Goodwill Accounting: What It Is and How to Calculate It

Goodwill accounting involves the process of calculating and accounting for the value of an intangible asset that is part of a company’s value. Because many existing businesses are purchased at least partly because of the value of intangible assets such as customer base, brand recognition, or copyrights and patents, the purchase price frequently exceeds book value.

Roughly speaking, the difference between the purchase price of a business and its book value is considered goodwill.

Calculating goodwill, while not difficult, can be confusing and is usually completed by an experienced accounting professional rather than a bookkeeper or accounting clerk.

Overview: What is goodwill accounting?

Before we can talk about goodwill accounting, we’ll need to explain exactly what goodwill is and why it’s so important.

Goodwill is considered an intangible asset -- something that you cannot touch. A variety of asset types can be considered goodwill, including the following intangible assets:

- Business brand

- Business reputation

- Licensing and permits

- Copyrights

- Patents

- Domain names

- Talent

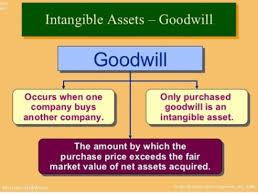

Goodwill accounting is most frequently used in the business valuation process when acquiring another business. Goodwill is an intangible asset, meaning that it has no physical presence, but it adds value to the company.

Goodwill is not always part of acquiring a business but needs to be recorded in your company’s general ledger any time that the cost of purchasing a business exceeds the fair value of its assets and liabilities.

Goodwill is an intangible asset that usually occurs when a company buys another company. Image source: Author

Goodwill accounting involves a series of simple calculations to determine exactly how much goodwill will need to be recorded. Entering this information into your accounting software promptly after purchasing another business will help to ensure that your financial statements are accurate while reflecting the correct amount of goodwill.

Types of goodwill

The type of goodwill used in a business transaction can vary depending on the type of business purchased and what factors have been taken into consideration. In most cases, one of the following two types of goodwill will be used.

Business goodwill

Business goodwill considers the entire business and looks at factors such as customer base, marketplace standing, and brand considerations.

Professional practice goodwill

When a professional practice such as an accounting firm, law firm, or medical practice is purchased, things such as the current firm/practitioner’s reputation, clientele, location, and brand are all taken into consideration.

How to calculate goodwill

Calculating goodwill for a company that you have recently purchased is easy if you follow the goodwill formula.

To calculate goodwill, just follow the steps below.

1. Calculate the book value of assets

The book value of assets is the assets that are currently recorded on the balance sheet of the business that has recently been purchased. Total assets would include the following:

- Cash

- Accounts receivable

- Inventory

- Property, plant, & equipment (PP&E)

Once you determine the book value of the assets, you can move on to the next step.

2. Determine the fair market value of the assets

Fair market value can be a bit tricky to calculate and is not an Accounting 101 task, so be sure to have a CPA involved in the process, even if it’s just to look over your calculations. While the results will only be an estimate, fair market value should be arrived at by examining similar assets and their value on the open market.

3. Find the difference and adjust totals

The next step is calculating the difference between the book value of assets and the fair market value. For example, if a company’s assets were valued at $600,000 on the books but had a fair value of $700,000, you’ll need to subtract the book value from the fair market value, leaving you with a net value adjustment of $100,000.

4. Determine the excess purchase price

Before you can complete the goodwill calculation, you will first need to determine the excess purchase price. The excess purchase price is the amount paid minus the net book value of the company’s assets. This is a two-step calculation, with the first step to subtract liabilities from assets.

For example, if the company’s assets were $450,000 and liabilities were $175,000, the total net book value would be $275,000. The second step of the calculation is to subtract the $275,000 from the actual purchase price to arrive at the excess purchase price.

5. Complete goodwill calculation

With all of your calculations completed, you can now calculate goodwill. This is done by subtracting the fair market value adjustment in Step 3 from the excess purchase price. For example, if your excess purchase price is $400,000 and your fair value adjustment is $100,000, your goodwill amount would be $300,000.

Example of goodwill in accounting

Farm Fresh Restaurant is a household name in the southwestern part of the U.S, but with its recent purchase of Leticia’s, a small chain of restaurants found throughout the U.S., the company’s name recognition is going to get a lot better.

On Sept. 30, 2020, Farm Fresh purchased Leticia’s for $3 million. The book value of Leticia’s was $1.25 million, with a fair market value of $1.5 million, for a difference of $250,000. Leticia’s also had $500,000 in liabilities. To determine the excess purchase price, you would first need to subtract net liabilities from net assets. This gives you your net identifiable asset total.

$1,250,000 – $500,000 = $750,000

You would then subtract your net identifiable assets from your purchase price to determine the excess purchase price.

$3,000,000 – $750,000 = $2,250,000

Your final step would be to subtract the fair market adjustment, which is $250,000, from the excess purchase price.

$2,250,000 – $250,000 = $2,000,000

This result means that the goodwill valuation of Leticia’s totals $2 million. The transaction would be recorded on Farm Fresh’s books as follows:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 9-30-2020 | Assets | $1,500,000 | |

| 9-30-2020 | Goodwill | $2,000,000 | |

| 9-30-2020 | Liabilities | $ 500,000 | |

| 9-30-2020 | Cash | $3,000,000 |

Remember to record goodwill as a non-current asset since it is considered a long-term investment. Though not required by generally accepted accounting principles, or GAAP, rules, goodwill can be amortized for up to 10 years.

Why is goodwill important to small businesses?

As your business reaches more people, the value of your business increases as well. It’s difficult to put a price on the value of brand recognition or intellectual property, but both of those things are reflected in goodwill.

If this year has taught us nothing else, it’s certainly taught us that while we can plan for the future, we never really know what it holds. So, although your business may be small today, next year you could be buying up the competition.

Understanding what goodwill is and how it can impact your business is just one more part of being a business owner. And if you do start buying up the competition, you’ll know exactly what to look for.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles