An income statement, also known as a profit and loss statement, provides detailed information about business revenues and expenses for a particular accounting period.

Important to business owners, financial institutions, and investors alike, an income statement clearly indicates whether a business is earning a profit.

Overview: What is an income statement?

If you want to know how profitable your business is, create an income statement. An income statement lets you know exactly how much of a profit (or loss) your business generated during a particular accounting period after all revenues and expenses have been accounted for.

There are several variations of income statements, which we’ll explore later. We’ll also provide you with step-by-step instructions for creating an income statement for your business.

Income statement vs. balance sheet: What’s the difference?

An income statement provides details on revenue, sales, and expenses for a specific period of time. Information such as sales, cost of goods sold, and operating expenses are all included on an income statement, which reports net income for the period and provides a good snapshot of company performance.

An income statement is designed to report revenues and expenses for a specific period of time.

A balance sheet reports on your business assets, liabilities and owner’s equity. Assets are things you own such as cash, bank accounts, accounts receivable, and inventory. Liabilities are things you owe, including accounts payable, taxes, and loans.

Finally, owner’s equity is the amount of money currently invested in the company and includes any retained earnings. Unlike an income statement, a balance sheet reports on company assets, liabilities, and equity as of a specific date, not a specific time frame.

A balance sheet is used when calculating accounting ratios to determine whether the business has enough assets to pay its liabilities.

Four types of income statements

There are numerous variations of income statements that you can run. Here are some of the more commonly used types of income statements:

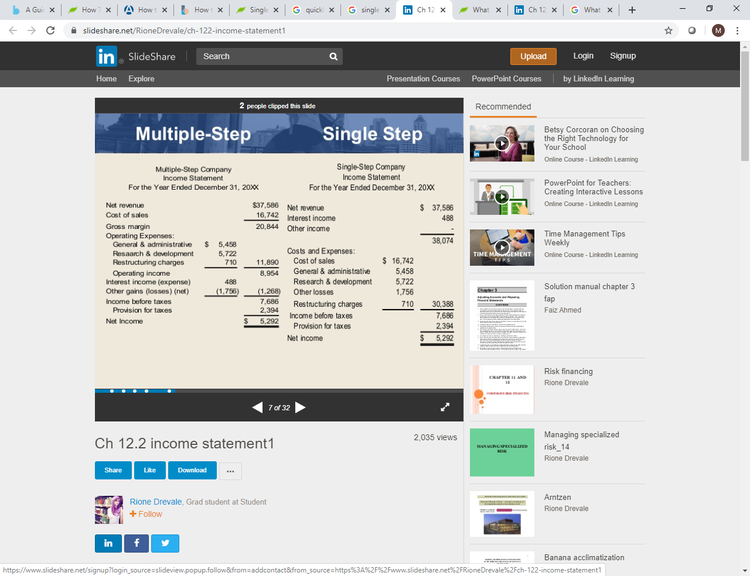

1. Single-step income statement

The single-step income statement is the simplest income statement format. It calculates totals for revenues and subtracts expenses to arrive at net income. The easiest income statement to prepare, the single-step income statement provides an at-a-glance look at revenues and expenses.

While not for everyone, most small business owners will find the single-step income statement sufficient.

Difference between a multiple-step and single-step income statement. Image source: Author

(Photo courtesy of SlideShare)

2. Multi-step income statement

The multi-step income statement provides more in-depth information about the financial performance of your business. breaking down revenue and expenses into operating and non-operating categories. The multi-step income statement is completed using a three-step calculation:

- Gross profit: The first step is calculating gross profit or gross margin. This is done by subtracting your cost of goods sold from net sales.

- Operating income: Next, you'll calculate operating income by subtracting current operating expenses from gross profit, which was calculated in Step 1.

- Net income: Lastly, you'll calculate your net income by adding to or subtracting other revenues and expenses from your operating income.

If your business is growing or you’re thinking about applying for a bank loan, the multi-step income statement is a better choice, as it provides details such as gross profit and operating income that are missing from the single-step income statement.

3. Common-size income statement

Used strictly for analysis, the common-size income statement, called a vertical analysis, expresses each line item total as a percentage of sales.

Extremely useful for comparing company performance from year to year, the common-size income statement is also used by investors to spot company trends that may not be readily visible on a standard income statement.

4. Contribution format income statement

The contribution format income statement, otherwise known as the variable costing income statement, deducts all variable expenses from revenue to arrive at a contribution margin.

Fixed expenses are then subtracted from the contribution margin to arrive at your net profit or net loss for the period. Useful in a manufacturing setting, contribution format/variable costing income statements provide details about variable costs that a standard income statement does not.

Aside from formatting, net income or loss will remain the same regardless of the type of income statement used.

How to prepare an income statement for your small business

If you’re a small business owner using accounting software, your income statement will be created for you. But even if you’re not preparing financials manually, you should still know what the process is for creating an income statement. Follow these steps to create a single-step income statement.

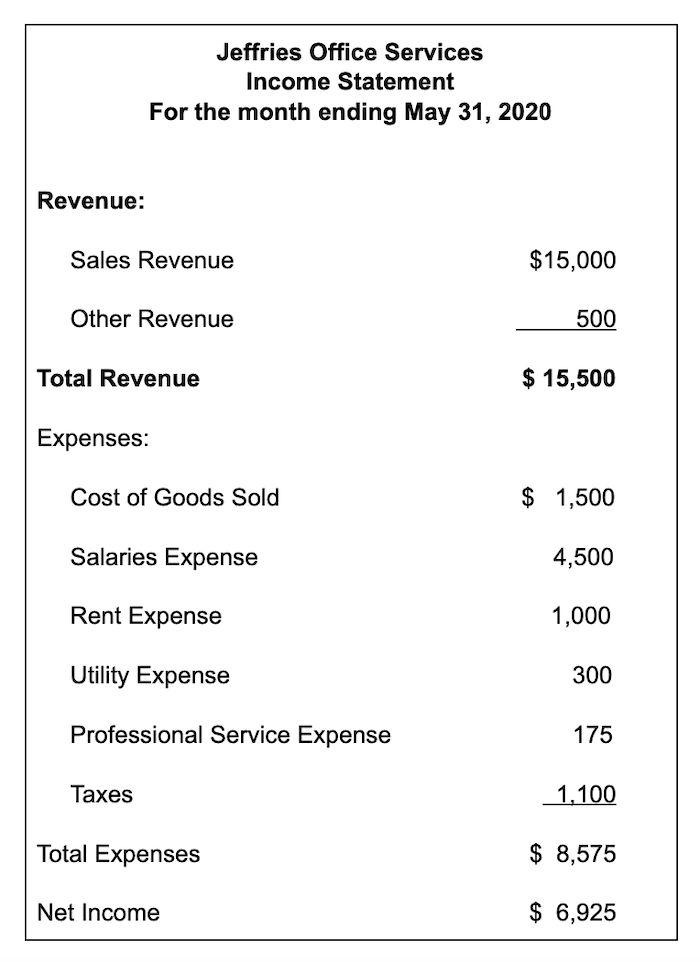

Example of an income statement (single step) Jeffries Office Services. Image source: Author

Step 1: Determine your accounting period

Determine what period of time you want your income statement to reflect. The statement above is for May of 2020, so it will include all income and expenses incurred throughout the month of May.

Step 2: Run a trial balance

The trial balance provides you with period ending totals for all of your general ledger accounts. You will need to use these amounts in order to calculate the totals reflected in your income statement.

Step 3: Calculate revenue totals

Add up all of your revenue for the month of May. For instance, you received payment for the following amounts:

- $1,200 for copying and printing services on 5-2-2020

- $5,000 for office staffing on 5-11-2020

- $3,500 for administrative services on 5-18-2020

- $4,000 for office staffing on 5-27-2020

- $1,300 for printing on 5-31-2020

- $500 for rental of a small office on 5-31-2020

After calculating revenue, you’ll end up with $15,000 in sales revenue and $500 in other revenue which will go on the income statement.

Step 4: Calculate expenses

Because you’re preparing a single-step income statement, you can combine all expenses into a single section. If you were preparing a multi-step income statement, you would separate your cost of goods sold to calculate gross income or gross margin, from which your other operating expenses would be deducted.

Using your trial balance, find your monthly expenses that need to be included on the income statement. Here are the expenses incurred:

- $4,500 for salaries

- $400 for ink for copier

- $600 for paper

- $1,000 for building rental

- $175 for electric bill

- $125 for gas bill

- $175 for CPA consultation

- $1,000 for taxes

These expenses need to be placed in the correct categories on your income statement and added up for the expenses total.

Step 5: Calculate net income

Now that you have your income and expenses recorded on your income statement, you can complete the final step, which is subtracting your expenses from your revenue to arrive at net income. Looking at the income statement above, here is your calculation:

$15,500 – $8,575 = $6,925

This means that for the month of May, your net income was $6,925

Choose the income statement format that works best for you

Freelancers, sole proprietors, and consultants will find that the single-step income statement works well for their needs, while larger or growing businesses will likely use the more comprehensive multi-step income statement.

If you currently manufacture goods, the contribution or variable costing format will provide a clearer picture of financial performance, while businesses that want to further analyze business performance can create a common-size income statement.

Whatever income statement format you choose, the best way to produce an accurate financial statement of any kind is by using accounting software.

If you’re still struggling with multiple accounting ledgers, be sure to check out The Ascent’s accounting software reviews and get ready to leave those ledgers behind.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.