How to Get Started in Property Management Accounting

Property management is stressful. Earlier this year, we had an earthquake here in Utah. I quickly checked my water heater and furnace to make sure we didn’t have any gas leaking. Next I had to make sure our rental properties were OK.

One tenant texted right away and said that he had checked everything and it was all good. That was a relief. The other tenant said he was out of town and couldn’t check, so I left work to run to the condo and make sure it wasn’t about to explode. Turns out it was pretty close.

When I got there, I discovered the furnace had come completely off the wall. I quickly turned off the gas and called the gas company. Several hundred dollars, an irritated tenant who came home early to a 50-degree apartment, and a few days of high blood pressure later, the furnace was fixed. I was reasonably sure the condo would not explode anytime soon. But was that cigarette smoke I smelled in the living room?

Accounting for your rental properties doesn’t have to be this stressful. Read on to learn how to set up a system for your property management accounting.

Overview: What is property management accounting?

Property management accounting is landlord accounting. You recognize revenue for all rents received and expenses for maintenance, landscaping, and other cash outflows.

How to set up a property management accounting system

Here are the steps I’ve personally used for a few different situations I’ve been involved in.

1. Determine your tipping point

I do property management bookkeeping in two different ways. I personally own two condos that are rented to tenants I find on a local classifieds website. In my day job, I manage 20-30 units owned by the owners of my company.

For the two condos, I keep a financial statement spreadsheet updated annually for when I’m doing my taxes. Every month, I check to make sure the rent payment went through, and I keep receipts for the year in a physical folder. I only do an income statement. Keeping a balance sheet updated would be more work than it’s worth for these little units.

For rental property accounting in my professional capacity, I use our accounting software to do monthly bank reconciliations and keep the rent roll up to date (we’ll get to these terms in a minute).

There’s no rule for when you should graduate from back-of-the-envelope bookkeeping to a full system with double-entry accounting. If you only have a few transactions per year, you can probably stick to a spreadsheet. If you’re processing multiple invoices each month, you probably need to buy accounting software.

2. Purchase accounting software

You won’t need to find specific software for landlords. Check out our accounting software reviews and go with the one you like the most -- it will work for property management.

Accounting for property management is done best when it’s like every other business. So normal accounting software will have all the functionality that you need.

3. Set up each property

Each property will need to have several items set up for it:

- Entity: If you have a commercial property with several units, put it into its own LLC to shield yourself from liability.

- Software account: Your accounting software should allow for multiple businesses to be created. Create a separate one for each entity.

- Bank account/credit card: The easiest way to keep track of expenses for each property is to use a bank account or credit card for that property only. Then each month you go through the statement and add each journal entry into the software.

- GL and chart of accounts: Set up a general ledger and chart of accounts for each rental property. The better you build them initially, the easier it will be to quickly process transactions each month.

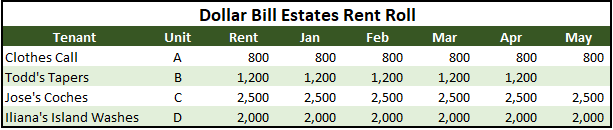

- Rent roll: Create a spreadsheet with one row for each unit. Each month when rent is paid, add the payment in. The graphic below shows how the rent roll should look.

This rent roll shows that Todd’s Tapers is late on their May payment. Image source: Author

4. Do the monthly accounting cycle

Here are the steps you should take for each month’s accounting cycle.

- Receive rents: Many accounting software programs will integrate with your bank account and make it easier to set up automatic monthly invoices with ACH (Automated Clearing House) payments. If your software doesn’t do this, meet with your bank’s treasury management representative to set up monthly ACH pulls from your tenants. Alternatively, you could require your tenants to set up automatic bill pay or an ACH push to your account. The key is taking the monthly rent responsibility out of your tenant’s hands and making it an automatic payment.

- Process invoices: You’ll get invoices for utilities, landscaping, maintenance, and other random expenses each month. Many of these can be automatically paid with electronic funds transfers. Use your accounting software to print checks for the other ones.

- Do bank reconciliation: Traditionally, a bank reconciliation is done to make sure the balance sheet cash amount matches the bank balance. We still want to do that, but we’re going to do it a little backward. Enter all transactions from the bank statement into the software (unless the transaction is from a check that you already entered). When that’s done, compare the book (the software amount) balance of cash to the statement balance. If it’s not the same, go back through the statement and your GL to figure out what was incorrectly entered.

- Print financials: You can do this every month, quarter, or year. For bigger properties, it may make sense to do it monthly to make sure you’re not burning a ton of cash. As long as you built the GL correctly and entered all transactions into the correct account, your property management financial statements will just need to be printed.

This is the cycle I follow for the properties in my professional life. We print financials annually for taxes and keep up with the bank balance during the year to make sure there isn’t a cash burn.

With the two condos that I personally own, I use a website called Cozy to do monthly rent payments and have a credit card that I only use for the investment properties. I generally have four or five non-HOA (homeowner’s association) expenses annually, so it’s easy enough to throw it all together on a spreadsheet at the end of the year.

Tips and tricks for setting up a successful accounting system for property management

Having an accounting system in place for managing your properties will help you ensure you don't miss any due dates and -- ideally -- it will save you a lot of time.

1. Link accounts

If you can link your accounting software to the bank account for each entity, it will make the monthly cycle at least 240% easier. Instead of laboring to enter in each line of the statement, you can just verify that the imported transactions are applied to the right accounts.

2. Do annual appraisals

There is always an opportunity cost to carrying investment properties. Make a practice of getting a Broker’s Price Opinion (BPO), or even do your own valuation on the properties annually, to decide whether you want to hold them or attempt to sell.

3. Analyze the financials at least annually

There are four ways that you make money on investment properties:

- Capital appreciation: When the value of the property goes up, and you can sell it for more.

- Rental cash flow: The actual cash that ends up in your pocket at the end of the year.

- Tax shelter: Tax deductions from items such as depreciation (non-cash) or interest.

- Debt paydown: Ideally, you will purchase a property for the least amount down possible and then charge more in rent than is due on the debt. When this works out, you are effectively having a tenant pay down the mortgage and receiving the asset for free. The best of both worlds is when the tenant easily clears the debt payment, but interest and depreciation make the property show a loss on your tax return.

When you run your annual financials, work on preparing a cash flow statement. The cash flow statement and appraisal will let you grade each property on those four key metrics each year.

4. Understand lease types

Most commercial leases are so-called triple net (NNN) leases. This means the tenants are responsible for paying their share of all common area expenses such as landscaping or snow removal. If you have NNN leases, you need to keep up on common area expenses and bill tenants annually.

5. Don’t forget the rent roll

If you want to get a loan on the property or sell it, the first thing you will be asked for is a rent roll. Having one accurate and up to date will go a long way toward making interacting with third parties easier -- not to mention helping you identify delinquent tenants faster.

(Land)lord of the Flies

If you’ve spent time in property management, you’ve likely had the same stressful moments (or weeks) that I’ve had. However, accounting for your properties doesn’t have to be an earthquake-level trauma.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles