate or proposal, you can convert it to an invoice with a few taps.

You can easily see when clients accept your estimates and proposals. Image source: Author

How to utilize the FreshBooks mobile app

Now that you know what you’re getting, let’s start setting it up for your business.

1. Add your business information

The FreshBooks mobile app syncs with the web app, so only newcomers need to complete this step.

You need a company profile, including the following information:

- Company name

- Street address

- Phone number

- Base currency for billing

- Standard hourly rate (if applicable)

When you create your first invoice, you can add your business logo at the top by choosing it from your phone’s photo album. FreshBooks saves the logo and adds it to subsequent invoices.

2. Add your products and services

The easiest way to add products and services from the FreshBooks mobile app is to draft a phony invoice. Add in the most common products and services your business sells so each time you want to send off an invoice you have a menu of pre-filled options available.

As a tutor, I charged different rates for CPA candidates and undergraduate accounting students. If I were using FreshBooks, I would create two services for CPA candidates and undergraduate students.

3. Set up mileage tracking

Self-employed people who use their personal car for business purposes might want to enable mileage tracking. For it to work, you must allow the app to track your location at all times -- not just when the app is open.

The app uses your phone’s GPS to detect when you’re in a car. The FreshBooks mobile app generates a list of your car rides, and you have to manually mark each one as a personal or business trip.

The app also spits out the estimated deduction for your car trips based on the IRS mileage rate, which is $0.575 in 2020.

The mileage tracker can only be used for car rides taken in a car that you or your company owns. You cannot deduct your business Uber, Lyft, or cab rides using the IRS mileage rate because you deduct them at the actual cost.

4. Input client information

The FreshBooks mobile app has a contact book that syncs with the web app. When you need to make a quick call to a client, you can find the client in the app and tap the phone icon on their contact card.

5. Manage notifications and security

The FreshBooks app can keep you as in or out of the loop as you’d like. You can get a notification every time a client views an invoice, or only when you get paid. Go into the app’s settings to figure out what works best for you.

While you’re in the settings, take a moment to add a layer of security to the FreshBooks mobile app. As an iPhone user, I turned on Face ID so the app will only open when it’s me or my doppelganger in front of the screen.

You can do a lot, but not everything

FreshBooks’ mobile app isn’t for making financial statements, but it’s convenient for the moments you wish you could send off an invoice or enter an expense while you’re out.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.