Multi-Step Income Statement: Is It Right for Your Business?

One of the top three financial statements, the income statement measures company performance. Also known as a profit and loss statement, the income statement provides an overview of revenues and expenses incurred during a specific period of time.

While the single-step income statement is suitable for smaller businesses, other businesses will appreciate the level of detail offered in a multi-step income statement.

Overview: What is a multi-step income statement?

The multi-step income statement provides detailed reporting of your company’s revenues and expenses using multiple steps to arrive at net income. Multi-step income statement items include revenue, cost of goods sold, and expenses, which are calculated to arrive at net income.

Unlike the simple, single-step income statement, the multi-step income statement differentiates between operating and non-operating revenues and expenses, giving both business owners and investors a better look at company operations and profitability levels.

The multi-step income statement requires a three step calculation:

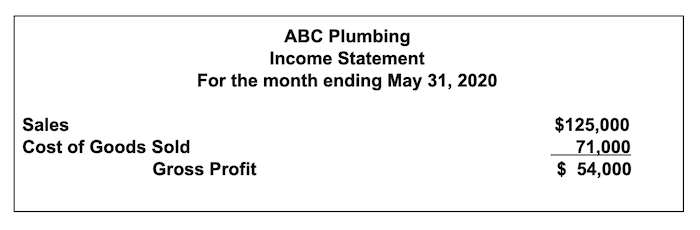

Step 1: Calculating gross profit or gross margin: The first step in a multi-step income statement is calculating gross profit or gross margin. This is done by subtracting the cost of goods sold in the first section of the statement rather than listing it with other expenses.

ABC Plumbing Income Statement with gross profit Image source: Author

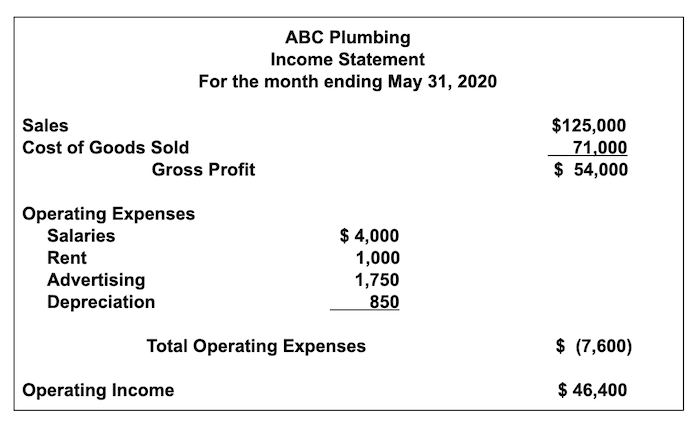

Step 2: Calculating operating income: The second step is to calculate operating income for the period. This is done by subtracting operating expenses from gross profit.

ABC Plumbing Income Statement with gross profit and operating expenses Image source: Author

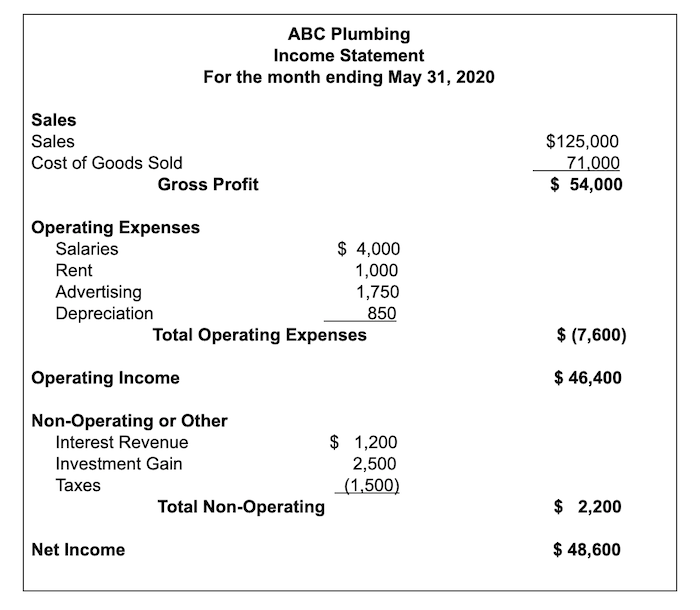

Step 3: Calculating net income: The final step is calculating net income. Now that you have gross profit and operating income totals, you’ll need to add in any non-operating income or expenses and add or subtract those amounts from your operating income to arrive at net income.

ABC Plumbing Income Statement with gross profit, operating and non-operating expenses Image source: Author

Income statement vs. multi-step income statement: What’s the difference?

The single-step income statement is the simplest income statement format, calculating revenue totals and subtracting expenses to arrive at net income.

The easiest income statement to prepare, the single-step income statement provides an at-a-glance look at revenues and expenses, which most smaller businesses will find sufficient.

More complex than its single-step counterpart, the multi-step income statement uses a three-step process to calculate net income that is used in the preparation of a single-step income statement. Here are some other ways that the multi-step income statement is different:

1. Preparation ease

The single-step income statement is the easiest income statement format to prepare, focusing mainly on net income.

On the other hand, the multi-step income statement requires three steps to complete, resulting in more detail about business operations, making it particularly valuable to investors and financial institutions.

2. Ability to calculate gross profit

One of the biggest differences between a single-step income statement and a multi-step income statement is the ability to calculate gross profit. This metric is important for business owners that need more detailed information on both business profitability and financial performance.

Because gross profit focuses only on sales revenue and cost of goods sold, business owners have a better idea about how profitable their core business operation really is.

3. Ability to calculate operating income

Another measurement available from the multi-step income statement is operating income. Like gross profit, operating income provides business owners with more detailed information on company profitability rather than focusing solely on net income.

Should your small business use a multi-step income statement?

If you’re a sole proprietor, freelancer, or consultant, a single-step income statement is sufficient. The single-step income statement is easier to prepare and provides the information you need.

However, if your business is in a growth stage, or you’re looking to obtain a bank loan or attract investors, a multi-step income statement provides details that are missing from the single-step income statement.

If you’re not sure which income statement is right for you, check out the chart below for guidance:

| Which income statement format should I use if : | Single-Step Income Statement | Multi-Step Income Statement |

|---|---|---|

| I only need to know net income |

|

|

| I’m looking for quick prep time |

|

|

| I need to know how profitable my operations are |

|

|

| I’m interested in reviewing non-operating expenses |

|

|

| I want to apply for a bank loan |

|

How a multi-step income statement works

Preparing a multi-step income statement requires more time and work than its counterpart, so let’s get started:

Step 1: Determine your accounting period

Income statements enable you to choose a monthly, quarterly, or yearly income statement period, depending on your needs.

Step 2: Run a trial balance

Run a trial balance for the same period that your income statement will cover. If you’re creating a multi-step income statement for the first quarter of 2020, your trial balance should be prepared for the same quarter.

Step 3: Calculate revenue totals

Add up all of your revenue for the income statement period. Be sure to only include revenue from sales, as any other revenue will be calculated in a later step.

Step 4. Calculate cost of goods sold

The next step when preparing a multi-step income statement is to calculate the cost of goods sold. This includes any materials required for manufacturing as well as direct labor costs for employees directly involved in the manufacturing process.

If you purchase products for resale, your cost of goods sold is the cost of purchasing those products.

Step 5. Calculate gross profit/gross margin

Subtract the cost of goods sold from your sales revenue in order to arrive at your gross profit or gross margin. This number tells you how efficient and profitable your core business is.

Step 6: Calculate operating expenses

When calculating operating expenses, don’t include any expenses already included in the cost of goods sold, such as direct labor and materials purchased.

Step 7. Calculate operating income

The next step is to subtract the total of your operating expenses from your gross profit in order to arrive at operating income. Operating income measures the amount of income from operations excluding all non-operating income and expenses.

Step 8. Calculate other revenue and expenses

If you have non-operational revenue or expenses, they will need to be added to your income statement. These can include the following:

- Interest income

- Interest expense

- Gain or loss on investments

You can also include taxes in this section, or if you’re looking to create EBIT (earnings before income taxes), you can create a separate section for taxes.

Step 9. Calculate net income

The final step for preparing your multi-step income statement is determining your net income. This is done by subtracting other revenue and expense totals from your operating income.

Multi-step income statements are worth the effort

If you’re a sole proprietor or independent contractor, you can certainly get by using a single-step income statement. But for established businesses as well as businesses looking to apply for a loan or attract investors, a multi-step income statement is worth the extra steps.

If you’re still struggling to track your business revenues and expenses in multiple ledgers, it may be time to move to accounting software. To see some of the best products available, be sure to check out The Ascent’s accounting software reviews.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles