The general ledger is an essential part of your accounting and bookkeeping processes. The general ledger serves as a repository for every transaction that is recorded, and is a must for any business using double-entry accounting.

Overview: What is a general ledger in accounting?

The general ledger provides a record of all financial transactions that affect your business. There are five different types of general ledger accounts, with each financial transaction or journal entry entered using at least one of these account types:

- Assets: Anything of value that your business owns.

- Liabilities: Anything that your business owes.

- Owner’s Equity: Owner’s equity shows how much a business is worth after liabilities are subtracted from assets.

- Revenue: Revenue is received from the sales of goods and/or services. It’s important to use the revenue recognition principle when recording revenue.

- Expenses: Expenses are the cost of doing business and include rent, utilities, payroll expenses, postage, and professional services fees to name just a few.

If you are a freelancer or sole proprietor, chances are that you may be able to get by without a general ledger, simply because you’re not using double entry accounting. But for every other business owner, the general ledger is the most important part of accounting.

What do general ledgers tell you about your business?

While your general ledger is not usually the first tool you would use to make business decisions, it can provide you with the details you need to view the financial performance of your business during the current month, or even the current fiscal year.

Whether creating a budget or calculating your accounts receivable turnover, one of the best places to start is with the general ledger.

In fact, if you want to see how much money your current bank account holds, or why your printing expense account is so high, you would turn to your general ledger first.

Better manage expenses

Your professional services expenses are through the roof and you don’t know why. Run a general ledger report to see what activity has been going on for the last year. Did your accountant raise their rates? Are you now paying an attorney to handle an employee dispute?

One of the best ways to better manage your expenses is to view in detail exactly what you’re paying each month. While this is easy to do for each individual vendor, using your general ledger to view all related expenses in each expense category provides you with a more encompassing view of your business expenses.

After all, you can’t manage your expenses if you don’t know what they are.

View activity for a specific time frame

While there are various financial reports you can run to view account activity for a specific period of time, running a general ledger report allows you to view all activity for a very specific time frame in greater detail.

For instance, running a general ledger report for two months will provide you with beginning and ending balances for each of those months, along with all of the activity recorded that affects your general ledger balance. If you run a general ledger report from January 1, 2020 through February 29th, 2020, you will have beginning and ending balances readily displayed for both January and February.

Catch and correct any errors

Your utility expense has gone up 1,000% since last month, but you don’t know why. One of the quickest ways to find out is to look at the general ledger activity for your utility expense account. Here are two possible scenarios where your general ledger can help:

Scenario A: When you review your general ledger for utility expense, you are able to see that a journal entry was posted for the incorrect amount, inflating your expenses for the month. You easily reverse the journal entry and enter a new one for the correct amount.

Scenario B: You see that one of the entries is for a one-time deposit for the new building you are renting. While the utility expense is higher than normal this month, it is accurate. No correction is necessary.

Example of a general ledger

All financial activities in your business are recorded in the general ledger. This activity includes:

- Deposits made to your bank accounts

- Checks written to various vendors for operating expenses

- Payroll checks issued to your employees

- Payroll taxes paid to both state and federal agencies

- Sales activity and related accounts receivable activity

- Recording of payments received from customers and clients

- Inventory adjustments such as receiving product or adjusting inventory levels

- Bills received and recorded in accounts payable

- Any owner contributions to the business or owner withdrawals

- Any journal entries to record transactions such as interest and bank fees

While this is just a partial list, remember that any transaction made by your business will always affect your general ledger accounts accordingly.

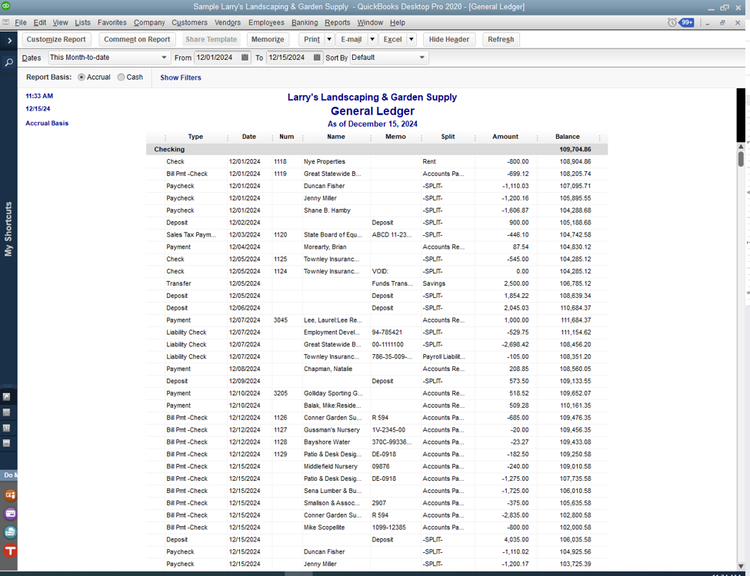

The general ledger displays all financial activity related to your business. Image source: Author

While you can certainly view these details in the areas where they originated, such as accounts receivable, inventory, and accounts payable, only the general ledger provides you with the details of all of your accounts, and how they relate to your business.

Best accounting software to view your general ledger

Any accounting software application that supports double-entry accounting can also produce a general ledger report. Here are just a few of the software applications that provide excellent general ledger reporting capability.

1. GnuCash

GnuCash is unique in many ways. It’s free, open-source software that is downloaded and installed on a desktop, workstation, or laptop computer. GnuCash is a single-user system, so it will work well for smaller businesses, or businesses that only require a single user.

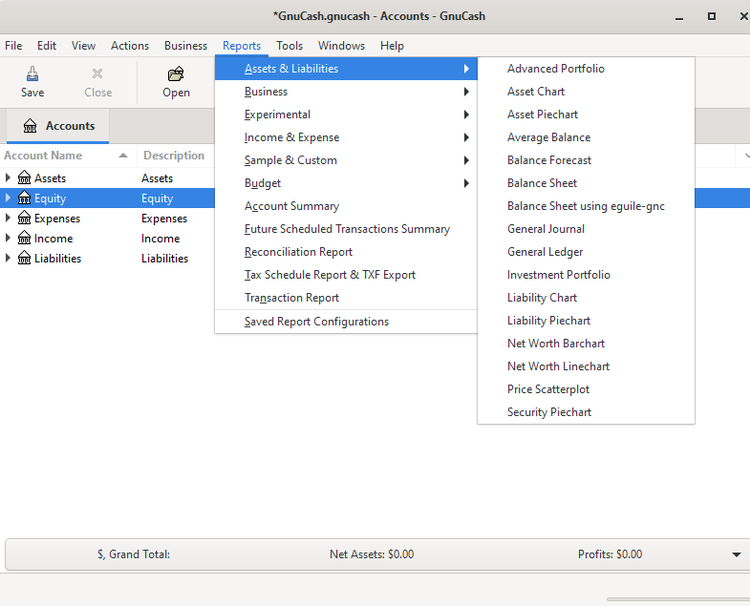

GnuCash offers account reports such as a general journal and a general ledger report. Image source: Author

GnuCash includes excellent reporting options, with detailed asset and liability reports as well as a complete general ledger report. Reports offer little in the way of customization, but there are so many reports available, that customization will likely not be an issue.

As an open-source application, GnuCash is completely free. Just visit the GnuCash website to download the application onto your desktop, workstation, or laptop.

2. FreshBooks

FreshBooks offers smaller businesses a great way to manage their general ledger. FreshBooks currently offers four plan options, making it easy to transition to a more powerful plan. FreshBooks is designed for easy navigation, so even new users can easily find their way around.

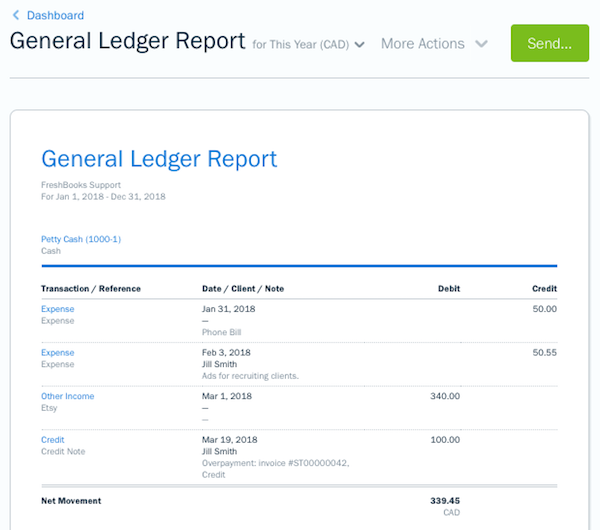

FreshBooks general ledger report includes details on each account. Image source: Author

Though reporting options are fairly basic in FreshBooks, reporting choices have improved in recent years, with both dashboard and insight reports available. FreshBooks also offers an easy-to-read general ledger report.

Pricing for FreshBooks Lite is $15 per month, with Plus running $25, and Premium $50. All plans include invoicing, online payment capability, project budgets, and solid reporting options.

3. QuickBooks Desktop

QuickBooks Desktop offers excellent general ledger reporting options for small and growing businesses alike. Designed for the single-user office as well as growing businesses with multiple users, QuickBooks Desktop offers three plans to choose from.

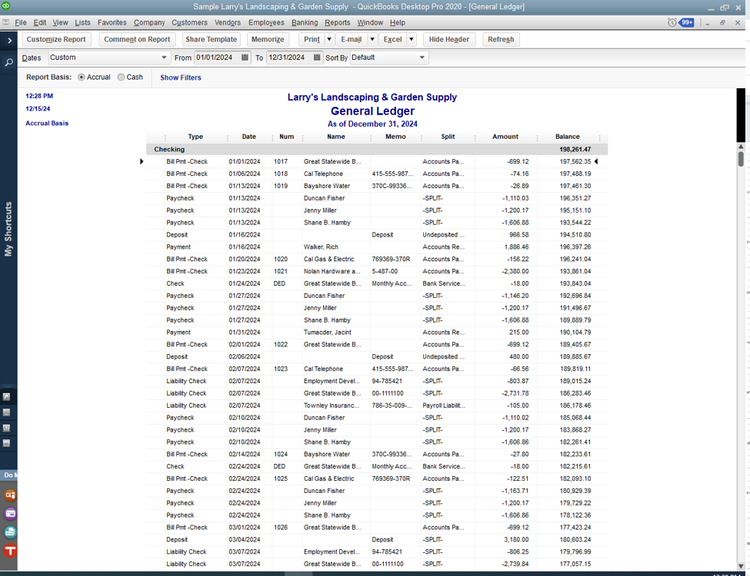

This general ledger report only includes bank accounts. Image source: Author

QuickBooks offers other excellent reporting options as well, with more than 100 standard reports included in QuickBooks Pro, while Premier and Enterprise plans include more than 150 reports. Report templates are also included in QuickBooks Desktop applications, and you can easily customize a general ledger report to include only the accounts you wish to view.

QuickBooks Desktop Pro currently runs $299.95 and supports up to three users. Premier is priced at $499.95 per year, and supports up to five users, while the Enterprise plan supports up to 30 system users and is available for $849.10 annually.

The general ledger is the heart of your accounting system

Whether you still record accounting transactions using a spreadsheet application, or you’re using accounting software, the general ledger is essential for accurate accounting, providing a detailed list of all of your financial transactions in one location.

Like a checkbook, general ledger accounting helps to ensure that all of your accounts remain in balance, with debits equalling credits.

If you’re looking for a better way to track general ledger activity, be sure to check out the applications above, or check out The Ascent’s accounting software reviews to view even more options.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.