Full-time equivalent, or FTE, is a metric used to determine how many full-time and part-time employees you currently have on staff. Each FTE is equivalent to the number of hours your full-time employees work.

In order to determine the number of FTEs created by your part-time employees, you would add their number of hours worked and divide it by the number of hours in a full-time workweek.

For instance, if your full-time workweek is 40 hours and you have two part-time employees who work 20 hours each week, when their hours are added together, they create one FTE.

Overview: What is an FTE employee?

If you currently employ both full and part-time employees, you need to determine how many FTE employees you have. An FTE employee is not necessarily a single employee; it may be a combination of several part-time employees who, when their hours are added together, create a full-time equivalent, or FTE, employee.

Calculating FTEs can be useful for budgeting current and future workforce needs. It also allows employers to examine total hours worked across the business rather than looking only at how many full-time and part-time employees are on staff.

Employers also need to calculate FTEs in order to be in compliance with certain federal laws and programs including:

- Affordable Care Act (ACA): The ACA requires small businesses with at least 50 FTEs on staff for the prior year to provide essential, affordable health insurance to their employees. If your business has less than 50 FTEs, you’ll have the option to apply for a small business tax credit of 50% if you choose to offer health insurance to your employees.

- COBRA: COBRA is a federal program that requires certain qualified employers to provide continuation of health insurance to employees and their dependents upon the termination of their employment. Offering COBRA is required only if you currently provide a health insurance plan to your employees and you have employed at least 20 FTEs in the previous calendar year.

Calculating FTEs is also required for any small business that currently works with the federal government in a professional capacity, as the submission of an FTE report is a required part of most federal government contracts.

How to calculate full-time equivalent (FTE)

Calculating full-time equivalent for your business can be time-consuming if you currently process your payroll and employee benefits manually.

When calculating FTE, make sure your payroll data is easily accessible since you’ll need this information to complete your calculations. The entire calculation will be much smoother if you’re using payroll software or a payroll service provider as you can use your payroll reports to obtain the information needed.

Step 1: Create a list of all employees and their hours worked

This can be done manually or by using the payroll reports available from your payroll service provider.

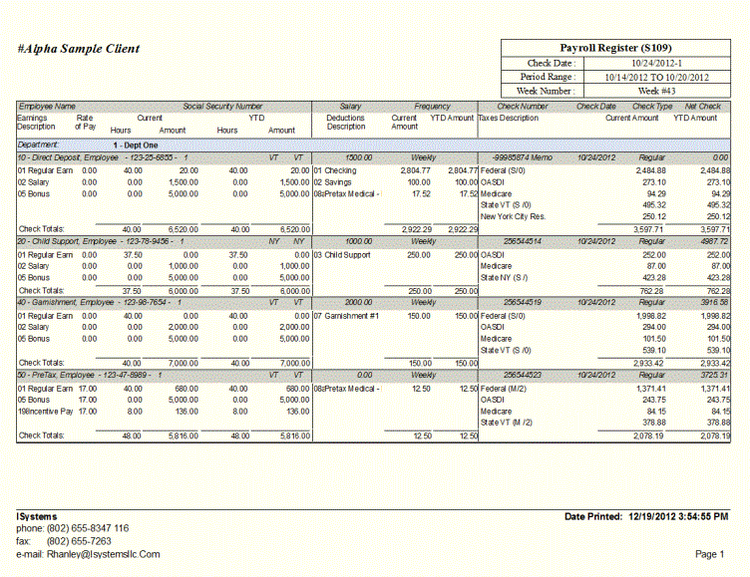

This sample report from ADP provides a list of employees and hours worked. Image source: Author

Once you have a list of employees, you'll need to determine how many hours each employee works each week. While full-time employees usually work the same hours each week, hours for part-time employees can vary from week to week, so be sure to look at each week to view the actual hours worked.

For our sample company, we’ll say we have the following employees on staff:

| Employee | Hours worked per week |

|---|---|

| Angela Administrator | 40 |

| Barbara Bookkeeper | 40 |

| Donald Delivery Person | 25 |

| Hannah Human Resources | 40 |

| Oliver Office Manager | 25 |

| Peter Programmer | 30 |

This employee list should include both the employee name and number of hours worked.

Once you’ve completed your list, you can move on to the next step.

Step 2: Determine what is considered full-time employment

Full-time employment varies from business to business. Some employers consider anything over 35 hours per week to be full-time, while others require that employees work 40 hours per week to be considered full-time.

For the purpose of our calculations, we’ll assume that the sample company considers 40 hours per week full-time employment. You’ll need to know the right figure for your business in order to properly calculate FTEs.

Step 3: Calculate employee hours worked for the month

First, add up all full-time hours worked for the week. The sample company currently has three full-time employees:

3 x 40 = 120 hours per week

Next, you’ll add your part-time employee who works 30 hours per week to the total:

30 x 1 = 30 hours per week

Finally, you’ll add your two part-time employees who each work 25 hours per week:

25 x 2 = 50 hours per week

Once all employee hours are accounted for, you can complete this step by adding all the hours worked for the week.

120 + 30 + 50 = 200

This means that, when combined, your full- and part-time employees work 200 hours per week.

Step 4: Separate the part-time hours

Now that you’ve calculated all your employee hours for the week, you’re ready to calculate your total FTEs. In order to do so, you’ll need to separate your three part-time employees from the total hours worked per week and calculate their total hours separately:

30 + 50 = 80 part-time hours worked per week

When added together, the hours of your three part-time employees equal 80 hours.

We have already determined that, at this sample company, one full-time employee equivalent, or FTE, works 40 hours in a week. In order to calculate the FTE hours for your part-time employees, you’ll do the following the following calculation:

80 (part-time hours) ÷ 40 (full-time hours) = 2 FTEs

This indicates that the combined hours of your three part-time employees (80 hours), when divided by your regular full-time workweek (40 hours), equals two FTEs.

Remember that your calculation will change based on the agency or program for which you’re calculating FTEs, since different government agencies and programs have different calculation requirements.

For instance, if you were completing an FTE calculation for ACA reporting purposes, you would need to divide the total number of hours worked by part-time employees by 30 instead of 40, as the IRS considers anything over 30 hours per week full-time employment.

In addition, because Peter Programmer works 30 hours a week, under the ACA calculation, he would be considered a full-time employee rather than a part-time employee, as he was in the first example.

If you’re calculating FTEs to determine COBRA eligibility, you can base your calculation on the full-time requirements established by your business rather than adhering to the 30-hours-per-week standard mandated for ACA calculations.

Step 5: Add your full-time employee total to your FTE total

Now that you’ve determined that your three part-time employees equal two FTEs, you can add that number to your full-time employee total to determine the final FTE total for your business. In this case, the total is five: two FTEs from your part-time employees and three FTEs from your full-time employees.

This process needs to be repeated for every payroll week throughout the year. If your employees work the same number of hours every week, the calculation process will be simple.

However, if your business regularly changes the hours of its part-time employee hours, adds additional staff during certain months, or furloughs staff during slow periods, you’ll have to be sure to factor all those changes into your final FTE count, which should be based on prior-year totals.

Your FTE number does matter

Because many government agencies use FTEs when determining eligibility for certain programs, it’s important that you or your benefit administrator calculate your full-time equivalent employees properly. The number of FTEs your business has can also affect your business taxes, since many programs provide tax deductions based on the number of FTEs your business employs.

For all these reasons, it’s important to you learn to calculate full-time equivalent employees accurately.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.