Payment terms may seem like a minor addition to an invoice, but they can have a major impact on how quickly you get paid.

There are a ton of both accounting software and invoicing software products on the market today that make it easy to produce a professional invoice, but if you fail to add in the appropriate due date, you may be waiting for payment for a long time.

Overview: What are payment terms?

Part of writing an invoice properly is including the appropriate payment terms on the invoice. Payment terms specify the exact terms and conditions of the sales agreement including when the customer must pay.

For example, if your invoice includes Net 30 terms, it means your customer must pay the invoice within 30 days.

Adding payment terms to an invoice also helps with budgeting. For example, if you offer your customers Net 30 payment terms, you can assume you’ll receive a payment within that time, which allows you to properly manage cash flow.

Of course, it’s unlikely every customer will pay on time, but if you screen customers properly, chances are late payments will be at a minimum.

So what payment terms should you offer your customers? Part of the answer lies in the type of business you own. Service businesses tend to offer shorter terms or require a deposit, while retail suppliers and large equipment sellers may give their customers a longer time to pay.

As a small business owner, it’s up to you what terms you offer your customers. But before you invoice, it may be a good idea to familiarize yourself with these invoicing and payment terms.

10 invoice and payment terms you should know as a small business owner

Everybody wants to be paid for the work they do or the products they sell. But what if you’re still not sure what payment terms to give your customers?

You can base your decision on their credit history, while you may choose to have new customers pay a deposit. For some customers, you may not offer any credit at all.

If you’re not sure what payment terms are or which ones you should use, these terms may be helpful.

1. Payment in advance

Common in professional services businesses, payment in advance lets your customer know that the entire invoice for goods or services is due before you begin work. Payment in advance is common in the legal profession and in the home improvement and landscaping businesses.

2. Net 7, Net 15, Net 30, Net 45, Net 60

Using payment terms on your invoices is nothing new. Most businesses that offer payment terms to their customers offer Net 10, Net 30, Net 60 terms, or a similar variation. This means the invoice is due within that time frame.

For example, if you offer creditworthy customers Net 10 terms, and the invoice is dated August 15, they are expected to make a payment on or before August 24. If you were offering Net 30 payment terms, your customer would be expected to pay their invoice by September 13.

Terms can still be extended to customers without using Net 10, etc. by simply stating the due date on the invoice. This process is much more common today than it was in years past, for good reason. It leaves no room for confusion and lets your customer know exactly when their payment is due.

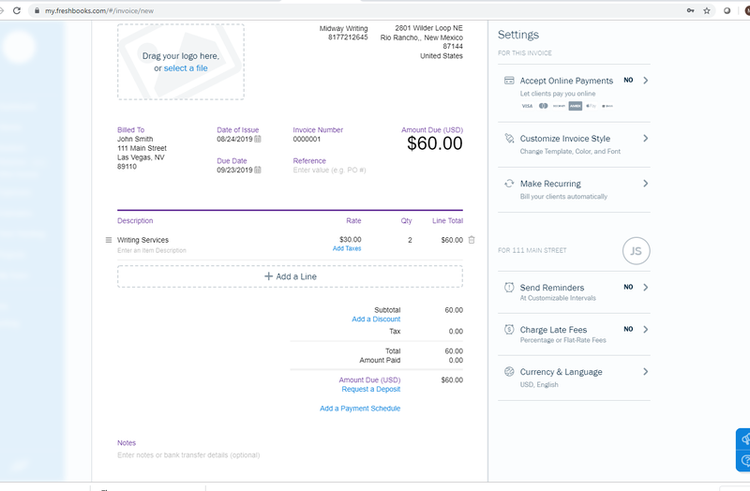

FreshBooks lets you create an invoice that includes a specific due date and links to online payment options. Image source: Author

3. 2/10 Net 30

2/10 Net 30 means that if your customer pays you within 30 days, they’re entitled to take a 2% discount. For example, if your invoice was for $100, and you offered 2/10 Net 30, if your customer paid within 10 days, they would pay you $98 instead.

Of course, as the business owner, you’re free to offer any discount you wish. Discounts for early payments work better on larger invoices, as they can help you get larger invoices paid more rapidly, while also offering a larger incentive for your customer to pay early.

4. Payment at the time of service

Payment at the time of service is an easy concept to understand. When you eat at a restaurant, payment for the food you ordered is due at the time of service. Doctors and dentists typically require payment at the time of service, as you would if you were selling your wares at a flea market or craft show.

5. Due upon receipt

Due upon receipt indicates you expect your customer to pay you once they receive the invoice. Historically, this meant that your customer would pay you during their next check run. However, with online payment capability, your customer now really can pay you upon receipt.

If you use this payment term, be sure you offer your customers a quick way to pay the invoice, such as a link to an online payment option. Due upon receipt is best used for businesses that email invoices to their customers.

6. Deposit required

Similar to the 50% down payment, the deposit required means that to complete the purchase, you require a deposit from your customer. This is common for custom orders created specifically for the customer.

7. Recurring

Recurring invoices are used to bill customers for regular, monthly services, such as office cleaning, landscaping, web services, or consulting fees.

The invoice is typically in the same amount for the length of the agreement, so if your customer signed a contract for a year, you would send them a recurring invoice monthly in the amount you agreed on.

8. 50% deposit required

Not used in every business, a 50% deposit is fairly common in professional services industries such as those offered by attorneys and accountants. A 50% deposit is also common in the construction and home improvement industries, where jobs can take months to complete.

9. Cash on delivery (COD)

Cash on delivery or COD terms require your customer to pay for goods upon delivery. Very popular at one time, the option to pay online has reduced the usage of COD to a fraction of what it once was, but it is still used by some businesses.

Cash on delivery or COD lets your customers pay upon delivery of the product. Image source: Author

10. Invoice factoring

Invoice factoring is not always the best solution for collecting on invoices, but for small businesses with limited cash flow options available, it can get cash into your bank account quickly.

If you use invoice factoring, you’re selling an unpaid invoice to a factoring company, who will pay you a set percentage of the value of the invoice. The collection activity then shifts to the factoring company, which keeps their portion, while sending you the balance once they receive an invoice payment from your customer.

Factoring fees vary widely and can range between 65% to 90%, so if this is something you decide to use, do your homework before signing an agreement with any factoring company.

Some suggestions for using payment terms

When offering payment terms to your customers, it’s helpful to pay close attention to the following suggestions.

- Screen your customers: Before you offer payment terms to any of your customers, do your due diligence to determine whether they’re a good credit risk. This should be done with every customer that wishes to buy on credit. Spending a few extra minutes doing your research will hopefully prevent time-consuming collection activities later.

- Be clear about due dates: It’s your prerogative to use Net 30 or similar terms when invoicing your customers, but it’s more likely to get you paid faster if you’re very specific about the due date. For example, instead of using “Net 30,” just state clearly Payment Due on September 15. That’s hard to miss.

- Give your customers multiple ways to pay: Perhaps the most important thing you can do at your end to facilitate faster payments is to give your customers multiple ways to pay you. Offering online payment options, in particular, is likely to get you paid faster than requiring your customers to write you a check and mail it.

- Use late fees when necessary: The best way to let your customers know you’re serious about being paid on time is to assess a late fee when payment is past due. Be sure you note on your initial invoice that late payments will be assessed a fee, so your customers know upfront. Hopefully, you’ll never have to use them.

Offering credit to your customers can be a scary step, particularly for smaller businesses with limited cash flow. But if you do it the right way, offering credit expands your customer base, increases cash flow, and helps your business grow.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.